New CRP Rules Coming; Poultry Competition Rules, More $ for Meat Processing Capacity

Chinese Premier Li Keqiang acknowledged business impact of Covid-19 lockdowns, marking contrast with President Xi Jinping

|

In Today’s Digital Newspaper |

USDA Secretary Tom Vilsack could unveil new CRP rules at today's hearing at the Senate Ag Committee. A press release is expected this morning. If so, they could involve early out without penalty and earlier field work than current rules provide, but some observers do not expect much impact from the coming changes. Vilsack will also likely tout more funding for meat processing capacity and several proposed rules for competition in the poultry sector (link for details announced this morning by USDA).

Several cancellations of export sales to China in latest week. USDA data for the week ended May 19 show small amounts of sales of U.S. ag commodities to China but several cancellations of sales resulting in net reductions in sales. Activity for 2021-22, the week included net reductions of 23,035 tonnes of corn, 4,066 tonnes of sorghum, 108,379 tonnes of soybeans, but net sales of 6,335 running bales of upland cotton. Net sales for 2022 of 2,465 tonnes of beef and 5,291 tonnes of pork were also reported.

More than 16 months into Biden’s tenure, Secretary of State Antony Blinken will deliver a long-awaited speech outlining U.S. strategy toward China. But the top US diplomat is expected to use his remarks today at George Washington University to explain existing policies rather than unveil any bold new direction, observers advise.

Russian forces were pushing to encircle two cities in eastern Ukraine, part of an all-out Russian assault to take control of the Donbas region. A Ukrainian official urged world leaders to instead focus on ending the war and strengthening sanctions, and a senior U.K. official also rejected the idea of lifting sanctions.

Russia cuts interest rates as ruble rises. Russia’s central bank cut its main policy rate to 11% from 14% as a strengthening ruble eased inflationary pressures. Yesterday President Vladimir Putin unveiled double-digit increases to Russia’s minimum wage and pensions. Putin admitted Russia faced “difficulties” but denied these were linked to what he referred to as the country’s “special military operation” in Ukraine.

Russia continues to signal that it might lift its blockade of Ukrainian ports to food shipments if sanctions are lifted, something few observers believe will happen. More in Russia/Ukraine section.

Polish Prime Minister Mateusz Morawiecki told the WSJ that Poland is offering to let Ukraine use its ports to export grain. The shipments would have to be transported by road or rail, but Poland and Ukraine use two different track gauges so the grain needs to be shifted between rail lines. Ukraine’s harvest has become a global concern, and some shipments have moved through Romania. Adding another export hub would get more of the harvest out, but Morawiecki says, “We have to invest very quickly.”

The Fed minutes from earlier this month showed officials discussed the possibility of raising interest rates high enough to slow economic growth in the name of combating inflation.

The SEC voted to issue two proposals that aim to give investors more information about funds that take into account ESG factors — environmental, social and corporate-governance.

Natural-gas exporter Venture Global said it will move forward with a new LNG-export facility in Louisiana after securing $13 billion in financing. Details below.

Chinese Premier Li Keqiang acknowledged the business impact of Covid-19 lockdowns, marking a contrast with President Xi Jinping. He didn’t defend Xi’s zero-Covid strategy and agreed more vaccination is needed. Details in China section. “We can’t have companies stopping their operations,” he said.

The commissioner of the FDA said it responded too slowly to a whistleblower report about an Abbott Laboratories baby-formula plant that led to its shutdown.

Election Day 2022 is 166 days away. Election Day 2024 is 894 days away.

|

MARKET FOCUS |

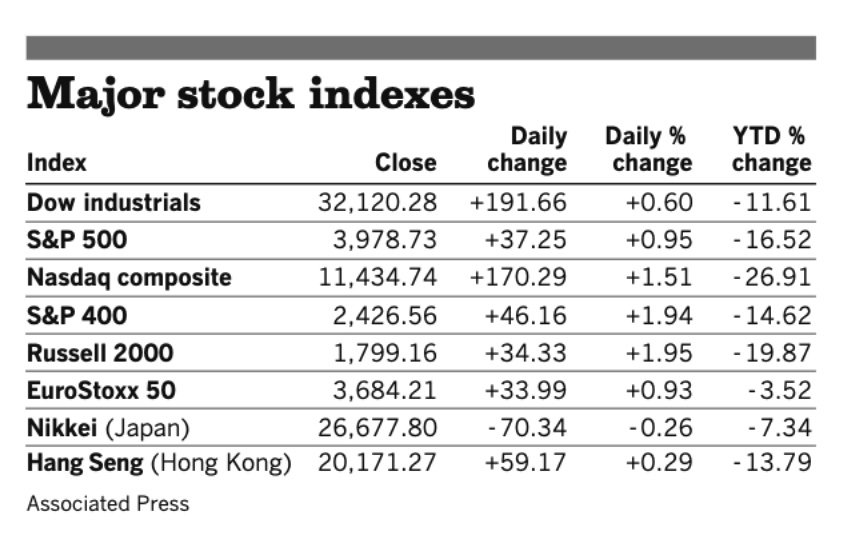

Equities today: Global stock markets were mixed overnight. U.S. stock indexes are pointed toward narrowly mixed openings.

U.S. equities yesterday: The Dow finished up 191.66 points, 0.60%, at 32,120.28. The Nasdaq gained 170.29 points, 1.51%, at 11,434.74. The S&P 500 was up 37.25 points, 0.95%, at 3,978.73.

Agriculture markets yesterday:

- Corn: July corn futures rose 1/2 cent to $7.72 1/4 after dropping near a seven-week low earlier, while December futures fell 2 cents to $7.23 1/4, a two-week low.

- Soy complex: July soybeans fell 12 cents to $16.81, the lowest close in a week. July soymeal fell $2.90 to $424.20 per ton. July soyoil fell 120 points to 78.92 cents per pound, the contract’s lowest closing price since April 20.

- Wheat: July SRW wheat fell 6 1/2 cents to $11.48 1/4, the contract’s lowest closing price since May 11. July HRW wheat fell 4 1/2 cents to $12.33 1/4. July spring wheat fell rose 3 1/4 cents to $12.80 1/2.

- Cotton: July cotton rose 362 points to 145.16 cents per pound, while December rose 83 points to 124.61.

- Cattle: June live cattle fell 42.5 cents to $132.30, while August feeders dipped 20 cents to $167.95. Choice beef cutout values fell 35 cents early to $263.30, which may have also encouraged selling in futures.

- Hogs: July lean hogs fell $1.10 to $107.95. Pork cutout values fell $1.06 early in the day to $107.18, led by a drop of nearly $14 in bellies.

Ag markets today: Wheat and corn futures faced heavy selling pressure overnight but remained above Wednesday’s lows. Selling in soybeans was lighter. As of 7:30 a.m. ET, winter wheat futures were trading 20 to 25 cents lower, spring wheat was mostly 4 to 7 cents lower, corn was 8 to 11 cents lower and soybeans were fractionally to 2 cents lower. Front-month U.S. crude oil futures were around 75 cents higher and the U.S. dollar index was almost 200 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims, due at 8:30 a.m. ET, are expected to fall to 215,000 in the week ended May 21 from 218,000 one week earlier. UPDATE: Initial jobless claims, a proxy for layoffs, decreased to 210,000 last week from the previous week’s level of 218,000, the Labor Department said Thursday. Claims remain near 2019 prepandemic levels, when the job market was also historically tight. The four-week average for claims, which smooths out volatility in the weekly figures, rose to 206,750 last week.

• U.S. gross domestic product, due at 8:30 a.m. ET, is expected to contract at a 1.3% annual pace in the first quarter, a small upward revision from the previously reported 1.4% contraction.

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• U.S. pending-home sales in April, due at 10 a.m. ET, are expected to fall 2.0% from the prior month.

• Kansas City Fed's manufacturing survey, due at 11 a.m. ET, is expected to fall to 22 in May from 25 one month earlier.

• Federal Reserve Vice Chair Lael Brainard appears before the House Financial Services Committee to discuss digital currency at 12 p.m. ET.

Minutes from the Federal Reserve's most recent meeting showed the central bank's decisionmakers were willing to be both aggressive but flexible in the face of both inflationary and recessionary pressures. Much of what the Federal Open Market Committee said in the minutes was largely as expected: Members favor 50-basis-point increases to the Fed's benchmark interest rate in both its June and July meetings, then could pull back to quarter-point raises in subsequent meetings. There was no mention of 75-basis-point moves that had become the base case for a few Wall Street banks at the end of April.

Federal Reserve has revised up the forecast for its preferred inflation gauge — the personal consumption expenditure index — to 4.3% for this year before decelerating to 2.5% next year.

U.S. budget deficit is expected to fall from $2.7 trillion in 2021 to $1 trillion this year, reflecting lower government spending and faster economic growth, the Congressional Budget Office said. The agency also predicted that inflation will come down but will remain above the Fed’s 2% target next year.

Apple said that the minimum hourly wage for U.S. its retail workers would rise to $22 per hour and that it would award annual raises several months early. Other companies are also increasing salaries, amid a tight labor market and rising prices, and as retail employees consider unionizing.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker in early trading. The yield on the 10-year U.S. Treasury note is fetching 2.724%. Nymex crude oil futures prices are higher and trading around $111.25 a barrel.

• U.K. announces tax on oil and gas giants to ease the pain of soaring household energy bills. U.K. Finance Minister Rishi Sunak imposed a windfall tax on oil and gas majors as the government scrambles to alleviate the country’s worsening cost-of-living crisis. “The oil and gas sector is making extraordinary profits not as the result of recent changes to risk-taking or innovation or efficiency but as the result of surging global commodity prices driven in part by Russia’s war,” Sunak told lawmakers in the House of Commons on Thursday. “And for that reason, I am sympathetic to the argument to tax those profits fairly,” Sunak said, prompting jeers from opposition lawmakers. Sunak said the government is imposing a temporary targeted energy profits levy with a so-called “investment allowance” to incentivize oil and gas firms to re-invest their profits. The new levy will be charged on the profits of oil and gas companies at a rate of 25%, before being phased out when commodity prices return to more normal levels.

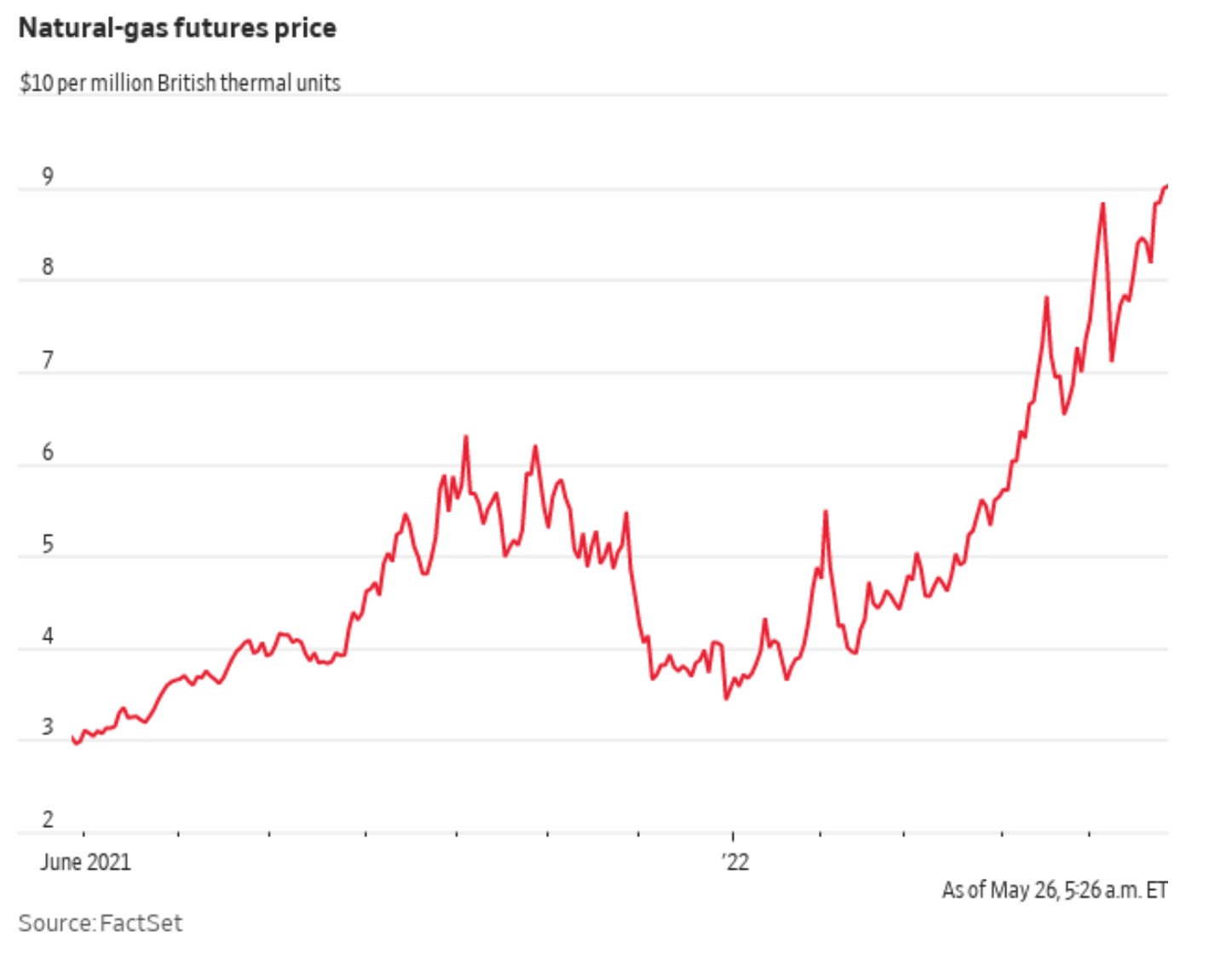

• Natural-gas prices are heating up ahead of air-conditioning season, adding pressure to household budgets and manufacturing costs. Prices have tripled over the past year and haven’t been so high since 2008, which was before frackers flooded the market with cheap shale gas.

• U.S. natural-gas exports are due for a big new boost. Venture Global LNG plans to build a multibillion-dollar liquefied natural-gas export facility in Louisiana, the Wall Street Journal reports (link), after securing $13.2 billion in financing for the first new U.S. plant to get a green light in three years. It is also the first American LNG project to officially go forward since the Biden administration said the U.S. would increase shipments of gas to Europe after Russia’s invasion of Ukraine threw Europe’s supplies into doubt. LNG prices in Europe and Asia began hitting record high levels months before the war as countries began competing fiercely for supplies. But the U.S. is already sending all the LNG it can to Europe and expanding volumes will require new infrastructure. Venture Global began construction on its Plaquemines project near New Orleans last year and expects to begin shipping LNG in 2024.

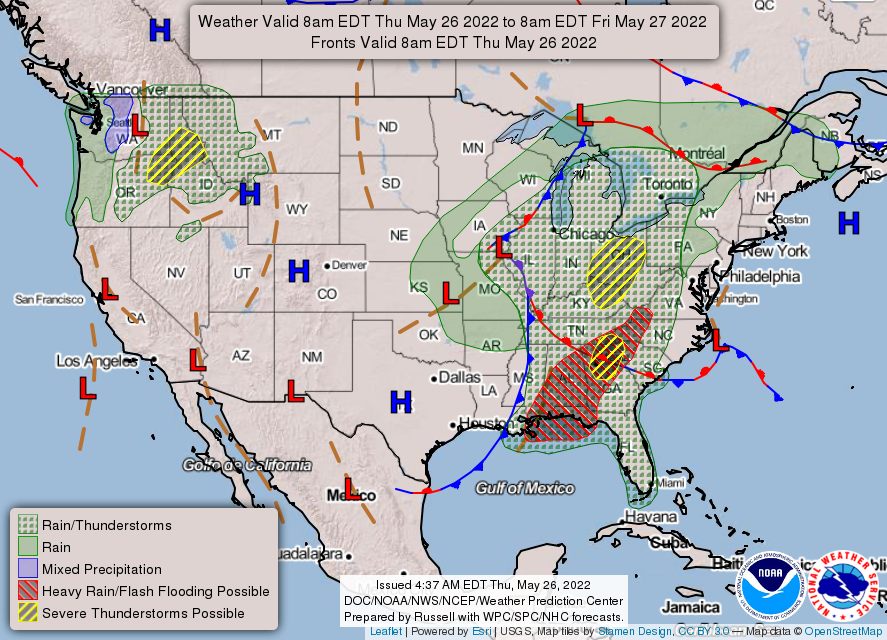

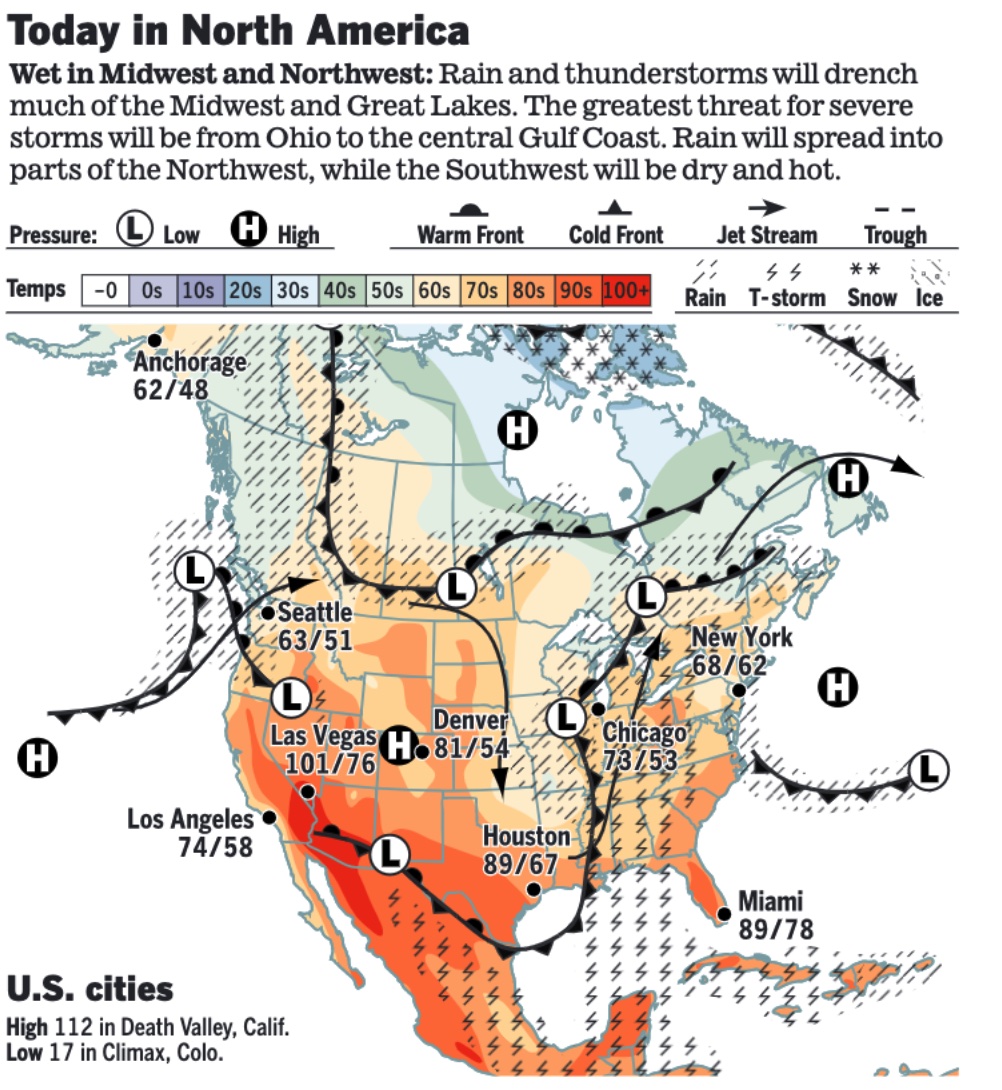

• NWS weather: Severe weather and flash flooding possible for the eastern third of the Lower 48... ...Slight Risk for severe weather in portions of Oregon and Idaho... ...Above normal temperatures and some fire weather risk in the West.

Items in Pro Farmer's First Thing Today include:

• Wheat, corn continue to weaken

• China to continue state soybean reserve sales

• Ideas Choice beef has topped

• Cash hog index continues to climb

|

RUSSIA/UKRAINE |

— Summary: Russian forces pummeled Sievierodonetsk, the easternmost city still under Ukrainian control. Artillery barrages have knocked out water and electricity in the city, driven citizens into shelters. Ukrainian officials expect Russian forces to try to duplicate the siege tactics they used in Mariupol, choking off Sievierodonetsk from the rest of the country.

- Russia claims it will allow foreign ships to leave Ukraine ports. Russia’s defense ministry claimed overnight that it will let foreign ships leave ports on the Black Sea and Sea of Azov, according to state news agency Interfax. A safety corridor due to open Thursday will allow ships to leave Mariupol via the Sea of Azov port as well as Kherson and Odesa on the Black Sea, the report said. The Russian foreign ministry claimed yesterday that five foreign ships were able to leave Mariupol.

- Russia: West to blame for Ukraine grain crisis. The Kremlin rejected U.S. and European Union claims that Russia had blocked grain exports from Ukraine and accused the West of creating such a situation by imposing sanctions. “We categorically do not accept these accusations. On the contrary, we blame Western countries of taking actions that have led to this,” Kremlin spokesperson Dmitry Peskov said. The Kremlin called for the West to remove the sanctions to free up Ukrainian grain exports. Kyiv and some Western leaders have accused Russia of using food exports as a weapon and stealing grain from Ukraine. Meanwhile, Turkey is in negotiations with Russia and Ukraine to open a corridor via the Bosphorus for grain exports from Ukraine, a senior Turkish official told Reuters.

- Treasury Department will study how Russians could use hedge funds and private equity to evade sanctions. Brian Nelson, the top U.S. counterterrorism finance official, said the expanding list of sanctions against Russia highlights money-laundering risks for investment advisers.

— Market impacts:

- Germany said it would keep coal-fired plants open in case Russia cuts its gas supplies.

- Russia's central bank cuts key interest rate to 11%, citing decreased stability risks. The Central Bank of Russia on Thursday cut its key interest rate from 14% to 11%, citing a slowing in inflation and the recovery of the ruble. “The latest weekly data point to a significant slowdown in the current price growth rates. Inflationary pressure eases on the back of the ruble exchange rate dynamics as well as the noticeable decline in inflation expectations of households and businesses,” the CBR said in a statement Thursday. “In April annual inflation reached 17.8%, however, based on the estimate as of 20 May, it slowed down to 17.5%, decreasing faster than in the Bank of Russia’s April forecast.” Having plunged to a record low of 150 against the U.S. dollar on Mar. 7, weeks after Russian troops began their unprecedented invasion of Ukraine, the CBR’s capital control measures have brought the currency surging back to a two-year high, briefly touching 53 rubles to the dollar on Tuesday. The ruble weakened against the greenback on this morning to trade at 60.80 to the dollar.

- Russia raises pension and minimum wage as inflation hits economy. President Vladimir Putin has unveiled double-digit increases to Russia’s minimum wage and pensions as western sanctions push up the cost of living. Putin admitted Russia faced “difficulties” but denied these were linked to what he referred to as the country’s “special military operation” in Ukraine and said the economy had “better dynamics than forecast by some experts.” The country had to ensure incomes remained above subsistence levels, Putin said at a state council meeting. “This year is not a simple one [but] I do not mean that all these difficulties are due to this special military operation. Because in countries that are not conducting any operations, across the ocean in the U.S., in Europe, the inflation is similar,” Putin said.

|

PERSONNEL |

— Christopher Frey overcame criticism from Senate Republicans to win confirmation on Wednesday, becoming assistant secretary of the EPA’s Office of Research and Development. Frey was confirmed on a 51-43 vote.

— Antonio Delgado was sworn in as New York’s Lieutenant Governor Wednesday afternoon, shortly after 4 p.m. ET, when the 45-year-old Democrat officially resigned the Hudson Valley Congressional seat he first won election to in 2018. New York will hold a special election to fill Delgado’s vacant house seat on August 23, the same day as New York’s Congressional primaries.

|

CHINA UPDATE |

— China is pursuing a sweeping deal with 10 Pacific island nations that would significantly expand its regional influence. China is pursuing a regional agreement with Pacific island nations that would expand Beijing’s role in policing, maritime cooperation and cybersecurity while offering scholarships for more than 2,000 workers and young diplomats, according to documents obtained by the New York Times (link for details). The regional agreement included language requiring that Pacific island countries abide by the “one China” principle. The pending agreement is a direct challenge to the new Australian government under Prime Minister Anthony Albanese, who has vowed a response.

— Chinese premier: Some conditions worse than 2020. Chinese Premier Li Keqiang gave a dour warning about the world’s second-largest economy as it struggles from Covid-19 outbreaks and lockdowns. The premier said the situation in some cases is worse than 2020 when the pandemic first emerged. He urged more efforts to reduce a soaring unemployment rate. China will strive to get its economy back on a “normal track” in the second quarter, Li said. Beijing announced a package of policy steps earlier this week, including broader tax credit rebates and postponing social security payments and loan repayments to support the economy. It is also encouraging banks to extend loans to small businesses and those hit by tight Covid restrictions. Pandemic-hit Shanghai, China’s financial hub, unveiled more post-lockdown plans on Thursday as it moves towards a return to normalcy.

— Brazil corn exports to China will require ‘biotechnology equivalence’ agreement. China and Brazil agreed to corn export protocols earlier this week, but Brazilian corn exports to China require an agreement about approved GMO varieties before effectively beginning, Brazilian corn growers’ association Abramilho said. The Chinese are keen to sign a “biotechnology equivalence” agreement for GMO corn to allow trade with Brazil, according to Abramilho’s Executive Director Glauber Silveira. “Now the second step is the approval of biotechnologies, which needs to be more agile,” Silveira said.

— A bipartisan group of senators are calling on Biden to not lift Section 301 tariffs, which currently target China “and their illegal and unfair trade practices.” Rolling back the tariffs on China would “expose many U.S. companies and workers to a sudden flood of imports, and signal to China that waiting out the United States is preferable to changing their non-market behavior,” they wrote in a letter (link).

|

ENERGY & CLIMATE CHANGE |

— Reporting GHG emissions. The Biden administration will soon propose a rule requiring major companies that supply goods and services to the federal government to disclose their greenhouse gas emissions, a White House official said Wednesday. The rule will be distinct from — but similar to — the U.S. Securities and Exchange Commission’s March proposal that requires publicly traded companies to report their carbon emissions.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— FDA acknowledges slow response to formula shortage. Sluggish response and questionable decisions by the Food and Drug Administration (FDA) exacerbated the nation’s infant formula shortage, agency officials told lawmakers at a congressional hearing Wednesday. “You’re right to be concerned, and the public should be concerned,” said FDA Commissioner Robert Califf. The agency’s response “was too slow and there were decisions that were suboptimal along the way.” Top executives from Abbott Nutrition, Gerber Products Co. and Reckitt — three of the largest manufacturers of infant formula in the U.S. — also testified before the committee, with Abbott Nutrition apologizing for its facility’s shortfalls. Regulators said that they reached a deal to allow Abbott Nutrition to restart its factory — with production projected to be underway as soon as June 4 — following an overhaul in the company’s safety protocols and procedures. Abbott said it would take at least two months for its formula to begin arriving in stores.

Califf said the FDA’s food programs require a revamp, including more funding, more personnel and newer technologies to track the nation’s supply chains. The House last week passed a bill to provide $28 million in emergency funding to the FDA to address the formula shortage, which Califf said would be helpful. The bill’s prospects in the Senate are unclear.

— Poultry regs unveiled by USDA. The proposed rule on poultry grower contracting and tournaments is one of three regulations the Biden administration has promised to pursue. USDA Secretary Tom Vilsack will likely talk about the results as he appears today before the Senate Agriculture Committee. Link to USDA release on the topic.

Details: USDA unveiled a proposed rule under the Packers and Stockyards Act they say will “protect poultry growers from abuse,” according to a USDA release. The proposed rule will require poultry processors to provide information to poultry growers at several steps which USDA said is aimed at “increasing transparency and accountability in the poultry growing system. Processors would have to disclose details of inputs provided to each farmer and information about the input differences among farmers being ranked. The disclosures would cover the level of control and discretion exercised by the poultry processor and “what financial returns the farmer can expect from the relationship based on the range of real experiences of other growers,” USDA said. “Contracts would also be required to contain guaranteed annual flock placements and density. Poultry processor CEOs would be required to sign off on the compliance process for disclosure accuracy.”

— USDA announces effort to gather information fairness in poultry growing tournament systems. USDA said it “opening an inquiry into whether some practices of processors in the tournament system are so unfair that they should be banned or otherwise regulated.” USDA wants feedback to “determine whether the current tournament-style system in poultry growing could be restricted or modernized to create a fairer, more inclusive marketplace.”

— USDA is making $200 million available to create a new meat processing capacity expansion program, providing $25 million for workforce training under the Meat and Poultry Intermediary Lending Program (MPILP). The $200 million will “provide much-needed financing to independent meat and poultry processors to start up and expand operations,” USDA said. The program will provide grants of up to $15 million to qualifying recipients that will use the funding to create a revolving loan fund to finance capacity expansion.

Details. The financing will be available to independent meat and poultry processors to “start up and expand operations.” MPILP will provide grants of up to $15 million to nonprofit lenders, including private nonprofits, cooperatives, public agencies and tribal entities, according to USDA. Those entities are to use the funding to “establish a revolving loan fund to finance a variety of activities related to meat and poultry processing.”

— Carl Icahn is hoping to get the backing of fellow shareholders for his plan to replace two directors on the board of McDonald’s. The activist investor has clashed with the fast-food chain’s management over its treatment of pigs.

|

POLITICS & ELECTIONS |

— Ten races move in Republicans’ direction. Says David Wasserman of the Cook Political Report with Amy Walter: “This week, we're shifting ten races in Republicans' direction and two in Democrats' direction. Overall, there are now 35 Democratic-held seats in Toss Up or worse, and we're revising our fall House outlook to a net GOP gain of between 20 and 35 seats.” For subscribers, link to article.

Rating Changes:

AZ-04: Stanton - Likely D to Lean D

CA-40: Kim - Likely R to Lean R

CA-49: Levin - Likely D to Lean D

CT-02: Courtney - Solid D to Likely D

CT-05: Hayes - Likely D to Lean D

IL-14: Underwood - Lean D to Likely D

MN-01: VACANT (Hagedorn) - Likely R to Solid R

NV-01: Titus - Lean D to Toss Up

OR-05: OPEN (Schrader) - Lean D to Toss Up

PA-01: Fitzpatrick - Likely R to Solid R

PA-07: Wild - Toss Up to Lean R

PA-10: Perry - Likely R to Solid R

— In Pennsylvania, Oz's lead over fellow Republican Dave McCormick is down to 902 votes out of 1.3 million votes cast in that state's GOP primary. There will be a recount, but recounts seldom change the final results of an election. Still, there is a dispute over the counting of absentee ballots — McCormick has gone to court to allow the counting of absentee ballots that were received by the deadline but did not have a date written on them. Pennsylvania officials ordered a recount in the too-close-to call race. Acting Pennsylvania Secretary of State Leigh Chapman said Oz currently has a lead of 902 votes over McCormick based on unofficial votes tallied so far, which by state law triggers an automatic recount.

— Update on Tuesday primary races (Source: Ballotpedia):

- Alabama: Britt, Brooks advance to runoff in Alabama Republican primary. Katie Britt and Mo Brooks were the top two finishers in the Republican primary for U.S. Senate in Alabama. Britt had 45% of the vote to Brooks’ 29%. The two advanced to a June 21 runoff since neither received more than 50% of the vote. Britt is a former chief of staff to retiring incumbent Richard Shelby (R), and Brooks is a member of the U.S. House.

- Georgia: McBath defeats Bourdeaux in incumbent-vs.-incumbent primary. Incumbent Lucy McBath defeated fellow incumbent Carolyn Bourdeaux in the Democratic primary for Georgia’s 7th Congressional District. McBath had 63% of the vote to Bourdeaux’s 31%. The two were running against one another because of new district lines following the 2020 census. Bourdeaux is the fourth member of the U.S. House to lose a primary so far in 2022.

- Texas: Cuellar, Cisneros runoff still too close to call. The Democratic primary runoff between incumbent Henry Cuellar and Jessica Cisneros remained too close to call. Cuellar had 50.2% of the vote to Cisneros’ 49.8%, with the two separated by a margin of 175 votes out of more than 45,000 cast. Cuellar and Cisneros disagreed on abortion policy, with Cisneros supporting legal access to abortion and Cuellar voting against a bill that would codify access to abortion at the federal level. Cisneros and Cuellar also ran against one another in 2020. That year, Cuellar defeated Cisneros 52% to 48%.

— Beto O’Rourke interrupts press conference on Texas school massacre. The Democratic candidate for Texas governor accused the incumbent Republican Greg Abbott of “doing nothing” to curb gun violence in the state at a press conference to give further information on the shooting of 19 young children and two teachers at an elementary school. His remarks prompted shouts from Republican officials assembled onstage and reflected the rawness of American emotions, and of gun-control debates.

— Biden approval falls below every modern president. Citing approval polling dating back to Harry S. Truman in 1945, FiveThirtyEight said that no president has been below, or even equal to, Biden’s average of 40.9% on Day 490 of their presidency. Former Presidents Donald Trump, Bill Clinton, and Gerald Ford had lower average approval ratings at some stage early in their presidencies, but Biden has caught up, and today’s average was the first for which he was below all presidents since Truman, a potentially troubling trend as Democrats ready for the midterm elections.

|

CONGRESS |

— After today, the Senate departs for two weeks for the one-day Memorial Day. The House has been gone since May 19 and will return June 7.

|

OTHER ITEMS OF NOTE |

— Biggest wave of Cuban migrants arriving in U.S. since 1980 is driving policy changes. A Miami Herald article (link) notes: “"About 115,000 Cubans — more than 1% of the island’s population — have left their homeland fleeing poverty and repression and reached the U.S. in the past seven months, a mass migration wave on a scale not seen in four decades that has prompted recent changes in U.S. policy and provided the Cuban government an escape valve following unprecedented protests last year."

— Brazil President Jair Bolsonaro said he and Biden will have their first bilateral meeting next month after the South American leader agreed to attend a regional summit in Los Angeles, according to CNN Brasil.

— Tom Brady + drone = magic. Just watch the video (link).