Putin Could Formally Declare War on Ukraine on May 9

Roe vs. Wade | FOMC meeting begins | Countries facing wheat crisis | Food banks

Washington Focus

Today’s dispatch is abbreviated as I will speak early this morning to a CIPA event in Kansas City.

U.S. and Western officials believe Russian President Vladimir Putin could formally declare war on Ukraine as soon as May 9 to coincide with "Victory Day" inside of Russia, which commemorates the country's defeat of the Nazis in 1945. Meanwhile, tensions remain heightened at the besieged Azovstal steel plant, where a commander among the Ukrainian soldiers yesterday said that the complex is under "constant fire" as hundreds of civilians try to evacuate. Ukraine says it sank two Russian naval vessels in the Black Sea, as a Russian missile attack killed civilians in Odessa and heavy fighting continued in eastern Ukraine. Russia is assembling an economic relief package equivalent to tens of billions of dollars to soften the blow of Western sanctions.

Ukraine expecting significant grain storage shortage. Ukraine is forecast to have a significant shortage of grain storage facilities for this year’s crops due to a sharp decline in exports resulting from Russia’s invasion, analyst APK-Inform said. The firm said Ukraine’s exports could total only 45.5 MMT in 2021-22 after last year’s record harvest of 86 MMT and grain and oilseeds stocks might reach an all-time of 21.3 MMT. APK-Inform said Ukraine could have available storage capacity of only 16.3 MMT for this year’s harvest that could total 55.9 MMT of grains and oilseeds.

Hungary said that it would not support an embargo on Russian oil and gas, and Slovakia said that it would seek an exemption from any EU-wide oil ban. The comments came after the German finance minister said that Germany would be “able to bear” an embargo, paving the way for a ban on the import of oil from Russia which could come into effect by the end of the year. Oil prices rose on the news.

Supreme Court is ready to overturn Roe vs. Wade and allow states to outlaw abortion, according to a purported draft opinion that was leaked to Politico. Sometimes draft rulings can be revised in the final months as justices weigh in during the writing process. According to Politico, Justice Samuel A. Alito Jr. wrote a draft in February that says the 1973 Roe abortion ruling was “egregiously wrong” and should be overturned completely. Alito and Justice Clarence Thomas have made clear for years that they thought Roe should be overturned. In recent years, they have been joined by three Trump appointees who agree with them: Justices Neil M. Gorsuch, Brett M. Kavanaugh and Amy Coney Barrett. Meanwhile, pro-choice and anti-abortion protesters descended on the Supreme Court in Washington D.C. late Monday as tensions mounted following the leak of the draft Supreme Court opinion.

The opinion in this case is not expected to be published until late June. Major media has not independently confirmed the document's authenticity. Politico says it has authenticated the draft.

At least 12 states have “trigger laws” that would automatically ban all abortions if Roe is overturned.

Global stock markets were mostly higher overnight. U.S. stock indexes are pointed toward lower openings.

The key outside markets today sees Nymex crude oil futures prices lower and trading around $103.75 a barrel. The U.S. dollar index is weaker in early trading. The yield on the 10-year U.S. Treasury note is presently fetching 2.967%. The 10-year yield early this week hit a 3.5-year high just above 3%. The yield on the benchmark German 10-year bond (bund) rose above 1% for the first time since 2015.

Quiet, two-sided trade overnight. Corn futures are firmer, soybeans are weaker and wheat is mixed this morning following two-sided trade overnight. As of 7:30 a.m. ET, corn futures were trading 3 to 4 cents higher, soybeans were 3 to 5 cents lower, SRW wheat was 1 to 2 cents lower, HRW wheat was 3 to 4 cents higher and spring wheat was narrowly mixed. Front-month U.S. crude oil futures were around $1.35 lower and the U.S. dollar index was about 235 points lower this morning.

Federal Reserve’s two-day FOMC meeting begins today. Wednesday is widely expected to bring a 50-basis-point hike in interest rates. But it will be what Fed Chairman Jerome Jay Powell says during his presser that will garner the most attention. Most still expect this week’s rate boost to be followed in June with another half-point increase — and possibly more after that. But the watch is on to see if Powell provides new signals about how high officials think interest rates are likely to rise in the coming year or two. "While it's clear that this economy doesn’t need stimulative monetary policy, what is less clear is the speed at which this stimulus should be removed, and the reasons for choosing that speed," said Alex Roever, U.S. rates strategist at J.P. Morgan.

10-year Treasury yields hit 3% for first time since 2018. Treasurys, a reference for borrowing costs on everything from mortgages to student loans, are responding to Fed plans to raise interest rates in an effort to rein in inflation.

Germany's 10-year bond also reached 1% for the first time since 2015, reflecting expectations of tightening monetary policy. Besides the U.S. Fed, the Bank of England meets on Thursday and is also expected to provide signals on what they see ahead for increases in interest rates.

The Reserve Bank of Australia raised its benchmark interest rate for the first time in more than a decade, acting to tame inflation that is threatening the country’s economy.

Still little change in CFAP payouts. Data as of May 1 from USDA indicated little change in payments under the Coronavirus Food Assistance Program (CFAP) efforts. CFAP 2 payments totaled at $19.16 billion with original CFAP 2 payments at $14.33 billion and top-up payments at $4.83 billion. Total CFAP 1 payouts were at $11.81 billion, with original CFAP 1 payments at $10.62 billion and top-up payments at $1.19 billion. The figures have remained largely unchanged since the weekly updated issued for the period ending April 19.

Food banks are serving more people again as inflation squeezes budgets. Forgotten Harvest, which serves the metro Detroit area, said demand increased 25% to 45% since December in different areas it serves. In March alone, demand rose 30% compared with the previous month. Christopher Ivey, a spokesman for the food rescue, told the WSJ that metro Detroit is at the front of the bell curve, experiencing economic ripples before they hit other parts of the U.S. The Labor Department last month reported that the price of food at grocery stores in March was 10% higher than a year earlier.

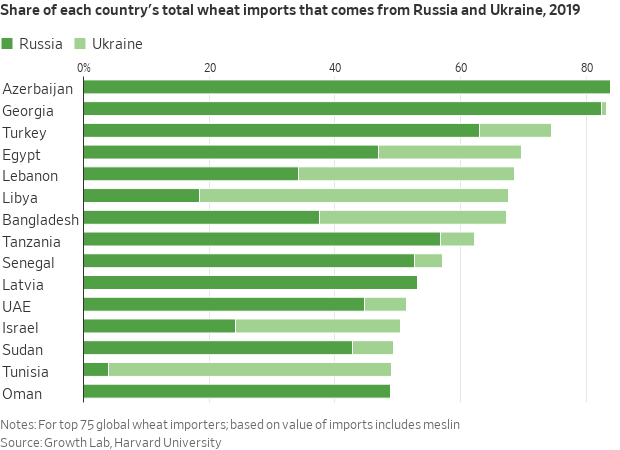

Countries are facing a wheat crisis as Russia's attack on Ukraine threatens food supplies from one of the world’s most productive farming region, the WSJ reports (link). From India to Ireland, governments are moving to fill a void that could total tens of millions of tons of grain. They are paying farmers to sow more crops and are enlisting railcars and additional containers to move wheat. Traders are exploring alternate routes to move crops out of Ukraine, where the key port of Odessa is offline and fighting has turned fields into battlegrounds. In the near term, according to the WSJ article, it will be hard for the rest of the world’s farmers to take up the slack, given that Russia and Ukraine combined typically account for more than a quarter of global wheat exports.

“It’s not a question of the world running out of grain, it’s a question of how high the price will be that people have to pay for it,” says Dr. Joe Glauber of the International Food Policy Research Institute and former chief USDA economist.

Workers strike at CNH plants. Workers at CNH Industrial plants in Racine, Wisconsin, and Burlington, Iowa, are on strike, the first strike in nearly 20-years. The United Auto Workers (UAW) said talks broke off with CNH on Monday and told workers to leave their jobs. The contract between UAW workers and CNH expired Sunday morning, but negotiations continued into Monday. Around 1,100 workers are affected by the action and marks the first strike by the union against CNH since 2004.

U.S. tariff relief on China is now under consideration at the White House as the Biden administration confronts the strongest U.S. inflation readings since the early 1980s. "Are they on the table or not? All tools are on the table," U.S. Trade Representative Katherine Tai said during an interview at the Milken Institute Global conference in Los Angeles. "The question is 'What do you do with them?'" Last week, Treasury Secretary Janet Yellen also proposed the phasing out of Trump-era tariffs on merchandise imports from China to provide price relief to Americans. "While they may have created negotiating leverage, they serve no strategic purpose," added Daleep Singh, deputy national security adviser for international economics. "From the beginning of the administration, we talked about how some of the tariffs implemented by the previous administration were not strategic and, instead, raised costs on Americans," White House Press Secretary Jen Psaki further declared at a press briefing. "And our effort — which has been ongoing, of course — has been to ensure current Section 301 tariffs align appropriately with our economic and trade priorities."

Tai also raised questions about the conclusions of a Peterson Institute for International Economics report that said inflation would fall by 1.3 percentage points if the U.S. and China eliminated tariffs and the U.S. also removed steel and aluminum tariffs and those on softwood lumber from Canada. "I really have to challenge the premise of that study," Tai told the conference. "I think it's either something between fiction or an interesting academic exercise." Tai Monday suggested “let’s also look at monetary policy, fiscal policy. Let’s look at tax policy.”

Commercial bird flu operations affected by HPAI reaches 164. USDA’s Animal and Plant Health Inspection Service (APHIS) has now confirmed highly pathogenic avian influenza (HPAI) in 164 commercial flocks with the addition of flocks in Lancaster County, Pennsylvania (19,300 duck meat birds), Stearns County, Minnesota (10,000 turkey breeder hens), and Weld County, Colorado (1,100,000 table egg layers) listed as confirmed April 29. APHIS also reported the April 30 confirmation of HPAI in a commercial broiler breeder operation in Sequoyah County, Oklahoma involved 13,800 birds.

Big new investment money is heading into cold storage. Private-equity firm Bain Capital and real-estate developer Barber Partners are teaming up on a $500 million plan to build 10 to 15 refrigerated warehouses across the U.S. in the next few years. The WSJ writes (link) the companies are targeting grocery chains and logistics operators with multi-tenant facilities measuring around 300,000 square feet apiece. The joint venture managing sites under the name Chill Storage could bring significant new capacity to a refrigerated market that has seen strong demand driven by the growth of e-commerce in the past two years. The broader online demand is waning, but Bain’s David DesPrez says demand for fresh, local food “is a very durable trend.” The refrigerated sector has been active lately, with Lineage Logistics and Americold dominating the market and building scale in part by consolidating smaller operators.

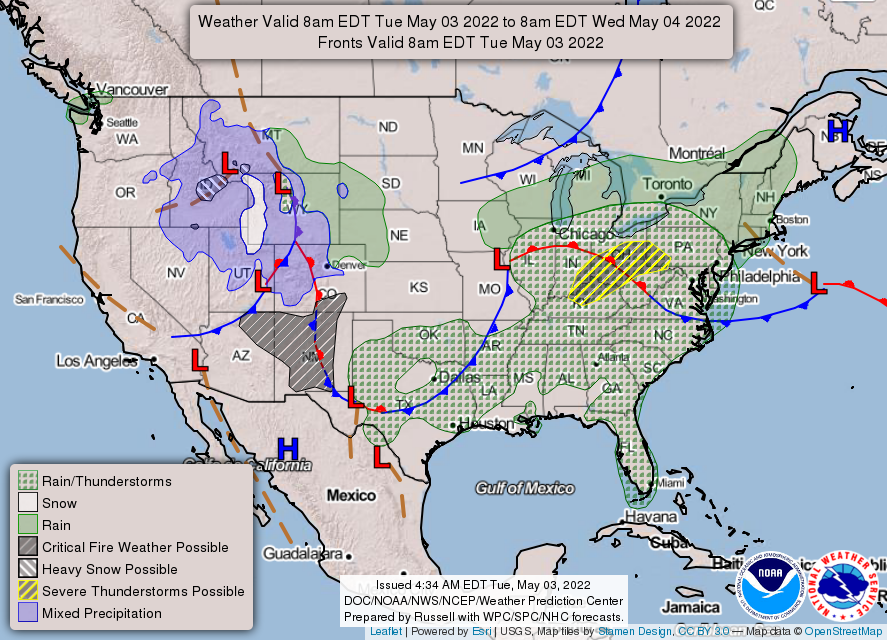

NWS weather: There is a Slight Risk of severe thunderstorms for portions of the Ohio Valley/Central Appalachians through Wednesday morning... ...Heavy rain and severe thunderstorms for portions of the Central/Southern Plains and Middle/Lower Mississippi Valley on Wednesday... ...There is a Critical Risk of fire weather over parts of the Southern Rockies/Southwest.

Extreme heat in India is “testing the limits of human survivability,” according to a climate expert. Last month, New Delhi saw seven consecutive days over 40 degrees Celsius (104 Fahrenheit). In some states, the heat has damaged crops and put pressure on energy supplies as officials warned residents to remain indoors and keep hydrated. The heatwave has also been felt by India's neighbor Pakistan, where the cities of Jacobabad and Sibi in the country's southeastern Sindh province recorded highs of 47 degrees Celsius (116.6 Fahrenheit) on Friday.

Global cases of Covid-19 are at 514,284,077 with 6,238,474 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 81,444,332 with 993,999 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 574,232,736 doses administered, 219,483,386 have been fully vaccinated, or 66.61% of the U.S. population.