Senate Ag Committee Reviews Two Cattle Market Legislative Proposals

Ranking member reveals he had ‘spirited conversations’ with USDA

Note: This updated special report includes more comments from those testifying at today’s hearing, and a bottom-line assessment of the topic.

The Senate Ag Committee today reviewed two controversial cattle market proposals — S 4030 the Cattle Price Discovery and Transparency Act of 2022 and S 3870 the Meat and Poultry Special Investigator Act of 2022. Link for details from the Senate Ag panel.

The Senate Ag Committee today reviewed two controversial cattle market proposals — S 4030 the Cattle Price Discovery and Transparency Act of 2022 and S 3870 the Meat and Poultry Special Investigator Act of 2022. Link for details from the Senate Ag panel. (Note: This special report could be updated with additional comments and perspective.)

S 4030 would require beef packers to buy more of their cattle in “open, competitive markets.” Its proponents believe a lack of competition due to heavy concentration in the meatpacking industry is giving packers too much market power, to the detriment of both consumers and farmers and ranchers. The measure (S 4030) now has a total of 19 co-sponsors in the Senate, including nine Republicans and 10 Democrats. The legislation is being spearheaded by Sens. Chuck Grassley (R-Iowa), Deb Fischer (R-Neb.), Jon Tester (D-Mont.) and Ron Wyden (D-Ore.).

“Today’s marketplace is more consolidated than it was in 1921, when this body passed the Packers and Stockyards Act. Rural America is drying up because we can’t get fair prices at the farmgate. Capitalism isn’t working, in this particular instance, because of concentration and consolidation in the industry,” said Sen. Tester.

Meatpackers currently acquire the majority of their cattle by contracting with individual producers. The Cattle Market Transparency Act would require more public disclosure of what packers are paying for their cattle and also require the packers to buy more cattle through competitive cash markets.

Packers argue there is nothing inherently wrong with cattle markets, attributing the price changes to natural supply and demand forces and market disruptions like the pandemic.

The North American Meat Institute in a statement urged members of the Senate Ag Committee to reject the Grassley-Fischer bill’s mandates and federal intrusion in the beef and cattle markets. “Leading agricultural economists have determined Grassley-Fischer bill’s latest draft remains costly to producers, especially producers in Texas, Oklahoma and Kansas where the majority of U.S. fed cattle are raised,” said Meat Institute President and CEO Julie Anna Potts. “Due to a shrinking herd and sustained consumer demand, cattle prices are at seven-year-highs without federal intervention in the market.”

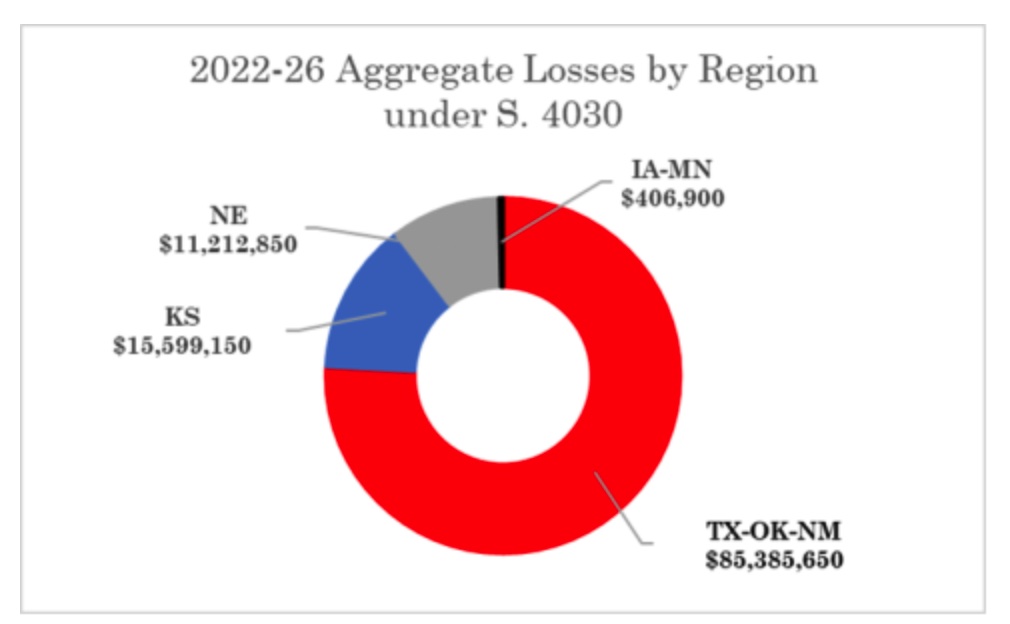

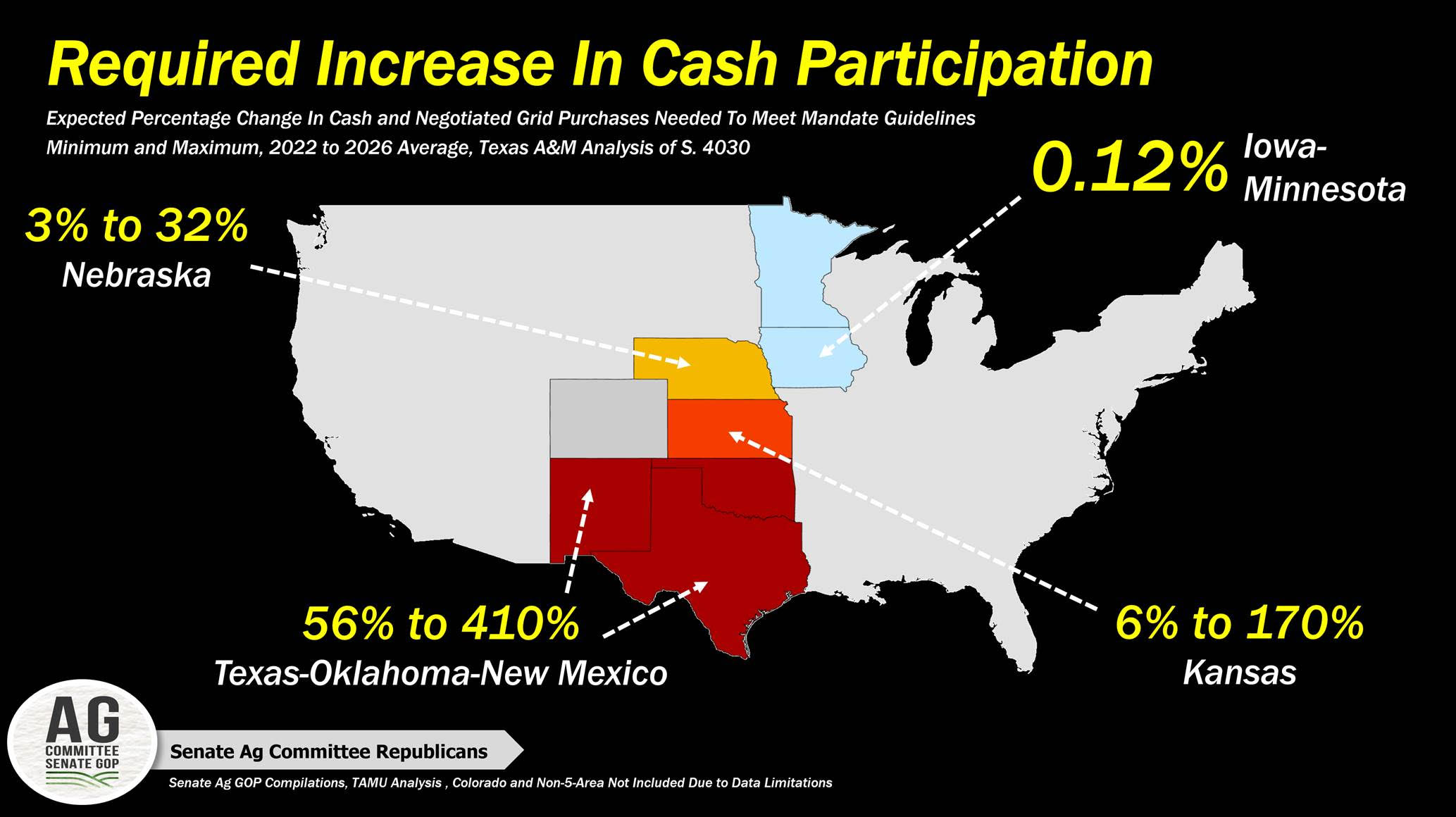

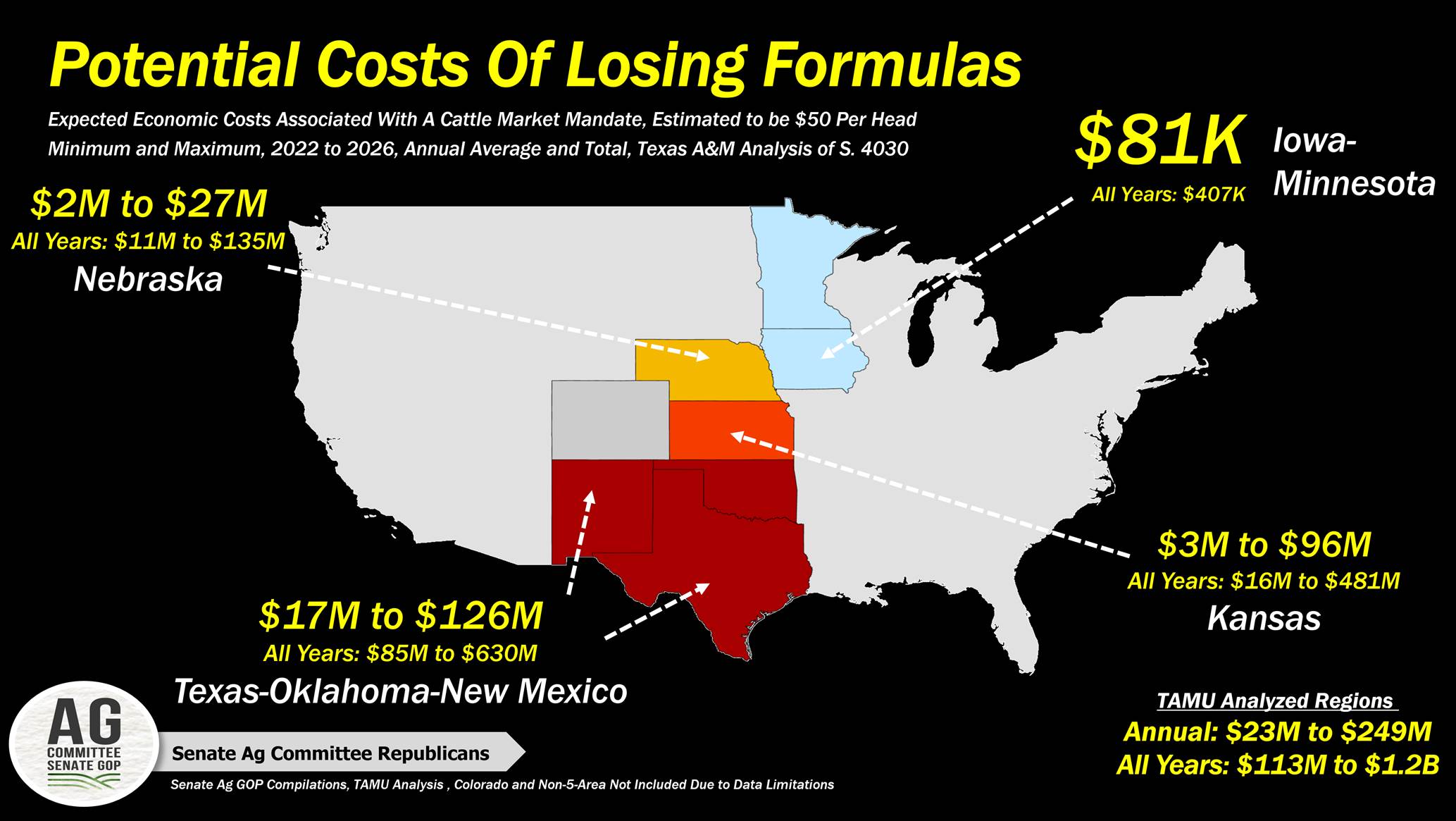

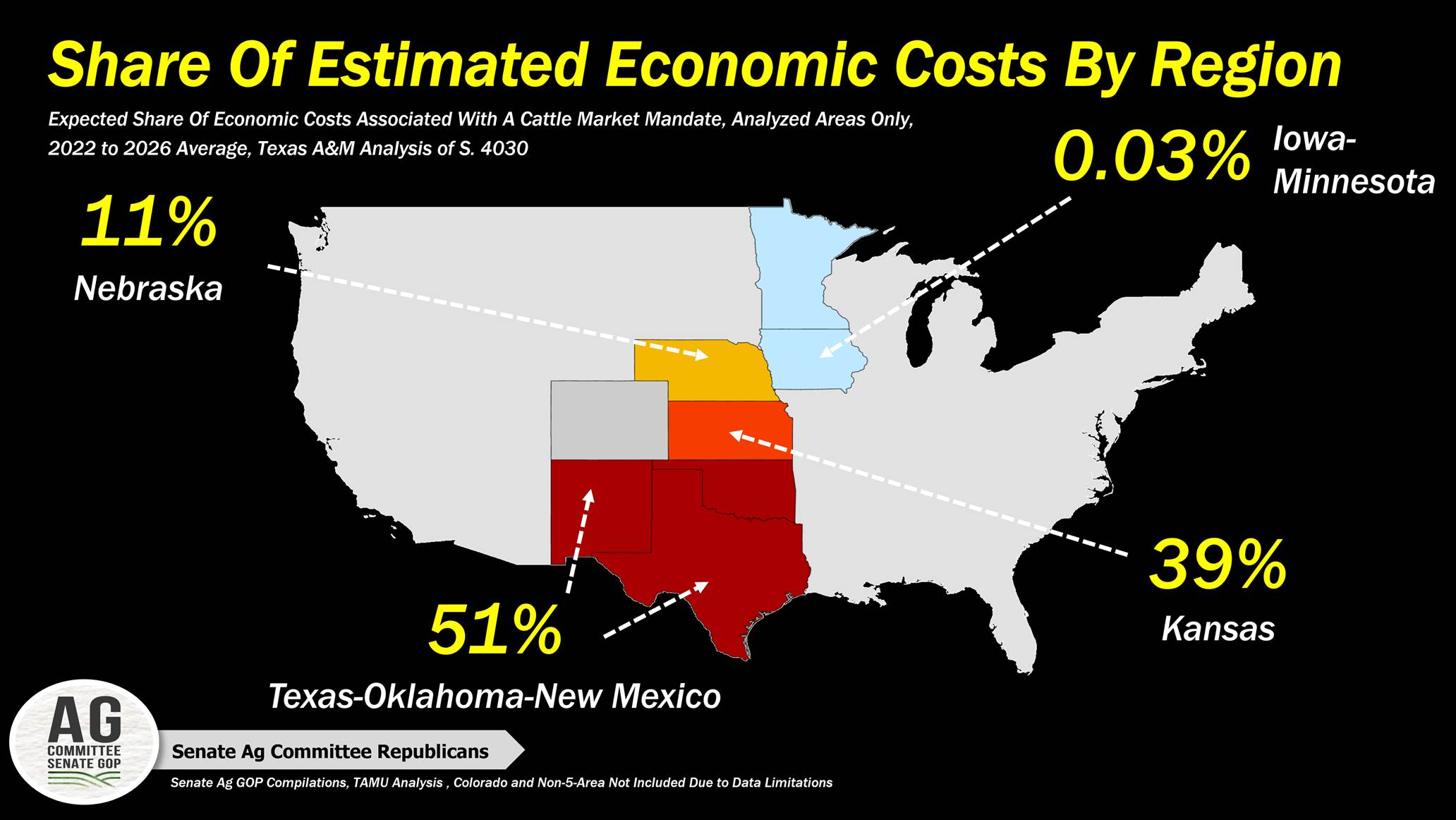

Economists from the Agricultural and Food Policy Center at Texas A&M University found that the latest Grassley-Fischer bill, S 4030, could cost producers even more than an earlier estimate of $112 million over five years ($50 a head on 2.3 million head). The economists found the mandate would have regional disparities: the Texas-Oklahoma-New Mexico region, Kansas, and Nebraska would shoulder most of the costs, while the Iowa-Minnesota region would escape relatively unscathed (see chart).

In her statement Potts said: “…applying the cash market mandate to only the largest packers reveals the proposed mandate for what it is: a punitive tool. Under the latest version of the bill, if a beef packer gets too large, they will be forced to buy a certain percentage of cattle on the cash market. Gone is the illusion that the cash market is somehow more virtuous than other means of marketing cattle; gone is the argument that the cash market is necessary for transparency and price discovery. Instead, the cash market mandate is just that: a government mandate designed to punish the largest companies and their suppliers. In this sense, the mandate is an antitrust tool that could be used in any industry. If a company gets too large, it will be punished with a government mandate directing how the company can purchase inputs. Such a government mandate should elicit opposition from anyone interested in protecting the free market.”

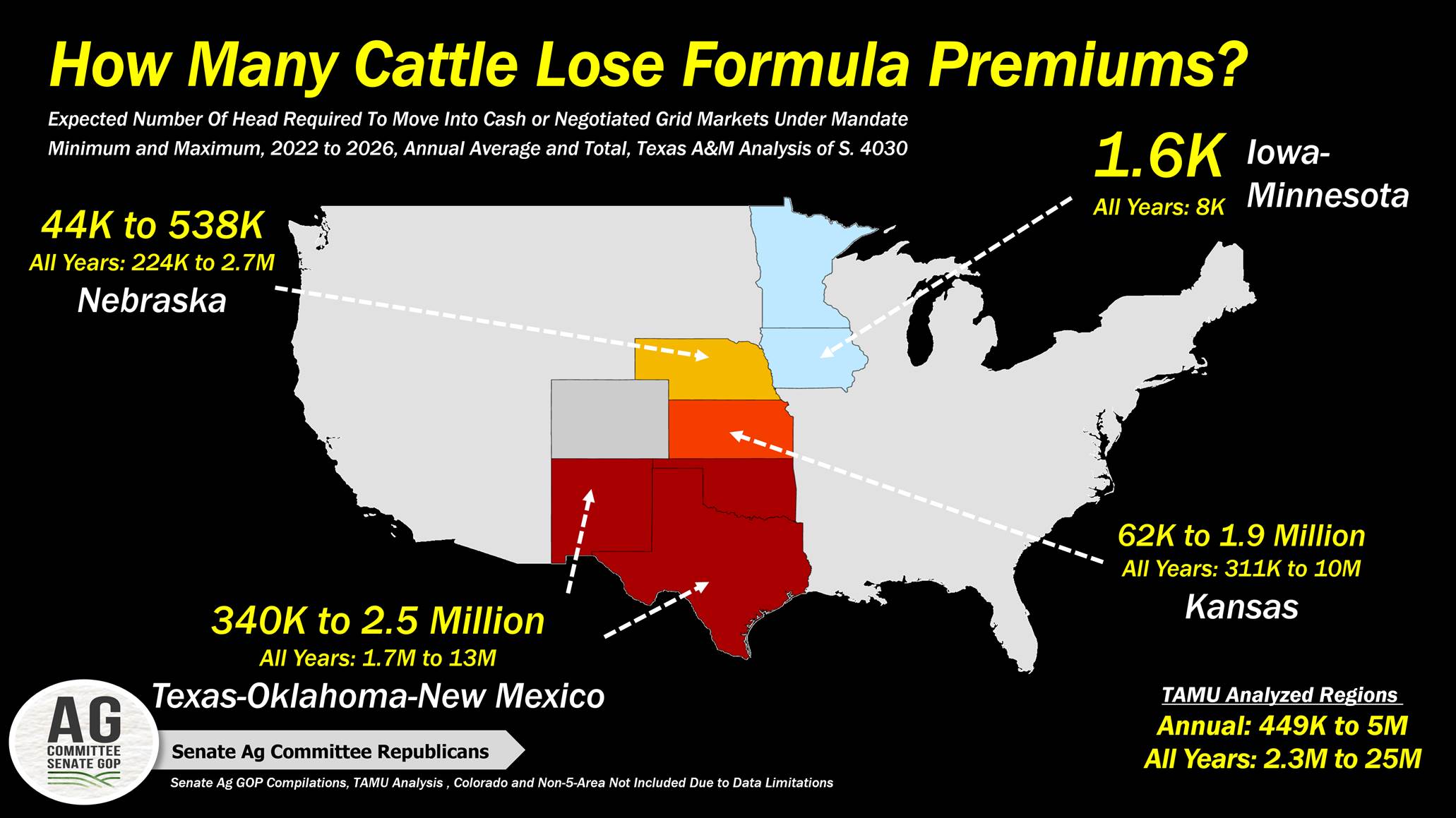

Sen. John Boozman (R-Ark.), ranking panel member, said under the proposed measure, the number of cattle marketed under alternative marketing agreements (AMAs) will decrease and the number of cattle sold in the cash market will increase. “For example, in Texas, Oklahoma and New Mexico, between 340 thousand and 2.5 million fed cattle will need to move out of formula contracts annually. In Iowa and Minnesota, it’s fewer than two thousand head a year.”

Using Texas A&M’s analysis and economic cost estimates from Dr. Koontz, Boozman said the costs of this shift away from AMA’s will cost cattle producers between $23 million and $249 million annually, depending on how the Secretary of Agriculture decides to implement the law. Over the five years analyzed by Texas A&M, the costs are in the hundreds of millions to billions of dollars.

The costs to cattle producers are not all borne equally, Boozman detailed. “Some regions will be more heavily impacted that others. Nearly 90% of the economic costs of this bill are estimated to be borne by farmers in Kansas and the Southern Plains, including Texas, Oklahoma and New Mexico.”

Questions for review. The conversations Boozman has had with participants in all sectors of the cattle industry, he said the following questions need to be considered:

How do the proposed solutions influence packer concentration?

What regions or sectors of the cattle industry will ultimately benefit, and what regions or sectors will bear the costs?

Does S 4030 disincentivize investment and innovation?

With the utilization of AMAs capped, what tools do producers have to manage risk?

What will the cattle industry look like in a decade if this legislation is enacted, and what will it look like if it isn’t?

And, how would these bills have changed the supply and demand dynamics during the Covid-19 pandemic or other black swan events?

Boozman revealed he has been in “spirited conversations with USDA” as he has “unsuccessfully attempted to secure the expert opinion of the Office of the Chief Economist on S 4030. To ensure the committee has the benefit of the chief economist's expert opinion, I will pose questions to the witnesses today and submit questions for the record. It is my expectation, and I hope the members of the committee will share my expectation, that the Office of the Chief Economist should be empowered to answer any question of any senator fully, completely, independently and without fear of reprisal. Furthermore, any effort by any government official to thwart this committee’s oversight activities should not be tolerated.”

The hearings also heard from Andy Green, USDA’s senior advisor for market competition, Agricultural Marketing Service Administrator Bruce Summers, and a separate panel of ag economists and producers. Green said, “In general, we are intending to be as careful — input-driven, fact-driven — as we possibly can and take into account all the different viewpoints of a complex and complicated industry.”

“Today’s competition challenges in our cattle markets didn’t happen overnight; we’ve been at this a long time. These challenges have been decades in the making & didn’t just come about because the Holcomb fire in 2019 nor the Covid-19 pandemic,” said Sen. Cindy Hyde-Smith (R-Miss.).

The panel of producers — Shelly Ziesch from North Dakota, William Ruffin from Mississippi and Shawn Tiffany from Kansas who is also president-elect of the Kansas Livestock Association — and Dr. Stephen Koontz from Colorado State University had some clear divisions. Ziesch and Ruffin both back the legislation and Ruffin specifically said that he did not see a price downturn as a cow/calf operator when more negotiated sales took place in the region he is in. His often-stated response was that he lacked information on the basic market, leaving him unable to determine what is a fair market value for his cattle. Ziesch echoed that, saying that without more cash-market information, she is unable to determine that fair value. Tiffany, however, cautioned that he feared that premiums that are currently available to him and others that feed cattle via marketing agreements would disappear if more negotiated cash sales were mandated to take place. He explained that the decisions he makes are made perhaps years in advance of the cattle actually going to market. Koontz also cautioned against the provisions in the bill mandating cash sales by region. He, too, said his research and research he is familiar with conclude that it would lower cattle in general. He also pointed out that some of what is happening in the market is from the market being “out of balance — too many cattle and not enough capacity.” He said that was a marked change from what had been seen for an extended period where there was too much capacity and too few cattle.

Bottom line: There continues to be a lot of differences on this controversial measure, and it is murky whether supporters can find enough votes to get it through the full Senate. Meanwhile, it will be interesting to see if Farm Bureau and/or NCBA releases any statement on the topic, or release updated recommendations on the subjects at hand. The hearing underscored the differences that remain over this issue and why getting agreement on a single piece of legislation will be extremely difficult, also underscored by how long it took to generate the package which finally got to the point of having a hearing before the Senate Ag Committee.

Sen. Jon Tester (D-Mont.) is sponsoring a bill (S 3870) that would create a team of investigators, with subpoena power to enforce anti-trust laws, establish minimums for negotiated sales, and require clear reporting of marketing contracts.

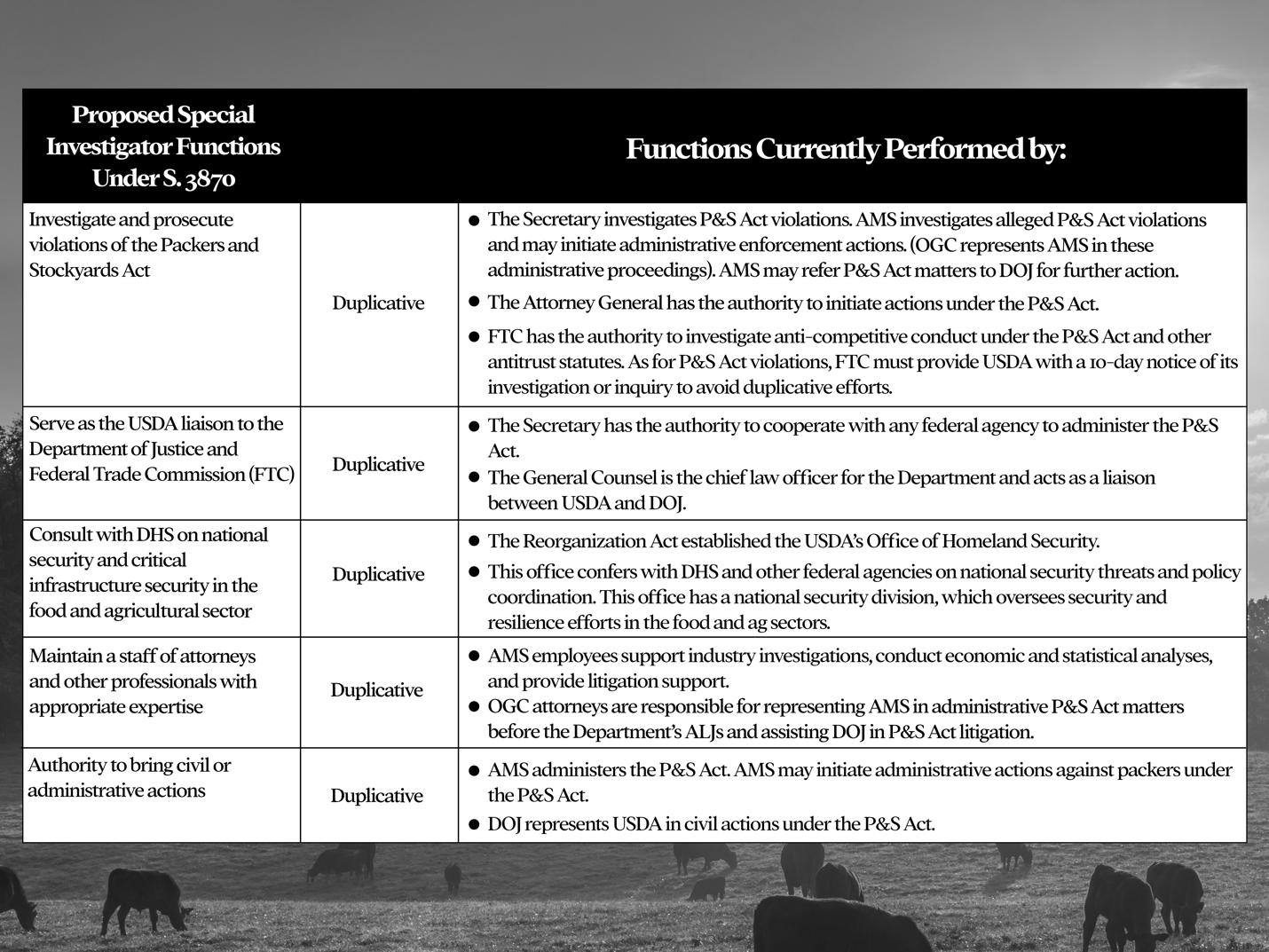

Sen. Boozman noted his concern about the Meat and Poultry Special Investigator Act (S 3870), which is also being pushed by Sen. Chuck Grassley (R-Iowa). Boozman said he is “very uncertain about this legislation’s purpose and goals. Legal experts have shared with me that this newly created office at USDA will just duplicate functions already performed by either USDA, the Department of Justice, the Federal Trade Commission, or the Department of Homeland Security.

Questions raised by Boozman: "Do we really think that creating yet another government entity is a real solution? Is duplication of responsibilities and confusing the chain of command among federal regulators helpful to our stakeholders? Does the creation of this office discourage the establishment of new small and midsize meat packers?"

While the focus of the legislative proposal is on the large packers, what are often referred to as the “Big 4” in the beef industry, Boozman noted “there are more than a thousand small packers across the country” who are also subject to the requirements of the Packers and Stockyards Act. “Those small businesses are dotted across rural America, and they represent the vast majority of the meat and poultry processing facilities in America. They would also be subject to investigation by this new law.”

The proposal also impacts the pork, poultry, and lamb industries. Yet, Boozman said, “none of those stakeholders are testifying today. I believe the committee should ensure that the record reflects any comments or analysis those industries would like to provide.”