USDA Announces 1,347,000 MT of Corn for Delivery to China

Treasury Secretary Yellen discusses logistics and need for food, fertilizer aid for some nations

|

In Today’s Digital Newspaper |

Ukraine’s president, Volodymyr Zelenskyy, said 120,000 civilians remain trapped in Mariupol, which Russia has besieged for two months. The mayor of the port city said that Russian forces had been burying dead civilians in mass graves — visible on satellite pictures — to hide “barbaric” war crimes. He made a new appeal for the “full evacuation” of the city. Russia claimed on Thursday to have captured the town, despite few apparent changes on the ground. President Vladimir Putin told his army to withhold “unnecessary” attacks, and instead blockade the area of the Azovstal steelworks where Ukrainian resistance is holed up. Meanwhile, a Russian general said Moscow aims to extend control over the entire south of Ukraine. German Chancellor Olaf Scholz pledged to continue shipping weapons to Ukraine, yet insisted an open conflict with Russia that could lead to nuclear war must be avoided at all costs. In related news, the Biden administration announced another $1.3B in support for Ukraine — $500 million for government operations and $800 million for military aid. Also, officials are searching for U.S. sponsors to house up to 100,000 Ukrainian refugees.

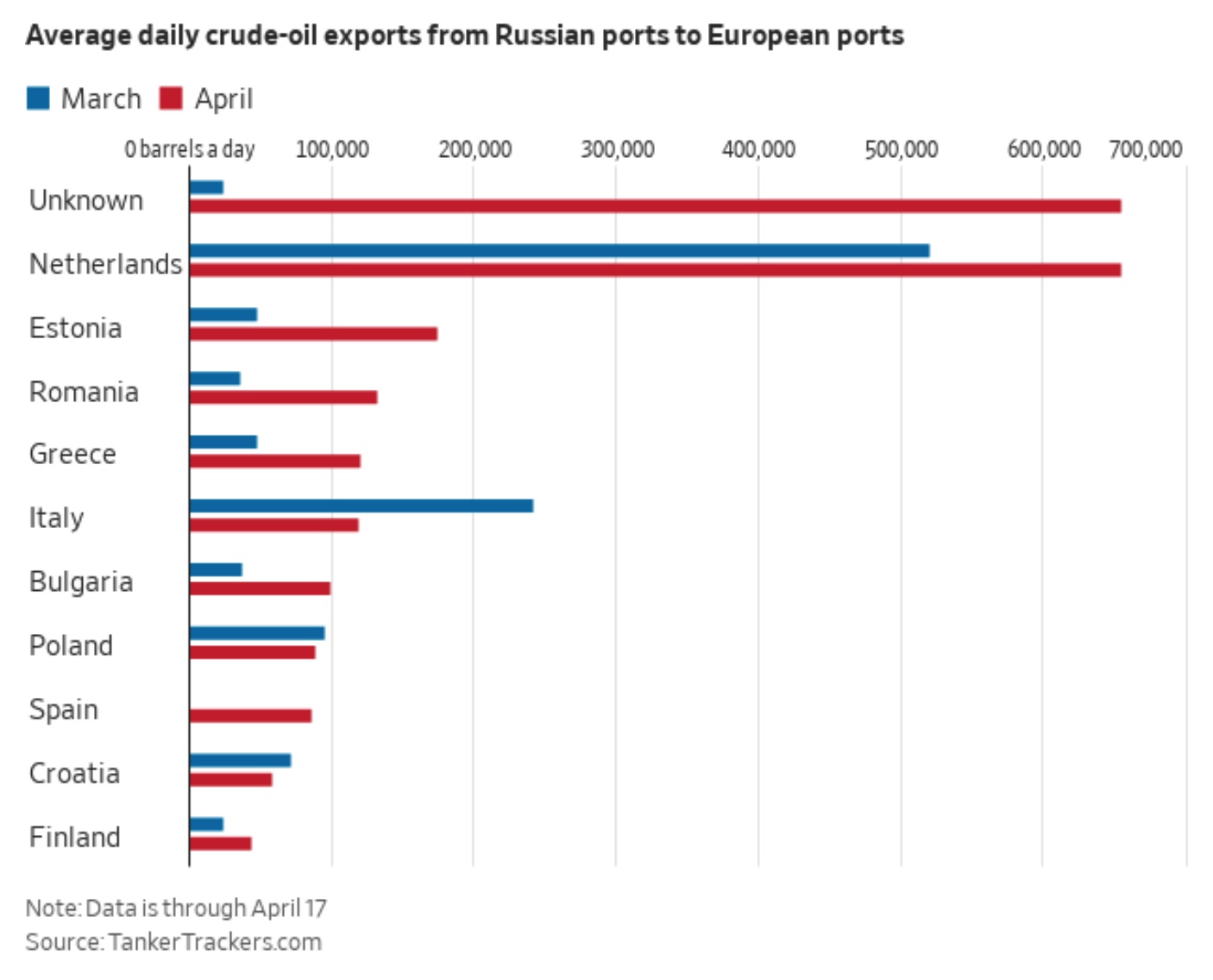

Russia ramped up oil shipments to key customers in recent weeks, defying its pariah status in world energy markets. One increasingly popular method for delivery: tankers marked “destination unknown.” (You know… similar to ‘unknown destination” for some daily USDA export sales announcement….)

USDA announced the following daily export sales:

• 1,347,000 MT of corn for delivery to China — 735,000 MT for delivery during MY 2021-2022 and 612,000 MT for delivery in MY 2022-2023. (Remember recently when some U.S. ag economists were saying it looked like China did not need to import additional U.S. corn? WRONG)

• 281,000 metric tons of corn for delivery to Mexico. Of the total, 90,200 metric tons is for delivery during the 2021-2022 marketing year and 190,800 metric tons is for delivery during the 2022-2023 marketing year.

• 144,000 metric tons of soybeans for delivery to Mexico. Of the total, 48,000 metric tons is for delivery during the 2021-2022 marketing year and 96,000 metric tons is for delivery during the 2022-2023 marketing year.

A clear sign of inflation… Ukraine needs up to $7 billion per month in support, President Volodymyr Zelenskyy told the World Bank. Earlier this week the tally was $5 billion per month.

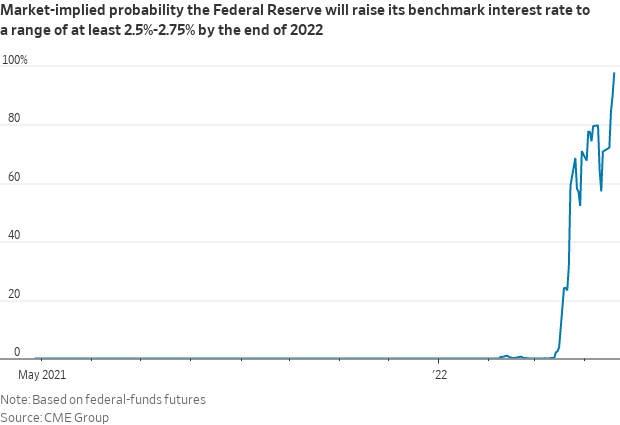

Go take a hike… was the message from Fed Chair Jerome Powell in Thursday remarks. He nearly confirmed a half-percentage point interest rate increase early next month. A half-point increase would be the first such move since 2000. “Economies don’t work without price stability,” Powell said. Bond-market futures pricing now implies a 98% probability of a half-point increases on May 4, up from about 64% a month ago, according to data from CME Group. Bond yields jumped on the news, sending the 2-year U.S. Treasury note yield up 0.12 percentage point, to 2.69%, and the 10-year U.S. Treasury note yield up 0.08 percentage point, to 2.92%. Both are at their highest yields since late 2018.

Shanghai launched another round of universal Covid-19 testing, as the city remains crippled by a Covid outbreak. Authorities reiterated that China’s financial hub would only reopen once all local transmission had stopped — although some important businesses have started up again using a “closed loop” model, where workers live on site. Officials also plan to ease controls on truck drivers to improve food supplies and trade. The number of new cases fell by nearly 5% to around 17,500 today. As Shanghai’s lockdown to stamp out a raging coronavirus outbreak extends into its fourth week, logistics services in the Yangtze River Delta industrial area have faced severe disruptions. Transport of goods into Shanghai, one of China’s biggest manufacturing and export hubs, has almost ground to a halt. Details in China section.

Janet Yellen called for a reshaping of global supply chains that are “not secure.” The Treasury secretary said that trade relationships should be oriented around “trusted partners,” even if it meant higher costs for businesses and consumers. Meanwhile, world officials will release in the coming weeks proposals to bolster food supplies, ensure that small farmers can afford fertilizer and improve social safety nets in places with food insecurity.

Sen. Chuck Grassley (R-Iowa) gave an interesting preview of next week’s Senate Ag panel hearing on the bill he really wants to see passed regarding cash pricing for cattle. Check the Livestock section for details and yesterday’s Special Report on how a working group of ag economists blasted the revised legislative proposal.

China’s growing influence in Africa seen in arms trade and infrastructure investment. Data compiled in a new report show Beijing gaining ground in areas like weapons sales.

USDA’s Food and Nutrition Service (FNS) is planning to issue a Request for Volunteers from states for mobile payment pilots (MPPs) with a goal of approving five state agencies to implement MPPs to use mobile payment technology as a way Supplemental Nutrition Assistance Program (SNAP) recipients to access benefits under the program.

The American Petroleum Institute, the nation’s biggest oil industry trade group, drafted a proposal urging Congress to adopt a carbon tax, which would put a surcharge on gasoline and other fossil fuels to discourage greenhouse-gas emissions. More in Energy section.

President Joe Biden today will mark Earth Day in Seattle, announcing new steps to make the nation's forests more resilient against the threat of wildfires and climate change. Biden will sign an executive order that calls for the government to undertake the first-ever inventory of mature and old-growth forests on federal lands.

On the political front, Amy Walter examines what type of Republicans we can expect to join Congress next year.

U.S. Election Day 2022 is 200 days away. Election Day 2024 is 928 days away.

Sign of the times… Elon Musk says he has $46.5 billion in funding for Twitter bid while some people find it hard to get a loan for a used car.

|

MARKET FOCUS |

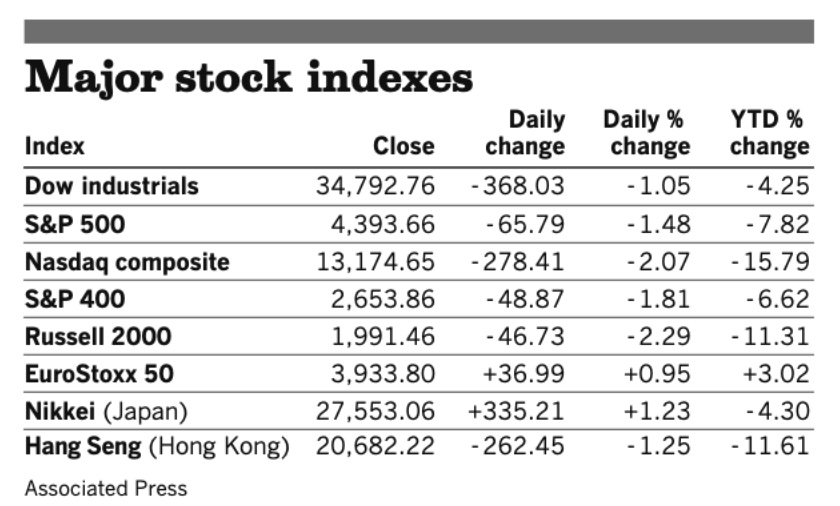

Equities today: Global stock markets were mostly down overnight. The U.S. Dow opened around 160 points lower. Asian equities ended mostly lower on comments by U.S. Fed Chair Pro Tempore Jerome Powell on inflation and rate-rise expectations. The Nikkei was down 447.80 points, 1.63%, at 27,105.26. The Hang Seng Index declined 43.70 points, 0.21%, at 20,638.52. European equites are posting sizable losses in early activity, with the Stoxx 600 down 1.3% and regional markets 0.9% to 1.8% lower.

It’s been a painful week for traders of China’s stocks, bonds and currency. Sentiment toward the country’s assets has soured as Covid lockdowns slow economic growth and policy stimulus falls short of investors’ expectations. Domestic equities have lost about $2.7 trillion of market value this year, prompting the authorities to step up efforts to halt the decline. The offshore yuan posted its biggest weekly loss since the surprise devaluation in 2015. China is heading for the largest oil demand shock since the early days of the pandemic. Crude headed for its third weekly loss in four. Meanwhile, China’s currency has fallen 1.5% against the dollar on weakening economic outlook and higher U.S. debt yields.

U.S. equities yesterday: The Dow fell 368.03 points, 1.05%, at 34,792.76. The Nasdaq declined 278.41 points, 2.07%, at 13,174.65. The S&P 500 was down 65.79 points, 1.48%, at 4,393.66.

Agriculture markets yesterday:

- Corn: July corn futures fell 14 3/4 cents to $7.95 1/4, the contract’s lowest settlement in a week. December corn fell 9 3/4 cents to $7.38 3/4.

- Soy complex: July soybeans rose 2 1/2 cents to $17.19 1/2, while May futures ended at $17.48 1/4, the highest close for a nearby contract since September 2012. July soymeal fell $2.40 to $463.90. July soyoil rose 89 points to 79.64 cents.

- Wheat: July SRW wheat fell 21 cents to $10.76 1/2, the contract’s lowest closing price since April 8. July HRW wheat fell 26 cents to $11.43 1/2. July spring wheat fell 17 3/4 cents to $11.54 1/2.

- Cotton: July cotton dropped 99 points to 137.89 cents. December cotton fell 84 points to 120.18 cents.

- Cattle: June live cattle futures climbed $1.275 to $139.90, the contract’s highest settlement since Feb. 23. April futures rose $1.025 to $144.10. May feeder cattle jumped $2.375 to $164.85.

- Hogs: June lean hogs fell $1.575 to $117.175, the contract’s lowest closing price since April 11.

Ag markets today: Grains extended losses in Chicago, with wheat poised for the longest streak of declines since November, as U.S. exports slumped, and Russian shipments continued to flow through ports. Corn and soybeans posted two-sided trade, with corn weaker and soybeans firmer early this morning. As of 7:30 a.m. ET, corn futures were trading 3 to 6 cents higher, soybeans were 5 to 6 cents higher, winter wheat futures were mostly fractionally higher to a penny lower and spring wheat was mostly fractionally to a penny higher. Front-month U.S. crude oil futures were around $1 lower and the U.S. dollar index was about 250 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• European Central Bank President Christine Lagarde speaks to the Peterson Institute for International Economics at 9 a.m. ET.

• S&P Global's preliminary U.S. manufacturing index for April is expected to fall to 58.2 from a final reading of 58.8 in March. The services index is forecast to tick down to 57.9 from 58.0. (9:45 a.m. ET)

• Bank of England Gov. Andrew Bailey participates in an International Monetary Fund panel on inflation at 10:30 a.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• President Biden is set deliver remarks on Earth Day in Seattle. He is also scheduled to speak in Auburn, Wash., about his agenda to reduce prices. He will then depart for Seattle and will spend the weekend in Delaware.

Fed Chairman Powell: A half-percentage point interest rate hike is 'on the table' for May. A half-percentage point interest rate hike is officially on the table, Federal Reserve Chairman Jerome Powell said Thursday, as the central bank prepares to get inflation under control. He also signaled support for further aggressive tightening. "We really are committed to using our tools to get 2% inflation back," the Fed chair said. His comments, among others, led the S&P to close down 1.5% in a major reversal as Treasury yields soared. The next meeting of the Federal Open Market Committee, which determines the central bank’s interest rate target, is set for May 3-4.

Compared with the central bank’s 2004-2006 tightening cycle, inflation now is higher and yet monetary policy remains more accommodative, Powell said. “So it is appropriate, in my view, to be moving a little more quickly,” he continued, though he declined to endorse a specific path forward and said any decisions will be made at the meeting itself. “I also think there’s something in the idea of front-end loading whatever accommodation one thinks is appropriate. So… that points in the direction of 50 basis points being on the table.”

Asked specifically on Thursday whether markets are correct to be braced for three half-point interest-rate increases, Powell demurred. “I think markets are processing what we’re saying,” he said. “They’re reacting appropriately, generally — but I wouldn’t want to bless any particular market pricing.”

The Fed is also set to soon begin shrinking its nearly $9 trillion balance sheet, aiming for a monthly reduction of as much as $95 billion that is likely to officially kick off in June.

Key line: Powell said it is going to be “very challenging” for the central bank to rein in inflation without triggering a recession. However, he pushed back on concerns that the effort to tighten monetary policy will result in a recession, pointing to the historically strong labor market, which he said was “unsustainably hot.”

Nomura says the FOMC will hike the fed funds rate by 75 basis points in June and July after a 50-basis point rise in May. That would bring the rate up to 2.25%, a major amount of tightening given that the Fed was still easing by buying assets as recently as March. Chatter of a hike of as much as 75 basis points started last week when St. Louis Fed President James Bullard said that he wouldn't rule one out. Before Powell spoke yesterday, San Francisco President Mary Daly added some fuel to the fire, saying she would be talking to colleagues about whether a hike of 25, 50 or 75 basis points was needed.

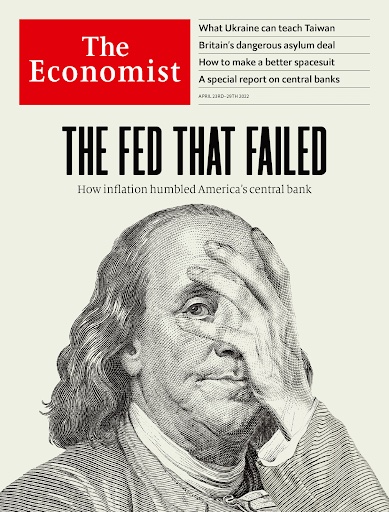

Economist magazine slams U.S. Fed in article titled, The Fed That Failed. The magazine wrote: “Central banks are supposed to inspire confidence in the economy by keeping inflation low and stable. Yet America’s Federal Reserve has suffered a hair-raising loss of control. Consumer prices in March were 8.5% higher than a year before, and nearly a fifth of Americans say inflation is the country’s most important problem. It is also a global worry, as Vladimir Putin’s invasion of Ukraine has led to soaring food and energy prices. But Uncle Sam has been on a unique path, thanks to President Joe Biden’s excessive stimulus. As the White House hit the fiscal accelerator, the Fed should have applied the monetary brakes. Because it did not, it is now struggling to clear up a monumental mess. Its blunders partly reflect an insidious shift among central bankers worldwide. Many are dissatisfied with the staid work of managing the business cycle and wish to take on more glamorous tasks, from fighting climate change to minting digital currencies. Their loss of focus puts their hard-won credibility at risk.”

Mortgage rates jumped again heading into the year’s busiest stretch for home sales. The average rate for a 30-year fixed-rate mortgage rose to 5.11%, mortgage-finance giant Freddie Mac said Thursday. The rate hit 5% last week for the first time since 2011, up from 3.22% at the beginning of 2022.

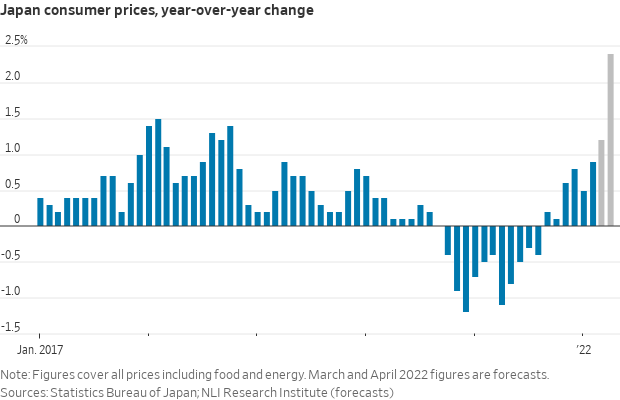

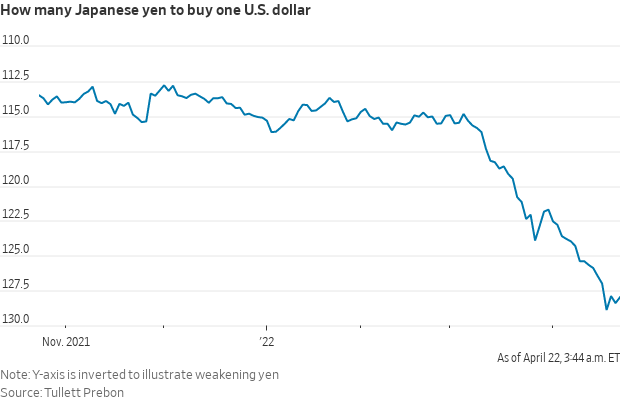

Inflation in Japan is finally taking off. But unlike the Federal Reserve, the Bank of Japan has resolved to keep interest rates low. The Bank of Japan’s (BOJ) unusual stance has propelled the yen to its weakest level against the dollar in two decades. The weak yen is one reason prices are rising in Japan, with consumer price inflation expected to approach the central bank’s longstanding 2% target in the next month or two. Japan is paying more in yen terms for imports such as oil and food, while global energy shortages and supply-chain bottlenecks also push prices higher. BOJ officials believe the current inflation is a one-time phenomenon driven by factors outside of Japan’s control. In the BOJ’s mind, such “cost-push” inflation contains the seeds of its own demise because it is likely to tamp down demand and cool the economy.

U.S. airlines sound bullish as bookings roar back. Airlines are back. That's the message major U.S. carriers are sending investors after grappling with coronavirus-induced uncertainty for two years. Meanwhile, President Biden and the airline industry want Congress to offer financial incentives for sustainable aviation fuel, which could help lower airlines’ soaring energy costs. Lawmakers proposed new legislation this month on funding for sustainable aviation fuel, while continuing negotiations on a tax credit to help the transition to greener fuel.

Market perspectives:

• Outside markets: The U.S. dollar index has moved higher ahead of U.S. market action, with weakness in the euro, yen and British pound. The yield on the 10-year U.S. Treasury note firmed to trade around 2.92% while there is a mostly lower tone in global government bond yields. old and silver futures were lower in electronic trade, with gold under $1,938 per troy ounce and silver under $24.38 per troy ounce.

• Crude oil futures are under pressure ahead of U.S. market action, with US crude trading around $102.50 per barrel and Brent around $106.70 per barrel. Futures were under pressure in Asian action, with US crude around $103.10 and Brent around $107.70 per barrel.

• Some U.S. oil firms are reportedly lobbying Washington to restart their drilling operations in Venezuela, which are barred by sanctions. Link to details via Reuters.

• Democrats want the FTC to probe alleged price manipulation in the gas market, including refinery capacity reductions, according to a statement. House Judiciary Chair Jerry Nadler (D-N.Y.) and others unveiled a bill that would also mandate the FTC to submit a report to Congress on a long-term strategy to stabilize gas and oil prices in national crises.

• The President of Indonesia announced banning palm oil exports starting April 28. The move is a sign of governments making a move to control their domestic demand. The exports will be restarted at some time, but the time length is unknown.

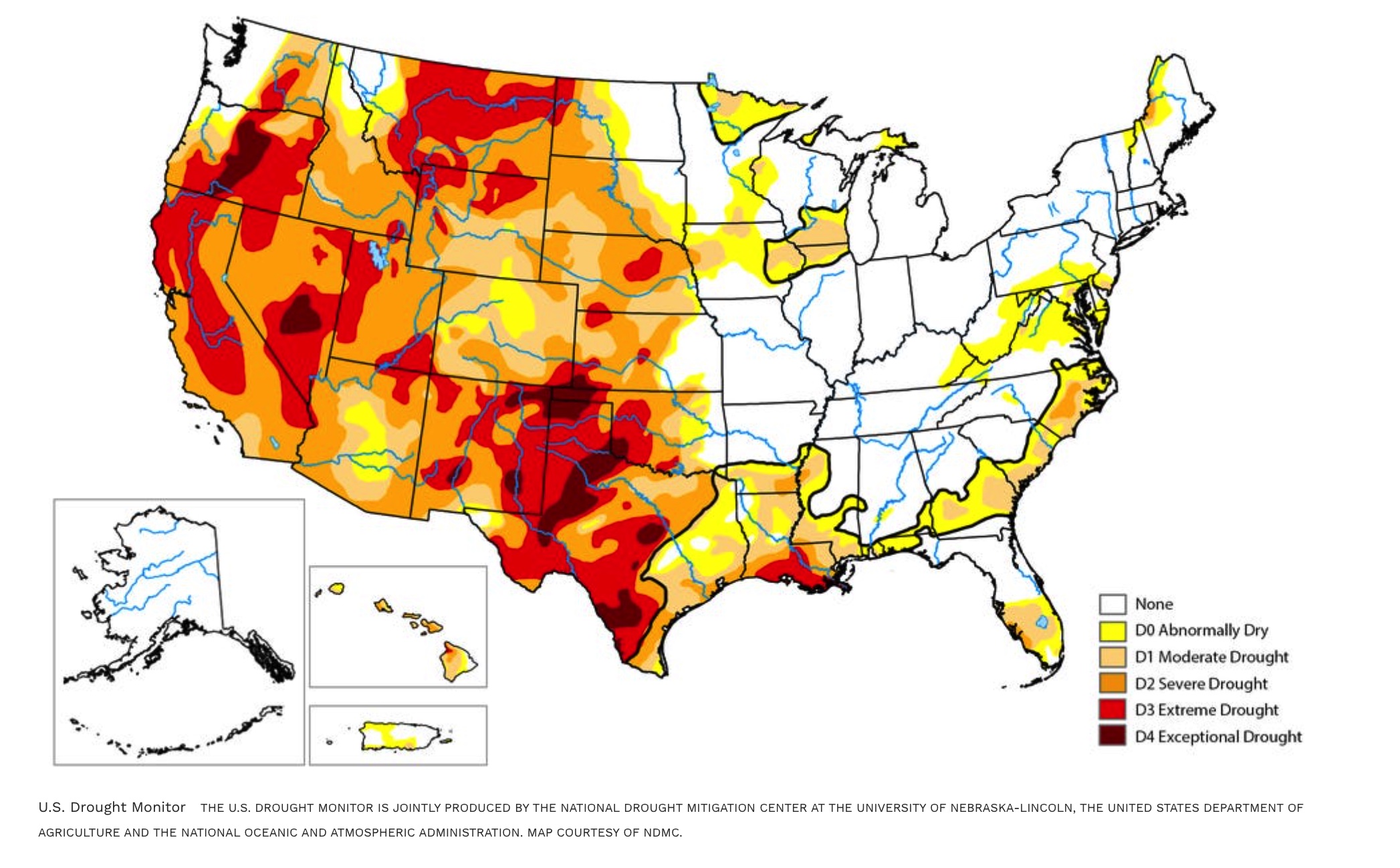

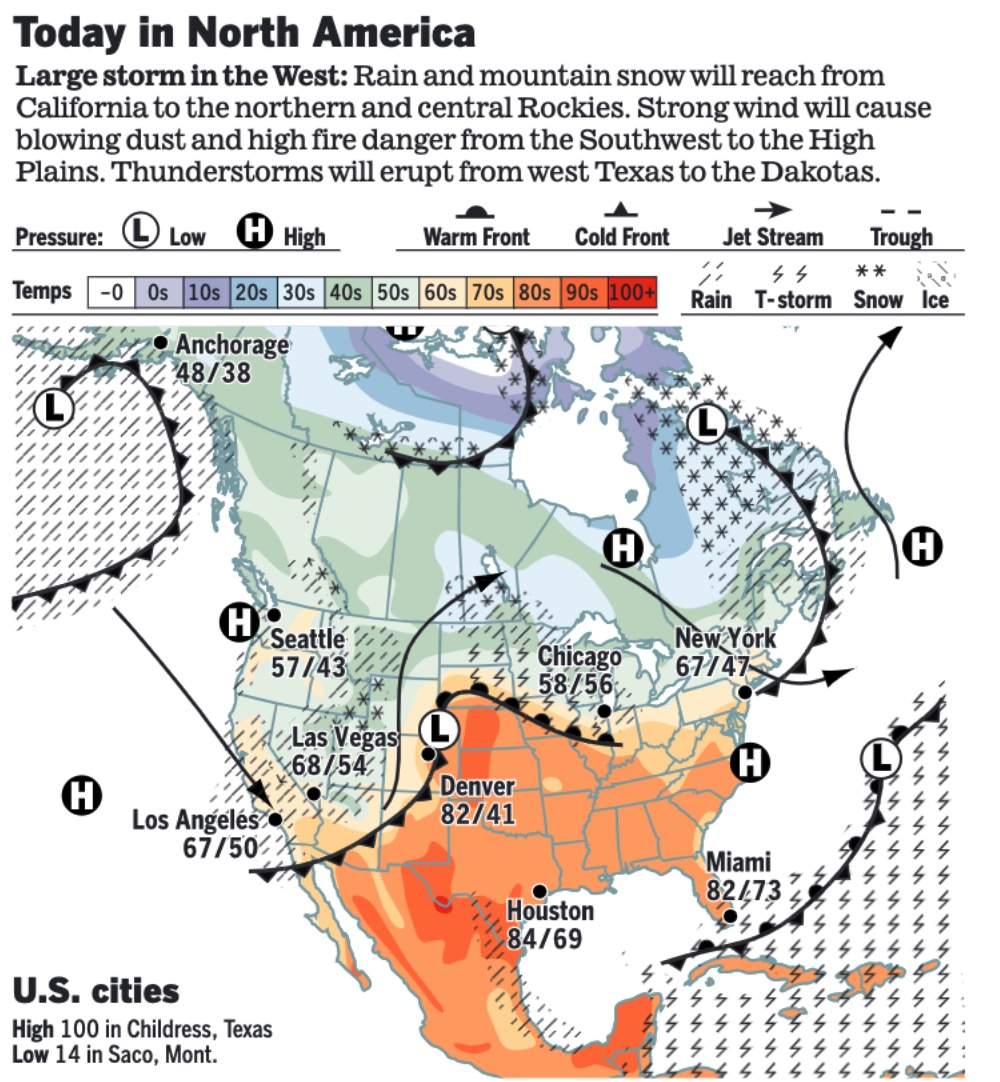

• Dry weather forecast calls for higher food prices — and billions in farm losses. Forbes magazine looked at the current U.S. weather/crop situation (link). The U.S. Drought Monitor shows that the West’s current multiyear drought is “the most extensive and intense” in the 22-year history of the database. “Right now, I can’t give anyone any good news,” said Rich Tinker, meteorologist and drought expert with the National Weather Service and the National Oceanic and Atmospheric Administration, who helps maintain the monitor. “Anything west of the middle of the country that’s in drought is probably going to stay there for at least a few more months. There will be an economic effect.”

• The International Rice Research Institute predicts that rice yields could drop 10% in the next season, causing a loss of 36 million tons of rice, or the equivalent of feeding 500 million people. That could exacerbate food inflation that’s contributing to turmoil gripping developing nations such as Egypt, Tunisia and Sri Lanka.

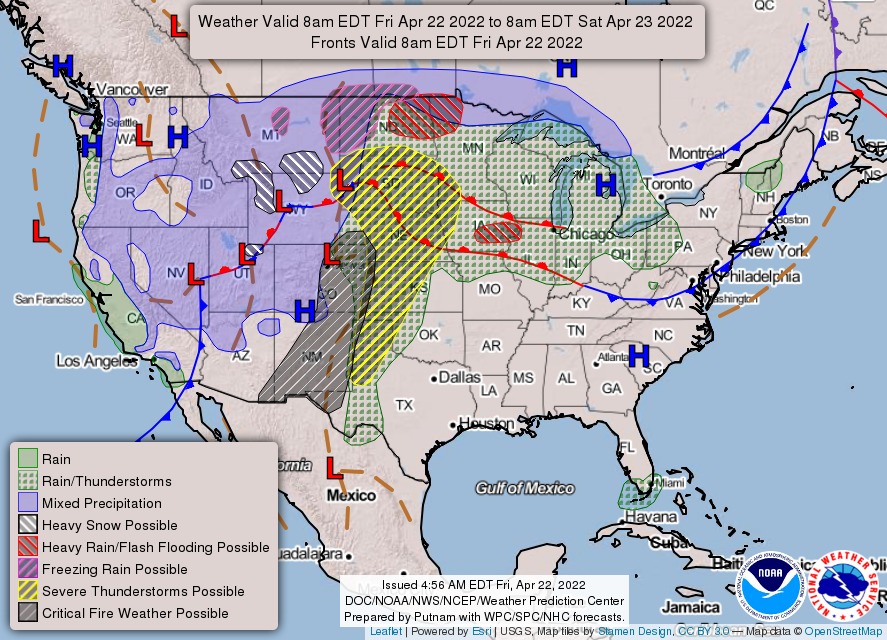

• NWS weather: Significant winter storm to impact parts of the northern Rockies and northern Plains with heavy snow and blizzard conditions beginning tonight... ...Severe thunderstorms expected over the Great Plains today and from the Upper Midwest to the southern Plains on Saturday along with the potential for scattered instances of flash flooding... ...Damaging wind gusts and very dangerous fire-weather conditions are forecast throughout the central/southern High Plains and southern Rockies today.

Items in Pro Farmer's First Thing Today include:

• Corn and soybeans firmer, wheat mixed this morning

• Cattle on Feed, Cold Storage Reports out this afternoon

• China to sell soybean reserves next week

• Another big jump in Russian wheat export tax

• Russia donates wheat to Cuba

• French corn planting jumps

• Cattle futures post technical breakout

• Pork cutout back to $110

|

RUSSIA/UKRAINE |

— Summary: Russian forces made minor gains across a 300-mile front in eastern Ukraine, according to military analysts. Satellite images show what appears to be a growing mass grave near Mariupol. People who escaped its ruins said “the city is gone.”

- More U.S. sanctions, aid. President Biden formally announced (1) an $800 million package of security assistance to Ukraine, (2) an additional $500 million in direct economic assistance, and that (3) the U.S. would begin banning Russian ships from its ports to further isolate Russia from the world economy. However, Russian-flagged ships account for less than 1% of cargo that arrives at American ports. Biden also laid out a new program to accept 100,000 Ukrainian refugees. Biden’s new package brings the U.S. support to Ukraine to over $2 billion since the war’s start eight weeks ago. Biden said the U.S. would not disclose all of the weaponry that it will be sending to Ukraine. Referencing Theodore Roosevelt’s famous line, the president said the U.S. would “speak softly and carry a large Javelin.”

- A new poll from Associated Press-NORC Center for Public Affairs Research finds Americans are not satisfied with Biden’s handling of Russia thus far: “54% of Americans think Biden has been ‘not tough enough’ in his response to Russia’s invasion of Ukraine. Some 36% think his approach has been about right, while 8% say he’s been too tough.”

- Russian oligarch Vagit Alekperov stepped down as the president of Lukoil after sanctions were imposed on him by Britain and the EU, The Guardian reports (link).

— Market/impacts:

- Ukraine is calling on members of the International Monetary Fund to donate 10% of their reserve assets received from the institution to support rebuilding the country following Russia’s invasion. The cost for the rebuilding is estimated at $600 billion, according to Prime Minister Denys Shmyhal. The IMF expects Ukraine’s economy to contract 35% in 2022 as a direct result of the invasion.

Meanwhile, Treasury Secretary Janet Yellen said the U.S. was committed to providing Kyiv with an additional $500 million in economic aid on top of $500 million already pledged by President Joe Biden last month. She also said Washington was considering funding some of Ukraine’s reconstruction with about $300 billion worth of Russian central bank assets, which the US and its allies froze at the start of the invasion. Such a move may require legislation, however. “We would carefully need to think through the consequences… before we’re taking [this step] I wouldn’t want to do so lightly,” Yellen said. “It’s something that I think our coalition and partners would need to feel comfortable with and be supportive of.” - Treasury Secretary Janet Yellen urged Europe to be “careful” about imposing a complete ban on Russian energy imports, warning of the potential harm such a move could inflict on the global economy. “Medium-term, Europe clearly needs to reduce its dependence on Russia with respect to energy, but we need to be careful when we think about a complete European ban on say, oil imports,” Yellen said during a press conference in Washington on Thursday. She said an immediate ban by the EU would “clearly raise global oil prices” and “would have a damaging impact on Europe and other parts of the world.” Yellen added that “counter-intuitively”, a total embargo may not have such a negative impact on Moscow’s finances, with Russia benefiting from higher prices.

- The West is still buying Russian oil, but it's harder to track. An opaque market is forming to obscure the origin of oil from Russia as more tankers are loaded without a precise destination. Oil from Russian ports is increasingly being shipped with its destination unknown. In April so far, over 11.1 million barrels were loaded into tankers without a planned route, more than to any country, according to TankerTrackers.com. That is up from almost none before the invasion. Link for details via the WSJ.

- Chatham House experts argue that while the war in Ukraine is having significant global impacts for energy, food and fertilizer markets, it may also aggravate wider economic and social upheaval. Link to research report.

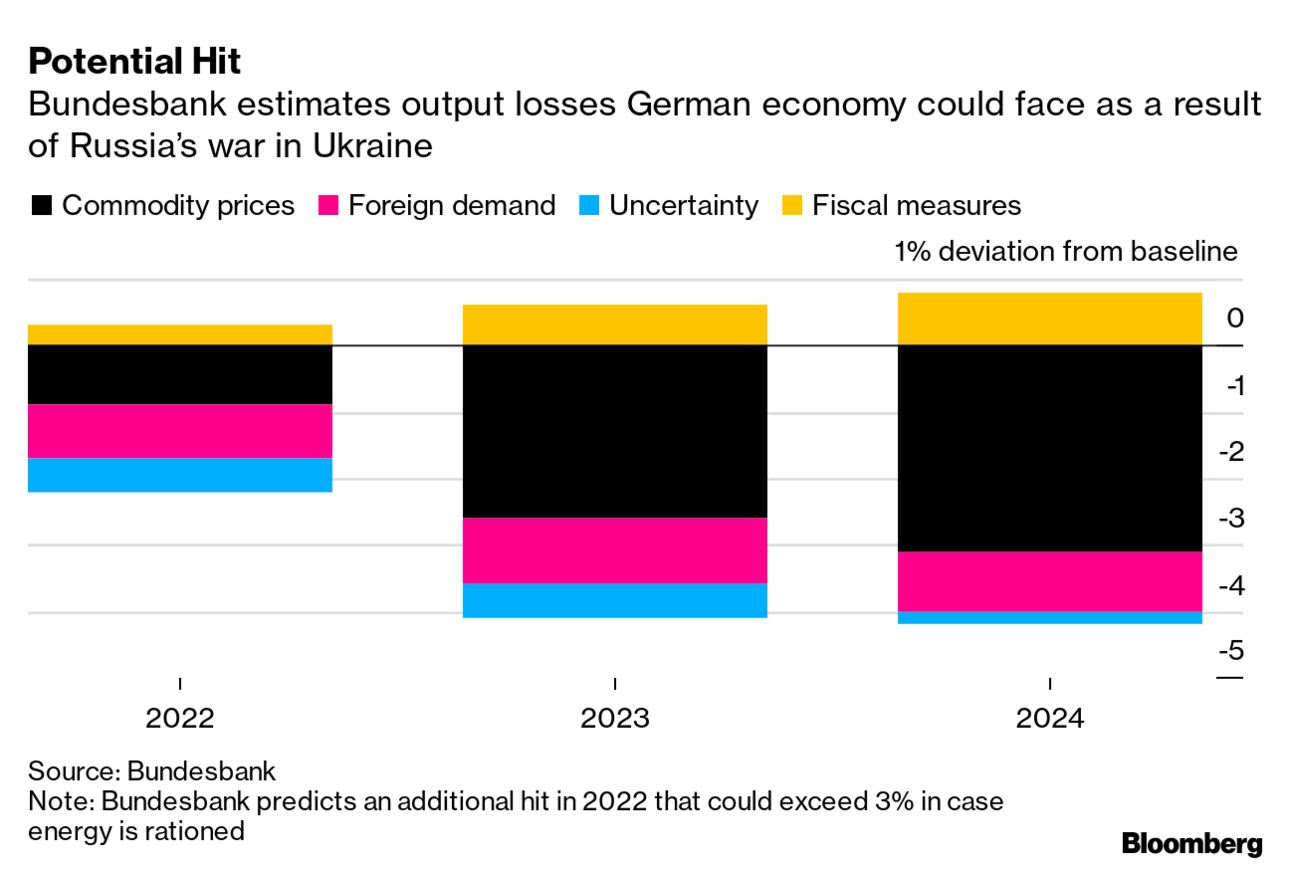

- The German economy is at risk of shrinking nearly 2% this year if the war in Ukraine escalates and an embargo on Russian coal, oil and gas leads to restrictions on power providers and industry, according to the Bundesbank.

|

POLICY UPDATE |

— USDA to run pilot program for using mobile devices to access SNAP benefits. USDA’s Food and Nutrition Service (FNS) is planning to issue a Request for Volunteers from states for mobile payment pilots (MPPs) with a goal of approving five state agencies to implement MPPs to use mobile payment technology as a way Supplemental Nutrition Assistance Program (SNAP) recipients to access benefits under the program. FNS was required by the 2018 Farm Bill to authorize the use of mobile payment technology for accessing SNAP benefits via smart phones, tables and other personal mobile devices in place of Electronic Benefits Transfer (EBT) cards. FNS said in a notice in the Federal Register the effort is needed to “determine whether it is feasible to implement this technology nation-wide, whether further study is required before doing so, or if implementation is not in the best interest of the program.” FNS said it will provide a report to Congress outlining their findings. The agency said this evaluation of MPPs by state agencies must happen before it can meet the law requiring allowing mobile technology for SNAP benefits nationwide.

— GAO faults Trump move of USDA agencies out of Washington, DC. The action by the Trump administration to move USDA’s Economic Research Service (ERS) and National Institute of Food and Agriculture (NIFA) to Kansas City, Missouri, did not align with its objectives and did not follow the usual government steps, according to the Government Accountability Office (GAO). USDA relocated most ERS and NIFA staff positions out of Washington, DC, in October 2019 based on a USDA analysis that said the move would save money, improve its ability to attract highly qualified staff and bring agencies closer to stakeholders. GAO, however, said the economic analysis did not fully align with those objectives. There has been no discussion at this point relative to moving the components of ERS and NIFA back to Washington, DC. GAO is not making any recommendations at this time because, among other reasons, “the relocation has already taken place and OMB has since circulated comprehensive guidance on how to build and use quality evidence that, if effectively implemented, should address the weaknesses highlighted.” Link to report.

— President Joe Biden will sign an executive order today to protect "mature" and "old growth" forests both domestically and internationally to increase natural carbon absorption to limit climate change. The executive order will also have federal agencies develop 2030 targets for reforestation and promote efforts to increase natural carbon absorption through methods including marsh restoration and the planting of drought-resistant crops. Link to Vilsack statement.

|

PERSONNEL |

— Andrea Durkin is now assistant U.S. Trade Representative for WTO and multilateral affairs. She most recently was principal and founder of Sparkplug LLC.

— The Senate returns Monday to resume considering the nomination of Lael Brainard to be vice chairman of the Board of Governors of the Federal Reserve. At 5:30 p.m. ET, senators will vote on the motion to invoke cloture, or limit debate, on Brainard’s nomination. Senate Majority Leader Chuck Schumer (D-N.Y.) has also filed cloture on the nominations of Lisa Cook to be governor for the Fed and Alvaro Bedoya to be a commissioner for the Federal Trade Commission.

— Vice President Harris named Lorraine Voles as her new chief of staff, replacing Tina Flournoy who is leaving the administration. Harris, in a statement, praised the departing Flournoy, calling her a “valued advisor and confidant to me and tremendous leader for the office.”

— Charles Evans, the longest-tenured regional Fed bank president, is retiring, setting off a search for a new leader in Chicago.

|

CHINA UPDATE |

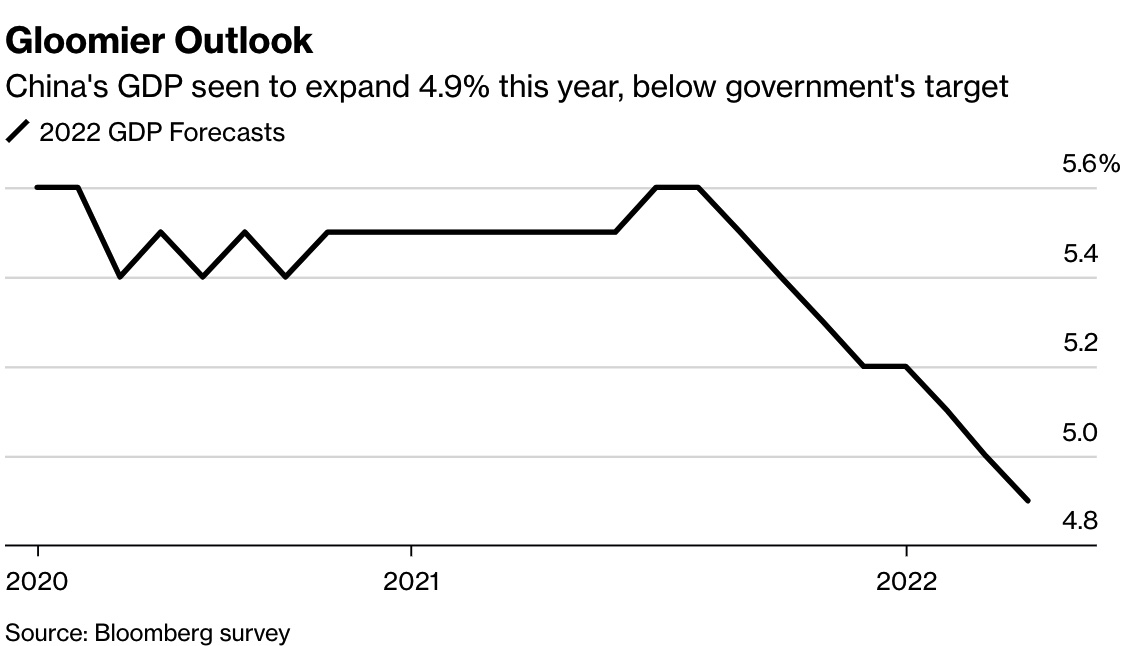

— Economists polled by Bloomberg have lowered their growth forecasts for China once again, as widespread Covid-19 lockdowns threaten to hold back the economy in the months ahead. Gross domestic product will likely expand 4.9% in 2022, down from the previous estimate of 5%, according to a survey of 62 economists compiled by Bloomberg. Second- and third-quarter economic growth forecasts were slashed by 30 basis points to 4.3% and 5.2% year-on-year, respectively. The outlook for major policy interest rates stayed largely unchanged. Economists expect a 10 basis-point cut in the one-year loan prime rate to 3.6%, and a conservative 25 basis-point easing in reserve ratio requirement in the second quarter.

Other major points in the survey:

• Forecasts for retail sales growth were lowered to 5.2% from 6% previously in 2022, but a higher growth rate of 7.2% is expected in 2023.

• Imports and exports will likely grow 7.1% and 6.6%, respectively, this year, lower than the previous projections.

• Factory inflation will likely jump 5.4%, while an expectation for consumer prices to rise 2.2% stays unchanged.

— Central bank governor stresses price stability. China's central bank governor Yi Gang on Friday underlined the importance of grain production and energy supply for ensuring price stability amid rising inflationary pressure worldwide, reported China Daily. “Price stability is our policy priority," Yi said, adding that agricultural production and the production and import of key energies — such as coal, oil and gas ‚ are the focus of financial services. "As long as grain production and energy supply remain stable, inflation will be kept within a reasonable range," Yi said while delivering a keynote speech at a session organized by Boao Forum for Asia Annual Conference 2022. The session was titled "Global Inflation, Interest Rate Hikes and Economic Stability.” Yi said the People's Bank of China, the nation's central bank, will maintain an accommodative monetary policy throughout this year to support the real economy and is ready to support small and medium-sized enterprises with more instruments if needed.

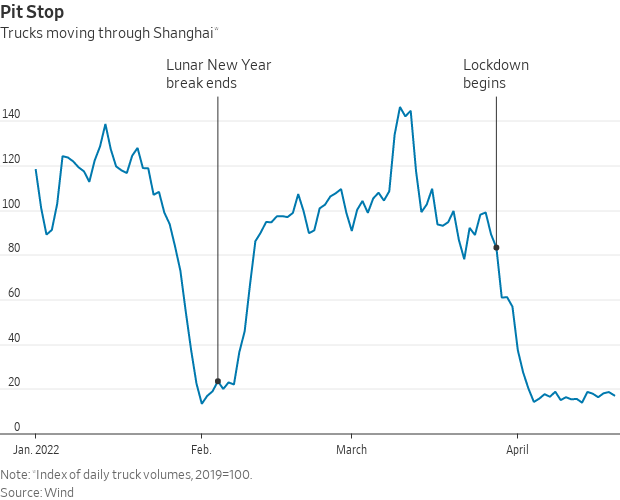

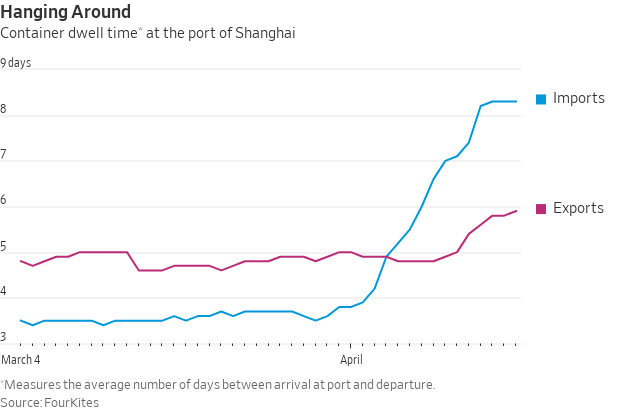

— Shanghai’s Covid lockdown leads to logistics disarray. Shanghai’s effort to stamp out a raging Coronavirus outbreak has led to severe disruptions for logistics services, with transport of goods into one of China’s biggest manufacturing and export hubs nearly grinding to a halt, the Wall Street Journal reports (link). Trucking has been the worst hit, as strict local pandemic policies and arbitrary implementation of rules choke off the transport of goods. At Shanghai’s port, normally the busiest container port in the world, empty containers are stacked on docks waiting for trucks to deliver cargo. The logistics snarls in and around Shanghai further add pressure to an already battered global supply chain and to rising prices of goods in the U.S. They also complicate the Chinese government’s efforts to reopen factories shuttered due to lockdowns. Logistics managers expect weeks to months before some international shipments return to normal.

Meanwhile, China says imports are causing outbreaks of Covid-19 — alleged vectors include everything from pork knuckles to clothing. Link for details via the Economist.

The stringent lockdown, now into its fourth week, has had a ripple effect on businesses in the Yangtze River Delta region, an area of more than 160 million people encompassing Shanghai as well as the neighboring Zhejiang and Jiangsu provinces. Together, they account for about a fifth of national gross domestic product.

— A senior U.S. diplomat again warned China of sanctions if it offers “material support” for Vladimir Putin’s war in Ukraine, while also pledging to help India end its dependence on Russian weapons. China wasn’t helping the situation in Ukraine by doing things like amplifying Russian disinformation campaigns, U.S. Deputy Secretary of State Wendy Sherman said Thursday.

— China’s arms sales, military training and investment in African infrastructure projects are increasingly giving Beijing a foothold on the continent, according to a new analysis by an open source intelligence company. Nearly 70% of the 54 countries on the African continent possess Chinese armored military vehicles, and nearly 20% of all military vehicles in Africa are imported from China, according to the new analysis by Jane’s, a company known for its publications on global weapons. The study shows sharp increases over the past two decades in Chinese military equipment sales to Africa, compared with the continent’s traditional benefactor, Russia.

— U.S. could lower China tariffs to combat inflation, White House adviser suggests. Trump-era duties on items like bicycles and underwear serve no strategic purpose, says national security official Daleep Singh. Meanwhile, Politico reports (link) that with Trump gone, Republicans look to weaken his China tariffs. It says Republicans in both chambers are backing trade language in the Senate's China competition bill that would roll back some of the tariffs — instead of a more protectionist proposal from House Democrats.

|

TRADE POLICY |

— Treasury Secretary Janet Yellen called for reshaping trade around “trusted partners” to improve the security of supply chains, even if consumer costs rise following global supply chains proving to be unstable amid the pandemic and Russia’s war in Ukraine. Yellen spoke at a news conference during the spring meetings of the World Bank and International Monetary Fund. She said that protectionism, or taxing imports more, was not the answer, but that the economic benefits of the world’s network of supply chains were not worth the risk of a reliance on adversaries. “Our supply chains are not secure, and they’re not resilient,” Yellen said at the Treasury Department. “And I think that’s something, in terms of long-term risk to the U.S. and to other countries, that’s a threat that needs to be addressed.” She added that trusted trading blocs would need to be big enough to avoid amplifying inflation while ensuring that supply chains were secure.

|

ENERGY & CLIMATE CHANGE |

— Federal Energy Regulatory Commission released its first set of draft rules for upgrading the national electric grid, calling for regional transmission planning to weigh impacts on the grid up to at least 20 years, including changing demand mixes and extreme weather. The proposed rules would also require utilities and transmission planners to get agreement from states in each region for cost allocation. Link to details via Bloomberg.

— The American Petroleum Institute, the nation’s biggest oil industry trade group, drafted a proposal urging Congress to adopt a carbon tax, which would put a surcharge on gasoline and other fossil fuels to discourage greenhouse-gas emissions, the Wall Street Journal reports (link). The draft proposal was approved by the group’s climate committee last month, according to a document reviewed by the WSJ. The measure must still be approved by the group’s executive committee.

A carbon tax would raise gasoline prices and other energy costs for consumers. Some API members want to delay action on the proposal amid near-record prices at the pump, contending it could alienate not only voters but also Republican lawmakers friendly to the oil industry ahead of midterm elections, according to people involved in the discussions or who were briefed on them.

Perspective: One energy analyst emailed: “I don’t support any taxes as a general principle, but I think there’s a pretty solid argument that a carbon tax is the simplest and economically most efficient way of paying for and establishing a price of carbon without all of the other bureaucratic morass/red tape and wasteful spending defining most of the other climate programs. This also aligns with the Business Roundtable.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— World officials will release in the coming weeks proposals to bolster food supplies, ensure that small farmers can afford fertilizer and improve social safety nets in places with food insecurity. “There’s a very real risk soaring global market prices for food and fertilizer will result in more people going hungry, further exacerbate inflation and harmful fiscal and external positions,” Treasury Secretary Janet Yellen said.

— Sen. Grassley previews Senate Ag Committee hearing on the Cattle Price Discovery and Transparency Act of 2022. Grassley made the following comments on his Capitol Hill Report:

Grassley: “The nine Democrats and nine Republicans that are sponsoring the bill are enough to get it out of committee. I think we're not going to learn a whole lot… A bad situation for Midwest cattle feeders that want to negotiate a daily price, a negotiated daily price and can't get a market. And we know about the cozy relationship between the four big packers and the big feedlots of Texas, Oklahoma, Kansas and Colorado. So, I think that this is just more of a formality that we have to go through to get the bill brought up. But it does give [an opportunity] to people that are for the billl, and to people that are against the bill, to speak for the hundreds of people that are on both sides of the issue to get everything out public. Those that are for the bill are going to say how bad the situation is and how bad the bills are needed, and those against the bill, probably representing the industry, they're going to say how everything is just working perfectly. If you pass this bill, it's going to screw everything up.”

— Five new HPAI finds confirmed in commercial operations. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed additional cases of highly pathogenic avian influenza (HPAI) in commercial poultry operations in two states. APHIS said two more flocks in Lancaster County, Pennsylvania were confirmed (1,127,700 in one commercial table egg layer flock and 879,400 in another commercial table egg layer flock) and three in Minnesota (two commercial turkey meat bird flocks in Todd County with a total of 60,000 birds and one commercial turkey meat bird flock in Stearns County with 63,700 birds).

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 504,970,935 with 6,212,253 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,850,937 with 990,679 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 571,201,893 doses administered, 219,160,055 have been fully vaccinated, or 66.76% of the U.S. population.

— Three major U.S. airlines announced yesterday they will let some passengers banned for mask violations back on their flights. Delta Air Lines, United Airlines and American Airlines said they will allow passengers back on their flight rosters on a case-by-case basis.

— Philadelphia ends its indoor mask mandate after four days. It had become the first major American city to reinstate an indoor mask mandate in response to rising cases but said yesterday that the mandate would be lifted because the numbers seemed to be plateauing. The rapid U-turn comes amid legal wrangling at the federal level over mask mandates and debate about the effectiveness of masking rules in general.

|

POLITICS & ELECTIONS |

— This Sunday will see the French presidential runoff vote between President Emmanuel Macron and his far-right rival Marine Le Pen. Polls currently point to a victory for Macron with a lead of around 12 percentage points. That she is still within range of Macron, who trounced her by 30 percentage points in 2017, has Western capitals nervous that the French could swap an ardent EU supporter for one closer to Moscow than Brussels. Of note: Undecided voters are one concern, with as many as 11 percent still yet to make up their minds. exit polls should predict the winner by the time voting ends at 8 p.m. Paris time on Sunday (2 p.m. ET in Washington).

— Florida lawmakers approved a congressional map proposed by Republican Gov. Ron DeSantis that is expected to add four GOP seats to their House delegation and could counter Democrats’ gains in other states this redistricting cycle.

— Amy Walter examines what type of Republicans we can expect to join Congress next year. Walter, of the Cook Policy Report, noted that Rep. Fred Upton (R-Mich.), in an interview with Meet The Press' Chuck Todd last weekend, argued that unless Republicans pick up more than 15 seats this fall (for a total of at least 230 GOP-held seats), "it will be very hard to govern for Republicans… knowing that we've got the MTG [Rep. Marjorie Taylor Greene] element that's really not a part of a governing majority." Walter notes: “With very little chance that Republicans don't take control of the House this fall, Upton's point about a 'governing majority' is the more critical one to focus on. In other words, it's not just how many seats Republicans pick up, but what kind of Republicans win those seats that matter.”

— Are former President Donald Trump’s tax returns still being audited? Remember Trump repeatedly saying he could not release his tax information because the IRS was still auditing them.

|

CONGRESS |

— Sen. Ben Ray Luján (D-N.M.) has “mostly recovered” from the stroke he suffered in January and “said voters, not his health scare, will decide who represents New Mexico.” During a tour of a high school on Thursday, he said, “I’m feeling strong. I’m still not 100% but I think I’m over 90%.” The AP calls Luján’s recovery “a relief for Democrats who barely hold power in the evenly divided Senate, thanks only to the tie-breaking vote of Vice President Kamala Harris.

|

OTHER ITEMS OF NOTE |

— Cotton AWP rises for second straight week. The Adjusted World Price (AWP) for Upland Cotton rose to 136.20 cents per pound, effective today (April 22), up from 131.10 cents per pound the week of April 15 which also marked an increase. USDA also announced that Special Import Quota $1 will be established April 28 for 46,314 bales of Upland Cotton, applying to supplies purchased not later than July 26 and entered into the U.S. not later than Oct. 24.

— More than 20 states have asked a judge to immediately block the Biden administration from repealing Title 42, a Trump-era pandemic restriction which allows authorities to turn away migrants at the U.S. southern border. Despite pushback from both Democrats and Republicans, the Biden administration is on track to end the restriction on May 23 — which is expected to result in a surge of migrants at the border.

— Elon Musk said he has lined up $46.5 billion to fund his bid for Twitter Inc., answering the biggest question that had loomed over his takeover offer. In a regulatory filing, Musk also said he was considering taking his offer straight to Twitter shareholders, bypassing a board that appears dug in. Twitter said Thursday it was reviewing the newly detailed proposal.

— On Earth Day, reporters from the NYT’s climate desk answer some of your most burning questions. Link for more info.

— The FBI issued a private industry notification on Wednesday (link) to warn agricultural cooperatives about a potential increase in ransomware attacks during planting and harvest seasons. In September 2021, two major farming cooperatives were hit by ransomware. “Cyber actors may perceive cooperatives as lucrative targets with a willingness to pay due to the time-sensitive role they play in agricultural production,” the agency said. The FBI said it is aware of multiple ransomware attacks targeting farming co-ops since 2021. In some of the attacks reported in September and October 2021, the victim had to completely shut down production.

“A significant disruption of grain production could impact the entire food chain, since grain is not only consumed by humans but also used for animal feed,” the FBI explained. “In addition, a significant disruption of grain and corn production could impact commodities trading and stocks. An attack that disrupts processing at a protein or dairy facility can quickly result in spoiled products and have cascading effects down to the farm level as animals cannot be processed.”

The FBI's warning cited two ransomware attacks on U.S. agriculture so far in 2022. The two incidents were a March attack on a grain company by Lockbit 2.0 and a February attack on "a company providing feed milling and other agricultural services," which reportedly thwarted the ransomware before it could fully deploy and encrypt systems.

Upshot: The recent flash alert from the FBI is not an unfamiliar sight, as similar warnings were released in 2021 by federal agencies.