Survey: Tepid Reception to Summer Sales of E15 Ethanol

Nominee close for still-vacant role of USDA Undersecretary for Trade & Foreign Ag Affairs

|

In Today’s Digital Newspaper |

Russia began what its foreign minister called a second phase of the war in Ukraine, and early indications are it could go better for Russia than the first. Russian forces threaten to encircle an area at the top of the eastern front one military analyst says holds as much as 40% of Ukrainian troops in the region. Meanwhile, President Biden said Tuesday the U.S. would send more artillery to Ukraine as Russia presses its campaign in the Donbas. Press Secretary Jen Psaki said that Biden and other world leaders on a call earlier Tuesday “spoke about providing more ammunition and security assistance to Ukraine.” Ukraine said a humanitarian corridor had been agreed for Mariupol on Wednesday, in an attempt to allow women, children and elderly people to escape the besieged port city.

Nearly five million refugees have left Ukraine, and a further 13 million are trapped in areas affected by the war, according to the U.N.

Bloomberg reports Kremlin insiders are alarmed over the growing toll of Putin’s war in Ukraine, fearing the invasion was a catastrophic mistake — but say the Russian president won't relent and is in no danger of losing power.

Analyst Jim Wyckoff says: “Lumber has always been a volatile futures market, but its past two years of extreme price action suggests something more pervasive: higher price volatility across the entire raw commodity sector in the coming years.” More on this below.

Treasury Secretary Janet Yellen urged nations to drop export restrictions that affect food prices and to provide more support to vulnerable countries as the Ukraine war threatens food supplies across the globe. Early estimates suggest at least 10 million in sub-Saharan Africa alone could be pushed into poverty due to higher food prices, Yellen said in prepared remarks.

U.S. mortgage giant Fannie Mae said it anticipates a "modest" U.S. recession next year.

In Japan, a weak yen, more imports = big price tag. Japan’s imports jumped 31% in March from a year ago to a record value, led by crude oil, coal and natural gas, the finance ministry reported today. That will translate into higher power bills in the nation that relies heavily on others for its energy resources.

Inflation impacts U.S. infrastructure spending. Construction costs, along with inflation, are rising at the fastest pace in decades, driven by higher commodity prices and supply chain disruptions. That threatens to undercut some of the benefits of the Bipartisan Infrastructure Law, a centerpiece of the Biden administration’s economic agenda, analysts at S&P Global said in a new report.

A push for energy security is on the table in reconciliation talks between the White House and members of Congress.

The U.S. gov’t will put field staff in more than two dozen rural communities to provide a link between local leaders and federal economic development programs, the White House said. The Rural Partners Network will be run by USDA.

The Biden administration is close to naming a nominee for the still-vacant role of USDA Undersecretary for Trade and Foreign Agricultural Affairs, USDA Secretary Tom Vilsack and U.S. Trade Representative (USTR) Katherine Tai told a meeting of Agricultural Policy Advisory Committee for Trade (APAC) and Agricultural Technical Advisory Committees (ATACs), according to Politico.

The Education Department announced new steps to expand access to student loan debt forgiveness in a move that it said would grant "immediate debt cancellation for at least 40,000 borrowers" working in public service and are part of an existing program known as the income-driven repayment option.

The China section today has several updates including items on China’s economy, it’s less-than-expected moves on interest rates, and ag-related updates on its soybean and pork sectors. China is making significant efforts to secure food supplies as the world’s biggest consumer faces challenges related to production and global dynamics, senior government officials said at a conference today in China. Spring plantings in some regions have become difficult due to strict Covid-linked isolation policies, Ma Youxiang, vice minister of agriculture and rural affairs, told the 2022 China Agricultural Outlook Conference.

The Biden administration restored environmental review of pipelines, highways, and other projects, reversing a Trump-era curb on such reviews to speed construction. The White House said the reinstatement won’t hamper projects, but some others disagreed. Meanwhile, the National Cattlemen’s Beef Association (NCBA) and Public Lands Council (PLC) expressed concern at the Biden administration moves.

Tepid reception to summer sales of E15 ethanol. The Biden administration announced last week it would suspend federal restrictions on sales of higher ethanol blend gasoline this summer to reduce gas prices, though the move was met with lukewarm reception from voters, according to a new Morning Consult/Politico survey. Details in Energy section.

The Biden administration is launching a $6 billion program to rescue nuclear power plants at risk of closing.

The Biden administration could fight ruling striking down mask mandate but there are some caveats… details below. Meanwhile, airports, city subways and transportation companies were split on allowing travelers to remove their masks for the first time in over a year Tuesday, following the abrupt end to America’s mask mandate on mass transport.

According to Axios, Biden’s inner circle is considering delaying the repeal of Title 42, the Trump-era order that prevented migrants from seeking asylum in the U.S. due to the pandemic. Biden’s plan to end the order on May 23 has been met with backlash from top Democrats, especially those facing tough re-election races Nov. 8.

Election Day 2022 is 202 days away. Election Day 2024 is 930 days away.

Florida lawmakers look ready to accept a congressional map that would eliminate districts now held by two of the state’s Black House members, add four seats likely to go Republican, and potentially spark a new federal court challenge.

David Wasserman: “This week, we're moving eight Democratic-held seats into more competitive categories.” Details in Politics section.

|

MARKET FOCUS |

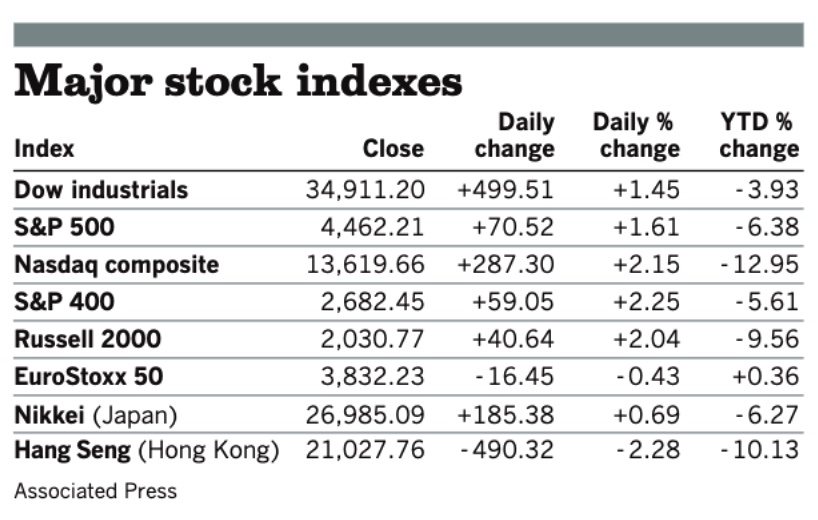

Equities today: Global stocks markets were mixed overnight. The U.S. Dow opened around 200 points higher and then went above 300 points higher. Asian equities finished mixed after tech-led rally in US markets, Japanese trade data. The Nikkei gained 232.76 points, 0.86%, at 27,217.85. The Hang Seng Index was down 83.09 points, 0.40%, at 20,944.67. European equities are posting advances in early trade after a relatively muted open in most markets. The Stoxx 600 was up 0.8%, with regional markets up 0.8% to 1.1%; the FTSE was only up 0.1%.

U.S. equities yesterday: The Dow gained 499.51 points, 1.45%, at 34,911.20. The Nasdaq rose 287.30 points, 2.15%, at 13,619.66. The S&P 500 gained 70.52 points, 1.61%, at 4,462.21.

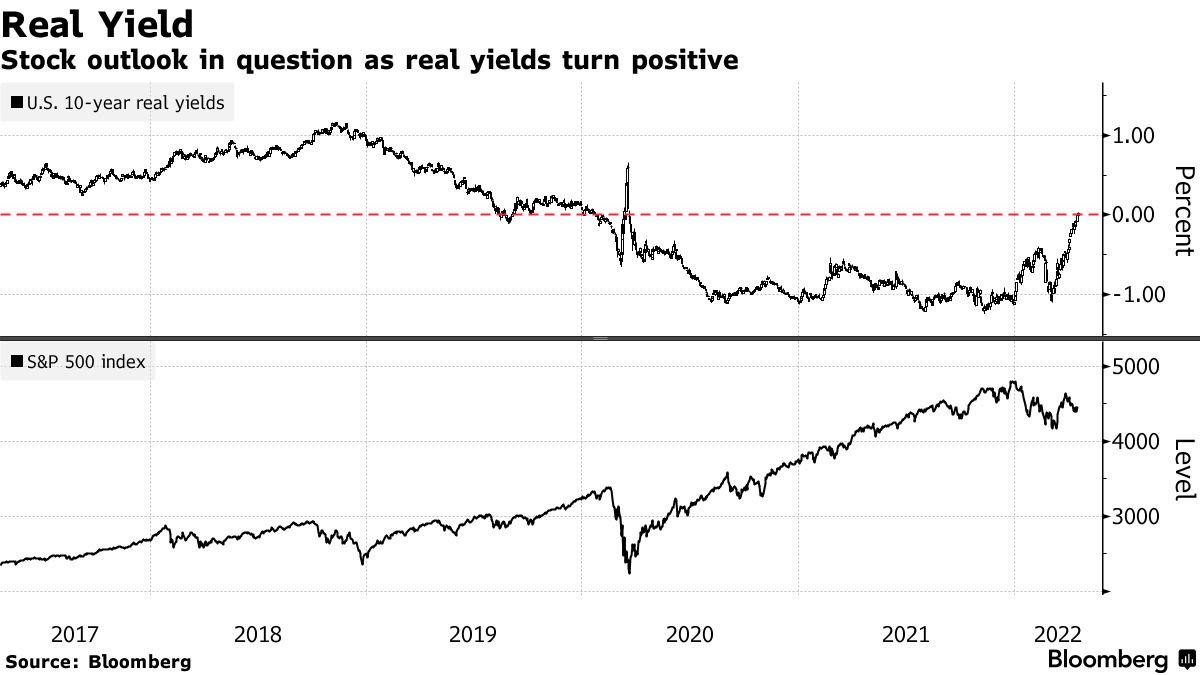

Investors in 10-year Treasuries can expect to earn real returns on their money for the first time in more than two years. The 10-year yield rose to as high as three basis points in Asia trading today.

Mortgage demand continued to crumble as home loan rates climbed to their highest levels since 2010. Total application volume fell 5% week over week, and it fell nearly 50% from year-ago levels. Refinance demand fell another 8% from the prior week, and it was 68% lower year over year. Purchase applications fell 3% for the week, and they were 14% lower than a year ago.

Agriculture markets yesterday:

- Corn: July corn futures fell 7 3/4 cents to $7.99 1/4 after reaching a contract high at $8.14 overnight. December corn lost 2 3/4 cents to $7.47 after hitting a contract high for the seventh straight day.

- Soy complex: July soybeans fell 1 1/2 cents to $16.91 3/4, after rising to a three-week high overnight at $17.05 3/4. July soymeal fell 70 cents to $459.60 per ton and July soyoil rose 11 points to 78.20 cents per pound.

- Wheat: July SRW wheat fell 19 3/4 cents to $11.09 after posting a six-week high at $11.43 1/2 overnight. July HRW wheat fell 12 3/4 cents to $11.76 1/4 and July spring wheat fell 5 3/4 cents to $11.72 1/4.

- Cotton: July cotton fell 492 points to 138.33 cents per pound, the lowest close in a week, while new-crop December dropped 252 points to 120.95 cents.

- Cattle: June live cattle rose 77.5 cents to $136.575, while April gained 87.5 cents to $141.35. May feeder futures rose $1.625 to $160.775.

- Hogs: June lean hogs fell $1.075 to $121.325 after hitting a three-week high earlier. The CME lean hog index rose 35 cents to $100.33, the fourth consecutive daily gain.

Ag markets today: Corn futures faced light followthrough selling in overnight trade, while soybeans firmed. As of 7:30 a.m. ET, corn was trading 1 to 5 cents lower, soybeans were 3 to 14 cents higher, SRW wheat futures were narrowly mixed, HRW wheat was mostly around 8 cents higher and HRS wheat was 2 to 4 cents higher. Front-month U.S. crude oil futures were around $1 higher, and the U.S. dollar index was more than 500 points lower this morning.

Technical viewpoints from Jim Wyckoff:

Perspective on lumber volatility the past two years. Wyckoff notes: “See on the monthly continuation chart (below) for nearby CME lumber futures the mammoth price moves and trading ranges of the past two years, when compared to the previous 45-plus years. Lumber has always been a volatile futures market, but its past two years of extreme price action suggests something more pervasive: higher price volatility across the entire raw commodity sector in the coming years.”

On tap today:

• U.S. existing-home sales are expected to fall to an annual pace of 5.75 million in March from 6.02 million one month earlier. (10 a.m. ET)

• Federal Reserve speakers: San Francisco's Mary Daly at the University of Las Vegas Center for Business and Economic Research at 10 a.m. ET, Chicago's Charles Evans on the economy and monetary policy at 11:30 a.m. ET, and Atlanta's Raphael Bostic on equity in urban development at 1 p.m. ET.

• Fed's Beige Book, summaries of economic conditions from the 12 central bank districts, is due out at 2 p.m. ET. (See item below for more on this topic.)

• International Monetary Fund-World Bank spring meetings in Washington, D.C., today include gatherings of finance ministers and central bank governors from the Group of 7 and Group of 20 major economies.

Yellen warns of war’s impact on food prices for poor. Treasury Secretary Janet Yellen calls on countries to drop export restrictions that affect food prices and to provide more support to vulnerable countries as the war in Ukraine threatens food supplies around the globe.

Early estimates suggest at least 10 million in sub-Saharan Africa alone could be pushed into poverty due to higher food prices, Yellen said during a meeting of Group of Seven and Group of 20 ministers along with officials from international financial institutions in Washington. Yellen said more than 800 million people worldwide suffered from chronic food insecurity before the war. “The war has made an already dire situation worse,” she said, adding “Russia’s actions are responsible for this.”

Institutions like the International Monetary Fund and World Bank should increase investments in agricultural capacity and resilience and help relieve global fertilizer shortages and supply chain disruptions, Yellen said. She called on technical experts to develop an action plan for a coordinated international response.

Bottom line: The World Bank is preparing to mobilize a relief package larger than the one it doled out in response to the pandemic.

U.S. recession watch: U.S. mortgage giant Fannie Mae said it anticipates a "modest" U.S. recession next year. Goldman Sachs put the odds of a recession at 15% over the next 12 months.

Weak yen, more imports = big price tag. A weak yen is exacerbating the pain of rising prices for Japanese households. Japan’s imports jumped 31% in March from a year ago to a record value, led by crude oil, coal and natural gas, the finance ministry reported today. That will translate into higher power bills in the nation that relies heavily on others for its energy resources. The impact is likely to worsen because the trade data were based on a yen averaging 115.86 against the dollar. Now the yen hit its 20-year low versus the dollar, hovering around 130.

Beige Book report due today. The Fed will release its Beige Book report today, an anecdotal recap of economic and business conditions in the 12 Federal Reserve Districts. The report is released two weeks prior to the conclusion of the next Federal Open Market Committee (FOMC) meeting. The report is expected to show continued price/inflationary pressures in businesses and reflect impacts/concerns by businesses over the Russian invasion of Ukraine. The report also breaks down information from individual sectors in each district, and some of the key ones that will be watched will be consumer activity and the housing sector. There will be no shortage of information on any of these key topics as markets continue to expect a 50-basis-point increase in the target range for the Fed funds rate at the May 3-4 FOMC session.

Inflation impacts U.S. infrastructure spending. Construction costs, along with inflation, are rising at the fastest pace in decades, driven by higher commodity prices and supply chain disruptions. That threatens to undercut some of the benefits of the Bipartisan Infrastructure Law, a centerpiece of the Biden administration’s economic agenda, analysts at S&P Global said in a new report. The Producer Price Index for building materials and supplies soared 24.9% over the 12 months that ended in March, and is up 58.6% since January 2020, just before the start of the pandemic. Higher costs for steel mill products, diesel fuel, plastic construction products, paint, lumber, trucking and tires all helped push the index higher.

Another measure of cost increases for public and road works projects, the National Highway Construction Cost Index, climbed 10.8% between the third quarter of 2020 and the third quarter of 2021, according to the most recent available data. That doesn’t include the recent surge in oil prices due largely to Russia’s war on Ukraine, which is expected to push the figure even higher.

Market perspectives:

• Outside markets: The U.S. dollar index is under mild pressure ahead of U.S. housing data amid strength in the euro and British pound. The yield on the 10-year U.S. Treasury note has eased to trade around 2.87% with a mixed tone in global government bond yields. Gold and silver futures are weaker ahead of U.S. housing data, with gold around $1,955 per troy ounce and silver around $25.35 per troy ounce.

• Crude oil futures are higher with U.S. crude around $104.10 per barrel and Brent around $108.75 per barrel. Those marks are up from Asian action which saw U.S. crude around $103.80 per barrel and Brent around $108.70 per barrel.

• Biden blamed high consumer prices on supply-chain disruptions and Russia’s invasion of Ukraine. He said the coordinated release of 240 million barrels of oil a day by the U.S. and its allies will lower gasoline prices, which now average $4.09 a gallon.

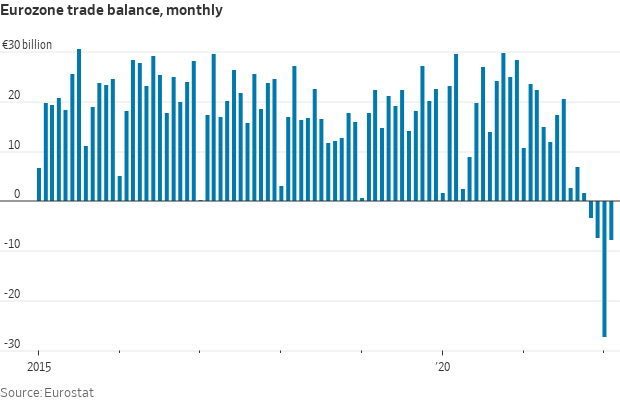

• Eurozone’s trade balance swung to a deficit in February from a surplus a year earlier as the cost of imported energy increased sharply, according to data from the European Union’s statistics agency. The eurozone’s trade deficit in goods — the difference between exports and imports — was 7.6 billion euros ($8.23 billion) in February, compared with a €23.6 billion surplus the same month a year earlier. Imports rose 38.8% on year in February, higher than the 17.0% on-year rise in exports.

• Shipping updates:

— Federal Maritime Administration Chairman Daniel Maffei says he plans to get more aggressive in investigating shipping lines’ behavior. Link

— Container xChange says sea container prices are tumbling as companies look to sell boxes because of tight storage space. Link

— Container dwell times at Southern California big seaports are rising again after several months of improvements.

— Shanghai-region manufacturers looking to resume production are hamstrung by parts and labor shortages. Link

• Soybean oil rallied to a fresh record on worries that dry weather in some key growing regions and any disruption in supplies from top exporter Argentina will hit global food trade already rattled by the Russia/Ukraine war.

• Another strike planned in Argentina, but minimal impact expected: Reuters. Argentine ship workers under the Maritime, Port and Naval Industry Federation (Fempinra) are set to hold a 24-hour strike Thursday, but an official with the Chamber of Port and Maritime Activities (CAPyM) told Reuters the strike will not affect the Rosario area that is important for agricultural shipments as Fempinra does not have a major presence there. This comes after Argentine truckers had staged a strike that affected corn and soybean transportation during harvest. The port workers said the strike was in part due to a lack of maintenance along the Parana River that transports some 80% of Argentine agricultural goods. Strikes have become a key tool for portions of the Argentine supply chain as the country has seen dramatic increases in inflation which is output workers’ wages.

• Ag trade: Jordan made no purchase in its tender to buy 120,000 MT of optional origin milling wheat.

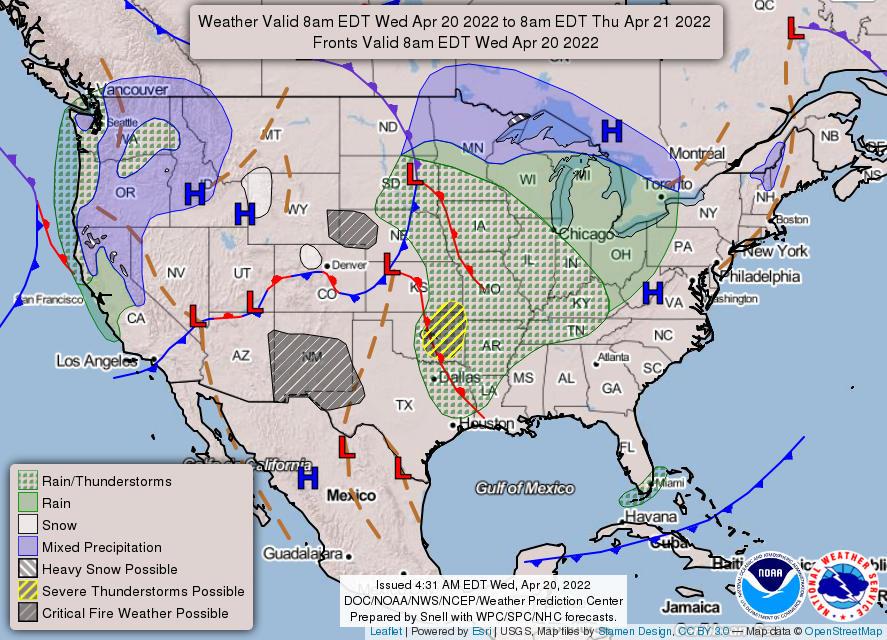

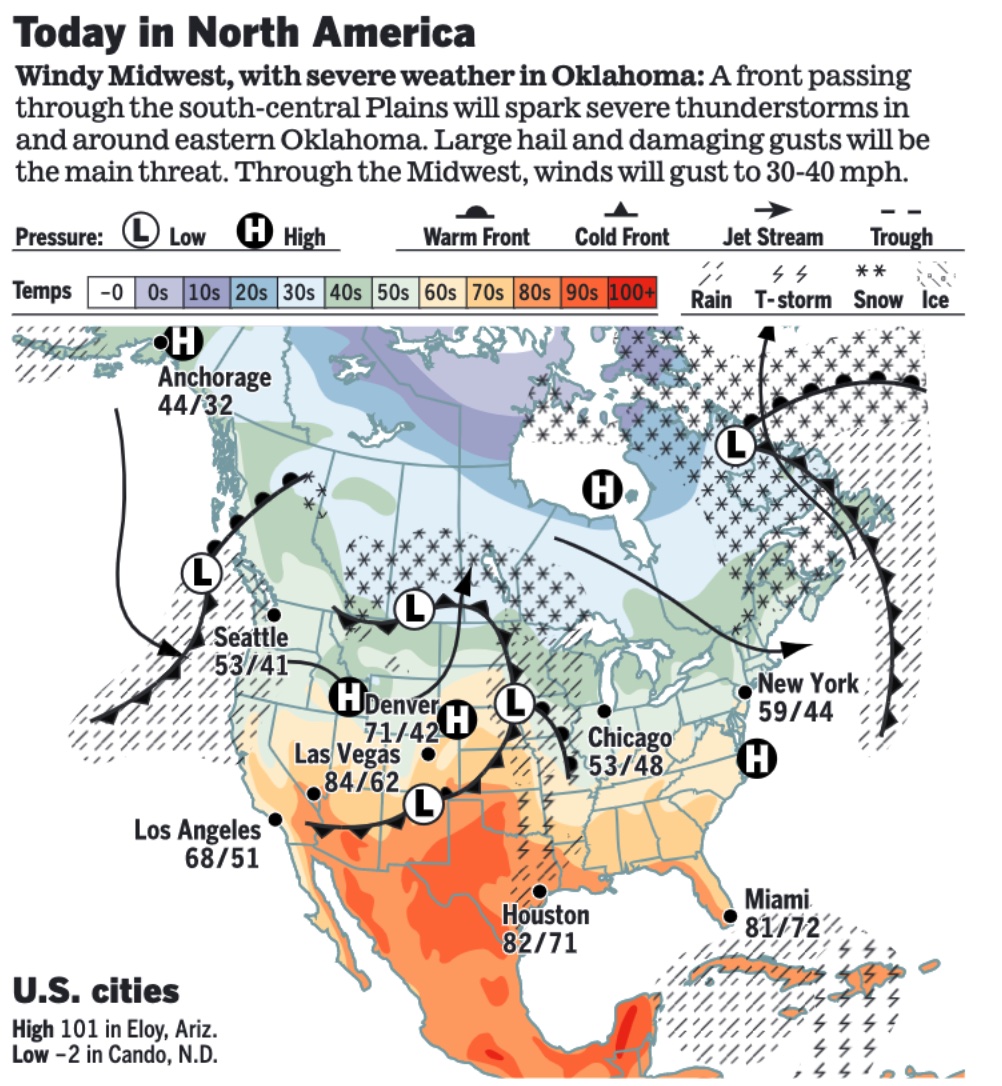

• NWS weather: Storm system to produce snow in northern Minnesota, showers throughout the Great Lakes, and severe storms in portions of the Heartland today... ...Strong upper low to bring unsettled and cooler weather to California and the Pacific Northwest ... ...Summer-like warmth and a Critical Risk of fire weather over parts of the Front Range, Southwest and Southern Plains through Wednesday; cooler temps sticks around in the Northeast through Thursday.

Items in Pro Farmer's First Thing Today include:

• Corn weaker, soybeans firmer overnight

• China unexpectedly keeps interest rates unchanged (details in China section)

• Light cash cattle trade at higher prices

• Wholesale pork prices again unable to hold morning gains

|

RUSSIA/UKRAINE |

— Summary: Ukrainian forces repelled numerous Russian attempted advances in the Donbas region amid Moscow’s increased shelling and attacks in the area, U.K. defense intelligence noted. Ukrainian troops are also resisting Russian attacks in the southeastern port city of Mariupol, where hundreds of civilians are sheltering in the basements of a massive steel plant. According to senior Biden administration officials, the U.S. is preparing another $800 million military assistance package for Ukraine. The latest package would come a week after the Biden administration authorized a separate $800 million security package.

- Nearly five million refugees have fled the war in Ukraine, and another 13 million are trapped because of the war, according to the United Nations’ High Commissioner for Refugees. About 5,000 Ukrainians entered the U.S. on humanitarian grounds in March, according to Customs and Border Protection data.

- Ukrainian authorities are scrambling to evacuate the remaining civilians from eastern regions as Russia begins its new military offensive and pitched battles get closer to the area’s main population centers.

- Kremlin insiders are quietly questioning the cost of Vladimir Putin's war. Some in the elite fear the invasion was a catastrophic mistake that will set Russia back for years, but they are too fearful of retribution to voice their concerns in public, Bloomberg reports (link).

— Market impacts:

- Lack of USDA staff in Russia a ‘huge void’ for crop forecasts. An absence of on-the-ground staff in Russia is a “huge void” for USDA’s crop forecasting, Patrick Packnett, deputy administrator for global market analysis at USDA’s Foreign Agricultural Service, said Tuesday at a meeting in Chicago. U.S. citizens and government workers fled Russia in the wake of the country’s invasion of Ukraine. USDA still has in-country sources in Ukraine even though the agency hasn’t published an update from its attaché since February, Packnett said. With a lack of intelligence on the ground, the government is relying on other data such as satellite images to track the “very fluid” situation. USDA will make its first official crop outlooks for Russia and Ukraine crop production and exports for the 2022-23 season in its WASDE report due May 12.

- Treasury Dept.: Russia’s invasion of Ukraine does not impact agricultural and medical exports, nongovernmental organization activities, Covid relief and other support to those impacted by the war. Link to fact sheet.

- Sunflower oil exports from Ukraine were halted amid fighting with Russia, triggering a domino effect for food prices worldwide. In a video report (link), the Wall Street Journal explains how the shortage of a single ingredient is leading to higher prices for other vegetable oil substitutes and disrupting production around the world. The upheaval from Russia’s invasion of Ukraine is feeding food inflation that is hitting developing countries particularly hard.

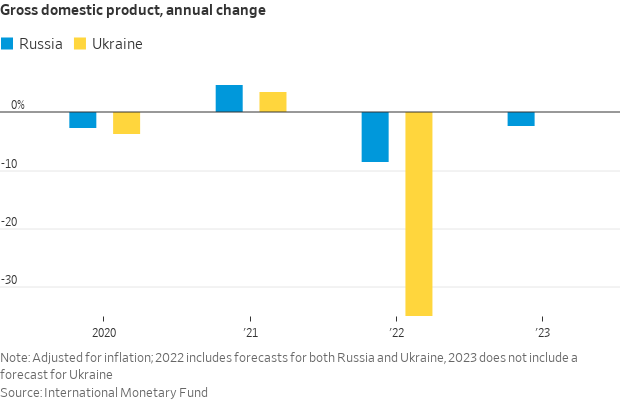

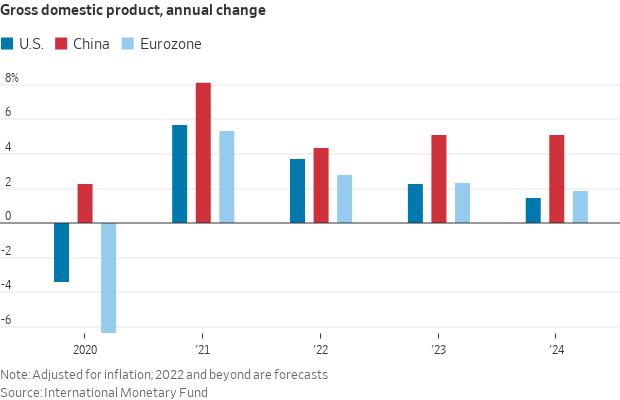

- Russia’s invasion of Ukraine “is sending shock waves throughout the globe,” IMF Managing Director Kristalina Georgieva said. “We are facing a crisis on top of a crisis.” The IMF attributes the world GDP downgrades primarily to the war in Ukraine, with its economic costs spreading farther afield through higher food and energy prices and disruptions in global trade.

- Russian oil exports plunged 25% last week. The week leading up to April 15 saw roughly $181 million in oil revenue, compared to $240 million the week prior.

|

POLICY UPDATE |

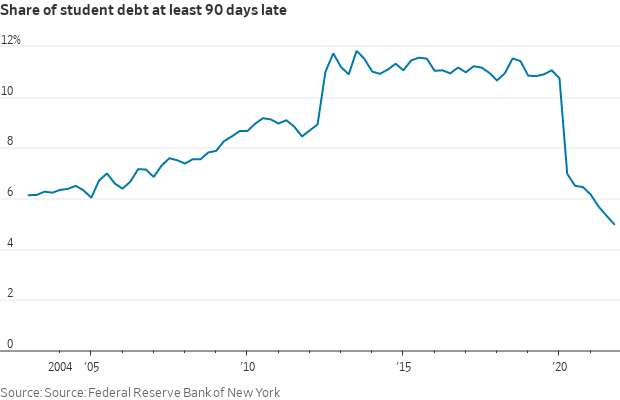

— Biden administration plans to make it easier for lower-income student-loan borrowers to get debt forgiveness through an existing program that has enrolled millions of people but provided few with relief. The move is part of a politically sensitive debate on the forgiveness of student-loan debt and attempts to more broadly overhaul how the student-loan repayment system works. The latest changes would apply to an income-based program for repaying student loans, allowing around 3.6 million people — nearly 10% of all student-loan borrowers — to receive at least three years of credit toward eventual debt forgiveness. The program, referred to as income-driven repayment plans, permits borrowers to pay a certain percentage of their income on loans for 20 to 25 years and have the rest of their balances forgiven.

Upshot: By the end of March, more than 700,000 of the 43 million federal student loan borrowers had seen their outstanding debt discharged under President Biden, totaling more than $17 billion in relief.

— A push for energy security is on the table in reconciliation talks between the White House and members of Congress, said Ali Zaidi, the administration’s deputy national climate advisor, at the BNEF Summit in New York. “We’re having conversations with members on the Hill, a number of them, about a reconciliation package that will help us tackle consumer costs and boost energy security,” Zaidi said. Sen. Joe Manchin (D-W.Va.) has said he is interested in restarting negotiations on a slimmer version of the stalled Build Back Better Act that would target climate change, high drug prices, and deficit reduction.

— U.S. to connect rural areas with development funding. The U.S. gov’t will put field staff in more than two dozen rural communities to provide a link between local leaders and federal economic development programs, the White House said. The Rural Partners Network will be run by USDA but will have a "whole of government" approach, working with 10 federal departments. Link for details.

|

PERSONNEL |

— Report: Biden administration close to naming USDA trade official. The Biden administration is close to naming a nominee for the still-vacant role of USDA Undersecretary for Trade and Foreign Agricultural Affairs, USDA Secretary Tom Vilsack and U.S. Trade Representative (USTR) Katherine Tai told a meeting of Agricultural Policy Advisory Committee for Trade (APAC) and Agricultural Technical Advisory Committees (ATACs), according to Politico. The administration had been vetting another nominee who dropped out of consideration on indications the individual would have had to make several changes to investments to hold the post. However, there still is no word on a nominee for the chief agricultural negotiator at USTR after the prior nominee Elaine Trevino withdrew. The administration has been facing rising pressure from agricultural interests over both positions being left unfilled more than a year into the Biden administration.

— Biden signed papers to appoint Ketanji Brown Jackson to the Supreme Court on April 8 even though she can’t begin work until Justice Stephen Breyer departs later this summer. Her precise status has been the subject of discussion stemming from the unprecedented timing of her Senate confirmation.

|

CHINA UPDATE |

— China is making significant efforts to secure food supplies as the world’s biggest consumer faces challenges related to production and global dynamics, senior government officials said at a conference today. Spring plantings in some regions have become difficult due to strict Covid-linked isolation policies, Ma Youxiang, vice minister of agriculture and rural affairs, told the 2022 China Agricultural Outlook Conference. The government is prioritizing farm production; seeds and fertilizers would be delivered to farmers on time.

Hog production losses in China have been increasing due to rising animal feed prices and weak pork rates. Losses widened to about 300 yuan ($47) per head in March, from about 200 yuan in February. Pork and hog prices are about to recover, costs and selling prices may match in June, Ma noted. A sustainable financial support system is needed to keep hog production stable.

China is also monitoring global farm production and supplies amid surging fertilizer prices and geopolitical tensions, said Qian Keming, vice minister for commerce.

— The IMF slashed its growth forecast for China this year to 4.4%, well below what Beijing aims to achieve, as widespread Covid-19 lockdowns and Russia’s invasion of Ukraine exacerbate pressure on the world’s second-largest economy. The IMF’s second downgrade of its China forecast in three months underscores the rising challenges for China’s leadership to meet its 2022 growth target of around 5.5% — a pace seen by senior leaders as needed to create as many as 13 million urban jobs in a year when President Xi Jinping is seeking a third term in office.

— Sharp increase expected in Chinese soybean production. China’s soybean production is expected to increase nearly 26% this year amid major efforts to boost domestic output. Land planted to soybeans is forecast to rise 16.7%, according to the country’s ag ministry, and production is expected to jump 4.2 MMT to 20.6 MMT. That would, however, be less than one-fifth of China’s total consumption.

— Chinese pork output expected to rise 2.9%. China’s pork production is forecast to rise 2.9% to 54.5 MMT this year as the country’s hog sector continues to expand after being sharply reduced by African swine fever. But the rise in production has oversupplied the market, which along with high feed costs, has caused negative hog production margins for hog farmers. A Chinese ag ministry official forecasts Chinese hog farmers should see a return to profitable levels by the third quarter of this year, as he expects feed prices will decline. But he also warned hog farmers against heavy sow liquidation.

— China’s pledges for more economic support are mounting as Covid outbreaks and efforts to contain them threaten to upend global supply chains and push a critical government growth target out of reach. In Shanghai, businesses are gradually resuming operations.

— China unexpectedly keeps interest rates unchanged. The People’s Bank of China (PBOC) surprisingly kept its benchmark lending rates unchanged, despite frequent pledges by Beijing to support its slowing economy hit by the recent Covid outbreak. The one-year loan prime rate (LPR) was kept at 3.70% and the five-year LPR was unchanged at 4.60%. Economists widely expected China to cut interest rates. Last Friday, PBOC said it would cut the reserve requirement ratio (RRR) for all banks by 25 basis points (bps), effective from April 25, and reduce RRR by an additional 25 bps for some smaller banks.

— China is set to ratify two international treaties on forced labor amid criticism over its treatment of the Uyghur ethnic minority, which has hindered trade ties with the U.S. and Europe. Observers say China’s latest move is unlikely to improve trade ties with the U.S. and Europe after Chinese leader Xi Jinping provided diplomatic support to Russia in the wake of Vladimir Putin’s war in Ukraine.

— China buys cheap Russian coking coal as world shuns Moscow. China more than doubled imports of steel-making coal from Russia in March, procuring the fuel at a discount as other nations move to ban deliveries due to the war in Ukraine. Bloomberg has details at this link.

|

TRADE POLICY |

— ITA seeks comments on subsidies on softwood lumber imports into the U.S. for required report to Congress. The Commerce Department’s International Trade Administration (ITA) is seeking comments on subsidies provided by countries exporting softwood lumber or softwood lumber products to the U.S. ITA will use the information to provide a report to congressional committees that is required every 180 days. The report covers the period from July 1- Dec. 31, 2021. ITA said in a notice in the Federal Register (link) that U.S. trade data indicate exports of the products from Brazil, Canada, Germany, Romania, and Sweden during that time period accounted for at least 1% of U.S. imports of softwood lumber products.

|

ENERGY & CLIMATE CHANGE |

— Biden administration is restoring stricter environmental standards for approving new pipelines, highways, power plants and other construction projects, including requiring consideration of how such projects might affect climate change. The changes announced Tuesday reinstate National Environmental Policy Act measures that had been removed by former President Donald Trump, who said that federal regulations were needlessly hindering much-needed infrastructure projects. Link for details.

The National Cattlemen’s Beef Association (NCBA) and Public Lands Council (PLC) also expressed concern at the Biden administration moves. “When it comes to federal regulations, ranchers are often caught in the middle of political whiplash, and this CEQ process is no exception,” said NCBA Executive Director of Natural Resources and PLC Executive Director Kaitlynn Glover. “Livestock producers and land managers need regulatory certainty and consistency. By returning to a pre-2020 standard, this rule returns environmental analysis to a failed model that industry and government have long agreed is woefully inadequate and inefficient. This failed model will stall important environmental projects, delay critical infrastructure improvements, and impede progress made as part of ongoing NEPA processes.” The groups also said NEPA processes have become inefficient and the source of an immense amount of regulatory red tape and uncertainty as producers renew grazing permits, improve rangeland, and participate in USDA voluntary conservation programs.

— Tepid reception to summer sales of E15 ethanol. The Biden administration announced last week it would suspend federal restrictions on sales of higher ethanol blend gasoline this summer to reduce gas prices, though the move was met with lukewarm reception from voters, according to a new Morning Consult/Politico survey. The results show 42% of registered voters support allowing summertime sales of higher ethanol blend gas, with the distinction that the special blends could lower prices but may also increase smog in warmer weather (ethanol proponents deny the smog impact, saying that is based on outdated information). About one in three voters opposed the Biden administration's move. At 49%, Democrats were slightly more likely to support allowing summer sales of higher ethanol blend gasoline than independents (39%) and Republicans (36%).

— Sen. Manchin raises red flag on possible imports of Iranian oil. Senate Energy and Commerce Committee Chair Joe Manchin (D-W.Va.) is warning the Biden administration against considering the import of oil from Iran to replace supplies lost due to Russia’s invasion of Ukraine. Manchin said in a letter to Secretary of State Antony Blinken that he was “particularly worried” about reports that the administration might remove the Islamic Revolutionary Guard Corps (IRGC) from the Foreign Terrorist Organization list “in hopes that trade relations can be re-established with Iran to assist with our energy crisis,” adding that sanctions are the “primary leverage” in trying to halt Iranian actions on nuclear weapons. He called on Blinken to keep focused on halting Iran’s use of “state-sponsored terrorism, advancement of its missile program, and the continued proliferation of dual-use technologies.” Manchin pledged to do “everything” in his power to “ensure we do not repeat the mistakes of the past,” a reference to 2015 negotiations with Iran on the Joint Comprehensive Plan of Action (JCPOA). Manchin has already demonstrated his ability to affect the Biden administration’s agenda. Link to Manchin letter.

— Nuclear plant rescue. The Biden administration is launching a $6 billion program to rescue nuclear power plants at risk of closing, opening a certification and bidding process for a civil nuclear credit program to aid financially distressed owners or operators of nuclear power reactors. The Department of Energy said it will take applications for the first round of funding in its program until May 19, prioritizing reactors that have already announced plans to close.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 506,005,218 with 6,203,669 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,733,217 with 989,366 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 570,111,773 doses administered, 218,996,861 have been fully vaccinated, or 66.71% of the U.S. population.

— Justice Department says it will appeal a court ruling that struck down the federal mask mandate for travelers — but only if the CDC determines the mandate is still necessary to protect public health. Before the ruling on Monday, the Biden administration had extended the mandate — which required masks to be worn aboard public transit, on planes, on trains and inside airports -- through May 3. If there is an appeal, that would mean that the administration would head to a higher court to extend the mandate — despite many airlines and public transit systems already deciding to make masks optional following the court ruling.

— A panel of outside experts to the U.S. Centers for Disease Control and Prevention will meet today to discuss the agency’s guidance for a fourth dose against Covid-19 and a framework for future additional shots. The panel of outside experts, which advises the CDC on how best to administer new vaccines, will also discuss safety and effectiveness of the boosters at the meeting, according to a draft agenda published late Tuesday.

— Biden’s Covid-19 vaccination mandate for federal workers can’t be challenged in court since the Civil Service Reform Act removed jurisdiction to hear certain actions involving federal employment, the Fourth Circuit ruled. Two federal staffers said that the mandate is unconstitutional for forcing them to choose between their jobs and getting vaccinated.

|

POLITICS & ELECTIONS |

— David Wasserman: “This week, we're moving eight Democratic-held seats into more competitive categories.” The House editor for the Cook Political Report with Amy Walter, adds: “With these changes, there are 27 Democratic seats in Toss Up or worse, and that list is certain to grow longer when Florida and New Hampshire finalize their lines. By contrast, there are only 12 GOP-held seats in Toss Up or worse — all of which are due to redistricting, not atmospheric factors. Republicans need to net just five seats to regain the House.”

Rating Changes:

IN-01: Mrvan (D) - Likely D to Lean D

NV-03: Lee (D) - Lean D to Toss Up

NV-04: Horsford - Lean D to Toss Up

NJ-03: Kim (D) - Solid D to Likely D

NY-04: OPEN (Rice) (D) - Solid D to Likely D

NY-19: Delgado (D) - Likely D to Lean D

NC-01: OPEN (Butterfield) (D) - Likely D to Lean D

VA-07: Spanberger (D) - Lean D to Toss Up

— President Joe Biden paid a visit to New Hampshire on Tuesday, the first of three trips this week to highlight his infrastructure plan and demonstrate to voters that Democrats can get agenda items through the Washington gridlock as midterm elections loom in the fall. New Hampshire is a Senate battleground, and Biden used the stop to praise Democrat Maggie Hassan, who helped drum up support for the infrastructure program. Portsmouth Harbor, N.H., got $19.9 million to improve its deep-water port. Other projects will fix bridges and expand high-speed internet.

Biden’s trips to Portland on Thursday and Seattle on Friday will emphasize investments to address climate change, including: electric-vehicle charging stations, making EVs 50% of new vehicles by 2030, promoting clean energy, and reducing methane emissions.

— Florida lawmakers look ready to accept a congressional map that would eliminate districts now held by two of the state’s Black House members, add four seats likely to go Republican, and potentially spark a new federal court challenge to the Voting Rights Act of 1965. Gov. Ron DeSantis (R) vetoed a map from lawmakers to make room for a new district added by reapportionment after the 2020 Census. Now, Republicans who hold the legislature have indicated they’ll accept a proposal from the governor’s staff.

|

OTHER ITEMS OF NOTE |

— A tight U.S. job market and low-cost online registration have contributed to an unprecedented number of registrations for high-skilled H-1B visas, immigration lawyers say. Employers submitted more than 483,000 H-1B registrations for fiscal 2023, U.S. Citizenship and Immigration Services reported — an increase of 57% from the previous record high in fiscal 2022. Up to 85,000 H-1B temporary work visas are available each year.

— Recreational marijuana sales will begin tomorrow in New Jersey at 13 medical dispensaries. Jeff Brown, executive director of the Cannabis Regulatory Commission, expects the locations to be "extremely busy" and warned people not to cross state lines. Customers can buy up to 1 ounce (28 grams) of dried flower or up to 5 grams of concentrates, resins or oils, or ten 100-milligram packages of ingestibles in a single transaction. (Yes, it’s 420 today… The numbers are a cannabis culture reference to the supposed best time to get high.)