USDA Formally Launches ELRP Effort; Crop Producers Await WHIP+ Details

World's largest container port hit by Covid surge in Shanghai

|

In Today’s Digital Newspaper |

President Joe Biden called for war-crime trials in Ukraine. The fallout from the Bucha atrocity continues, and Ukrainian president Volodymyr Zelenskyy addresses the U.N. Security Council today. The U.S. will also ask for Russia to be removed from its rotating seat at the UN Human Rights Council. Russia claims that the allegations are based on a hoax.

The U.S. stalled Russian debt payments. Russia can no longer access $600 million of reserves held in American banks and will have to eat into its own dollar holdings. The move increases pressure on Moscow to find alternative funding sources to pay bond investors.

European Commission is set to propose broad new sanctions on Russia today, European officials said, including a ban on imports of Russian coal. The proposal will need backing from the 27 member states.

On the ag policy front, USDA formally launched its ELRP effort. USDA on April 4 published a notice of funding availability on the Emergency Livestock Relief Program (ELRP) in the Federal Register, formally launching the effort which will automatically generate payments to livestock producers who have faced increased supplemental feed costs from forage losses due to a qualifying drought or wildfire in calendar 2021. Details in Policy section.

Regarding trade policy, Festering trade issues between the U.S. and Mexico figure high on the agenda for USDA Secretary Tom Vilsack’s trip to Mexico.

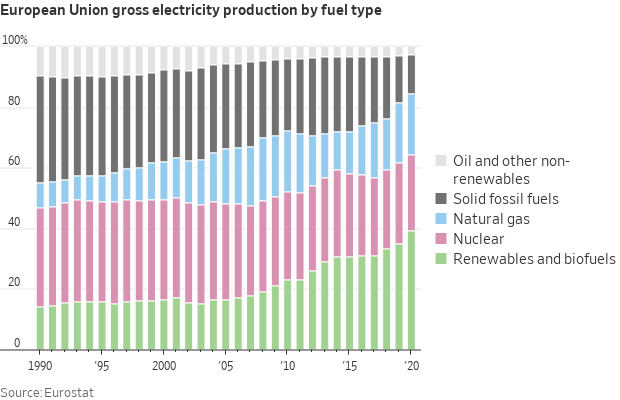

A U.N. climate report called for rapid fossil fuel cuts. Although climate scientists say the world must reduce oil and gas production, the war in Ukraine has prompted governments to do the opposite. The analysis from the United Nations’ Intergovernmental Panel on Climate Change says leaders must make radical, immediate changes. That includes rapidly phasing out the use of fossil fuels.

All 26 million Shanghai residents are now in lockdown. Restrictions have been extended even further in China’s financial hub, following a fresh Covid surge. China on Monday reported more than 16,400 new coronavirus cases, a record. More than 80% were in Shanghai. On Tuesday Shanghai reported 13,000 cases, more than three times the number nine days ago, when it first announced a plan to lock down in two phases. Most of the cases have been asymptomatic. Impact: The world's largest container port is hit by the Covid surge — details under China section.

The U.S. Senate dropped funding for fighting covid overseas. Senators reached a US-only $10 billion deal that’s less than half of what president Joe Biden wanted.

Republican senators Lisa Murkowski and Mitt Romney will vote to confirm Ketanji Brown Jackson to the Supreme Court, giving her three Republican votes (Susan Collins is the third).

|

MARKET FOCUS |

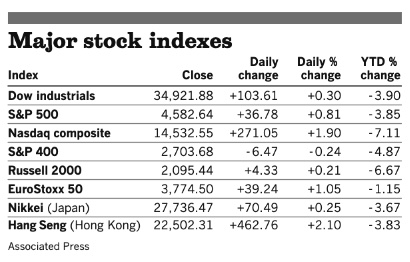

Equities today: Global stocks markets were mixed to firmer overnight. The U.S. Dow opened around 100 points lower and then reversed and is up around 75 points at this writing. Asian equities ended mostly higher after reversing course following a lower start on a rise in oil prices. The Nikkei gained 51.51 points, 0.19%, at 27,787.98. Markets in mainland China and Hong Kong were closed for a holiday. European equities are mixed to mostly lower in early activity, with some markets shifting between losses and gains. The Stoxx 600 was unchanged while regional markets were down 0.05% to 1.3% with Spain up 0.9%.

U.S. equities yesterday: The Dow finished with a gain of 103.61 points, 0.30%, at 34,921.88. The Nasdaq rose 271.05 points, 1.90%, at 14,532.55. The S&P 500 was up 36.78 points, 0.81%, at 4,582.64.

"Over the last two weeks, the S&P has produced one of its sharpest rallies in history, larger than the biggest 10-day rallies in seven of the S&P's 11 bear markets since 1927," said Bank of America analysts led by Gonzalo Asis and Riddhi Prasad. "It has done so despite clearly weaker fundamentals (more hikes, higher inflation, and curve inversion) and the Fed leaning against equity market strength to hike faster. The worsening macro backdrop and market-unfriendly Fed make sustained U.S. equity gains unlikely. In practice, this means lower risk assets."

JPMorgan Chase Chief Executive Jamie Dimon said the U.S. economy is facing unprecedented risks that have him preparing for dramatic upheavals. The head of the nation’s biggest bank offered a largely upbeat view of the economy’s health in his annual letter to shareholders. Consumers and businesses are flush with cash, wages are rising, and the economy is growing rapidly after its pandemic slowdown. Yet Dimon warned that the war in Ukraine could collide with rising inflation to slow the pandemic recovery and alter global alliances for decades to come.

Agriculture markets yesterday:

- Corn: May corn gained 15 1/2 cents to $7.50 1/2, while December corn gained 11 cents to $6.99, after posting a contract high for the third straight session.

- Soy complex: May soybeans rose 19 1/2 cents to $16.02 1/4 after dropping overnight to a 2 1/2-month intraday low. May soymeal rose $5.10 to $455.10 per ton and May soyoil gained 114 points to 72.34 cents per pound.

- Wheat: May SRW wheat rose 25 3/4 cents to $10.10. May HRW wheat rose 24 3/4 cents to $10.37 3/4. May spring wheat rose 19 3/4 cents to $10.85.

- Cotton: May cotton futures soared 339 points to 137.94 cents per pound.

- Cattle: June live cattle fell 92.5 cents to $134.925, while May feeder cattle plunged $3.65 to $162.475.

- Hogs: June lean hogs plunged $4.30 to $116.15, the lowest closing price since March 18. The CME lean hog index fell 50 cents (as of March 31) to $102.63.

Ag markets today: Winter wheat futures led strong followthrough buying in the grain and soy markets overnight amid lower-than-expected U.S. crop ratings and global supply concerns. As of 7:30 a.m. ET, winter wheat futures were trading mostly 40-plus cents higher, spring wheat was 18 to 24 cents higher, corn was 5 to 7 cents higher, and soybeans were 8 to 12 cents higher. Front-month U.S. crude oil futures were around 60 cents higher, and the U.S. dollar index was modestly weaker.

Technical viewpoints from Jim Wyckoff: “The 2-year/10-year U.S. Treasury notes yield curve is now inverted (2-year yield above 10-year), which is one historical clue, although not 100% predictive, that the U.S. is headed for economic recession.”

On tap today:

• U.S. trade deficit, due at 8:30 a.m. ET, is expected to narrow to $88.5 billion in February from $89.7 billion one month earlier. UPDATE: The U.S. registered a trade deficit of $89.2 billion for February, even with the downwardly revised January deficit of $89.2 billion. Imports rose 1.3% in February to a record $317.8 billion, marking a fourth month in a row they have been at $300 billion or more. Exports also increased, rising 1.8% to $228.6 billion, setting a new record.

• S&P Global U.S. services index for March, due at 9:45 a.m., is expected to hold at 58.9, unchanged from a preliminary reading.

• Institute for Supply Management services index, due at 10 a.m., is expected to rise to 58.3 in March from 56.5 one month earlier.

• Federal Reserve speakers: Governor Lael Brainard on inflation at 10:05 a.m. (livestream), and New York's John Williams in discussion with U.S. Surgeon General Vivek Murthy at 2 p.m.

‘Great resignation’ not that great after all, Fed study says. High levels of workers quitting their jobs — dubbed the “Great Resignation” — may not be that rare after all, according to the latest Economic Letter (link) from the Federal Reserve Bank of San Francisco. The so-called quits rate, which measures voluntary job leavers as a share of total employment, remained near a record at 2.9% in February. Roughly 4.4 million Americans quit their jobs in the month, according to Labor Department data back to 2000. The letter argues that prior to 2000, high waves of quits had actually been quite common during rapid economic recoveries in the postwar period, based on the Manufacturing Labor Turnover Survey, which was discontinued in 1981

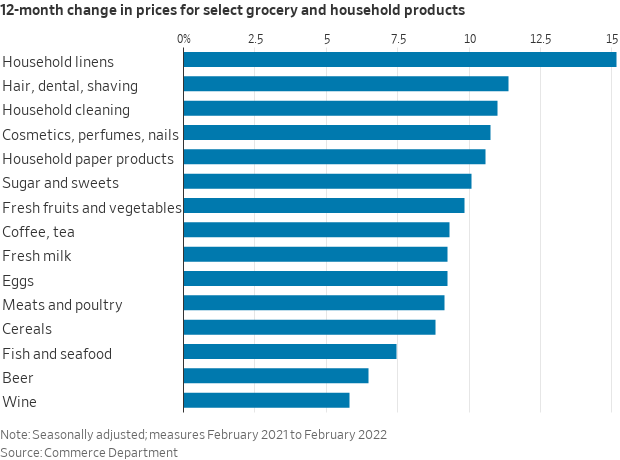

U.S. inflation watch: Household staples are no longer immune to inflation. American consumers are starting to cut costs on mainstays from toothpaste to baby formula as inflation hits a swath of the economy that had thus far proven resistant to substantial price increases. The WSJ reports (link) that Procter & Gamble, Clorox, Kraft Heinz and other consumer-products giants have made a bet that consumers will pay up for household products. Over the past year, the companies have seen profits and market share grow as they have raised prices on products from detergent and diapers to snacks and soda. Now consumers are drawing a line. Shoppers are buying staples in smaller quantities, switching to cheaper, store-name brands and more rigorously hunting for deals. The shift is especially pronounced among lower-income consumers.

Turkey’s inflation rate climbed to 61% in March — its highest level in 20 years — as Russia’s invasion of Ukraine drives up global energy and food prices, further compounding the country’s existing economic woes during the pandemic. The country is experiencing an “extraordinary period,” Turkish Finance Minister Nureddin Nebati said. Energy was a key driver of the March surge, with transportation costs nearly doubling. Food costs were up 70%.

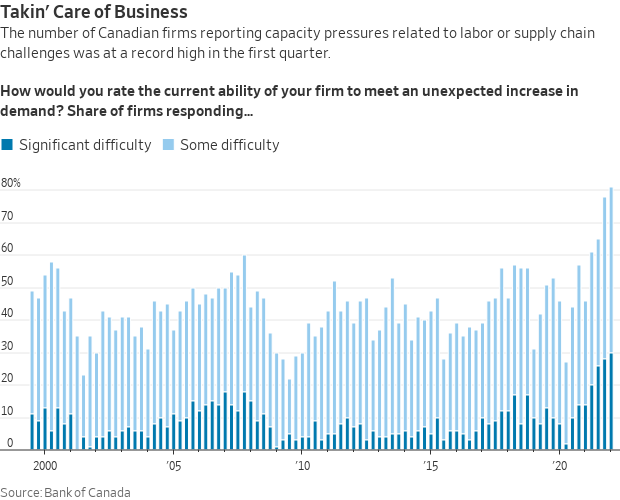

A record number of Canadian companies expect significant rises in the prices they pay for goods and what they charge customers because of labor shortages, supply-chain constraints and robust consumer demand, according to the Bank of Canada’s latest business-outlook survey. Some economists say the report, which includes a special section on the impact of the conflict in Ukraine, likely cements the case for a half-point increase in the central bank’s benchmark rate on April 13, when it is scheduled to announce its latest policy decision.

The government of Peru declared a state of emergency in Lima, the capital, and the port city of Callao, to curb protests against the high costs of fuel and fertilizers. Toll booths were set alight and lorry drivers blocked streets. The prices of gasoline and fertilizers have shot up since the start of the war in Ukraine.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly weaker amid a mixed-to-firmer tone for global currencies against the greenback. The yield on the 10-year U.S. Treasury note was higher, around 2.46%, while global government bond yields were also mostly higher. Gold and silver futures are mixed ahead of U.S. economic updates. Gold was weaker around $1,930 per troy ounce and silver higher around $24.80 per troy ounce.

• U.S. Mint has seen its strongest gold sales since 1999. First-quarter sales rose to 426,500 ounces, up 3.5% compared to the same period last year. The first quarter of this year was the mint’s strongest sales quarter in 23 years. In March, the U.S. Mint reported that it sold 155,500 ounces of various denominations of its American Eagle Gold bullion coins, up 73% from February.

• Crude oil futures remain in positive territory despite paring earlier gains. U.S. crude is around $103.75 per barrel and Brent around $108 per barrel. Futures had traded above $104.60 per barrel and Brent at nearly $109 per barrel in Asian action.

• Wheat futures headed for the biggest two-day rally in a month as weather worries and export challenges risk keeping global supplies tight.

• Ag trade: Japan is seeking 137,516 MT of milling wheat from the U.S., Canada and Australia in its weekly tender. The Philippines tendered to buy at least 50,000 MT of feed wheat.

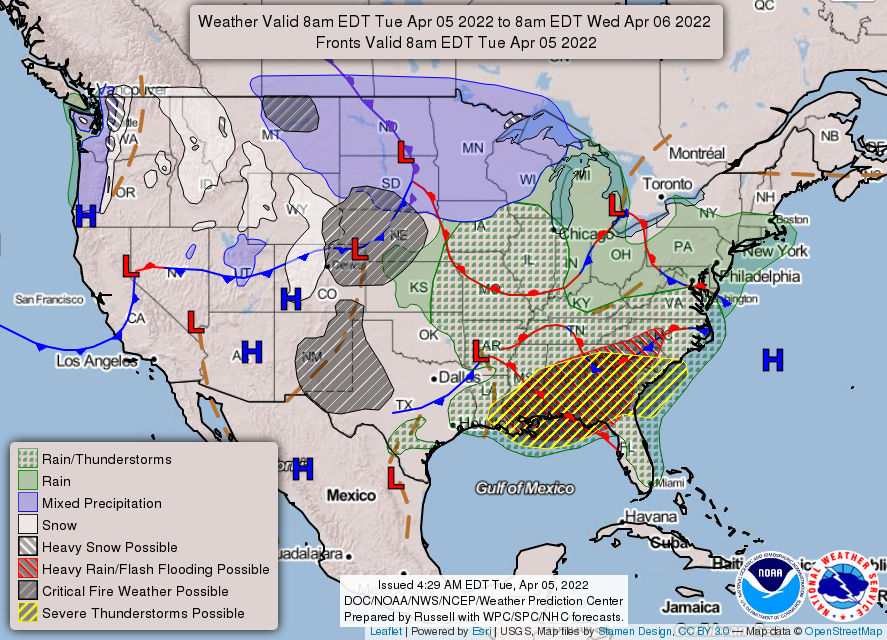

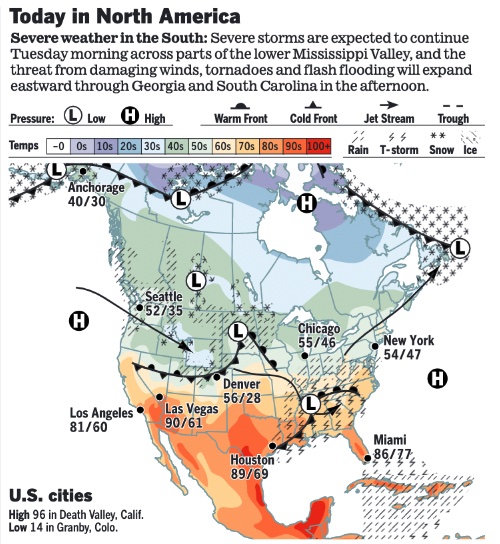

• NWS weather: Widespread high winds impacting the northern Rockies and High Plains will shift eastward and persist across the northern Plains through midweek along with snow... ...Heavy to excessive rain and severe thunderstorm threat will expand across much of the South today before moving up the East Coast tonight/early Wednesday... ...Critical Fire Weather Risk will expand across portions of the High Plains with record heat also possible in parts of south Texas today and Wednesday.

Items in Pro Farmer's First Thing Today include:

• Strong followthrough buying overnight, led by wheat

• Winter wheat CCI ratings plunge from last fall

• Argentine grain transporters call for strike amid fuel shortage

• Cash cattle traded roughly steady on Monday

• Cash hog index softens again

|

RUSSIA/UKRAINE |

— Summary: Russian forces on Tuesday were preparing for an offensive in Ukraine’s southeast, the Ukrainian military said, as President Volodymyr Zelenskyy prepared to talk to the United Nations. Ukrainian and Western officials said that Russia appeared to be positioning troops for an intensified assault in the eastern Donbas area. In Kharkiv, roughly 30 miles from the border, unrelenting bombardment has left parts of the city of 1.4 million unrecognizable. The systematic destruction is part of a broader strategy to seize the country’s east.

- U.S. Treasury banned Russia from accessing more than $600 million U.S.-held reserves to pay holders of its sovereign debt, Reuters reports (link), a move that increases pressure on the Kremlin and could lead to default. Under sanctions put in place after Russia invaded Ukraine on Feb. 24, foreign currency reserves held by the Russian central bank at U.S. financial institutions were frozen. An $84 million coupon payment was also due on Monday on a 2042 sovereign dollar bond — the move was meant to force Moscow to make the difficult decision of whether it would use dollars that it has access to for payments on its debt or for other purposes, including supporting its war effort.

- Pentagon plans to order and send to Ukraine 10 of the newest model Switchblade drones armed with tank-busting warheads in addition to previously announced deliveries of a less powerful version. The new Switchblade-600 weapons are part of $300 million in lethal military assistance announced by the Pentagon Friday.

- European Commission is set to propose broad new sanctions on Russia today, European officials said, including a ban on imports of Russian coal, slashing the access of Russian road and shipping goods carriers into the bloc, targeting oligarchs and their families and blocking some machinery exports. The proposed ban on Russian coal would be the first time the EU has agreed to block imports of one of Russia’s main energy supplies. EU capitals remain divided on whether to impose a ban on Russian oil and gas imports. On Monday, French President Emmanuel Macron joined the public calls for a ban on Russian coal and oil imports for the first time.

- Communist Party in China is mounting an ideological campaign to build domestic sympathy for Russia. Link for details.

— Market impacts:

- Ukraine grain group asks gov’t to lift wheat-export restrictions. The Ukrainian Grain Association, a group representing producers and exporters, is asking the nation’s government to scrap licensing restrictions on wheat exports to restore shipments, it said Tuesday. Ukraine has extra stockpiles of wheat due to a robust harvest last year. Maintaining shipments has been complex amid Russia’s invasion that’s blocked the country’s seaports. Reports note that Ukraine’s government will likely consider removing the need for licenses from shippers to sell wheat abroad later this month after it has clarity on how the nation’s sowing campaign is progressing.

- War has big impact on Ukraine’s sunflower oil output: Kernel CEO. Closing of Ukrainian ports amid Russia’s war will have a huge impact on the country’s sunflower oil production and supplies worldwide, Ievgen Osypov, chief executive officer of Kernel Holding, said in an interview on Bloomberg TV. Local infrastructure is still currently in good condition. Ukraine’s planting area could fall 20% y/y, with yields also decreasing. The country can only ship about 5% of its pre-war volumes, and it will take time to build a new logistics chain through the western border. Kernel is the world’s leading sunflower oil producer and exporter, according to its website. Meanwhile, huge stocks are building inside Ukraine with little sold abroad. Customers in Europe and Asia are awaiting supply that’s unable to be delivered; buyers are switching to alternatives like soy, palm and rapeseed oils.

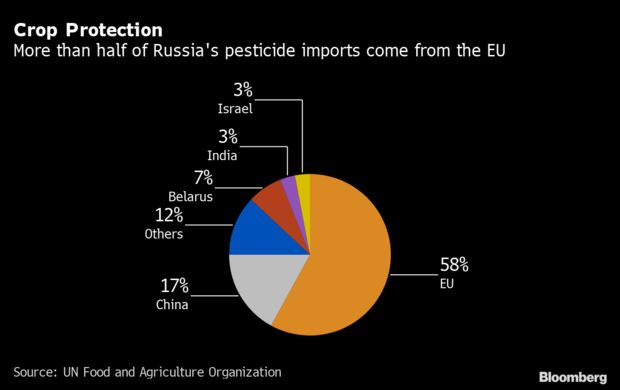

- Russian farmers are switching to domestic suppliers of seeds and pesticides to sow their spring crops, as the fallout from the invasion of Ukraine leads to import challenges. War-related sanctions and logistical issues have created import problems for about 10% of seeds, Dmitry Rylko, general director of the Moscow-based Institute for Agricultural Market Studies, said in an interview with Bloomberg. For now, most demand for seeds has been fulfilled “one way or another” and planting is going smoothly, he added. Major Russian agricultural producer Steppe Agroholding said it would keep the area of wheat crops at last year’s level, while expanding plantings of “highly profitable niche crops.” Sugar-beet farmers are now having to pay in advance for inputs and equipment, rather than in installments as they did before the war, Interfax reported, citing Russia’s union of sugar producers, which said 60% of components for sugar beet are imported. Some major shipping companies have restricted vessels from visiting Russia, creating further complications. The country was dependent on the European Union for 58% of its pesticide imports and 68% of its high-value seed imports last year, according to the U.N. Food and Agriculture Organization.

- Growing numbers of tankers carrying Russian oil are turning off their radio signals to avoid detection on the seas. Link for details.

- The impact of sanctions is spreading through Russia’s economy, providing early indications of the pressures the country will face, the WSJ reports (link). Inflation has jumped, imports are growing scarce, and Russians are girding for tough times. Foreign companies halted business with Russia, causing job losses and hobbling industries. Next, economists expect inventories to be depleted and unemployment to mount. Many Russians aren’t waiting. They are scrambling to get imported goods such as Nespresso pods and contact lenses, and are stocking up on staples, even though stores generally remain well supplied. Their buying could speed up inflation and worsen the impact of the sanctions.

|

POLICY UPDATE |

— USDA formally launches ELRP effort. USDA on April 4 published a notice of funding availability on the Emergency Livestock Relief Program (ELRP) in the Federal Register (link), formally launching the effort which will automatically generate payments to livestock producers who have faced increased supplemental feed costs from forage losses due to a qualifying drought or wildfire in calendar 2021.

Phase 1 of the program will use data already provided by affected producers under the Livestock Forage Program (LFP).

ELRP payments will be based on the number of animal units, limited by available grazing acreage, in eligible drought counties. USDA said it was using LFP data to make the payments quickly even though there is not a “direct correlation to the increased feed costs incurred.” LFP payments were calculated as being $18.71 per month per animal unit for drought while there was not a single rate calculated for fire. ELRP will pay 90% of that amount ($16.84) per animal unit per month for “historically underserved farmers and ranchers” while all others will receive 75% of that amount ($14.03) per animal unit per month.

There is a $125,000 payment limit for a person if their average farm adjusted gross income (AGI) is less than 75% of their average AGI for tax years 2017, 2018 and 2019; if 75% of more of their average AGI is from farming, then the limit per person is $250,000.

FSA will issue ELRP Phase 1 payments as 2021 LFP applications are processed and approved and are expected to total $577 million; any additional payments under ELRP will be covered under a Phase 2 effort.

— Slight changes to total CFAP payments. Payments under the Coronavirus Food Assistance Program (CFAP) continue to change slightly from week to week. As of April 3, total CFAP 1 payments were at $11.81 billion ($11.82 billion prior week) with little change in original CFAP 1 payments at $10.62 billion ($10.62 billion prior) and top-up payments at $1.19 billion ($1.19 billion prior). Similarly, total CFAP 2 payments edged down to $19.16 billion ($19.17 billion prior) with original CFAP 2 payments at $14.34 billion and top-up payments at $4.83 billion, both little changed from the prior week.

— Senators agree on $10 billion Covid spending package after stripping $5 billion in global aid; $1.6 bil. cut from prior USDA funding. Senate negotiators struck a deal on $10 billion in Covid aid on Monday, setting the chamber on a potential course to clear the bill this week. The compromise would reprogram billions in unused money from other coronavirus bills (including $1.6 billion in unused funding at USDA) to deliver funding for therapeutics, testing and vaccine distribution. However, it does not include global pandemic aid sought by Democrats and a handful of Republicans, which could become a hurdle when the package comes before the House. But others say Democrats in the House will be under intense pressure to send the aid package to President Joe Biden’s desk by this week, especially as lawmakers head out for a two-week Easter recess.

Upshot: The accord would give the Biden administration $5 billion to buy Covid therapeutics and antivirals and another $4.75 billion that could be used for a wider range of purchases, such as tests and vaccines. It would also provide $750 million for research projects for future Covid vaccines and therapeutics.

Cost Offsets. The measure would permanently rescind unobligated balances from previous Covid-19 relief laws, including:

- $2.31 billion from a payroll support program for aviation manufacturing.

- $2.14 billion from amounts set aside from the State Small Business Credit Initiative for states to support businesses owned by socially and economically disadvantaged individuals, plus $200 million in technical assistance funds. Outlays from the credit initiative would be reduced by $1.87 billion over 10 years, according to an April 4 cost estimate from the Congressional Budget Office.

- $1.93 billion from a Small Business Administration grant program for live venue operators.

- $1 billion from a program to purchase food and agricultural commodities and to support smaller food processors, and $600 million in additional funds set aside for the Agriculture Department to support agricultural producers.

- $900 million from the SBA’s disaster loan program.

- $887 million from the Local Assistance and Tribal Consistency Fund, which was established to assist certain revenue-sharing counties and tribal governments.

- $500 million from the Higher Education Emergency Relief Fund.

|

CHINA UPDATE |

— Lockdown extended in Shanghai as data shows infection spreading. The lockdown in Shanghai has been extended to cover the 26 million people in the entire city after authorities reported 13,086 Covid cases with restrictions in the city’s western district in place until further notice. Reuters reported at least 38,000 personnel have been deployed to the city from other areas of the country in what was labeled the biggest nationwide medical operation since the country shutdown Wuhan in 2020. Around 23 cities across China are under total or partial lockdowns, affecting 193 million in areas that account for 13.6% of China’s GDP, according to an estimate by Nomura brokerage.

— World's largest container port hit by Covid surge. Shanghai’s coronavirus lockdown and the surge in cases (see previous item) have hit operations at the world’s largest container port by disrupting the logistical chain on land, according to industry insiders cited by the South China Morning Post. Shanghai Port, a major export gateway for goods produced in the nearby manufacturing hubs of Jiangsu and Zhejiang provinces, has so far stayed in operation 24 hours a day inside a “closed loop” bubble, which requires workers to stay on site all the time, the article notes. “Even with the world’s largest port open, the closure of many warehouses, the drop in manufacturing and the serious disruption to trucking in, out and within the city are expected to cause a significant drop in the availability of goods and port output,” said Judah Levine, head of research at Freightos, an online freight marketplace. The major logistical difficulties are on the land side rather than in the port area, according to Yan Hai, a senior transport analyst at SWS Research. Trucking services in and out of the Shanghai Port are still available for the moment, but there will be a 30% drop in efficiency until Tuesday, according to the latest customer advisory from Maersk, one of the world’s largest container shipping companies.

— Russia’s attack on Ukraine is sidetracking China’s ambitions to export more goods to Europe. Europe-bound rail shipments from China that pass through Russia have been plummeting, the Wall Street Journal reports (link), dealing a setback to the $4 trillion Belt and Road initiative aimed at cementing China’s role as a pre-eminent trading force. Although the European Union hasn’t officially banned imports passing through Russia, freight forwarders increasingly are shipping away from the rail corridor to avoid the risk of getting caught up in sanctions. That is a blow to operations that moved around $82 billion worth of Chinese exports into the EU by rail in 2021, a 10-fold increase since 2016. The Ukraine war could also shift sentiment on projects in Europe aimed at expediting Chinese cargo. Germany’s port of Duisburg plans to stop business activity in Belarus and sell its 39% stake in a Europe-Asia rail business.

|

TRADE POLICY |

— Department of Commerce ordered by court to review solar duties. The Department of Commerce (DOC) has been ordered to reconsider U.S. duty rates on certain entries of solar power cells from China, the U.S. Court of International Trade determined Monday. The U.S. has put antidumping duties on crystalline silicon photovoltaic cells (CSPV) with imports of those products estimated at $441 million in 2017, according to the U.S. International Trade Commission. DOC conducted a review of Chinese CSPV cells coming into the U.S. from December 2017 and November 2018, applying a 50.33% duty for Trina Solar and its affiliates and 106.39% for Risen Energy and its affiliates. Other producers and exporters were levied a margin of 68.93%. DOC can either provide an updated explanation of its calculations or can change the way it calculated the duties and has until July 5 to take the action.

— Trade issues high on agenda as USDA’s Vilsack in Mexico. Festering trade issues between the U.S. and Mexico figure high on the agenda for USDA Secretary Tom Vilsack’s trip to Mexico, including Mexico’s foot-dragging on several matters like approvals of biotech crops, allowing in U.S. potatoes, and threats made to USDA inspectors from the Animal and Plant Health Inspection Service (APHIS) that briefly halted imports of avocados from Mexico’s Michoacán state. Issues related to farm workers from Mexico and U.S. vaccine requirements are also on the list of topics hoped to be addressed.

U.S. Trade Representative Katherine Tai last week indicated she was working closely with Vilsack on the potato and biotech crops issues relative to Mexico, though she had no major update to offer. A call with reporters scheduled for later today could shed some light on the matter.

|

ENERGY & CLIMATE CHANGE |

— Climate action. According to a new report by the U.N.-affiliated Intergovernmental Panel on Climate Change, the world is currently on a path (link) to speed past critical climate targets, even if countries’ existing pledges (link) are met. But the report outlines immediate, collective actions that will help the world correct course — including investing seriously in climate mitigation, focusing on renewable energy (link), and reconfiguring cities and transportation systems. “Some government and business leaders are saying one thing—but doing another,” said U.N. Secretary General Antonio Guterres (link). “Simply put, they are lying. And the results will be catastrophic.”

— Climate change is liable to cost the federal government an extra $25 billion to $128 billion per year by the end of the century, the White House said Monday. The new estimates come as Biden administration officials prepare to justify their fiscal 2023 budget requests to Congress later in the week. President Joe Biden also is trying to resurrect his stalled Build Back Better package, which contains hundreds of billions of dollars for an array of climate-related programs. Overall climate spending in Biden’s budget proposal is $44.9 billion, a nearly 60% increase from fiscal year 2021, the White House Office of Management and Budget said.

The projected cost increases stem from six climate-related financial risks — disaster relief, flood insurance, crop insurance, health care expenditures, wildland fire suppression spending, and flood risk at federal facilities — and take into account only a limited range of potential damages.

Under the White House’s projections, more frequent hurricanes would raise the price of coastal disaster response by $22 billion to $94 billion per year by the end of the century.

More wildfires would increase federal fire suppression costs by $1.55 billion to $9.6 billion annually, and more than 12,195 federal buildings would be inundated by 10 feet of sea level rise — posing replacement costs of some $43.7 billion, according to the White House. Federal expenses on crop insurance premium subsidies would increase by 3.5% to 22% percent each year.

Next step: Michael Regan, head of the Environmental Protection Agency, is scheduled to defend his agency’s budget request before the Senate Environment and Public Works Committee on Wednesday.

— House Agriculture Committee to examine renewable energy. The House Agriculture Committee holds a hearing today on a “2022 Review of the Farm Bill: Renewable Energy Opportunities in Rural America.” USDA Undersecretary for Rural Development Xochitl Torres Small will testify along with officials from the Rural Business-Cooperative Service and Rural Utilities Service. From the private sector, the witness list includes Andy Olsen, Senior Policy Advocate, Environmental Law & Policy Center, a group that advocates for renewable energy; Bill Cherrier, Executive Vice President and CEO, Central Iowa Power Cooperative, on behalf of the National Rural Electric Cooperative Association; Dr. Patrick Gruber, Chief Executive Officer, Gevo, Inc., a firm focused on renewable chemicals and advanced biofuels; and Jay McKenna, Chief Executive Officer, Nacero, an energy company focused on using hydrogen as a fuel and making gasoline from natural gas.

The session is more focused on electrification in rural areas and not on “mainstream” biofuels which is what many think of relative to renewable energy in rural areas. Some have signaled they expect a push by lawmakers on E15 fuels, but it is not clear such a push will do much more than get the issue on record as being raised.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA: HPAI found in 118 flocks in 24 states. USDA’s Animal and Plant Health Inspection Service (APHIS) has relaunched their site (link) which tracks highly pathogenic avian influenza (HPAI) cases. APHIS said the new page uses the same data previously made available, “but in a more visual and easy-to-navigate format.” The 118 flocks in 24 states now affected include 72 commercial flocks and 46 backyard flocks totaling 22,851,071 birds. The new data also includes an entry for when locations with cases have been released from the control area and movement control restrictions. The 10-kilometer control area and movement control restrictions are in place until at least 14 days have elapsed since the initial virus elimination of the last infected premises and negative results of all surveillance activities. New cases in commercial poultry operations April 3 confirmations in North Dakota (86,000 commercial turkey meat birds in Dickey County).

— USDA formally publishes final rule of origins of livestock relative to organic dairy. USDA today (April 5) published in the Federal Register (link) a final rule on the origins of livestock under the National Organic Program relative to dairy animals. USDA said the action is based on public input to a proposed rule the agency previously released. Under the final rule, “organic milk and milk products must be from animals that have been under continuous organic management from the last third of gestation onward, with an exception for newly certified organic livestock operations.”

The rule becomes effective June 6, 2022, and all certified organic operations have to comply with its provisions by April 5, 2023.

Upshot: USDA acted via the final rule to address what it said were “inconsistencies” in how the transition of animals from conventional dairy production to organic production was being handled.

— Restaurant groups pushing for aid extension. Congress should pass an extension of the Restaurant Revitalization Fund (RRF) this week, according to the National Restaurant Association (NRA). The House may consider legislation this week that would replenish the fund designed to help restaurants slammed by Covid-19. Some $28 billion of economic relief was provided to more than 101,000 restaurants but another 177,000 establishments have not been able to receive any funding.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 493,904,579 with 6,170,945 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 81,495,687 with deaths closing in on 1 million at 997,129. The Johns Hopkins University Coronavirus Resource Center said that there have been 562,435,301 doses administered, 217,882,466 have been fully vaccinated, or 66.37% of the U.S. population.

— The CDC announced a comprehensive review of its operations amid a barrage of criticism about its handling of the pandemic.

|

POLITICS & ELECTIONS |

— Texas Gov. Abbott sets June 14 special election for newly vacated House seat. Texas Gov. Greg Abbott (R) set June 14 as the date for an emergency special election to fill the House seat vacated by Democratic Rep. Filemon Vela.” In a statement Monday, Abbott said candidates will have until April 13 to file to run in the election. Early voting in the special election will start on May 3, Abbott said. Vela resigned from Congress on Thursday, becoming one of 31 House Democrats who said they would not seek re-election this year. Whoever wins will only have the congressional seat for five months before the November midterms determine who will represent the 34th Congressional District for the following two years.

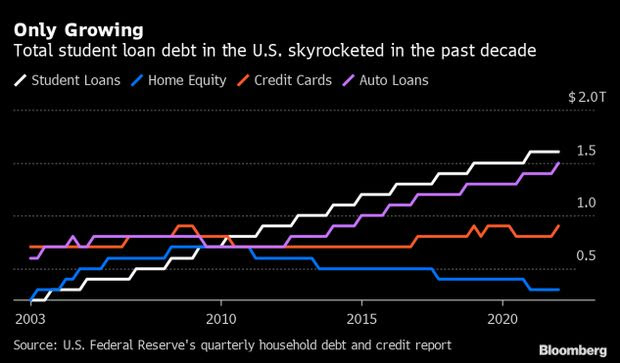

— More than 90 Democrats have sent a letter to President Biden asking for student loan forgiveness to be extended. Senate Majority Leader Chuck Schumer (D-N.Y.), House Majority Whip James Clyburn (D-S.C.), Sen. Elizabeth Warren (D-Mass.), and other lawmakers asked the president to extend the Covid-era suspension on student loan past the current May 1 deadline. The legislators also called for the administration to make broader movements on student debt cancellation.

|

CONGRESS |

— Senators discharge Jackson’s SCOTUS nomination from deadlocked Judiciary Committee as Romney, Murkowski express support. The Senate put Ketanji Brown Jackson on a clear track to be confirmed later this week as the Supreme Court’s 116th justice — and its first Black woman — after three Republicans joined Democrats to advance her nomination in a Monday vote.” Sens. Lisa Murkowski (R-Alaska) and Mitt Romney (R-Utah) become the second and third Republicans to announce support for Jackson, joining Sen. Susan Collins (R-Maine), who publicly backed the judge last month, while all 50 members of the Democratic caucus also backed Jackson in a 53-to-47 procedural vote.

|

OTHER ITEMS OF NOTE |

— Twitter names Elon Musk to its board of directors, giving the company's top shareholder a major role at the social media giant. Musk wrote on Twitter that he was looking forward to working with the company "to make significant improvements to Twitter in coming months!" Twitter's chief executive, Parag Agrawal, tweeted that Musk is "both a passionate believer and intense critic of the service which is exactly what we need on @Twitter, and in the boardroom, to make us stronger in the long-term."