Canadian Pacific Railway, Union Agree to Arbitration, Ending Work Stoppage

WSJ: Ag giants like Cargill have refused to cut ties with Russia, citing humanitarian concerns

|

In Today’s Digital Newspaper |

Ukrainian forces said they retook a strategically important suburb of Kyiv early

Ukrainian forces said they retook a strategically important suburb of Kyiv early today, as today, as Russian forces squeezed other areas near the capital. The invading Russian forces are increasing air raids that have caused uncounted deaths and sent millions of people fleeing. Russian attacks struck Kyiv, Odessa and other locations across Ukraine as Moscow appears focused on a war of attrition aimed at compelling the government to relinquish claims to southern and eastern territory.

President Biden warned companies to prepare for cyberattacks by Russia in retaliation for sanctions.

Agricultural giants like Cargill have refused to cut ties with Russia, citing humanitarian concerns. Nestlé defended its continued presence in Russia by saying it wouldn’t profit from operations there.

Commodity traders are being hit by huge cash requests from banks and exchanges, generating whipsaw moves in markets and hindering the movement of materials beyond Russia and Ukraine.

Canadian Pacific Railway and the union representing its conductors and engineers agreed to shift stalled contract negotiations to binding arbitration, freeing it to resume freight shipments after a two-day work stoppage.

USDA daily export sale: 240,000 MT of soybeans to unknown destinations during MY 2021-2022.

Wheat futures are surging again and leading the ag complex higher.

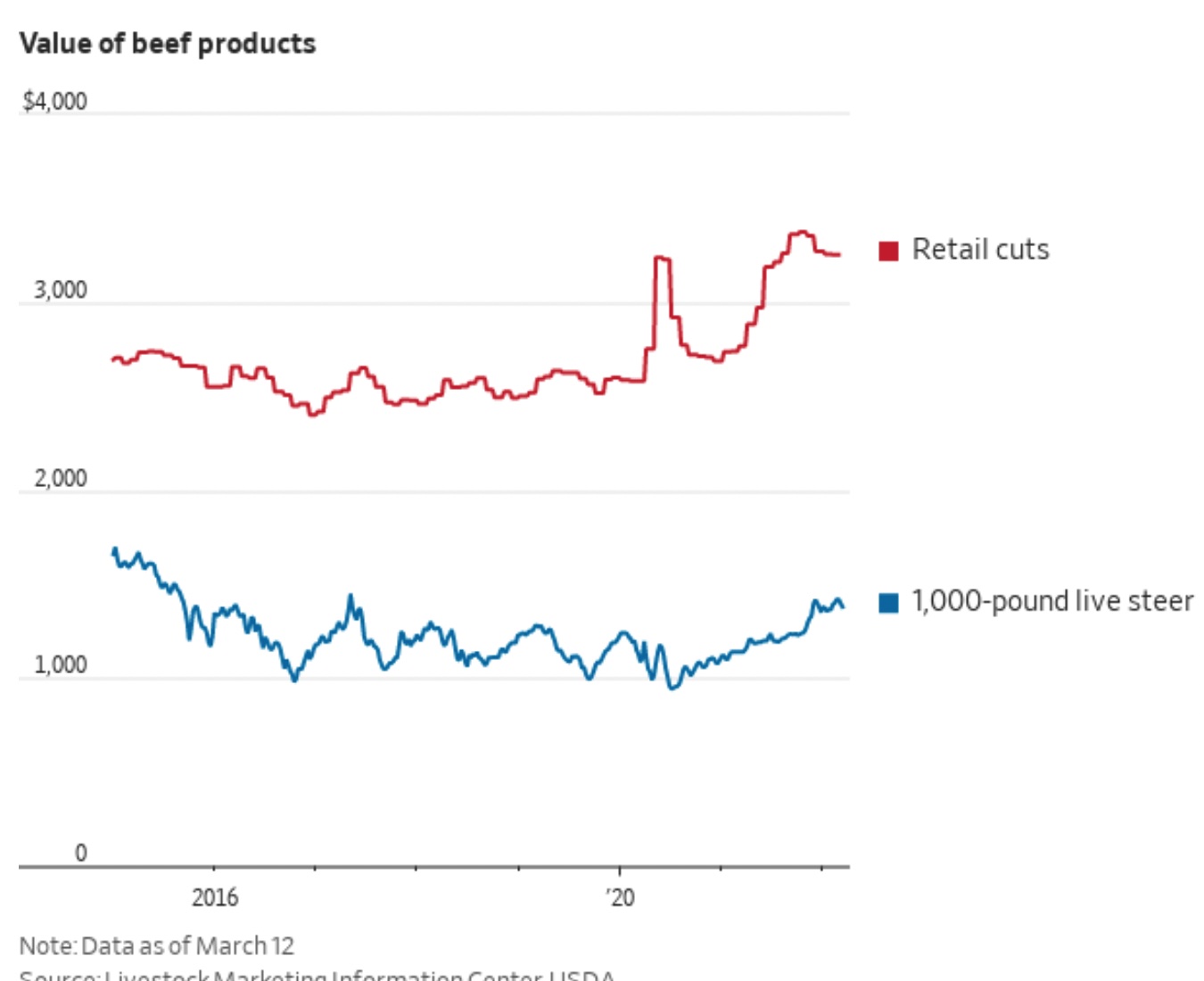

A group of Nebraska cattle ranchers and feedlot owners plan to build their own butchering plant to bypass meat-processing giants they say underpay for livestock. The average price for live cattle was up 5% in 2021 from 2019, according to figures from the Livestock Marketing Information Center and Agriculture Department, while the average price of cuts that packaging plants box to ship to retailers was up 26%.

Yields on shorter-term and longer-term U.S. government bonds have been converging rapidly, stirring fears that the bond market is close to signaling a looming recession.

Fed head Jerome Powell was chatty Monday during comments at the NABE confab, including remarks about a possible 50-basis point hike in rates ahead. He again tried to defend why the Fed lasted way too long with its ‘transitory inflation’ position.

On the farm policy front, contentious differences continue with the House Ag Committee, with Republicans saying they were not consulted at all regarding an upcoming hearing on meatpackers. Meanwhile, some farm-state lawmaker fret about funding levels for the new farm bill if a current huge spending package for conservation spending isn’t enacted. But a key Senate Ag panel lawmaker says “creative ways” will be found to garner the funding. Hmmm. In Europe, the European Union will for the first time tap an agricultural crisis fund to cushion the impact of the ongoing war in Ukraine on food producers facing high energy prices and shortages of some key products, including fertiizers.

The Securities and Exchange Commission proposed that public firms be required to disclose their greenhouse-gas emissions and climate-related risk exposure. If emissions generated by firms’ suppliers and partners are “material” to investors, they would need to be accounted for too.

Senators plan to question Supreme Court nominee Ketanji Brown Jackson today, with Republicans focusing on her years as a defense lawyer and later as a judge who they say was lenient on criminals.

|

MARKET FOCUS |

Equities today: Global stocks markets were mostly higher overnight. The U.S. stock indexes are pointed toward firmer openings. Asian equities finished higher despite concerns over energy prices, Russia’s invasion of Ukraine and inflation. The Nikkei advanced 396.68 points, 1.48%, at 27,224.11, reopening for trading after being closed Monday for a holiday. The Hang Seng Index was up 667.94 points, 3.15%, at 21,889.28. European equities are higher in early trading, with the Stoxx 600 up 0.5% and regional markets up 0.3% to 1%.

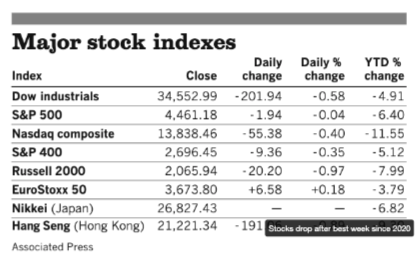

U.S. equities yesterday: The Dow’s win streak came to an end after five winning sessions by ending down 201.94 points, 0.58%, at 34,552.99. The Nasdaq was down 55.38 points, 0.40%, at 13,838.46. The S&P 500 eased 1.94 points, 0.04%, at 4,461.18.

Agriculture markets yesterday:

- Corn: May corn gained 14 1/2 cents to $7.56 1/4, while December futures strengthened 18 1/2 cents to $6.64.

- Soy complex: May soybeans rose 23 cents to $16.91, a lifetime-high close for the contract. May soymeal rose $4.30 to $481.30. May soyoil rose 142 points to 73.71 cents per pound.

- Wheat: May SRW wheat rose 55 1/2 cents to $11.19 1/4. May HRW wheat rose 42 3/2 cents to $11.13 1/4. May spring wheat futures firmed 28 1/2 cents to $10.88 3/4.

- Cotton: May cotton futures rose 315 points to 130.01 cents per pound, the highest settlement for a nearby contract since July 2011. May cotton also posted a contract high at 131.71 cents.

- Cattle: June live cattle dropped 45 cents to $140.05, while June live cattle fell 72.5 cents to $136.35. May feeder futures fell $1.70 to $165.75.

- Hogs: June lean hogs rose $3.75 to $119.825. April hogs gained $1.225 to $100.625.

Ag markets today: Global supply concerns amid the ongoing war between Russia and Ukraine fueled active followthrough buying in grain and soy markets overnight. As of 7:30 a.m. ET, winter wheat futures are trading mostly 38 to 45 cents higher, spring wheat is 30 to 32 cents higher, corn is 3 to 5 cents higher and soybeans are 12 to 15 cents higher. Front-month U.S. crude oil futures are trading near unchanged after topping $115 earlier overnight, while the U.S. dollar index is around 150 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Richmond Fed's manufacturing survey, due at 10 a.m. ET, is expected to rise to three in March from one in February.

• Federal Reserve speakers: New York's John Williams at a BIS Innovation Summit at 10:35 a.m., San Francisco's Mary Daly on Covid-19 and the economy at 2 p.m., and Cleveland's Loretta Mester on the economic outlook and monetary policy at 5 p.m.

Powell is ready to back half-point hike in May if it’s necessary. Federal Reserve Chair Jerome Powell said the central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed. Policy makers raised the benchmark lending rate by a quarter point at their meeting last week and signaled six more hikes of that magnitude this year, based on the median projection (St. Louis Fed President James Bullard did not support the 0.25% hike at the meeting this month, favoring instead a 0.5% hike). Powell indicated that half-point hikes may be on the table when policy makers next gather May 3-4 and at subsequent sessions. He added that such a decision had not been made, but acknowledged it was possible if warranted by incoming data. Powell made his comments to the National Association for Business Economics (NABE).

Powell comments on the Fed’s prior ‘inflation is transitory’ mistake. "In my view, an important part of the explanation is that forecasters widely underestimated the severity and persistence of supply-side frictions, which, when combined with strong demand, especially for durable goods, produced surprisingly high inflation," Powell declared at the NABE conference. However, he's somewhat optimistic that central bankers will be able to engineer a so-called soft landing, in which the rate is raised high enough to keep the economy from overheating but not so much that it triggers a recession. "While some have argued that history stacks the odds against achieving" this, there are three episodes — in 1965, 1984, and 1994 — where the Fed "significantly" raised rates without a downturn. "I hasten to add that no one expects that bringing about a soft landing will be straightforward in the current context — very little is straightforward in the current context."

Perspective: While Powell says forecasters “widely underestimated the severity and persistence of supply-side frictions,” that is an overstatement as there were more than a few private analysts and even more Americans who thought otherwise. Meanwhile, the Federal Reserve is trying to engineer a soft landing. Getting it wrong means recession. There have been 16 monetary policy tightening cycles in the U.S., United Kingdom and Europe since the late 1970s. Thirteen of those have ended in recession, according to Neil Shearing at Capital Economics.

Powell comments on a major topic of debate in the bond market: where to look to determine the chances for a U.S. recession. Some investors have been calling attention to a rapidly shrinking spread between two-year and 10-year Treasury yields to sound the alarm on a looming economic downturn. But Powell preferred a different measure of the yield curve that isn’t yet flashing a warning sign. “Frankly, there’s good research by staff in the Federal Reserve system that really says to look at the short — the first 18 months — of the yield curve,” Powell said.

Larry Summers continued his criticism of Federal Reserve policy by calling the notion of the country having unemployment at 3.5% and sharply falling inflation for the first time “the triumph of hope over experience and analysis” in a series of tweets. Summers is President Emeritus at the Kennedy School of Government and former U.S. Treasury Secretary.

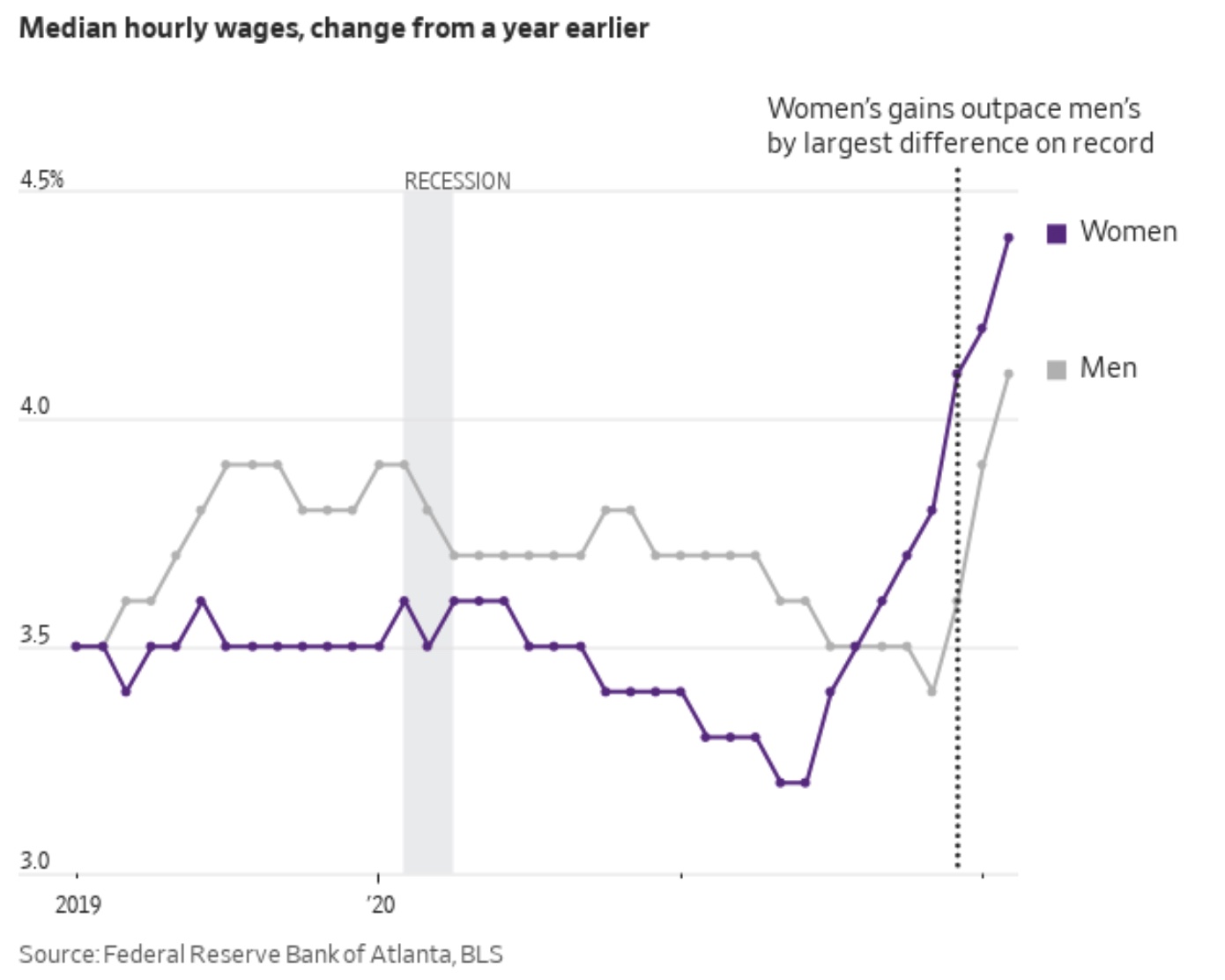

American women’s wages rose 4.4% in February compared with the previous year, as lower-wage service-sector industries raised pay to attract workers, the Atlanta Federal Reserve’s wage tracker found. That was the sixth straight month women’s wages outpaced men’s, but women working full time still earn 83% of what men make.

Market perspectives:

• Outside markets: The U.S. dollar index is higher amid a broadly higher tone in foreign currencies except the euro which is weaker against the greenback. The yield on the 10-year U.S. Treasury note has moved up to trading around 2.34% with a firmer tone in global government bond yields. Gold and silver futures are seeing mild pressure with gold around $1,927 per troy ounce and silver around $25.28 per troy ounce.

• Crude oil futures are seeing volatile trade action, with both markets shifting between losses and gains ahead of U.S. trading. U.S. crude is trading around $112 per barrel and Brent around $116 per barrel. Futures rose in Asian action, with US crude trading above $112.50 per barrel and Brent above $118.50 per barrel.

• Oil market substitutes. When oil costs have exceeded 4% of gross domestic product globally, users have historically looked for substitutes. We are near that number now: At $100 a barrel, 2022 oil expenditure would be about 4.3% of 2020 global GDP. The International Energy Agency sees lower consumption ahead.

• Canadian Pacific Railway, union agree to arbitration, ending work stoppage. Canadian Pacific Railway and the union representing its conductors and engineers agreed to shift stalled contract negotiations to binding arbitration, freeing it to resume freight shipments after a two-day work stoppage. Canadian Pacific said the agreement enables it to resume freight service at noon Mountain time. Collective bargaining negotiations between Canadian Pacific Railway and the Teamsters Canada Rail Conference “have agreed to resolve their remaining collective agreement provisions through binding arbitration,” according to a statement from Canadian Minister of Labor Seamus O’Regan released on Twitter. “Normal business operations will resume on March 22 and continue during the arbitration period. At the end of the arbitration period, a new collective agreement will be established.” The statement indicates the work stoppage that started to open the week is over which will bring relief to many in the agriculture industry who had grown increasingly concerned about the impacts to grain, fertilizer and other shipments that take place via rail.

• Canada has imported about 3.2 million metric tons of corn from the U.S., according to USDA, up 600% from 457,000 tons a year ago.

• Brazil’s government is cutting to zero import taxes on ethanol and six items of the basic food basket until December, which should impact tax collections by around 1b reais, Economy Ministry said in a press conference. Chosen items are the ones weighing the most on inflation: coffee, margarine, cheese, pasta, sugar and soy oil. The measure is part of the govt’s efforts to curb inflation, said Deputy Economy Ministry, Marcelo Guaranys. The cut in the ethanol import tax is expected to lower gasoline prices by 0.20 real per liter, according to Foreign Trade secretary Lucas Ferraz. The gov’t also announced a further reduction of 10% in the tax rate on imports of capital goods and computers, bringing the overall tax cut to 20%. New credit measures will soon be announced, Guaranys added.

• Commodity traders are being hit by huge cash requests from banks and exchanges, propelling whipsaw moves in markets and hindering the movement of materials beyond Russia and Ukraine. Traders borrow money from banks via letters of credit, revolving credit facilities and other instruments to finance shipments. As the value of each cargo has vaulted, they have maxed out existing facilities or borrowed more money to keep funding cargoes and paying margin.

• 2,849,341 tons of cargo were shipped through Los Angeles International Airport in 2021, up 22.3% from the year before and 30.5% more than the pre-pandemic year of 2019.

• Nickel trading resumes as the market begins to stabilize. Trading on the London Metal Exchange remained within the limits set by the market after high volatility led to shutdowns and false starts in recent weeks. Prices continue to drop, which suggests the short squeeze that shut down trading is abating.

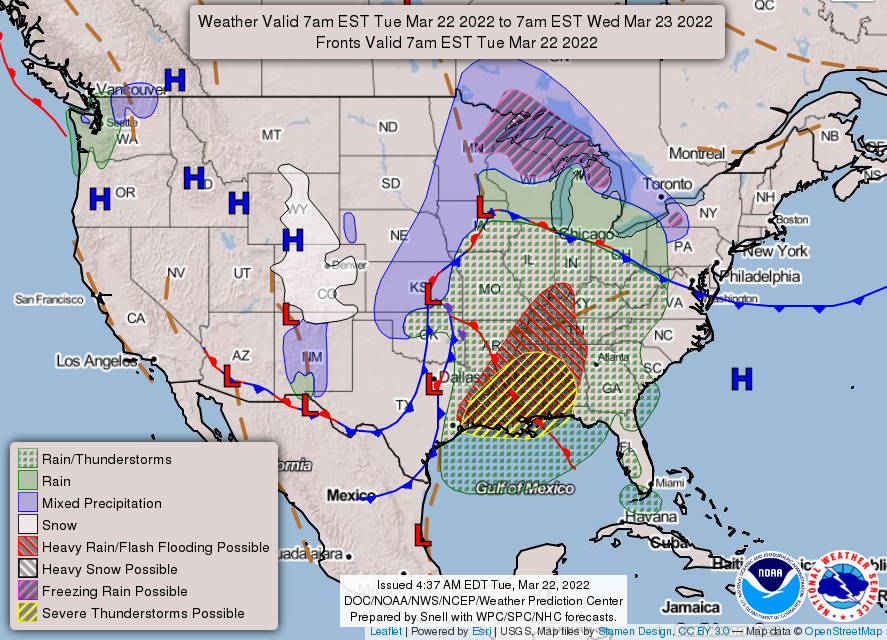

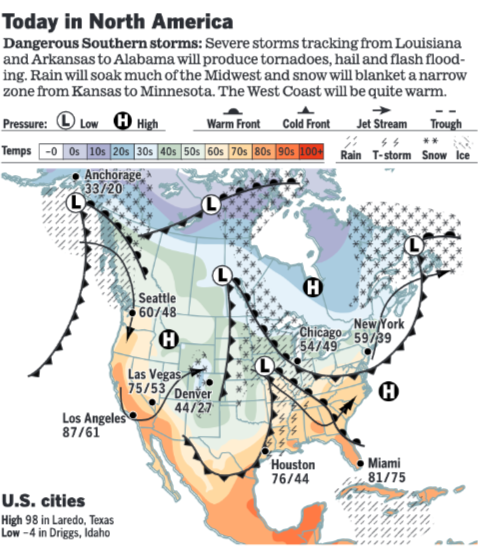

• NWS weather: Heavy to excessive rainfall together with severe thunderstorms likely across the Deep South Tuesday with a lessening threat into the Southeast on Wednesday... ...Some wintry weather possible across the northern Mississippi Valley and Great Lakes on Tuesday into Wednesday... ...Record heat for parts of California mid-week, with a critical fire weather threat across the southern High Plains.

Items in Pro Farmer's First Thing Today include:

• Wheat again leads price gains overnight

• Worst Paraguay soybean crop in modern history

• Argentina extends Parana River emergency declaration

• Delayed cash cattle trade likely

• Cash hog index rises

|

RUSSIA/UKRAINE |

— Summary: The battle for Ukraine’s strategic port of Mariupol continues, as Ukraine rejected a Russian offer to evacuate its troops from the besieged city. Volodymyr Zelensky, the Ukrainian president, said that any compromises with Russia to end the war would have to be confirmed via nationwide referendum. Speaking to Suspilne, Ukraine’s national broadcaster, Zelensky was adamant that he was willing to do “anything”, so long as it was what the public wanted. Zelensky has also insisted that it would not be possible to negotiate peace without a meeting between himself and Russian leader Vladimir Putin. Meanwhile, U.S. officials have confirmed that Russia has used hypersonic missiles during the invasion. These weapons — which travel at least five times the speed of sound and are nearly impossible to intercept — were likely used by Russia to send a message to the West about their capabilities, multiple sources told CNN.

- Biden sees risk of cyberattack on critical infrastructure. President Biden warned Monday about new indications of possible Russian cyberattacks in response to crushing sanctions over the invasion of Ukraine. Biden’s warnings were prompted by what he called “evolving intelligence that the Russian government is exploring options for potential cyberattacks.” The Biden administration urged private firms in America to “harden [their] defenses immediately” to guard against possible Russian cyber-attacks. Classified briefings were given to companies and sectors last week about the potential for Russian cyberattacks, MarketWatch reported. It quotes Anne Neuberger, the Biden administration’s deputy national security adviser for cyber and emerging technology.

- Ukraine’s ministry of defense said that Russian forces only have ammunition and food for three days. The armed forces’ latest operational report also said that the Russian government is calling up reserves from the “depths of the Russian Federation to the borders of Ukraine” but that its advance in many areas has either stalled or is being repelled. The report claimed that Russia is bombarding Belarusian soldiers with propaganda to encourage them to join the invasion.

- Support for a European Union-wide ban on the purchase of Russian oil is growing inside the bloc. Link for details via the WSJ.

— Market impacts:

- Pre-war Russian fuel-oil cargoes sail for U.S. ports. U.S. ports are set to admit more Russian fuel oil than they’ve seen in eight months under contracts signed prior to the Biden administration’s ban on such shipments. About 9 million barrels of Russian fuel oil is scheduled to offload along the Gulf Coast and eastern seaboard this month, the most since July, according to oil-analytics firm Vortexa.

- The Egyptian pound fell by more than 13% against the dollar Monday after Egypt’s central bank raised its key interest rate at a meeting of policy makers that was brought forward by three days, citing the pickup in inflation pressures it sees following Russia’s invasion of Ukraine.

- Fallout from Russia’s invasion of Ukraine is already threatening global food supplies. Crops from the most recent harvest are locked down in warehouses behind Russian battle lines, the Wall Street Journal reports (link), and farmers face the loss of wheat that is already in the ground and corn crops later this year because they can’t get needed materials. In just three weeks, war has disrupted Ukraine agriculture, triggering higher prices and the threat of global shortages to countries that rely on Ukrainian commodities. Much of the country’s exports go to developing economies already struggling with rising food costs. Russia’s naval blockade has cut off shipping exports, but the country is shifting some goods through Western borders by train. Adding to the global woes, Russia is also struggling to get its crops through the Black Sea. By one estimate, the country’s grain shipments are down 60% from normal levels.

- The world’s largest agricultural companies are continuing to sell seeds and handle crops in Russia, despite pressure to sever ties. The WSJ notes: “Companies including Cargill Inc., Bayer AG and Archer Daniels Midland Co. say humanitarian concerns over food availability for Russian citizens and other countries justify the companies’ continued operation in Russia, while Western oil companies, fast-food chains and other companies have pulled out or paused operations there.” Link for details. A Cargill spokeswoman pointed to the potential food-security implications outlined by the World Food Program, a United Nations agency, when responding to why the company is keeping essential food operations going. The U.N. agency notes the conflict could exacerbate food inflation and hunger in some of the world’s poorest countries.

|

POLICY UPDATE |

— GOP Covid funding objections linger. Republicans still haven’t gotten the accounting they’re seeking regarding the White House’s request for more Covid-19 funding, Senate Appropriations Vice Chairman Richard Shelby (R-Ala.) said, adding he wants details on how much previously appropriated money remains unspent. The White House sent a statement on the matter but not a full accounting, he said. “We don’t know if there’s a need there,” Shelby noted. “Some people say we’re going to have another wave of Covid. If we do, we’re going to have to deal with it. Is it going to be benign or is it going to be lethal? We don’t know that. All we’re looking for is data.”

Congress should provide the $22.5 billion President Joe Biden wants for continuing the battle against Covid-19 without cutting other programs to pay for it, senior administration officials said Monday.” And “if Republicans continue to insist that additional federal efforts to combat the pandemic must be paid for by culling spending elsewhere, the GOP should specify what it wants to cut, the officials said.”

The White House said Monday that it has about $300 billion in unspent Covid-19 funding but only about $60 billion that is unallocated.

— Little change in CFAP payouts. Payments under the Coronavirus Food Assistance Program 1 (CFAP 1) were actually down slightly as of March 20, with total CFAP 1 payments at $11.82 billion ($11.83 billion prior) and original CFAP 1 payments are at $10.63 billion ($10.64 billion prior) while top-up payments were steady at $1.19 billion. CFAP 2 payments held steady at $19.17 billion for total payments, $14.34 billion for original CFAP 2 payments and $4.83 billion in top-up payments.

— EU to propose using 500-million-euro crisis fund for farmers. The European Union will for the first time tap an agricultural crisis fund to cushion the impact of the ongoing war in Ukraine on food producers facing high energy prices and shortages of some key products. The European Commission on Wednesday will propose using the fund’s nearly 500 million euros ($551 million) to support European farmers as part of a package to tackle the fallout of the invasion on the agricultural sector and to ensure food security in the bloc, an EU official said. EU Agriculture Commissioner Janusz Wojciechowski said last week that the EU is also working on measures that would allow fallow land to be used to grow protein crops to avert a scarcity of feed, and measures to support the pork industry. Details will be announced by March 24.

More aid ahead. EU agriculture ministers on Monday discussed measures to support farmers suffering significant impacts of Russia’s invasion on inputs like natural gas, fertilizers and animal feed. The ministers also undertook to look at other requests including fertilizer autonomy. “We depend far too much on imports from Russia and Belarus in the fertilizer sector,” French Agriculture Minister Julien Denormandie said.

— Agriculture panel leaders focused on farm bill funding. Leaders of the House and Senate Agriculture Committees are intently focused on funding for the next farm bill, particularly with billions of dollars in conservation funding that was part of the stalled Build Back Better (BBB) package no longer in the picture. “I assure you we are moving on the conservation [funding],” House Agriculture Committee Chairman David Scott (D-Ga.) told a meeting sponsored by Agri-Pulse. “We’ve moved on some other areas to find monies that we can move within our farm bill, and we’ll find a way.” However, he did not indicate what those other areas were, and he also warned that efforts to cut funding from the Supplemental Nutrition Assistance Program (SNAP) would not be supported, noting that efforts in the two prior farm bills to significantly reform SNAP had failed.

Senate Agriculture Committee Chair Debbie Stabenow (D-Mich.) cautioned that the panel will be looking at essentially “a flat-funded farm bill” even though the safety net and crop insurance portions of the bill needed to be built up. “That will be our challenge at this point,” she said, adding there was “no automatic place” to find funds for climate-related agriculture. However, she did say they would try to find “creative” ways to make that happen.

House Agriculture Committee Ranking Member GT Thompson (R-Pa.) told the meeting in pre-recorded remarks that he has seen the panel’s schedule for farm bill hearings in the spring and early summer, noting it was “picking up the pace” on the process. Stabenow also said there would be field hearings by that panel and then a “title-by-title” review of the farm bill.

Congress could fail to pass a 2023 Farm Bill if Republicans try to mangle the food stamp program, Scott warned. He said the farm-and food-coalition of rural and urban groups was vital to enactment of the farm bill. “We saw during the past two farm bills that when one party tries to tear apart the farm bill coalition by going too far on trying to reform SNAP, that the farm bill fails,” said Scott, recalling roll call votes in the House that temporarily derailed the 2014 and 2018 farm bills. Both times, Republicans sought large cuts in SNAP spending and to eligibility restrictions.

Bottom line: This continues to point to a farm bill process that will not reach the point of getting down to putting legislative text together until later this year, continuing the expectation that there will most likely be a one- to two-year extension of the current bill, especially with the funding issues facing the panels.

|

TRADE POLICY |

— Not much new came from U.S./U.K. initial trade discussions. U.S. Trade Representative Katherine Tai and U.K. Secretary of State for International Trade Anne-Marie Trevelyan are scheduled to wrap up two days of talks on billed as “Dialogues on the Future of Atlantic Trade.” Ahead of the sessions, it was clear that the talks were not free trade agreement (FTA) discussions that had begun under the Trump administration but have been shelved by the Biden administration.

The sessions are expected to focus on global steel and aluminum overcapacity and the Section 232 tariffs imposed by the U.S. The two are expected to hold a presser following their discussions today and that may shed some additional light on the U.S./U.K. trade relationship.

Another round of talks in the U.K. is ahead and setting a date for those discussions could come out of the two days of talks this week.

|

ENERGY & CLIMATE CHANGE |

— SEC releases climate disclosure rule. Companies will need to reveal detailed information about their greenhouse gas pollution under a new U.S. Securities and Exchange Commission (SEC) plan, a major shift in how corporations must show they are dealing with climate change. The rule would for the first time require businesses to outline the risks a warming planet poses to their operations when they file registration statements, annual reports or other documents. Some large companies will have to provide information on emissions they don’t make themselves but come from other firms in their supply chain. Opponents argue the regulations are outside the SEC’s jurisdiction. Proponents say the public needs the information to make informed decisions.

Companies and other stakeholders have 60 days to comment on the SEC’s draft rule. SEC Chair Gary Gensler was reluctant to provide a time frame for final adoption of a rule. “We’ll take the time it takes to get it right,” he said. Gensler expects lots of input, judging from the flood of responses last year, when the idea of mandatory disclosure was first floated. The agency may have to adjust its proposal as a result.

SEC leader comments. "I really do think that the SEC has a role to play here when this amount of investor demand and need is there," said Gensler.

Others think the agency is overstepping its mandate, like former Chair Jay Clayton. "Taking a new, activist approach to climate policy — an area far outside the SEC's authority, jurisdiction and expertise — will deservedly draw legal challenges," he declared. "Setting climate policy is the job of lawmakers, not the SEC."

— Exxon gas find confirmed by Cyprus. A high-quality natural gas find in an area offshore of Cyprus licensed by ExxonMobil and Qatar Petroleum has been confirmed by an appraisal drilling, the country’s Ministry of Energy, Commerce and Industry said Monday (March 21). “The joint venture will proceed with a detailed analysis and assessment of the collected data to specify the qualitative and quantitative characteristics of the reservoir, but also the potential of developing and commercializing the find,” the ministry said in a statement. The find was made at the via the Glaucus-2 well in an area south-west of Cyprus known as Block 10. Estimates for a 2019 find at the Glaucus-1 well pegged reserves in the reservoir at 5 to 8 trillion cubic feet.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— HPAI cases hit 50. Confirmed cases of highly pathogenic avian influenza (HPAI) stand at 50 with additional finds in commercial poultry operations and backyard flocks, according to USDA’s Animal and Plant Health Inspection Service (APHIS). The finds are also in states where HPAI has been previously confirmed. New cases were confirmed commercial operations in Kingsbury County, South Dakota (39,000 turkeys), Hanson County, South Dakota (20,233 turkeys), Hutchinson County, South Dakota (49,000 turkeys), Buena Vista County, Iowa (confirmed March 17 in layer operation with 5,347,511 birds), Cecil County, Maryland (confirmed March 18 in flock of 315,000 pullets), and Kent County, Maryland (confirmed March 17 in 156,800 broilers). Backyard flock confirmations have been made in Dickenson County, Kansas; Rockingham County, New Hampshire; Lincoln County, Maine; Knox County, Maine; York County, Maine; and Warren County, Iowa.

Of the 50 cases, 27 have been in commercial poultry operations in seven states.

Perspective: One in eight of Iowa's laying hens dies in bird flu outbreaks. In less than three weeks, more than 10 million egg-laying hens have died in outbreaks of HPAI across the country. The casualties included 13% — one in eight — of laying hens in Iowa, the No. 1 egg-producing state, said USDA.

— Nebraska cattlemen plan to build their own butchering plant to bypass America’s meat-processing giants, which they say underpay for livestock even as inflation drives up food prices. On 80 acres in western Nebraska, a group of cattle ranchers and feedlot owners this spring plans to break ground on a $325 million processing plant they say will boost competition — and livestock prices. The venture is named Sustainable Beef LLC. Link for more details via the WSJ.

— Discord on House Agriculture Committee over meat packer hearing. A hearing scheduled for April 27 on the meat packing industry announced by House Agriculture Committee Chairman David Scott (D-Ga.) has revealed another friction point with the panel’s Ranking Member GT Thompson (R-Pa.). “It is well known that among the four companies that dominate this market, there have been a number of allegations and investigations,” Scott said in announcing the hearing. “It is critical that we find out if industry concentration and anti-competitive behavior [are] playing a role in inflating prices for consumers and preventing ranchers from receiving a fair price.” He noted the four companies have been “enjoying record profits” and said it was “time for the Agriculture Committee to address this very important issue.”

But Rep. Thompson said Republicans on the panel were not consulted at all on the coming hearing. “If there has been manipulation or wrongdoing by packers, then the law needs to be enforced under the existing authorities at both USDA and DOJ [Department of Justice],” Scott said in a statement given to some news outlets, including Pro Farmer. “Unfortunately, this hearing — scheduled with zero input from Republicans — has the appearance of a political charade designed to further this administration’s narrative of blaming industry executives, instead of the Democratic party’s own reckless spending, for skyrocketing inflation.” He also chided Scott for setting the hearing as other issues are hitting agriculture, including the Russian invasion of Ukraine, rising input prices and increasing global hunger. “While I remain committed to working on bipartisan commonsense solutions, I am very disappointed in this Committee’s direction,” Thompson said.

Scott said he invited the CEOs of the four largest U.S. meat packers to testify at the session. The situation continues what has been deteriorating bipartisanship in the House Agriculture Committee and that could become another hurdle for lawmakers to grapple with as they seek to write the next farm bill.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 472,165,737 with 6,094,412 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,778,889 with 972,634 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 558,678,770 doses administered, 217,093,232 have been fully vaccinated, or 66.13% of the U.S. population.

— U.S. Covid vaccination rates have stalled. About a quarter of eligible adults remain unvaccinated, and half haven’t gotten a booster shot, as the loosening of pandemic restrictions eases demand for the vaccines.

— Check your blood sugar. People who recovered from Covid-19 within the past year are 40% likelier to receive a new diagnosis of diabetes than those who weren’t infected, a study found.

— Pfizer said it will supply up to four million courses of its oral Covid treatment to dozens of poorer nations under an agreement with the United Nations Children's Fund. Pfizer expects to start supplying the antiviral pills, Paxlovid, to UNICEF beginning next month and will continue to do so through the end of the year.

|

POLITICS & ELECTIONS |

— Election countdown: Election Day 2022 is 231 days away. Election Day 2024 is 959 days away.

— New allegations from Greitens’ ex-wife. The ex-wife of Missouri GOP Senate candidate Eric Greitens “accused him in court documents Monday of knocking her down, taking away her cellphone and keys, physically abusing their children and repeatedly threatening suicide if she did not publicly support him during the 2018 scandal that led to his resignation as governor,” the Washington Post reports (link). The new allegations from Greitens’ ex-wife led to some of his opponents calling for him to leave the Senate race.

|

CONGRESS |

— Senate panel is nearing a vote on two bills to beef up regulators’ power to crack down on ocean shippers that senators say disadvantage U.S. exporters. The Senate Commerce, Science, and Transportation Committee today will weigh whether to advance bipartisan legislation (S 3580) to give more authority to the Federal Maritime Commission, which regulates ocean carriers, and a Republican bill (S 3262) that would add staff to the panel’s oversight offices. The bipartisan Senate measure is an alternative to the House’s proposal that was passed in December as a standalone bill (HR 4996) and as an amendment to legislation (HR 4521) advanced in February that aims to bolster competition with China. House and Senate leaders are planning to create a conference committee to resolve differences on the China competition measure, which also would provide $52 billion for semiconductor production. The Senate version (S 1260) didn’t address ocean shipping regulations.

— The confirmation hearings for Supreme Court nominee Judge Ketanji Brown Jackson resume later today. In the first day of hearings yesterday, Jackson assured senators that she takes her "duty to be independent very seriously.” If confirmed, Jackson would become the first Black woman to serve on the high court. Republicans used their opening statements to focus on past contentious Supreme Court confirmation hearings but promised that Jackson’s hearings won’t be a repeat of the heated process that Justice Brett Kavanaugh went through. Democrats hope to confirm Jackson by early April.

|

OTHER ITEMS OF NOTE |

— Stuck ship, again. The $5.25 billion expansion of the Panama Canal doubled its capacity in 2016, allowing the world’s largest cargo ships to sail more easily to America’s East Coast from Asia. Now, one of those giant vessels has been stuck near Baltimore for more than a week. Link to details via Bloomberg.

— From porn star to pawn shop? Porn star Stormy Daniels is on the hook to pay Donald Trump nearly $300,000 in attorneys' fees after a federal appeals court rejected her bid to overturn a lower court decision in her failed defamation lawsuit against the former president. Trump bragged about Friday's ruling in a statement issued Monday night.