NASS to Livestream Briefings to USDA Secretary Beginning March 30

Biden, Xi talk | Ukraine deputy ag minister details planting woes | Canadian shippers facing disruptions

|

In Today’s Digital Newspaper |

President Joe Biden and China leader Xi Jinping talked virtually this morning, with the goals of both leaders quite different as noted in this morning’s dispatch. Biden is expected to warn China’s government of the “costs” of helping the Kremlin, including being affected by sanctions. Xi will reportedly focus on longer-term trade relationships.

Russia hit western Ukraine with a cruise-missile barrage, but Ukraine still controls all major areas amid Russia’s assaults, demoralizing their troops. The number of tanks destroyed in recent weeks is likely the largest in such a short period since World War II. Russian missiles hit a maintenance plant by the airport in Lviv, a city in the west of Ukraine close to the Polish border. Vladimir Putin, Russia’s president, reportedly told Turkey’s President Recep Tayyip Erdogan what his demands would be for a ceasefire with Ukraine. Some have been widely reported, such as a promise that Ukraine will not join NATO — something President Volodymyr Zelensky has already conceded — and a degree of disarmament. Others, including changes to the status of Crimea and the Donbas region, look less surmountable. Separately, Russia said it made coupon payments worth $117 million on two government bonds, which would avert a default.

Oil climbed back above $100 a barrel, and U.S. stock indexes continued their rally.

Ag markets: China said they have 6 million tons of Ukraine corn which likely will not get shipped. Traders are chatting about how China will fill the void. Meanwhile, U.S. weather is getting discussion as the long-range spring and early summer outlook has warmer and less moisture than average for the western Corn Belt. “If you look at commodity prices, it’s going to affect every single consumer on the planet.” — OECD Chief Economist Laurence Boone, on the fallout from Russia’s invasion of Ukraine.

Of note: USDA will livestream briefings to USDA secretary. The National Agricultural Statistics Service will livestream the briefings presented to the agriculture secretary following major reports, beginning with the quarterly Hogs and Pigs report on March 30. NASS will livestream the briefing for the March 31 Prospective Plantings and Grain Stocks report starting at 12:05 pm ET that day.

We all know surging input prices are impacting the U.S. farm sector. Farm Bureau takes a look at the topic (link).

U.S. mortgage rates surpass 4%, the first time in nearly three years that home loans have climbed this high. Applications for new mortgage applications barely grew this week.

A labor dispute has Canadian shippers facing disruptions as soon as this weekend. Canadian Pacific Railway says it will lock out employees Sunday if it can’t get a new contract or an agreement for binding arbitration with Teamster-represented workers. An impasse would strand large volumes of manufacturing and consumer goods, and potentially stall shipments of potash ahead of the spring planting season. Canadian Pacific is a major carrier of the fertilizer and demand for the commodity has grown significantly since Western sanctions blocked supplies from Russia and Belarus.

A rise in Omicron cases in Europe may be a warning for the U.S. Experts are watching the rapid spread of a new subvariant across the continent; previous waves in Europe preceded ones in the U.S. Meanwhile, Jeff Zients will step down as the White House’s Covid czar, and will be replaced by Dr. Ashish Jha of Brown University; and Moderna applied for FDA authorization of a second booster shot for all adults. In China, Covid-19 deaths in Hong Kong are running at almost 300 a day, overwhelming the city’s ability to cope. Xi vowed to reduce the impact of Covid-control measures on the economy and people’s lives.

On the farm policy front, USDA published updates to its hog payment effort but still has not released info on WHIP+ for 2020 and 2021.

In Congress, the House voted to suspend normal trade relations with Russia and Belarus, fulfilling a promise made by Biden last week. Revoking their “favored-nation” status will let America raise tariffs on imports from both countries, such as aluminum and steel. The Senate will vote on the measure shortly. Below we list the eight Republicans who voted against the measure.

On the political front, Americans may be rallying around Ukraine, but they aren't rallying around the president; Amy Walter explains what polling and focus groups can tell us. Meanwhile, Election Day 2022 is 235 days away. Election Day 2024 is 963 days away.

Freeloaders watch out: Netflix will charge users who share their accounts with people outside their households. The company is testing a feature that will charge an extra fee for the ability to share accounts.

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed overnight, with European shares mostly down and Asian shares mostly up. The U.S. Dow opened around 80 points lower and is currently down around 160 points. Asian equities finished mostly higher Friday on a rise in oil prices. The Nikkei rose 174.54 points, 0.65%, at 26,827.43, while the Hang Seng Index shed 88.83 points, 0.41%, at 21,412.40. European equities are posting losses in early trade. The Stoxx 600 was off 0.5% with regional markets seeing losses of 0.3% to 1.5%.

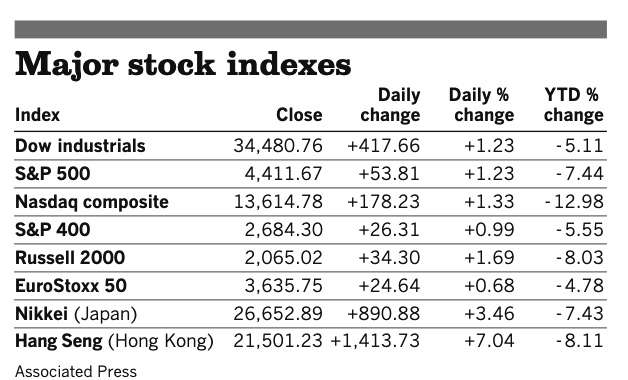

U.S. equities yesterday: The Dow rose 417.66 points, 1.23%, at 34,480.76. The Nasdaq gained 178.21 points, 1.33%, at 13,614.78. The S&P 500 finished up 53.81 points, 1.23%, at 4,411.78.

Agriculture markets yesterday:

- Corn: May corn futures surged 24 1/2 cents to $7.54 1/2, while December futures gained 15 1/4 cents to $6.45.

- Soy complex: May soybeans rose 19 1/4 cents to $16.68 1/2. May soymeal fell $3.90 to $474.10 per ton. May soyoil rose 108 points to 74.63 cents per pound.

- Wheat: May SRW wheat rose 28 3/4 cents to $10.98, after falling earlier to a two-week low at $10.31 3/4. May HRW wheat rose 19 3/4 cents to $10.92 3/4. May spring wheat rose 28 3/4 cents to $10.79.

- Cotton: May cotton rose 206 points to 121.86 cents per pound, the highest closing price since March 1.

- Cattle: June live cattle rose 40 cents to $135.925. May feeder cattle fell $1.40 to $165.875.

- Hogs: April lean hogs fell $2.025 to $100.35, the lowest close since March 10.

Ag markets today: Wheat futures pulled back from yesterday’s gains overnight as back-and-forth price action continued. Corn followed wheat lower, while soybeans were mixed. As of 7:30 a.m. ET, corn futures were trading 2 to 4 cents lower, soybeans are 5 to 9 cents higher in old-crop contracts and 1 to 2 cents lower in new-crop, winter wheat is mostly 13 to 21 cents lower and spring wheat is mostly 2 to 7 cents lower. Front-month crude oil futures are around 50 cents higher, and the U.S. dollar index is up nearly 400 points this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• President Biden will talk with Chinese President XI Jinping, 9 a.m. ET.

• U.S. existing-home sales are forecast to fall to an annual pace of 6.13 million in February from 6.5 million one month earlier. (10 a.m. ET)

• Conference Board's leading economic index is expected to increase 0.3% from the prior month. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• Federal Reserve speakers: Richmond's Thomas Barkin on the economic outlook at 1:20 p.m. ET, and governor Michelle Bowman on youth pandemic recovery at 2 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Recession watch. Fed chief Jerome Powell on Wednesday said the probability of a recession in the next year is “not particularly elevated.” Analysts recall that Powell stuck with inflation being “transitory” far longer than obvious inflation numbers dictated another stance. That is why the watch is on for a potential U.S. recession and/or stagflation. The market is pricing in a higher recession risk, some analysts note, citing the inversion between five- and 10-year yields. Fed officials expect the economy to expand by 2.8% this year and 2% in 2023. Grant Thornton’s Diane Swonk sees the twin blow of Fed tightening and higher oil prices potentially tipping the economy into a recession.

Even Powell has some concerns. During his presser, he mentioned price stability 24 times, largely as a “precondition” for “a strong and sustained labor market.” He also hinted that today’s labor market was “tight to an unhealthy level.”

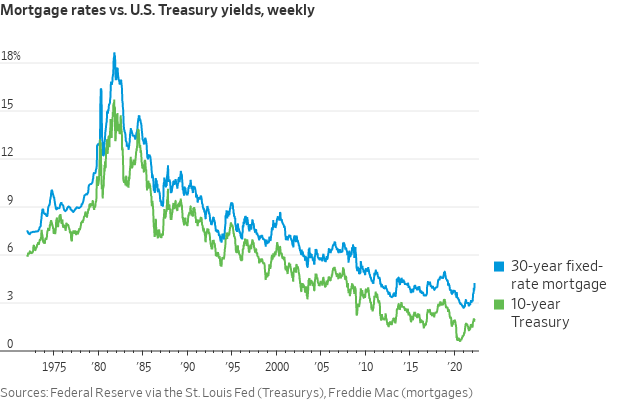

Mortgage rates rise above 4%. The average rate for a 30-year fixed mortgage topped 4% for the first time since May 2019, Freddie Mac said Thursday. At the beginning of the year, the average rate on America’s most popular home loan was 3.22%. It hit a record low of 2.65% in January 2021 and spent more than half the year under 3%. While the Fed’s quarter-point move didn’t affect Freddie Mac’s weekly average of 4.16%, recorded before the central bank’s announcement, it is likely to send rates even higher. Mortgage rates are closely tied to the yield on the 10-year U.S. Treasury, which tends to rise in tandem with the Fed’s benchmark rate.

Market perspectives:

• Outside markets: The U.S. dollar index is higher amid a generally weaker tone in several foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 2.15% amid a mixed tone in global government bond yields. Gold and silver futures are selling mild selling pressure ahead of U.S. economic data, with gold trading around $1,940 per troy ounce and silver around $25.40 per troy ounce.

• Crude oil futures have fallen back from highs in Asian trading, posting modest gains ahead of U.S. market action. U.S. crude is around $103.40 per barrel and Brent around $107 per barrel. Futures moved sharply higher in Asian action, with U.S. crude above $105.50 per barrel and Brent around $109 per barrel.

• International Energy Agency (IEA) is calling on consumers to travel less, share rides, drive slower, work from home, use public transport and more actions in a 10-point plan to reduce energy use amid increased fuel prices resulting from the Russian invasion of Ukraine. The IEA said their plan could oil demand by 2.7 million barrels per day (bpd) within four months. But governments in some areas are mulling rebates and other fuel subsidies that could thwart the IEA efforts. The IEA further suggested governments should make these changes permanent in a bid to address climate change. "Sustained reductions are important not only to improve countries’ energy security but also to tackle climate change and reduce air pollution,” the IEA said.

• Reasons why California gas prices are so much higher than other states. The state’s gasoline prices are averaging $5.79 per gallon compared to $4.29 nationwide. Reasons: hefty taxes and climate mandates. In 2010 Californians were paying 25 to 30 cents a gallon more than the national average. Then Democrats established a low-carbon fuel standard and cap-and-trade program to reduce fossil-fuel consumption and finance electric cars. These add at least 46 cents a gallon to gas prices, according to the Western States Petroleum Association. Democrats also raised the state excise gas tax by 12 cents a gallon in 2017 and indexed it for inflation, purportedly to repair roads and bridges. Much of the proceeds have gone instead to mass transit. Californians now pay upward of 70 cents a gallon in state and local gasoline and sales taxes versus about 20 cents in Texas and Arizona.

• A labor dispute has Canadian shippers facing disruptions as soon as this weekend. Canadian Pacific Railway says it will lock out employees Sunday if it can’t get a new contract or an agreement for binding arbitration with Teamster-represented workers. The Wall Street Journal reports (link) an impasse would strand large volumes of manufacturing and consumer goods, and potentially stall shipments of potash ahead of the spring planting season. Canadian Pacific is a major carrier of the fertilizer and demand for the commodity has grown significantly since Western sanctions blocked supplies from Russia and Belarus. The farm sector could use some stability. Grain shipments carried by Canadian railroads are down by more than a quarter so far this year, according to the Association of American Railroads. A deadlock would also end a period of relative labor stability in North America even as broader events have roiled global supply chains.

• USDA will livestream briefings to USDA secretary. To improve public access to USDA data, the National Agricultural Statistics Service will livestream the briefings presented to the agriculture secretary following major reports, beginning with the quarterly Hogs and Pigs report on March 30. NASS will livestream the briefing for the March 31 Prospective Plantings and Grain Stocks report starting at 12:05 pm ET that day.

• Brazil’s 2021-22 winter-corn crop, called safrinha, may rise 52% y/y to 92.2m tons, a record high, due to an increase in planted area and bigger yields, according to Brazil’s crop forecaster Agroconsult. Planted area is up 7%. Production last season was 61 million tons, hurt by weather issues. In the 2019-20 season, harvest totaled 76.7 million tons. About 60%-70% of the crop was planted in the ideal period, according to Valmir Assarice, an analyst at Agroconsult. Beneficial rain that is expected through mid-April should be enough for a good crop, he said at a press conference. Crops in Parana’s north and in parts of Mato Grosso do Sul and Goias are under higher weather risk.

• Indonesia details higher export levies on palm oil. The sudden policy shift by Indonesia to remove volume limits on palm oil exports and put in place higher export levies for palm oil was detailed on Friday after it was announced by the country’s trade minister Thursday. Indonesia now has in place higher progressive rates, with a maximum levy of $375 per tonne versus the prior maximum level of $175 per tonne. The March reference price for crude palm oil was at $1,432.24 per tonne. If prices are under $1,000 per tonne, there is no change in the export levy from the prior mark. Under the new program, the export levy ranges from $175 per tonne when the reference price is from $1,000 per tonne to $1,050 per tonne, increasing by $20 per tonne for each $150 increase in the reference price. The maximum levy would be $375 per tonne when the reference price is above $1,500 per tonne. The export levy is in addition to an export tax that is also imposed on palm oil exports, with a maximum mark of $200 per tonne. Indonesia’s government has come under fire for its shifting export policy on palm oil as it seeks to assure domestic supplies of cooking oil for consumers.

• U.S. cotton sowing to increase 8.6% on higher prices: Survey. Planting for 2022-23 harvest may reach 12.18 million acres compared with 11.22 million sown the prior season, according to the average of seven analysts in a Bloomberg survey. Estimates range from 11.2m acres to 12.7m. In February, the National Cotton Council projected growers will plant 12 million acres for the season starting Aug. 1. USDA has a preliminary projection (not based on a survey) of 12.7 million acres; USDA will release its Planting Intentions (survey) report on March 31.

• Floods may slow some U.S. planting. The risk of major flooding in the fertile Red River Valley and continued snow cover across Minnesota and North Dakota threaten to delay planting across the region for weeks, U.S. government forecasters said in a call with reporters. Heavy snow and saturated soils mean the Red River of the North, which serves as the border between the two states and flows on into Manitoba, including through downtown Winnipeg, will likely see the worst flooding in the U.S. this spring, the meteorologists said in a seasonal forecast Thursday. “In short, expect planting delays,” said Brad Rippey, a meteorologist with USDA and an author with the U.S. Drought Monitor. “There will be a few weeks of planting delays as we get into April.”

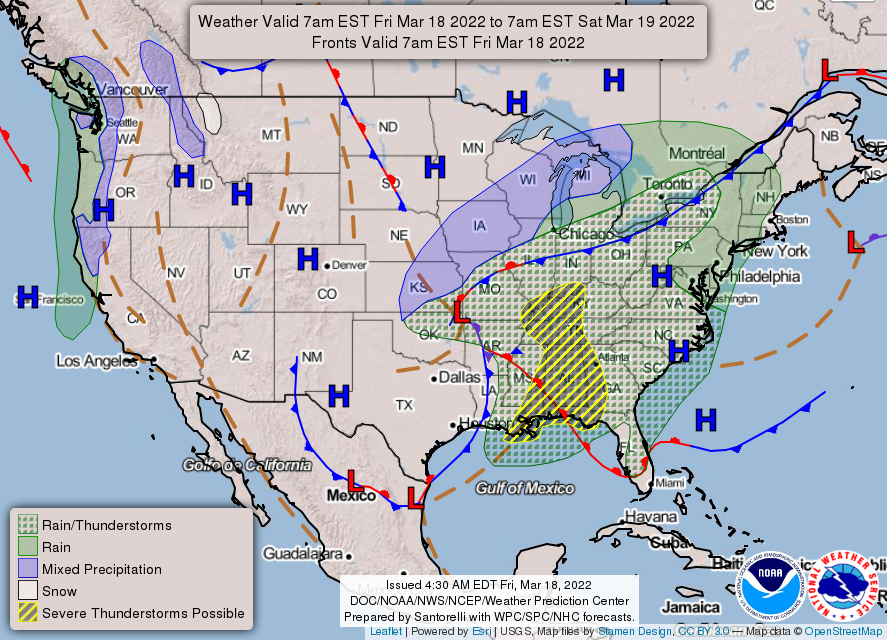

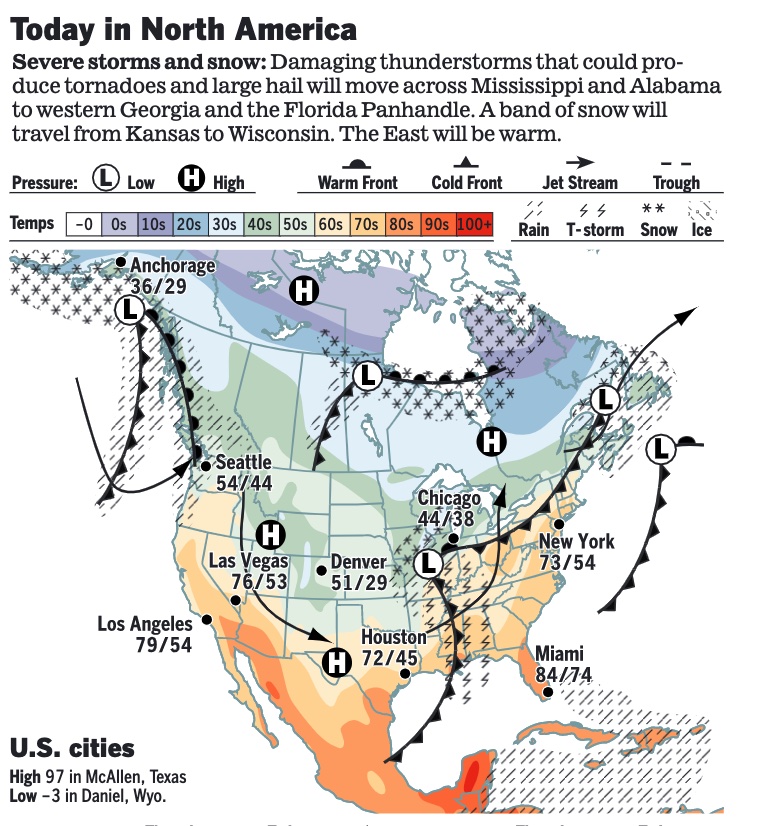

• NWS weather: Severe weather expected across parts of the Southeast and central Gulf Coast States today and potentially along the East Coast on Saturday... ...Rain and snow to spread over the Midwest and Great Lakes through Saturday, with a wintry mix entering northern New England to start the weekend... ...Cold front to swing into the West Coast tonight and extend unsettled weather throughout the Great Basin and Northern Rockies this weekend.

Items in Pro Farmer's First Thing Today include:

• Yo-yo price action continues in wheat

• China raises retail gasoline, diesel prices (details in China section)

• Russian wheat export tax inches up

• Cash cattle trade steady

• April hogs at discount to cash index

|

RUSSIA/UKRAINE |

— Biden and Xi talk this morning: President Joe Biden was set to speak to his Chinese counterpart Xi Jinping this morning (9 a.m. ET) as Russian attacks on Ukraine continue. The call will be only the fourth interaction between Biden and Xi and follows their virtual meeting in November, when Biden told the Chinese leader the two had a responsibility to make sure that competition did not “veer into conflict.” Beijing will seek to look at its relations with the U.S. beyond merely focusing on the Ukraine crisis in the upcoming conversation between the Chinese and U.S. presidents, according to diplomatic observers cited by the South China Morning Post. According to a readout from China’s foreign ministry on Thursday, the call on Friday evening is at the invitation of the U.S. side. It said Xi would exchange views with Biden “on China/U.S. relations and issues of mutual concern,” without mentioning Ukraine. Jen Psaki, White House press secretary, told reporters the call was a chance for Biden to see “where President Xi stands… The fact that China has not denounced what Russia is doing, in and of itself, speaks volumes,” she added. Xi and Russian President Vladimir Putin issued a statement last month in which the leaders described their growing partnership as having “no limits.” U.S. national security adviser Jake Sullivan met with Chinese officials in Rome this week with Ukraine on the agenda. Sullivan reportedly issued a warning not to assist Russia. The Financial Times reports Biden will warn Xi the U.S. is prepared to retaliate if Beijing actively supports Russia in Ukraine. U.S. Secretary of State Antony Blinken said Biden would “make clear that China will bear responsibility for any actions it takes to support Russia’s aggression, and we will not hesitate to impose costs.” While China is Russia's No. 1 trading partner, trade between the two countries made up just 2% of China's total trade volume. The European Union and the U.S. have much larger shares, according to Chinese customs statistics from last year.

- Russian forces have made little progress in capturing territory this week, as troops have been diverted to defend strained supply lines from what U.K. intelligence services described as “incessant Ukrainian counter-attacks.” Russian forces are stalled outside the capital, where they have taken heavy casualties and — perhaps most surprising — have failed to achieve dominance in the air. Western officials said they were no longer confident that Russia was planning a ground assault on Kyiv, a major objective. Also, Russia now appears to be struggling to resupply forces as troop morale is dropping.

- U.S. House of Representatives passed a bill to suspend normal trade relations with Russia, the latest effort by lawmakers to inflict economic pain on the Kremlin for its unprovoked invasion. The House voted 424-8, in favor of the legislation with Nay votes from Republican Reps. Andy Biggs (R-Ariz.), Dan Bishop (R-N.C.), Lauren Boebert (R-Colo.), Matt Gaetz (R-Fla.), Marjorie Taylor Greene (R-Ga.), Glen Grothman (R-Wis.), Thomas Massie (R-Ky.), and Chip Roy (R-Texas). Senate Majority Leader Chuck Schumer (D-N.Y.) said on Thursday morning that his chamber would move quickly to take up the trade legislation and send it to Biden’s desk. But one outstanding issue could delay that process: whether it will be paired with legislation barring Russian energy imports, something Senate Republicans are pushing for.

- Japan announces fresh sanctions on Russia. Japan’s foreign and trade ministries jointly announced Tokyo would impose sanctions on 15 Russian individuals and nine organizations. The move will raise the number of Russian individuals sanctioned by Japan to 76, and the number of organizations to 12.

- Putin can be expected to brandish threats to use nuclear weapons against the West if stiff Ukrainian resistance to Russia’s invasion continues, draining conventional manpower and equipment, according to a new assessment by the Pentagon’s Defense Intelligence Agency. The combination of Ukraine’s defiance and economic sanctions will threaten Russia’s “ability to produce modern precision-guided munitions,” according to the assessment.

- The number of Ukrainians fleeing the country has slowed but may rise again if fighting spreads into western areas of the country, according to a U.N. refugee agency official. Daily crossings into Poland peaked at around 100,000 per day and have fallen to about half that level, according to Matthew Saltmarsh with the U.N. agency. Overall, some 3.27 million have fled Ukraine since the Russian invasion began Feb. 24 and another 2 million have been displaced internally, according to the U.N.

- Britain’s communications regulator revoked the license of RT, Russia’s state-funded broadcaster, over concerns that its Ukraine coverage is biased. Britain noted the broadcaster’s close links to a government which has “recently invaded a neighboring sovereign country” and is strangling the country’s free press.

— Market impacts:

- Ukraine warned the WTO they may have to limit exports of agricultural products ahead to make sure of domestic food supplies, Geneva trade officials reported from the meeting this week of the WTO Committee on Agriculture. Ukrainian farmers are making their best effort not to miss the growing season — despite the danger they are facing, the country said. Countries also used the session to levy hefty criticism of the Russian action, with Russia predictably pushing back, arguing their action is outside the scope of the WTO and countries should use diplomacy and other international organizations to address their concerns.

- Ukrainian farmers are woefully short of fuel ahead of the spring planting season and have lost around 10% of their land “to military effects,” such as bombing, said Dzoba Taras, the country’s deputy agriculture minister, during a webinar. “We have huge uncertainty for farmers,” said Taras, who need financing, fuel, fertilizer, and other crop inputs amid the Russian invasion. In a survey of 2,500 farmers who operate 3.2 million hectares, the growers said they had just 20% of the fuel and between 40% and 65% of the crop inputs they need for spring planting, said Taras.

- Ukraine’s grain exports in the 2021-22 season are now seen at 47.8 million tons, down from a February outlook for 62.8 million tons, the International Grains Council said on Thursday. That includes a 3.7-million-ton cut to wheat and 10.9 million tons for corn. Russian grain exports were trimmed to 37.1 million tons, from 37.7 million tons.

- JPMorgan Chase processed a $117 million bond payment by Russia, so the country appears to have avoided default.

- Russian oil exports to India surge as Europe shuns cargoes. Delhi maintains close trading ties with Moscow despite western sanctions. Russia has exported 360,000 barrels a day of oil to India in March so far, nearly four times the 2021 average. The country is on track to hit 203,000 b/d for the whole month based on current shipment schedules, according to Kpler, a commodities data and analytics firm. On Tuesday, White House press secretary Jen Psaki warned that India would be on the wrong side of history if it bought Russian oil, although she acknowledged the purchases would not violate U.S. sanctions.

- Koch Industries defied pressure to pull out of Russia, while the Austrian bank Raiffeisen said it was reconsidering its decision to stay in the country.

- Chatham House report: Ukraine crisis could trigger cascading risks globally. It says the effects on the wider world from the Ukraine invasion go far beyond the waves of shock and horror being felt from this escalating conflict. Link to report.

|

PERSONNEL |

— Biden taps Jha to succeed Zients as Covid response coordinator. White House Covid Coordinator Jeffrey Zients plans to leave the Biden administration in April and will be replaced by public health expert Ashish Jha, President Joe Biden said in a statement Thursday. Zients spent much of his time securing the purchase and distribution of vaccines, as well as treatments, tests, and protective equipment. Biden said that Jha, dean of the Brown University School of Public Health, will be tasked with helping workplaces and schools “cope with Covid” as well as preparing for possible future waves and variants. Jha previously led research into the Ebola virus and has regularly served as a medical expert on television shows.

|

CHINA UPDATE |

— China retail gasoline and diesel prices were increased by the National Development and Reform Commission, putting the gasoline price at a mark not seen since at least 2006; diesel prices are at a 10-year high. The price of gasoline was increased by 750 yuan (about $118) per metric ton and the price of diesel increased by 720 yuan. Under the current pricing mechanism, when international crude oil prices change by more than 50 yuan per metric ton and remain at that level for 10 working days, prices of refined oil products such as gasoline and diesel in China are adjusted accordingly.

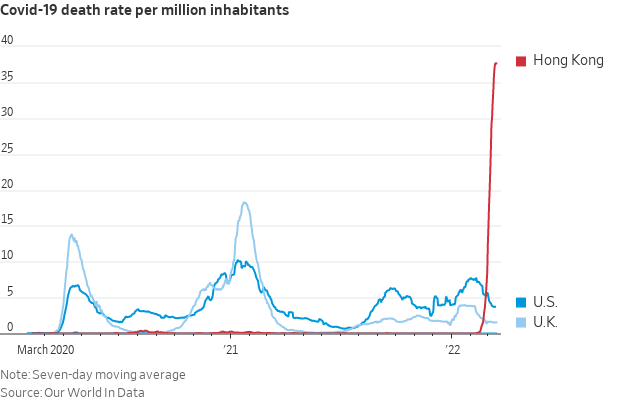

— People are dying from Covid-19 in Hong Kong at a rate that surpasses most of the world’s worst pandemic peaks, with almost 300 deaths a day overwhelming the city’s ability to cope. The city’s large population of unvaccinated elderly is feeling it most sharply: 87% of the people who have died in the current wave were 70 or older and almost three-fourths were unvaccinated.

— China pushes local governments to minimize Covid impacts on spring grains planting and harvest. China’s Ministry of Agriculture and Rural Affairs has issued a notice to local governments, calling on them to minimize impacts of any Covid control measures relative to delivery of farm materials for spring planting. Reuters reported the notice called on local authorities to guide farmers on managing the delayed wheat crop early and take advantage recent rains and apply fertilizer in a timely manner. Local authorities were also urged to make sure the transport of farming materials was smooth for spring planting and production. China’s Covid policies have resulted in restrictions on businesses and the movement of people and apparently that has affected delivery of farming supplies.

— Senate Majority Leader Chuck Schumer (D-N.Y.) filed cloture on a China competitiveness bill, setting up action for next week and an eventual conference committee with the House. Both the House-passed and Senate versions include $52 billion for grants and incentives to semiconductor manufacturers to locate manufacturing facilities in the U.S.

|

ENERGY & CLIMATE CHANGE |

— Granholm, Manchin to unveil U.S. lithium battery development plan. Energy Secretary Jennifer Granholm and Sen. Joe Manchin (D-W.Va.) today will jointly announce a program to develop lithium batteries in the U.S. as part of a broader strategy to help Appalachia amid a transition away from coal. Lithium-based batteries are critical components of electric vehicles, grid storage and weapons, but the U.S. relies on international markets for the processing of most raw materials, according to the Energy Department. The DOE is also announcing $5 million in funding for pilot projects for workers in communities where energy and automotive industries once held sway.

— Grid planning eyed for clean power overhaul in Democrats’ bill. The U.S. electric sector would be required to better plan for power grid upgrades to accommodate the renewable energy rollout while more frequently reporting greenhouse gas emissions data to federal energy regulators, according to legislation that Senate Democrats, including Sen. Ed Markey (D-Mass.), unveiled Thursday. The bill, called the Charge Act of 2022, aims to spur growth of power lines and infrastructure by expanding oversight of the Federal Energy Regulatory Commission, the five-member panel that oversees the interstate flow of power and the wholesale power market. The bill’s title is an acronym for the chief goal of the drafters: Connecting Hard-to-Reach Area with Renewably Generated Energy.

— EU transport and heating CO2 plans run up against spiking energy costs. The debate over a European Union (EU) plan to charge fuel suppliers a fee based on the carbon dioxide (CO2) emissions from their transportation and heating customers is drawing more pushback as energy prices surge. The plan would establish a carbon market for transport and heating. During a meeting Thursday (March 17), Sweden, Denmark, Germany, the Netherlands, Finland and Austria were among those speaking in favor of the proposals, Reuters reported. Poland and Hungary voiced opposition to the plan, while Belgium, Romania, the Czech Republic, Spain, Slovakia and Slovenia were among the members who expressed concern about the impact on consumer energy prices. "Any further artificial increase in the energy prices are neither necessary nor acceptable," Hungarian Ambassador Gabor Baranyai said. To pass, the plan would need the support of a majority of EU’s 27 member states and the European Parliament would need to clear new policies. The new carbon market would not launch until 2026.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA publishes updates to hog payment effort. USDA’s Farm Service Agency (FSA) has published revisions to the Spot Market Hog Pandemic Program (SMHPP) in the Federal Register (link), clarifying eligibility, documentation requirements and payment factoring for the $50 million effort. The SMHPP is available to producers who sold hogs via a spot market sale from April 16-Sept. 1, 2020.

FSA said the revisions are to “better target the effectiveness of SMHPP.” FSA is now including additional negotiated sales and third-party intermediary sales as being eligible under SMHPP, an effort to address sales by producers that were made “either directly or through third-party intermediaries to local processors, butchers, individuals, brokers, sale barns, or livestock aggregators” as that was the “only available marketing alternative” for many producers when selling packers was not possible.

FSA said the “only sales directly to packers that are eligible remain those through a negotiated sale. Hogs sold through a contract that includes a premium of the spot-market price or other formula such as the wholesale cut-out price remain ineligible.”

FSA also said that eligible hogs do not include immature swine (pigs) and the animals had to be “suitable and intended for slaughter.”

Producers will also be required to provide “verifiable or reliable documents” to ensure eligibility.

Payments will be $54 per head and would be paid out on a maximum of 10,000 head per producer but there is no payment limit. Producers will not receive payments until after the signup period ends as payments may be reduced by a factor so as not exceed the total amount available.

The signup will now run through April 29 versus the original end date of April 15.

— USDA has clarified the definition of a spot market sale and hog eligibility under the Spot Market Hog Pandemic Program (SMHPP), which assists producers who sold hogs through a spot market sale from April 16-September 1, 2020. Hog producers will also now be required to submit documentation to support information provided on their SMHPP application. USDA’s Farm Service Agency (FSA) will accept applications through April 29, 2022, which is an extension of the April 15, 2022, deadline previously set for the program.

The only direct to packer sales that are eligible for SMHPP are those through a negotiated sale. Hogs sold through a contract that includes a premium above the spot-market price or other formula such as the wholesale cut-out price remain ineligible. Hogs must be suitable and intended for slaughter to be eligible. Immature swine (pigs) are ineligible.

SMHPP payments will be calculated by multiplying the number of head of eligible hogs, not to exceed 10,000 head, by the payment rate of $54 per head. To ensure SMHPP funding availability is disbursed equitably to all eligible producers, FSA will now issue payments after the application period ends. If calculated payments exceed the amount of available funding, payments will be factored.

— Additional bird flu cases confirmed. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed highly pathogenic avian influenza (HPAI) in a non-commercial backyard flock (non-poultry) in Rockingham County, New Hampshire. The confirmation brings total HPAI cases in the U.S. to 38 in 18 states. Of the 38 cases, 21 are in commercial poultry operations.

Bottom line: Nearly 7 million chickens and turkeys in 13 states have been killed this year due to avian influenza, prompting officials and farmers to acknowledge that, despite their best efforts, stopping the disease from infecting poultry is incredibly difficult. State and federal officials remain hopeful that the disease won’t spread as extensively as an outbreak in 2015 that resulted in the deaths of about 50 million chickens and turkeys, causing egg and meat prices to soar. Bird flu hit more than 200 farms in 15 states that year, costing the federal government about $1 billion and the poultry industry an estimated $3 billion. Asked about Iowa’s first case in a commercial turkey flock, Iowa State Veterinarian Jeff Kaisand said, “We don’t know exactly how it got in.” It’s an especially big question in Iowa, which has 49 million chickens and is the leading egg-producing state. Last Friday, Iowa saw its first case this year in a commercial egg-laying operation, leading to the killing of about 919,000 hens.

— The SEC forced Wendy’s to let shareholders vote on a proposal requiring the fast-food chain to disclose its use of crates to house pregnant pigs. Link to more via Bloomberg.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 466,043,745 with 6,066,181 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,693,782 with 970,009 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 557,902,891 doses administered, 216,897,061 have been fully vaccinated, or 66.07% of the U.S. population.

— Experts warn that another Covid wave may be imminent in the U.S., fueled by BA.2, the more contagious Omicron subvariant that is spreading rapidly in Europe. Dr. Anthony Fauci, Biden's chief medical adviser, told CNN yesterday that the U.S. “generally follows what goes on in the U.K. by about two to three weeks.” In the U.K., cases are rising due to the increased transmissibility of the virus and the waning immunity of vaccines, Fauci said.

— Moderna seeks authorization for a second booster. The pharmaceutical company asked U.S. health officials for emergency authorization of a second booster of its coronavirus vaccine for all adults. It comes after Pfizer and BioNTech sought authorization for a second booster for those 65 and older on Tuesday.

— Ivermectin didn’t reduce Covid-19 hospital admissions in its largest trial so far. In a trial of nearly 1,400 Covid-19 patients at risk of severe disease, those given Ivermectin didn’t fare better than those given a placebo.

— House GOP wants to end mask mandate. House Republicans are calling for the Biden administration to “immediately reverse” the decision to extend the transportation mask mandate through April 18. “This policy continues to frustrate and damage an airline industry that has taken extraordinary measures to keep passengers safe,” wrote 129 House GOP members in a letter to Biden yesterday. The increased calls from House Republicans comes after the Senate voted this week to pass a largely symbolic resolution (SJRes. 37) to end the mask mandate on public transportation.

— Canada will soon stop requiring fully vaccinated travelers to show proof of a negative Covid test before entering the country.

|

POLITICS & ELECTIONS |

— Remember this item because it will likely be acted on before Nov. 8 midterm elections. The Congressional Progressive Caucus is urging Biden to issue executive orders to fulfill several Democratic priorities that remain stalled in Congress in the months before the midterm elections. The 98-member caucus of liberal Democrats in the document is urging Biden to go it alone on policies addressing climate change and reducing reliance on fossil fuels, canceling student debt, lowering prescription drug costs, raising worker wages and criminal justice reform.

— Former EPA Administrator Scott Pruitt is weighing a run for an open Senate seat in Oklahoma, following GOP Sen. Jim Inhofe’s retirement announcement, sources tell CBS, which said “Pruitt has been making calls to gauge support if he declares his candidacy for the already-crowded GOP primary.”

— United and still polarized. Amy Walter of the Cook Political Report writes: “Poll after poll finds Americans across the political spectrum united in supporting punishing sanctions against Russia and increased foreign aid to besieged Ukrainians. But, this unity of purpose hasn't resulted in more 'domestic tranquility' at home. Patrick Murray, the director of the Monmouth Poll, wrote this week that when they asked respondents to use a word to describe the state of the country, the most common response was "divided." And, while ‘fewer Americans feel we are becoming more divided than we have been over the past few years,’ Murray wrote, ‘this disunity remains the dominant image of the state of the country.’ This helps to explain the seeming contradiction of American voters who, on one hand, support the actions the Biden administration is taking against Russia, yet also tell pollsters they disapprove of the job the president is doing. Americans may be rallying around the flag, but they aren’t rallying around the president. The Monmouth survey as well as new surveys from Pew and Quinnipiac find Biden's job approval ratings anywhere between 38% and 43%, virtually unchanged from his pre-war standing.”

|

CONGRESS |

— Hearings for Supreme Court nominee Ketanji Brown Jackson start next week, and Republicans are telegraphing their line of attack. They will focus on her handling of sex-related offenses. The subject was first raised publicly by Sen. Josh Hawley (R-Mo.) Wednesday evening. Jackson has met with 44 senators as of today, according to former Sen. Doug Jones (D-Ala.), the White House “sherpa” guiding her nomination. Jackson has sat down with every member of the Senate Judiciary Committee, the panel that will kick off her confirmation hearings on Monday.

|

OTHER ITEMS OF NOTE |

— Cotton AWP shifts back higher. The Adjusted World Price (AWP) for cotton rose to 113.26 cents per pound, effective today (March 18), up from 111.71 cents per pound the prior week and ending what had been four consecutive weeks of declines. Meanwhile, USDA said that Special Import Quota #22 would be established March 24 for the import of 46,572 bales of Upland Cotton, applying to supplies purchased not later than June 21 and entered into the U.S. not later than Sept. 19.

— GOP wants report on Iran, Saudi Oil talks. House Republicans want the Biden administration to brief them on its overtures to “hostile” countries about producing more oil for the global market in response to the Ukraine crisis. House Oversight and Reform ranking member James Comer (R-Ky.) and other panel Republicans wrote to Secretary of State Antony Blinken on Thursday requesting a briefing by March 24 about any “plans to obtain oil from hostile foreign countries,” including Iran and Venezuela, “instead of encouraging energy production in the United States.”

“Trading the imports from one irrational and unpredictable dictatorial regime to another is not sound foreign policy,” said the letter, adding that the “United States must position itself as the major global energy producer.” Link to letter.