USDA Late, Again, on Releasing WHIP+ Details

Vilsack comments on fertilizer, biofuels while House Ag panel members spar again

|

In Today’s Digital Newspaper |

As Russia’s war in Ukraine enters its fourth week, the elements of a peace deal are beginning to come into focus. Topics currently under discussion include Ukrainian neutrality, a promise never to join NATO, and a pledge not to host any foreign military bases. Still, Russia attacked a theater in southern Ukraine where civilians were hiding. Ukrainian President Volodymyr Zelenskyy called on Germany to take the lead in helping his country tackle the Russian invasion. Russian President Vladimir Putin acknowledged that the country’s economy had taken a profound blow from Western sanctions imposed on Moscow, saying that the structural changes needed will lead to a temporary rise in inflation and unemployment. Russia has lost more than 7,000 troops in the war, according to American intelligence officials. Speaking to the New York Times, they said that this is a higher figure than the number of Americans killed over 20 years in Iraq and Afghanistan. Separately, the OECD said Russia’s invasion of Ukraine will have a global impact and hit the poorest the hardest.

The Fed on Wednesday finally hiked interest rates by 25 basis points, with six more hikes coming this year and five next year. U.S. bond markets delivered a mixed reaction, suggesting that investors still have questions on how much the central bank will tighten monetary policy, the WSJ notes. Today’s dispatch has details and more reaction to Fed policy moves and comments.

Jerome Powell’s renomination as Fed chairman and three other Fed nominees were approved by a Senate committee.

The 145-year-old London Metal Exchange (LME) reopened trading in nickel yesterday after a weeklong freeze — only to shut again within minutes due to a technical problem.

USDA daily export sale: 136,000 metric tons of corn to unknown destinations during the 2021-2022 marketing year.

Regarding gas prices, a $400 gas rebate may be ahead in California. Meanwhile, USDA Sec. Tom Vilsack yesterday said more biofuel blending means lower gasoline prices.

On the fertilizer front, several developments: Canadian Pacific Railway threatens lockout in labor dispute and USDA’s Vilsack said fertilizer market chaos stemming from Russia’s attack on Ukraine is underscoring the need for a self-sufficient U.S. economy that isn’t reliant on foreign resources. Unfortunately, he said, the U.S. today is reliant “on someone who feels that they can just invade another country for something that’s critical to agriculture — fertilizer.”

Feisty differences again surfaced during a House Ag “farm bill” hearing Wednesday. There are major differences regarding what role if any climate change/carbon mitigation should play in a new farm bill debate.

USDA is again whipping up a lot of anxiety regarding its still unreleased details of 2020 and 2021 WHIP+. They are the same problems that bogged down the 2018 and 2019 efforts. But around six months ago, Congress authorized $10 billion in new WHIP+ funding (adding $750 million for eligible livestock) but with two requirements: make the program less complex and accelerate payments. Waiting… waiting…

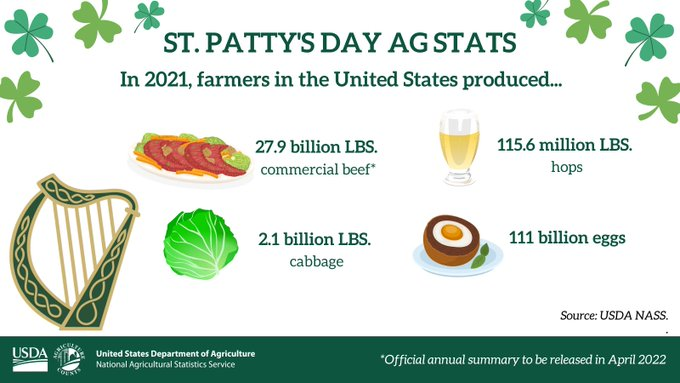

Happy St. Patrick’s Day! ☘️

|

MARKET FOCUS |

Equities today: Global stock markets were mixed. The U.S. Dow opened around 110 points lower. Chinese stocks continued to surge higher Thursday as Beijing’s pledge to support the stock market and boost the economy sparked a second day of buying. Asian equities finished with solid gains in the wake of the US Fed decision. Japan’s Nikkei rose 890.88 points, 3.46%, at 26,652.89. The Hang Seng Index surged for a second day in a row, jumping 1,413.73 points, 7.04%, at 21,501.23. European equities are posting losses in early trading. The Stoxx 600 was nearly flat with regional markets seeing losses of 1.0% to gains 0.4%.

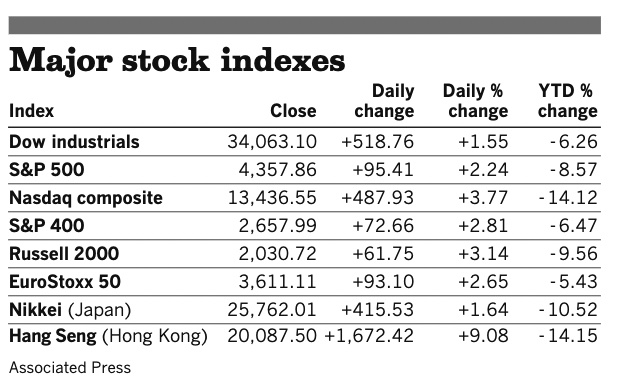

U.S. equities yesterday: The Dow rose 518.76 points, 1.55%, to 34,063.10. The S&P 500 rose 95.41 points, 2.24%, to 4,357.86; it has risen 4.4% over the past two trading days, the biggest two-day percentage gain since April 2020. The Nasdaq advanced 487.93 points, 3.77%, to 13,436.55, its best day since November 2020.

Agriculture markets yesterday:

- Corn: May corn futures fell 28 cents to $7.30, the contract’s lowest closing price since $7.25 on March 2. December futures lost 21 1/2 cents to $6.29 3/4.

- Soy complex: May soybean futures fell 9 1/2 cents to $16.49 1/4, a two-week low, while May soyoil slumped 13 points to 73.55 cents per pound. May soymeal slid $6 to $478.00 per ton.

- Wheat: May SRW wheat fell the 85-cent daily limit to $10.69 1/4, the contract’s lowest closing price since $10.59 on March. 2. March HRW wheat fell the 85-cent limit to $10.72 1/2. May spring wheat fell 60 cents to $10.50 1/4, the lowest settlement since Feb. 28.

- Cotton: May cotton futures rose 120 points to 119.80 cents per pound.

- Cattle: June live cattle fell $1.275 to $135.525, after earlier rising as high as $137.60, a two-week high.

- Hogs: June lean hogs rose 40 cents to $120.475.

Ag markets today:

- Corn and beans higher, wheat rebounds from overnight lows. Pro Farmer reports that corn and soybeans firmed after failing to take out Wednesday’s lows overnight. Wheat futures gapped lower but rebounded to fill the gaps and are mixed this morning. As of 7:30 a.m. ET, corn futures are trading 8 to 10 cents higher, soybeans are 6 to 10 cents higher, SRW wheat is mostly steady to a penny higher, HRW and HRS wheat are mixed. Front-month U.S. crude oil futures are around $4.75 higher, and the U.S. dollar index is around 400 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Bank of England releases a policy statement at 8 a.m. ET. Economists are forecasting that the BOE will raise its benchmark rate to 0.75% from 0.5%. UPDATE: The Bank of England raised interest rates for the third consecutive meeting as the Russia-Ukraine conflict is expected to keep inflation higher for longer. The Bank’s Monetary Policy Committee voted in favor of a further 0.25% hike to its main Bank Rate, taking it to 0.75%. U.K. inflation was already running at a 30-year high prior to Russia’s invasion of Ukraine, which sent energy prices surging and will exert more upward pressure on the central bank’s inflation projections.

• U.S. jobless claims are expected to fall to 220,000 in the week ended March 12 from 227,000 one week earlier. (8:30 a.m. ET)

• U.S. housing starts are expected to rise to an annual pace of 1.7 million in February from 1.638 million one month earlier. (8:30 a.m. ET)

• Philadelphia Fed's manufacturing survey is expected to tick down to 15 in March from 16 one month earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 ET

• U.S. industrial production for February is expected to increase 0.5% from the prior month. (9:15 a.m. ET)

• U.S. spring outlook: The National Oceanic and Atmospheric Administration (NOAA) will issue the outlook for the U.S. spring (April-June) relative to drought, temperature, precip and flood outlook at 11 am ET.

• President Biden was initially scheduled to meet with Irish Taoiseach Micheál Martin at 10:30 a.m. ET in the Oval Office, but Martin has since tested positive for Covid-19 after arriving in Washington.

Federal Reserve finally boosts rates, with six more increases this year, and five times in 2023. That would be three more in total than its previous cycle of rate increases, from 2015 to 2018, in roughly half the time. Highlights of Wednesday’s Federal Reserve actions and remarks:

- Voted to lift interest rates and penciled in six more increases by year’s end, the most aggressive pace in more than 15 years, in an escalating effort to slow inflation that is running at its highest levels in four decades.

- Fed will raise its benchmark federal-funds rate by a quarter percentage point to a range between 0.25% and 0.5%, the first rate increase since 2018.

- One dissenter: St. Louis Fed President James Bullard preferred a 0.5% rise in the target range of the Fed funds rate to 0.5% to 0.75%,

- Officials signaled they expect to lift the rate to nearly 2% by the end of this year—slightly higher than the level that prevailed before the pandemic hit the U.S. economy two years ago.

- Fed’s median projections show the rate rising to around 2.75% by the end of 2023, which would be the highest since 2008.

- Fed’s postmeeting statement hinted at rising concern about inflation that initially appeared last year to be driven by pandemic-related bottlenecks but has since broadened.

- Fed officials raised their expectations for inflation in 2022, pegging the personal consumption expenditure (PCE) inflation at 4.3%, up sharply from 2.6% in December, and the core PCE levels to be at 4.1% versus 2.7% in December projections.

- Still expects inflation will moderate. “With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2% objective and the labor market to remain strong,” the statement said.

- U.S. economy will also not be moving ahead as quickly, with the expectation for GDP at 2.8% versus expecting a 4.0% growth in the Fed’s December projections.

- Unemployment expectations were not changed and stand at 3.5% for 2022.

- As for the Russian invasion of Ukraine, the post-meeting statement noted the “tremendous human and economic hardship” was being seen. “The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity,” the statement said.

- Progress on the balance sheet. Fed Chair Jerome Powell declared that the Fed had made progress on paring down the balance sheet but was not yet ready to announce when that will begin. “At our meeting that wrapped up today, the committee made good progress on a plan for reducing our securities holdings,” he noted. “And we expect to announce the beginning of balance sheet reduction at a coming meeting.”

Powell: Framework not the cause of Fed’s policy path. The Fed has been criticized for waiting so long to increase rates given the inflationary pressures that have been evident in the U.S. economy. Some have suggested that the Fed’s policy framework is a culprit in the Fed only now starting to raise rates. “There is nothing in our new framework or in the changes we made has caused us to wait longer to raise interest rates,” Powell emphasized. “What we said in the framework changes was — this was a reflection of what had happened for the preceding couple of decades, actually. What we said was, ‘if we see… low unemployment, high employment but don't see inflation we're not going to raise rates till we see inflation. That's what we said.” He further commented what happened was there “was a sudden unexpected burst of inflation and then it was the reaction to it and it was what it was. But it was not in any way caused or related to the framework.”

Is the Fed behind the curve? Powell does not think so but his final answer in the presser almost intimated that yes, they are. “We don’t have the luxury of 20/20 hindsight in implementing real time decisions in the world,” he stated. “So, the question is, the right question is ‘did you make the right decisions based on what you knew at the time.’ That's not the question I was answering, which is knowing what you know now.” Knowing what the Fed knows now about supply chain issues that helped spur inflation, Powell said, “Yes it would have been appropriate to move earlier.” But that he stressed is a separate question from whether the Fed is behind the curve. “I don't have the luxury of looking at it that way,” Powell stated. “We're not going to let high inflation become entrenched. The costs of that would be too high. And we're not going to wait so long that we have to do that. No one wants to have to really put restrictive monetary policy on in order to get inflation back down.” But the Fed’s plan is “getting rates back up to more neutral levels as quickly as we practicably can,” he commented. “Moving beyond that if that turns out to be appropriate.”

Impacts of Fed action and actions to come.

- Reuters: “Big U.S. banks said on Wednesday they were raising their base lending rates by a quarter of a percentage point each, hours after the U.S. Federal Reserve increased its benchmark interest rate in a bid to contain stubbornly high inflation. Citigroup Inc, Wells Fargo & Co, JPMorgan Chase & Co and Bank of America Corp said they were each lifting their base rates to 3.5% from 3.25%, effective Thursday.”

- Powell was asked what he thought of the prospect that the Fed’s actions signaled on interest rates could send the U.S. economy into a recession. Powell declared that the odds of a recession “are not particularly elevated.” Powell said the reason is that “aggregate demand and strong and most forecasters expect it to remain so. Conditions are tight and payroll job growth is continuing at very high levels. Household and business balance sheets are strong. And so, all signs are that this is a strong economy, indeed, one that will be able to flourish, not to say withstand, but certainly flourish as well in the face of less accommodative monetary policy.” While acknowledging that price stability remains the Fed objective, Powell said the Fed feels “the economy is very strong and well-positioned to withstand tighter monetary policy.” After Powell made those remarks, equity markets rallied.

- Across the six times the Fed has started a rate-hiking cycle between 1988 and 2015, the S&P 500 has averaged nearly 14% gains over the subsequent 12 months.

- Powell spent a considerable amount of time in his post-meeting presser talking about strength in the labor market, noting that it is a situation where workers can leave one job and have confidence that they can find another job. “That means we think the economy can handle rate increases,” he noted, especially with a strong labor market.

- The Fed appears to be betting that inflation will solve itself. The Fed’s preferred gauge of inflation is running at just over 6%, and the official forecasts expect it to fall closer to 4% by the end of this year. A good deal of that drop, though, comes not from higher interest rates, but from the expectation that supply chain problems will fade, even as the war in Ukraine and pandemic lockdowns in China threaten to snarl trade. “While the Fed is no longer using the word ‘transitory’ for inflation, they still seem to be counting on it,” Vincent Reinhart, a former Fed official now at Dreyfus and Mellon, told the New York Times.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker even as most foreign rivals are down against the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 2.16% with a mixed-to-weaker tone in global government bond yields. Gold and silver futures are seeing strong buying activity ahead of U.S. market action, with gold above $1,935 per troy ounce and silver above $25.40 per troy ounce.

• Crude oil futures are moving higher ahead of U.S. trading, with U.S. crude above $100.50 per barrel and Brent close to $104 per barrel. Crude values were up in Asian action, with U.S. crude around $97 per barrel and Brent near $100 per barrel.

• Natural gas imports tracker introduced. Gazprom stopped updating its gasflow data on Feb. 24. As such, it has become difficult for investors to keep a track of European natural gas imports from Russia. Longview Economics aims to plug that gap by launching its Longview Europe Natural Gas Imports Tracker, which can be found here.

![]()

![]()

• $400 gas rebate may be ahead in California. A group of Democratic state lawmakers on Wednesday called for sending a $400 rebate to every California taxpayer to help soften the blow of the recent surge in gasoline prices. “This proposed $400 rebate would cover the current 51 cents-per-gallon gas tax for one full year, 52 trips to the pump for most vehicles,” the lawmakers wrote in a letter to Gov. Democratic Gavin Newsom, Assembly Speaker Anthony Rendon (D-Lakewood) and Senate President Pro Tem Toni Atkins (D-San Diego). “Notably, we believe a rebate is a better approach than suspending the gas tax — which would severely impact funding for important transportation projects and offers no guarantee that oil companies would pass on the savings to consumers,” said the letter, obtained by the Los Angeles Times on Wednesday.

• STB calls for more data on CP-KC Southern merger. The Surface Transportation Board (STB) Wednesday said it needs more data from Canadian Pacific (CP) Railway relative to its application to acquire Kansas City Southern Railway Company. The STB said it was CP to clarify the data behind the application, giving CP until Monday to submit new data and gave stakeholders until March 28 to comment.

• Canadian Pacific Railway threatens lockout in labor dispute. The railway said it would lock out employees on Sunday if the union representing train conductors and engineers fails to negotiate a new contract or agree to binding arbitration. The parties have been in daily discussions but “remain far apart.” Canadian Pacific will continue to bargain with the union to achieve a settlement. Canadian Pacific “has commenced its work stoppage contingency plan and will work closely with customers to achieve a smooth, efficient and safe wind-down of Canadian operations,” the company said. The disruption is poised to create more uncertainty in fertilizer markets just as farmers need key nutrients to plant spring crops. Canada, along with Russia and Belarus, is one of the main sources for the world’s potash, a mined mineral used in crop nutrients. Sanctions on Belarus and Russia following the invasion of Ukraine have already created a global shortfall and skyrocketing prices. CP is the primary rail transportation provider for the delivery of Saskatchewan potash to overseas markets, according to the provincial government. Nutrien Ltd., one of the top crop-nutrient suppliers, and Saskatchewan’s government have asked Canada’s federal government to act swiftly to stop a strike.

• Indonesia reverses course on export limits, to hike export levy instead. Indonesia will shift from volume restrictions on exports of palm oil products and will instead use higher export levies, according to Trade Minister Muhammad Lutfi. Indonesia recently announced that companies would be required to sell 30% of planned export volumes of palm oil products into the domestic market, up from 20% in January, under their domestic market obligation (DMO) effort. Lutfi told a parliamentary hearing that the DMO effort would be scrapped and the ceiling on the combined palm export tax and levy would be raised to $675 per tonne from a current $375 per tonne. He noted the maximum crude palm oil tax would be applied when prices reach $1,500 per tonne. "This is the market mechanism, and hopefully this can maintain supply stability for the people," Lutfi said, noting the DMO was being withdrawn after creating tight supplies and that it had created a price disparity between the DMO and market price. This marks the sixth policy shift in Indonesia on cooking oils since January.

• Ag demand: South Korea tendered to buy 45,000 MT of U.S. milling wheat and up to 138,000 MT of corn to be sourced from the U.S., Black Sea/eastern Europe, South America or South Africa. Jordan tendered to buy 120,000 MT of optional origin milling wheat.

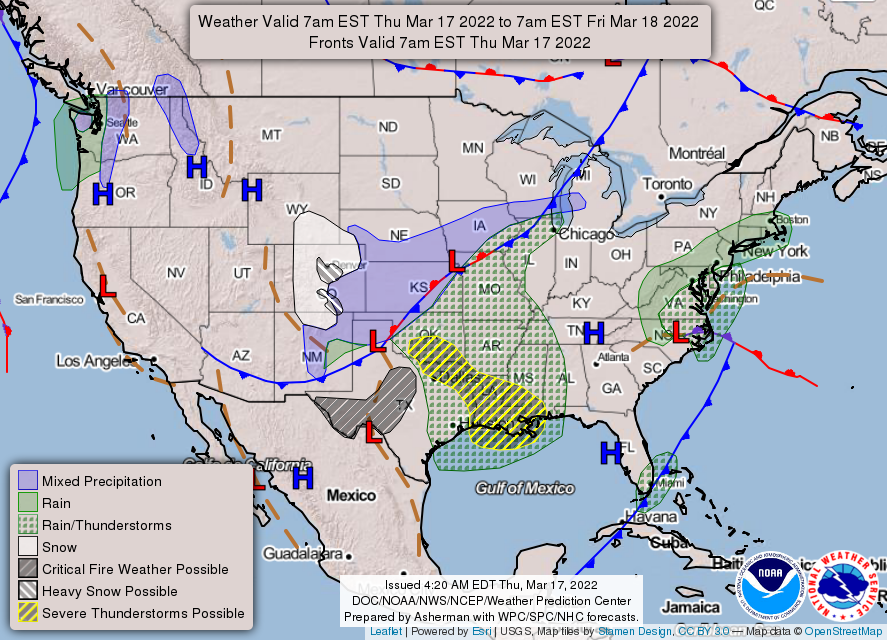

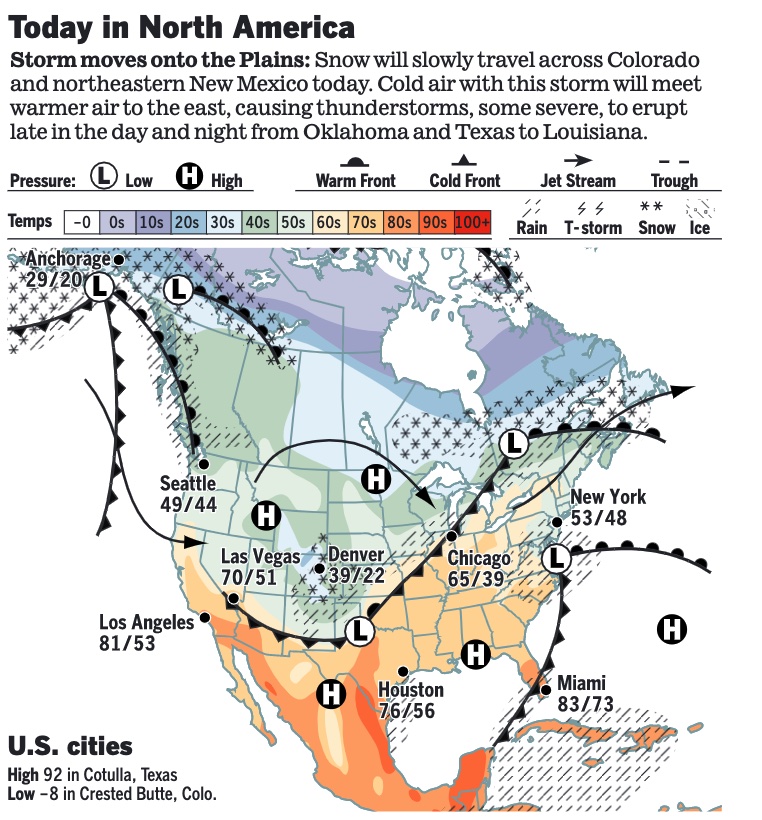

• NWS weather: Cloudy, wet, and dreary along the Mid-Atlantic and Northeast coast today... ...Strengthening upper low to trigger severe weather from the South Central U.S. to the Mid-South; Extremely Critical Risk of Fire Weather in west-central Texas... ...Accumulating snowfall to the Central and Southern Rockies and adjacent High Plains... ...April-like warmth continues for the Northeast, Ohio Valley, and Desert Southwest; Unsettled weather pattern in the Pacific Northwest.

Items in Pro Farmer's First Thing Today include:

• Corn and beans higher, wheat rebounds from overnight lows

• China’s Shenzhen plans ‘orderly’ work resumption (details in China section)

• Euro zone inflation continues record rise

• Strategie Grains raises EU wheat export forecast, lowers crop outlook

• Ukraine winter grains in favorable condition

• Argentina analyzing higher export taxes for soymeal, soyoil

• Argentina warns beef sector to help tame inflation or risk export bans

• Slow developing cash cattle trade

• Pork cutout climbs again

|

RUSSIA/UKRAINE |

— Summary: Ukrainian forces launched counterattacks against Russian troops outside the capital, Kyiv, and in the Russian-occupied city of Kherson. Russian President Vladimir Putin called pro-Western Russians “scum and traitors” who needed to be removed from society. President Biden on Wednesday called Russian President Vladimir Putin a war criminal as the atrocities in Ukraine mount and the president there begged the U.S. Congress for more help. Meanwhile, Putin acknowledged Wednesday that the sanctions had damaged the country’s economy.

- President Volodymyr Zelenskyy of Ukraine invoked the memories of Pearl Harbor and the Sept. 11, 2001, attacks in his virtual address to Congress Wednesday as he pressed for a no-fly zone over Ukraine, more weaponry and more sanctions to defend his country against Russia. Hours later, President Biden as expected announced $800 million in new military aid for Ukraine, including cutting-edge drones and anti-aircraft systems. Despite Ukraine’s pleas, Biden and NATO leaders have refused to set up a no-fly zone, which would draw the military alliance directly into a conflict with Russia.

- Zelenskyy’s key messages:

- He called for new sanctions “every week” against Russia. “Peace is more important than income,” he said.

- He called on all American companies to leave the Russian market immediately “because it is flooded with our blood.”

- His message to Biden: “To be the leader of the world means to be the leader of peace.”

- The IRS wants to add agents to a 3,000-person investigations unit to crack down on oligarchs evading sanctions.

— Market impacts:

- Resettling Ukrainian refugees could cost $30 billion in the first year alone, according to an early estimate, and has the potential to reshape Europe’s economic landscape.

- War in Ukraine could drive up global hunger by 2% in a year. Up to 13 million people around the world could be pushed into hunger because of the spike in food prices and disruptions in supplies that result from Russia’s invasion of Ukraine, said the U.N. Food and Agriculture Organization on Wednesday. The global hunger rate of 9.9% was already the highest in 13 years, due to the pandemic.

- Ukraine winter grains in favorable condition. “As for the new-crop winter crops are indeed in good condition throughout the country. And, despite the difficulties in which field work has to be carried out, Ukraine will have bread,” Deputy Agriculture Minister Taras Dzoba said in a statement. “Of course, the export potential is significantly undermined by this war, which will lead to higher prices,” he added.

- Russia-linked oil, fuel cargoes rush to U.S. before ban starts. At least 10 vessels carrying Russia-linked cargoes of crude and refined products were approaching the United States on Wednesday, as suppliers rushed to deliver ahead of the U.S. government's deadline to wind down Russian energy purchases, data from traders and Refinitiv Eikon showed. Link for details.

- The ship insurance market is in turmoil, with some underwriters staying clear of ships moving Russian crude and others hiking premiums 400% for oil transports through the Black Sea.

- Russia-driven fertilizer chaos shows innovation need: Vilsack. Fertilizer market chaos stemming from Russia’s attack on Ukraine is underscoring the need for a self-sufficient U.S. economy that isn’t reliant on foreign resources, USDA Secretary Tom Vilsack said. Unfortunately, the U.S. today is reliant “on someone who feels that they can just invade another country for something that’s critical to agriculture -- fertilizer,” Vilsack said during a bioeconomy conference in Washington. “Fertilizer costs have gone up in part” because of dependence on Russia, Vilsack said. He revealed he met earlier with agriculture ministers from Latin America and South America. “To a person they expressed concern about the impact of fertilizer on their ability to grow the crops and their ability to feed the world,” Vilsack said.

- Putin acknowledges impact of sanctions on Russian economy. Impacts: Russia has seen factory closures, job losses, a doubling of interest rates and a decline of the ruble. Since Russia attacked Ukraine in late February, the ruble has lost about 18% of its value against the dollar, according to FactSet. It had been down more than 40% earlier this month before recovering losses.

“Our economy will need deep structural changes in these new realities, and I won’t hide this—they won’t be easy; they will lead to a temporary rise in inflation and unemployment,” Putin said in televised remarks on Wednesday before a video meeting with Russian government officials. Putin held out opportunities to those multinational companies still doing business in his country. “We value the position of those foreign companies that, despite the inexcusable pressure from the U.S. and its vassals, continue to work in our country,” he said. “Going forward, they will definitely receive additional opportunities for development.” He also said Russia’s central bank wouldn’t resort to printing money to meet the government’s spending needs. Russia’s central bank is set to meet Friday to discuss possible interest-rate changes. - Putin focused on one of the West’s main financial weapons against Russia — freezing the assets of Russia’s central bank held in North America and Europe. That prevented Moscow from using much of its stockpile of $630 billion in reserves to prop up the ruble. “Now everyone knows that financial reserves can simply be stolen,” Putin said. He called the freezing of Russia’s central-bank assets illegitimate and warned it would lead countries around the world to store their reserves in tangible assets such as gold, land and raw materials instead of financial assets.

|

POLICY FOCUS |

— USDA certainly hasn’t whipped WHIP+ into shape. Around six months ago, lawmakers approved $10 billion for a WHIP+ program for eligible 2020 and 2021 livestock and crops. But Congress conditioned the funding with two requirements: USDA must accelerate payments under the program, and they must make it less complex. USDA Secretary Tom Vilsack previously said the first tranche of the WHIP+ livestock payments would be made “by March.” That meant by the end of February. It’s March 17.

Said one farm policy analyst: “All USDA had to do is blow dust off 2018 and 2019, use RMA data, make a few statutory changes required, and address any other anomalies and it would have been done. But… Here we are.” Asked why it is again taking USDA so long on this program, the analyst said: “Change the name. Probably bowing to their marquee issues. You know the ones.”

For 2018 and 2019 WHIP+, it took USDA a considerable amount of time to make the payments, much to the chagrin of farmers and lawmakers… and those trying to explain the delays.

— USDA extends deadline for climate-smart commodities funding. Citing a “high level” of interest in the Partnerships for Climate-Smart Commodities funding pilot programs, USDA has extended the deadlines to submit proposals for the effort. The first funding pool of proposals for pilot programs from $5 million to $100 million will now be May 6. For those proposals ranging from $250,000 to $4,999,999, the deadline is now June 10. USDA also said it was extending the deadline to make sure a “diverse applicant pool is able to apply” and said they provided additional guidance on the definition of “domestic applicant,” specifically noting that means an entity that is “neither a foreign organization nor a foreign public entity.” USDA said they also provided more information on the eligibility of producers as beneficiaries of the funding and on some of the qualification requirements.

Of note, USDA said carbon is not considered a commodity under the pilot efforts.

USDA said that while early adopters are eligible and encouraged to be a part of the pilot projects, they have stated funds “may not be used to pay for implementation of the same practice on the same land, but funding may be used to enhance a practice or to further incentivize the climate-smart commodity generated, especially with respect to early adopters.” That could become a key participation point for producers who are already using practices such as no-till or minimum tillage.

USDA announced it would put $1 billion toward the effort utilizing authority under the Commodity Credit Corporation (CCC). Several Republican lawmakers have pushed back against the effort, questioning whether USDA has the authority under the CCC to run the pilot effort.

— Organic transition payments will not be reduced. USDA has determined that there will not be a factor applied to Organic and Transitional Education and Certification Program (OTECP) payments. USDA announced in November that $20 million would be made available for the payments for the 2020 and 2021 program year, with signup ending Feb. 4. USDA opted to not make payments until they determined whether a factor would be needed to keep total payments under the $20-million level. Those payments will now be issued and will not be reduced.

— Lawmakers square off, again, on climate efforts at USDA. Members of the House Agriculture Committee remain deeply divided over the climate efforts being deployed by USDA and lawmakers on the panel heard from Texas A&M professor Dr. Joe Outlaw that the climate efforts could have negative effects on some producers that do not have some of the climate-smart options available to them. Further, Outlaw said it could lower the price for commodities produced by those who lack such options. Link to Outlaw testimony.

Republicans on the panel also pushed for there to be a hearing on issues like rising input and fertilizer prices and the Russian invasion of Ukraine, noting those are the most pressing issues they are hearing from their constituents.

The stark differences showed up in remarks by the panel’s leaders:

In his opening statement, House Agriculture Committee Chairman David Scott (D-Ga.) noted that he had discussed climate change in his first hearing after becoming chairman and that he has said “time and time again that we want agriculture to be at the tip of the spear in our efforts to address climate change. I want to ensure that our farm bill programs support producers, particularly historically underserved and beginning farmers, who want to innovate and adopt practices that conserve resources and address climate change, while also allowing farming to remain a viable way of life,” Scott said.

But in his opening statement, Rep. Glenn “GT” Thompson (R-Pa.), ranking member on the committee, said, “I would be remiss not to mention the tone deafness of this hearing as our country and our farmers face enormous and immediate challenges including higher food prices, record inflation and input costs, attacks on our energy independence, crop protection tools, and dependable labor.”

A divide not narrowed. The session did little indicate the divide between Republicans and Democrats on the panel over climate efforts at USDA is getting any narrower. And Republicans may feel a little more emboldened via the testimony from Outlaw offering them exactly what they wanted — warnings about potential negative impacts to producers.

|

PERSONNEL |

— A Senate panel on Wednesday advanced Jerome Powell’s nomination for a second term leading the Fed, along with three others for top posts at the central bank. The Senate Banking Committee approved Powell in a 23-1 vote. The panel also backed sending the nominations of Lael Brainard as vice chair and Philip Jefferson as Fed governors to the full Senate. The committee, evenly split between Democrats and Republicans, deadlocked 12-12 on Lisa Cook’s nomination to the board of governors, which will require another vote on the Senate floor.

|

CHINA UPDATE |

— China buys new-crop U.S. corn. USDA Export Sales activity for the week ended March 10 included sales of U.S. new-crop corn to China along with soybeans and cotton.

For 2021-22 activity to China, USDA reported cancellations of 2,091 tonnes of corn, net sales of 128,259 tonnes of sorghum, 395,544 tonnes of soybeans, and 144,741 running bales of upland cotton.

Sales for 2022-23 included 204,000 tonnes of corn, 406,000 tonnes of soybeans, and 1,320 tonnes of upland cotton.

Net sales for 2022 of 6,563 tonnes of beef and 762 tonnes of pork were reported.

— Rubio: Chinese companies must comply fully with U.S. rules if they want to keep trading on New York exchanges. “Americans are investing money in companies which don’t have the transparency that you would expect from other investments, virtually from any company from virtually any part of the world,” Sen. Marco Rubio (R-Fla.) said, as U.S.-listed Chinese stocks soared Wednesday. Rubio was discussing a law passed in 2020 that could lead to Chinese companies being booted off exchanges as soon as 2024 if regulators aren’t able to inspect their corporate audits.

— China’s Shenzhen plans ‘orderly’ work resumption. China’s technology hub of Shenzhen will allow firms to resume work in an “orderly” manner after the restriction of non-essential businesses to contain an outbreak of Covid-19, a city official said. “On condition that the epidemic prevention and control work is done well, enterprises will resume production in an orderly way based on region and category,” Huang Qiang, deputy-secretary general of the Shenzhen municipal government said. “There must be no loosening or slacking in virus control and prevention work,” the official added. But warehouses and other industrial sites around Shenzhen are closed this week and intercity deliveries are sporadic, raising concerns about the impact on global supply chains. Car maker Tesla is the latest to shut down assembly lines, suspending operations at its Shanghai Gigafactory for two days to test workers, according to the South China Morning Post.

|

TRADE POLICY |

— Lawmakers pressure USDA over Mexico actions on U.S. potatoes. More than 30 lawmakers are calling on USDA Secretary Tom Vilsack to address the situation with Mexico relative to their inaction on allowing in imports of U.S. potatoes. They expressed their “deep concern” about Mexico’s delay in granting access for U.S. fresh potatoes, saying it’s costing $150 million to US growers annually. “They want USDA to work to “ensure that the trade deal is honored by expeditiously reinstating access for U.S. fresh potatoes and to express that any Mexican request for enhanced agricultural access to the U.S. should not be granted until this access is restored.” U.S. potato producers hailed the April 2021 decision by the Mexico Supreme Court against Mexico’s potato industry that opened the door for resumed access. But on Feb. 16, USDA’s Animal and Plant Health Inspection Service (APHIS) and Mexico’s SENASICA announced the fresh table stock potato access would be delayed because Mexico had demanded site visits as a prerequisite to reopening markets, and it was disclosed that processing potato access to Mexico would be limited to two companies.

|

ENERGY & CLIMATE CHANGE |

— Vilsack: more biofuel blending means lower gasoline price. “As we deal with the current situation in Ukraine and Russia, what we know is that we’ve seen higher gas prices and we know — we know — that when you have more biofuel you’ve got lower gas prices,” USDA Secretary Tom Vilsack said. As “we expand availability” of fuel with higher blends of ethanol and biodiesel, known as E15 and B20, there is opportunity to “increase capacity, increase supply and decrease cost to consumers,” Vilsack said at the opening of the Advanced Bioeconomy Leadership Conference in Washington.

Background. Producers are lobbying EPA and lawmakers to allow year-round sales of the fuels, but refiners have long been resistant to using more biofuels at the expense of selling less gasoline and argue that higher blends don’t lower prices at the pump.

The Biden administration supports the biofuel industry and “despite the conversation about electric vehicles, the reality is we are still going to need biofuel, and a lot of it, for a long time,” Vilsack stressed.

— House panel leader wants oil execs to testify on rising prices. House Energy and Commerce Committee Chairman Frank Pallone Jr. invited the heads of Exxon Mobil Corp., Chevron Corp. and four other companies to appear at an April 6 hearing on oil prices. Pallone has accused the oil industry of maintaining artificially high energy prices and profits “by keeping domestic oil production low and funneling revenue back to investors and executives… This is all happening at the same time the industry is taking advantage of generous production tax incentives provided by American taxpayers,” Pallone said in letters to executives from BP Plc, Chevron, Devon Energy Corp. Exxon Mobil, Pioneer Natural Resources Co. and Shell Oil Co.

In the Senate, Majority Leader Chuck Schumer (D-N.Y.) earlier Wednesday bemoaned “the bewildering incongruity between falling oil prices and rising gas prices,” and said, “we will be calling on the CEOs of major oil companies to come testify before Congress.”

— Falling short on reducing carbon emissions. An analysis from Columbia University's Center on Global Energy Policy found that the climate pledges made by countries so far would reduce carbon emissions by 9% by 2030, much less than the universal target of nearly 50% by the end of the decade. The analysis also found that failure to meet the 2030 emissions goal would put the world at risk of irreversible climate impacts regardless of whether a second net-zero goal is met by 2050.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— World Food Program, a wing of the United Nations, needs more funding, in part due to rising transportation costs. The program is hundreds of millions of dollars short for its goals in Ukraine, according to David Beasley, a former South Carolina governor who is now the group’s executive director. The U.S. gave $3.8 billion to the World Food Program in 2021, about 40% of its $9.5 billion in contributions, according to the organization. The organization is aiming for $18.9 billion in funds in calendar year 2022, spokesman Kyle Wilkinson said. For the U.S. to maintain its historic level of providing 30-40% of the funding, officials would need to provide $5.7 billion to $7.6 billion this year, he said.

— USDA confirms bird flu in additional backyard flocks. USDA’s Animal and Plant Health Inspection Service (APHIS) has now confirmed highly pathogenic avian influenza (HPAI) in a non-commercial backyard flock (non-poultry) in Merrick County, Nebraska, and in a backyard mixed species (non-poultry) flock. This bring total confirmed HPAI cases to 37 with 16 of those being in non-commercial backyard flocks. USDA also updated the number of birds involved in the Jefferson County, Wisconsin HPAI case to 2,757,800 birds in a commercial layer flock — APHIS originally reported the total at 3 million birds.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 463,964,928 with 6,059,216 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,631,708 with 968,329 deaths. The U.S. 28-day total for Covid infections has declined dramatically, with the U.S. now sitting eleventh in the world using that criteria. The Johns Hopkins University Coronavirus Resource Center said that there have been 557,644,629 doses administered, 216,829,829 have been fully vaccinated, or 66.05% of the U.S. population.

— Irish leader tests positive for Covid during visit to DC. Irish Prime Minister Micheál Martin learned he had tested positive for Covid-19 Wednesday evening while attending an event with U.S. leaders, including President Biden and House Speaker Nancy Pelosi (D-Calif.), according to a senior administration official.

|

POLITICS & ELECTIONS |

— Sabato’s Crystal Ball looks at what’s left in redistricting. The national redistricting picture is nearly complete, as only vie more states — Florida, Louisiana, Missouri, New Hampshire, and Ohio — have yet to enact congressional maps. Key highlights? (Link for more details.)

- “While Democrats are currently up in our running House tally, the plans from those 5 remaining states should boost the Republican tally.

- “Despite GOP hegemony in Florida and Ohio, the situations in both states have been especially messy. Ohio Republicans are constrained by new voter-approved redistricting rules and a state Supreme Court that appears determined to enforce them, while Florida’s governor and legislature are not on the same page.

- “The Crystal Ball favors Democrats in 185 of the seats that have been drawn, to 169 for Republicans (22 districts are Toss-ups). But the five states that have yet to produce maps account for a sizeable 59 seats. Perhaps more notably, Republicans, at least on paper, technically control redistricting in four of those states — Florida, Missouri, New Hampshire, and Ohio — while they also may end up getting their way in the 5th, Louisiana, despite its Democratic governor. Altogether, Republicans currently hold 39 of the quintet’s 59 seats, so in terms of the overall House count, even a relatively status quo arrangement would likely benefit the GOP (while Ohio is losing a seat, Florida is gaining one).”

— Ohio’s Supreme Court plunged the state’s election schedule into doubt with a ruling that legislative maps were unconstitutionally gerrymandered. The court ordered the state redistricting commission to try again and file a new plan with the secretary of state by March 28. “Substantial and compelling evidence shows beyond a reasonable doubt that the main goal of the individuals who drafted the second revised plan was to favor the Republican Party and disfavor the Democratic Party,” according to the majority opinion issued late Wednesday.

— State AG considering primary challenge to Romney. Utah Attorney General Sean Reyes (R), who supported former President Donald Trump’s push to challenge the results of the 2020 election, is preparing for a 2024 Senate run that could pit him against Sen. Mitt Romney in a GOP primary. Reyes, according to Politico, in recent weeks has discussed the matter with key players in Utah politics and with allies of the former president. Reyes will make a final decision and likely announce his intentions in May. Politico says Romney “hasn’t publicly discussed his 2024 plans.” While he “is being encouraged by some anti-Trump Republicans to run again for president...multiple political operatives in Utah believe Romney is likely to retire from politics at the end of his current Senate term.”

|

CONGRESS |

— House to vote on Russia trade status. The House today will vote on ending permanent normalized trade relations with Russia and Belarus, a move that would allow the U.S. to impose higher tariffs on Russian goods and take other actions. The bill will use an expedited process requiring the support of two-thirds of lawmakers for passage. Revoking the status, which in the U.S. requires legislation, would put Russia in the same category as other states viewed by Washington as pariahs, including North Korea and Cuba. The bill also includes an expansion of the Global Magnitsky Human Rights Accountability Act. That would enable the Biden administration to impose further sanctions on Russian officials for human rights violations. The House included Magnitsky language in legislation to ban Russian oil that passed that chamber last week. However, attaching it to the trade legislation may move it through the Senate and to President Joe Biden’s desk sooner, though no timetable has been set.

|

OTHER ITEMS OF NOTE |

— An appeals court clears a key part of Biden’s environmental plans. The White House can proceed with policies that rely on higher estimates of the cost of climate change, a panel of appellate judges ruled. The decision overturns a lower court’s block but could still be reviewed by the full appeals court.