Today: Zelensky Addresses Congress and Fed to Hike Rates

Russia and Ukraine: Signs of progress on discussions to stop the war

|

In Today’s Digital Newspaper |

The Russian invasion against Ukraine continues into week three, with Ukraine saying it has launched a counteroffensive. Ukrainian President Volodymyr Zelensky is addressing Congress today, a day after asking the Canadian Parliament to help “close the sky” over Ukraine and increase sanctions on Russia. Russian drones are crossing into NATO airspace, testing the alliance’s red lines.

Beijing’s envoy to U.S.: ‘China would have tried to stop Ukraine war.’ China did not know about, acquiesce in or support the war, says Chinese ambassador Qin Gang in an opinion piece in the Washington Post giving China’s stance on the Ukraine crisis

Russia walked back recent demands related to the Iran nuclear deal, clearing the way to revive the 2015 agreement.

The Federal Reserve today is expected to lift interest rates for the first time since 2018. The bigger questions surround what Chairman Jerome Powell will say about the outlook for future rate increases, inflation and the economy.

Chinese stocks soar after Beijing promises to stabilize markets. Shares rallied after government officials promised to support stock markets and end a clampdown on tech companies.

Oil drops below $100 a barrel. After surging to $120 a barrel last week, WTI crude dropped precipitously to under $100 on Tuesday, entering a bear market just five days after settling near 14-year highs. The fall reflected those pandemic lockdowns in China. Coal prices jumped, however, as buyers anticipated Russia cutting off exports in retaliation for sanctions. Meanwhile, Saudi Arabia is reportedly considering pricing some of its oil sales in renminbi, bolstering the Chinese currency’s standing.

Airlines said demand is roaring back, despite higher ticket prices. With demand so strong, airline executives said that they expect to be able to absorb higher fuel costs by paring back capacity and passing along the costs to customers.

Biden administration launched a pilot program to have ocean carriers, ports, trucks and major retailers share data with each other to improve the flow of goods.

U.S. and the U.K. have agreed to start talks to deepen trade and investment ties, their first broad effort to promote bilateral trade since negotiations to forge a free-trade agreement between the two nations were suspended last year.

EPA is seeking additional comments on collecting information from the meat and poultry products industry.

Senate passed a bill to allow states to make daylight-saving time permanent.

|

MARKET FOCUS |

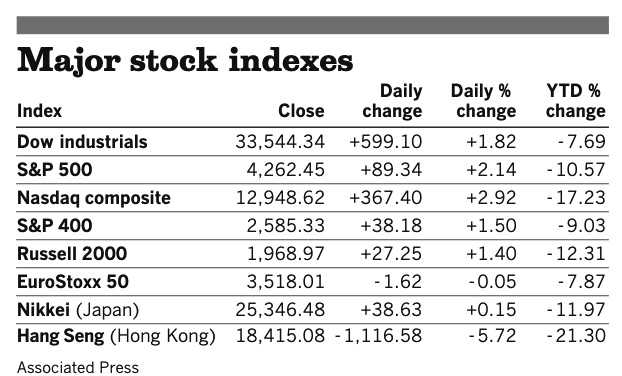

Equities today: China stocks soared after the government vowed policies to support financial markets and boost economic growth to quell a rout that erased $1.5 trillion in value over two sessions. Global stocks markets were mostly higher overnight. The U.S. stock indexes are pointed toward solidly higher openings. Asian equity markets finished with big advances ahead of the U.S. Fed meeting conclusion and on the rise in U.S. equities Tuesday. The Nikkei gained 415.53 points, 1.64%, at 25,762.01. The Hang Seng Index rose 1,672.42 points, 9.08%, at 20,087.50. European markets are posting solid gains in early trading with the Stoxx 600 up 2.7% and regional markets up 1.2% to 3.6%.

U.S. equities yesterday: The Dow gained 599.10 points, 1.82%, at 33,544.34. The Nasdaq rose 367.40 points, 2.92%, at 12,948.62. The S&P 500 moved up 89.34 points, 2.14%, at 4,262.45.

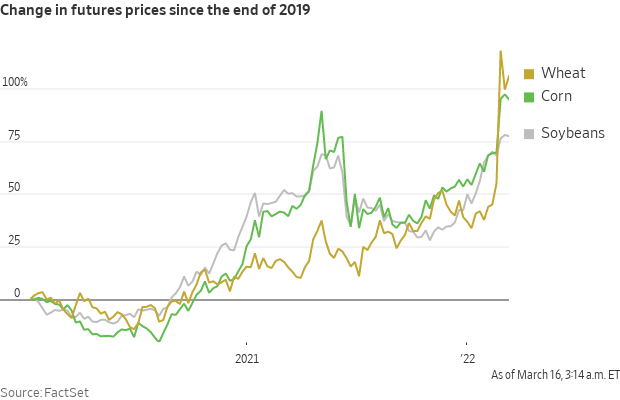

Agriculture markets yesterday:

- Corn: May corn futures rose 9 3/4 cents to $7.58.

- Soy complex: May soybean futures fell 11 3/4 cents to $16.58 3/4, the lowest close since $16.36 3/4 on Feb. 28. May soymeal fell 30 cents to $484.00 and May soyoil fell 27 points to 73.68 cents.

- Wheat: May SRW wheat rose 58 cents to $11.54 1/4. May HRW wheat rose 57 1/2 cents to $11.57 1/2. May spring wheat futures jumped 40 cents to $11.10 1/4.

- Cotton: May cotton futures fell 17 points to 118.60 cents per pound.

- Cattle: April live cattle rose 52.5 cents to $140.85, the contract’s highest closing price since $141.425 on Feb. 28. April feeders edged up 20 cents to $162.60.

- Hogs: April lean hog futures rose 20 cents to $102.40.

Ag markets today: Pro Farmer notes that wheat pulls corn lower, while soybeans rebound. Wheat futures traded sharply lower overnight, which pulled the corn market lower. Soybeans, along with meal and soyoil traded higher. As of 7:30 a.m. ET, wheat futures were trading mostly 18 to 32 cents lower, corn is 3 to 8 cents lower and soybeans are 6 to 12 cents higher. Front-month U.S. crude oil futures are around 50 cents lower, and the U.S. dollar index is down around 500 points this morning.

Technical viewpoints from analyst Jim Wyckoff:

On tap today:

• U.S. retail sales for February are expected to increase 0.4% from the prior month. (8:30 a.m. ET)

• U.S. import prices for February are expected to increase 1.6% from the prior month. (8:30 a.m. ET)

• U.S. business inventories for January are expected to increase 1.1% from the prior month. (10 a.m. ET)

• National Association of Home Builders housing market index is expected to fall to 80 in March from 82 one month earlier. (10 a.m. ET)

• Federal Reserve releases a policy statement and economic projections at 2 p.m. ET, and Chairman Jerome Powell holds a press conference at 2:30 p.m. ET.

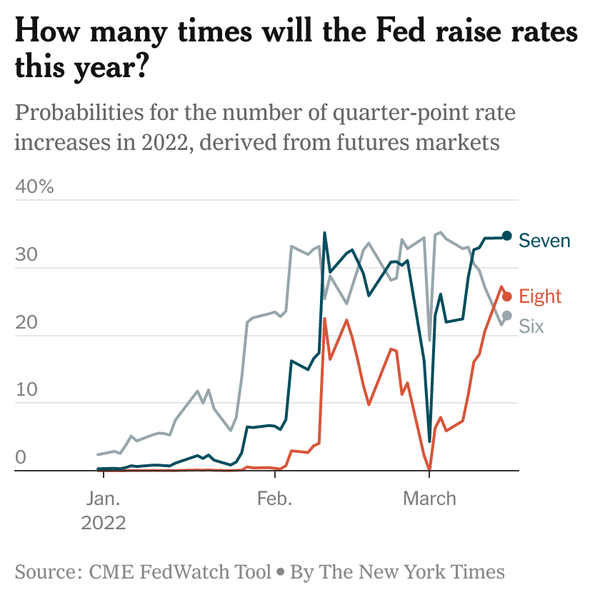

FOMC meeting conclusion today has big implications. The conclusion of the Federal Open Market Committee (FOMC) meeting this afternoon is expected to see the central bank raise its benchmark rate for the first time since 2018 to subdue inflation that is running at the fastest pace in four decades — increasing the target range for the Fed funds rate by 0.25%, putting it at 0.25% to 0.5%. But the real focus will come with release of updated projections by Fed members, with attention on the number of rate hikes that Fed officials now expect will be needed in 2022 and beyond. The Fed may also have something to say about how it intends to trim its balance sheet, which is at $8.9 trillion.

Playing catch up. The Fed has made clear their actions will be aimed at beating back inflation. But an aggressive Fed now would essentially be playing catch up with an economy that is being rattled by high prices that are being seen throughout the supply chain. And those high prices are not just being caused by elevated energy prices. But the signals from Fed officials will be important as markets are starting to fret about the potential that an aggressive attack on inflation could send the U.S. economy stumbling, potentially to the point of recession. Some are even raising the prospect of stagflation developing, the condition caused by high inflation, high unemployment and slow economic growth.

Impacts: Big gains in the post-pandemic jobs market could certainly be at risk if the Fed hits the brakes too hard on the U.S. economy. Plus, Fed Chair Pro Tempore Jerome Powell will be tasked with trying to explain all the actions and forecasts. The Fed’s hope now has to be that the economic recovery from the pandemic does not prove to be transitory.

Key unknown: How many rate hikes ahead? Ethan Harris of Bank of America said interest rates could end up a lot higher than many people expect. When the Fed starts tightening, markets “typically underprice” how high interest rates end up going, he wrote in a recent note to clients.

The Federal Reserve is charting a course to stagflation and recession: Summers. "I believe the Fed has not internalized the magnitude of its errors over the past year, is operating with an inappropriate and dangerous framework, and needs to take far stronger action to support price stability than appears likely. The Fed’s current policy trajectory is likely to lead to stagflation, with average unemployment and inflation both averaging over 5% over the next few years — and ultimately to a major recession," Harvard professor and former Treasury Secretary Lawrence Summers writes in the Washington Post (link).

White House unveils freight logistics optimization works initiative. The White House Tuesday released an information sheet announcing launch of Freight Logistics Optimization Works (FLOW), an information sharing initiative to pilot key freight information exchange between parts of the goods movement supply chain. FLOW includes eighteen initial participants that represent diverse perspectives across the supply chain, including private businesses, trucking, warehousing, and logistics companies, ports, and more. Those stakeholders will work with the administration to develop a proof-of-concept information exchange to ease supply chain congestion, speed up the movement of goods, and ultimately cut costs for American consumers. Dept. of Transportation (DOT) will lead this effort, to bring supply chain stakeholders together to problem solve and overcome coordination challenges. This initial phase aims to produce a proof-of-concept freight information exchange by the end of the summer.

China’s latest Covid-19 crackdown is starting to touch shipping operations amid fears of new disruptions to supply chains. Freight forwarders and Maersk Line say warehouses across the key exporting city of Shenzhen are closed until March 20, the Wall Street Journal reports (link), and companies are warning that truck movements around major hubs including Shenzhen, Shanghai, Tianjin and Qingdao are likely to slow as drivers are screened for Covid. Shenzhen is requiring freight trucks entering from neighboring hard-hit Hong Kong to change drivers at three designated border checkpoints to curb the spread of Covid-19. Operations at Shenzhen’s big container terminals are moving, but the shutdown of warehouses and stalled truck operations suggest the flow of goods may slow in the coming days. Major manufacturers including Apple supplier Foxconn and Toyota have already idled some factories, shutdowns that will reverberate across global supplies.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker ahead of U.S. market action and the Fed meeting conclusion at 2 pm ET. The euro and British pound are both higher versus the greenback. The yield on the 10-year U.S. Treasury note has firmed to trade around 2.17% with a mixed tone in global government bond yields. Gold and silver futures are under mild pressure ahead of U.S. trading, with gold around $1,927 per troy ounce and silver around $25.10 per troy ounce.

• Crude oil futures have seen mixed trade ahead of U.S. gov’t inventory figures due later this morning. U.S. crude has traded both sides of unchanged around Tuesday’s close of $96.44 per barrel and Brent around $99.60 per barrel. Futures moved higher in Asian action, with U.S. crude trading around $97.25 per barrel and Brent around $101 per barrel.

• Oil volatility defined. After surging to $120 a barrel last week, WTI crude dropped precipitously to under $100 on Tuesday, entering a bear market just five days after settling near 14-year highs. "The collapse has been spectacular," wrote Fawad Razaqzada, market analyst at online broker ThinkMarkets. Traders are betting on a hit to demand due to the strict measures seen in China, where 45 million people are now under lockdown as coronavirus cases climb to over 5,000 a day. Investors are also fearful of another disruption to the fragile global supply chain due to China's zero-Covid strategy. For example, a lockdown has been declared for the southeastern manufacturing hub of Shenzhen, which features the world's biggest electronics suppliers, and the nearby key port of Yantian could also be impacted.

• IEA cuts global oil demand outlook amid Russian supply reductions. The International Energy Agency (IEA) cut its world oil demand forecast for 2022, warning that sanctions against Russia over its invasion of Ukraine could spark a global supply “shock.” In its monthly report, IEA said, “Faced with what could turn into the biggest supply crisis in decades, global energy markets are at a crossroads.” The agency said 3 million barrels per day (bpd) of Russian oil and products may not find their way to market beginning in April in the wake of its invasion of Ukraine. IEA lowered its forecast for world oil demand for the final three quarters of 2022 by 1.3 million bpd. For the full year it cut its growth forecast by 950,000 bpd to 2.1 million bpd for an average of 99.7 million bpd. That would mean a third year of demand below pre-pandemic levels which the agency had previously seen recovering in 2022.

• Markets from stocks and bonds to lumber and wheat futures have been roiled by volatility this year as central banks begin to wean economies from pandemic-era support and Russia’s invasion of Ukraine threatens to upend the supply of critical raw materials.

• Egypt boosts local wheat procurement price. The Egyptian cabinet has approved an increase in the level it will pay for local wheat to coax farmers to sell more of the locally produced crop to the government ahead of harvest. The government will now pay 865-885 Egyptian pounds ($55.06-$56.34) per ardeb (one ardeb is 5.6 U.S. acres), an increase of 65 Egyptian pounds, according to Reuters. The government also is requesting the supply minister set up a pricing mechanism for unsubsidized bread in a bid to bring down rising prices.

• Ag demand: Iran tendered to buy 60,000 MT each of corn, soymeal and feed barley.

• Californians’ usage increased in January, alarming officials amid a historic drought. California will end winter in a perilous position as record-shattering dryness converges with lagging water conservation efforts in nearly every part of the state, officials said Tuesday. After months of cutting back, new data from the State Water Resources Control Board show that rather than conserving water, Californians increased urban water use 2.6% in January, compared with the same month in 2020 — the baseline year against which current savings are measured. The cumulative savings from July — when Gov. Gavin Newsom called on Californians to voluntarily cut water use by 15% — to the end of January were just 6.4%, less than half the target. Officials said more must be done to prevent worst-case drought scenarios, including increased restrictions and mandatory water cuts. Link to more via the Los Angeles Times.

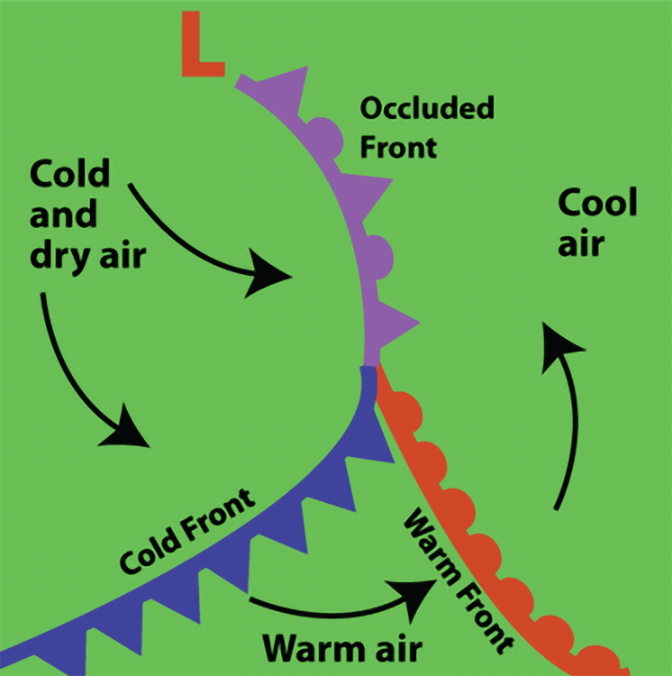

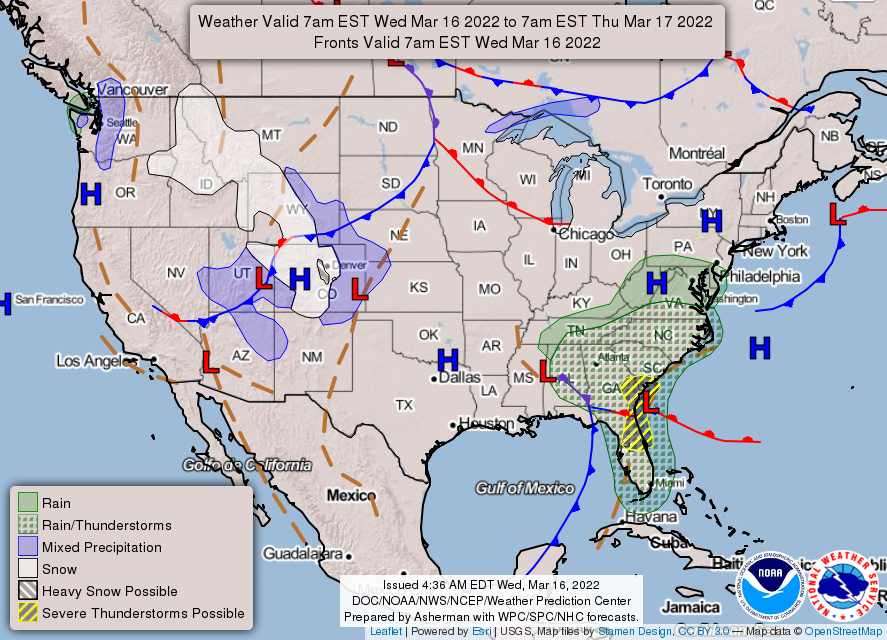

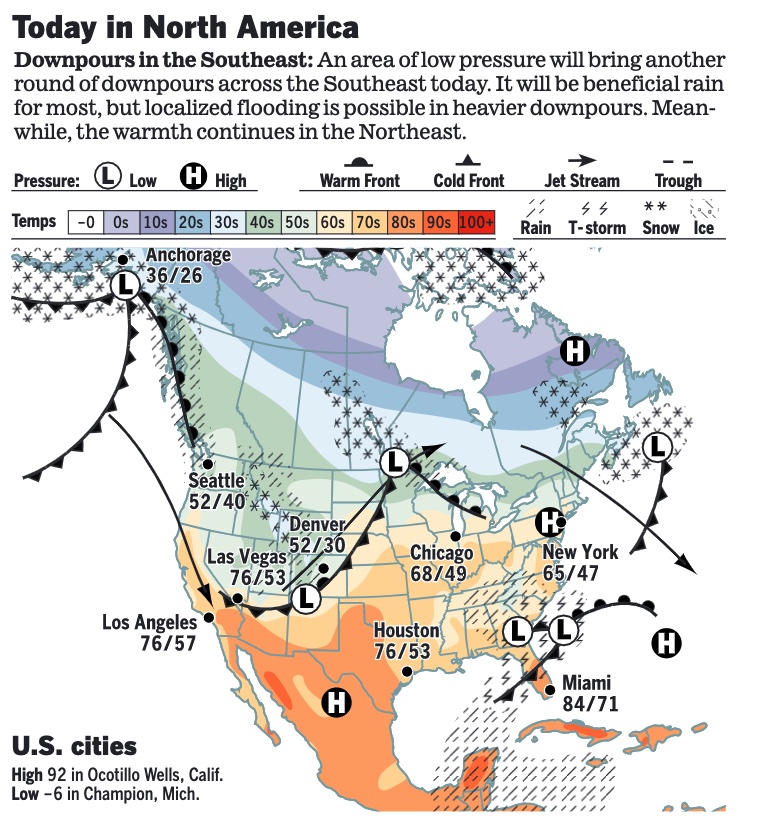

• NWS weather: Occluded storm system to direct showers and thunderstorms across the Southeast and eventually the Mid-Atlantic... ...Strengthening upper low to deliver mountain snow to the Central Rockies and trigger severe weather in the South Central U.S. Thursday... ...April-like warmth returns to the Mississippi Valley, Great Lakes, and Northeast; Elevated-to-Critical Risks for fire weather expected in the Southwest and Southern High Plains.

Background: At an occluded front, the cold air mass from the cold front meets the cool air that was ahead of the warm front. The warm air rises as these air masses come together. Occluded fronts usually form around areas of low atmospheric pressure.

Items in Pro Farmer's First Thing Today include:

• Wheat pulls corn lower, soybeans rebound

• Japan to revoke Russia’s MFN status

• IEA cuts global oil demand outlook amid Russian supply reductions

• Firmer cash cattle expectations

• Hog futures continue to pause

|

RUSSIA/UKRAINE |

— Summary: Ukrainian President Volodymyr Zelenskyy will address Congress virtually at 9 a.m. ET today. The WSJ reported (link) that President Biden would announce another $1 billion in security assistance to Ukraine today after Zelenskyy speaks — $200 million in previously appropriated funds that Biden already announced over the weekend, and $800 million in new funds from the $13.6 billion aid package signed into law on Tuesday. The NYT reports (link) Ukrainian officials plan to present the U.S. with a list of military equipment they need, including armed drones and mobile air-defense systems. The WSJ reports that Ukraine said it has launched a counteroffensive against Russian forces encroaching on its capital, Kyiv, and other key cities, seeking to reverse the momentum of a war that is entering its fourth week.

- Zelenskyy said Russia’s “positions in the negotiations sound more realistic” ahead of talks today. News overnight that both Russia and Ukraine said there are signs of progress on their discussions to stop the war has boosted trader and investor risk appetite at mid-week. Reports said discussions include having Ukraine become a neutral country like Sweden. Zelenskyy added the war would end “with disgrace, poverty, year-long isolation” for Russia. Earlier Zelenskyy suggested his country was unlikely to ever join NATO, hinting at a possible compromise; Russia has long demanded a guarantee that Ukraine would not join the alliance.

- President Biden will travel to Brussels Thursday, March 24, to attend a special NATO meeting over the war in Ukraine. He will attend a special meeting of NATO and then a previously scheduled European Council summit, the White House press secretary said.

- ‘China would have tried to stop Ukraine war’: Beijing’s envoy to U.S. China did not know about, acquiesce in or support the war, says Chinese ambassador Qin Gang in an opinion piece in the Washington Post (link), explaining China’s stance on the Ukraine crisis, two days after China’s top diplomat Yang Jiechi met US national security adviser Jake Sullivan in Rome. Media reports early this month said China had prior knowledge of Russia’s military action and demanded Russia delay it until the Winter Olympics were over. A more recent report said Moscow had asked Beijing for military and financial aid in the war. Qin said conflict between Russia and Ukraine “does no good for China”, citing the more than 6,000 Chinese citizens who had been in Ukraine and China’s roles as the biggest trading partner of both Russia and Ukraine and as the largest importer of crude oil and natural gas in the world. “Had China known about the imminent crisis, we would have tried our best to prevent it,” Qin said. He also pointed out that the legitimate security concerns of all countries must be taken seriously, showing China’s support for Russia over its concern about NATO’s eastern expansion, a cause of the war. Threats against Chinese entities and businesses, as uttered by some U.S. officials, were unacceptable, he said. Qin wrote in the Washington Post: “Neither war nor sanctions can deliver peace. Wielding the baton of sanctions at Chinese companies while seeking China’s support and cooperation simply won’t work.”

He also moved to dispel links between Taiwan and Ukraine, saying it was a mistake to play up the risk of a conflict in the Taiwan Strait. The future of Taiwan lay in the peaceful development of cross-strait relations and the reunification of China, he said. Qin said mainland China was committed to “peaceful” reunification, but retained all options to curb “Taiwan independence”. Beijing sees Taiwan as its territory and vows to take it back by force if necessary. - Japan to revoke Russia’s MFN status. Japan will revoke Russia’s most-favored nation trade status as part of further sanctions against Moscow, Prime Minister Fumio Kishida announced. Tokyo will also ramp up sanctions by expanding the scope of asset freezes against Russian elites and banning imports of certain products from the country. Japan will also coordinate with other Group of Seven nations to prevent Russia from tapping loans from the International Monetary Fund and other global lenders. The moves are in line with an announcement on Friday by the U.S. and its allies to escalate their economic pressure on Russia.

- Leaders from the Czech Republic, Poland and Slovenia vowed to support Ukraine during a visit to Kyiv. Poland’s deputy prime minister suggested an international peacekeeping mission with military capability should be sent to Ukraine. Meanwhile, NATO said it would convene a summit of its members’ leaders on March 24th in Brussels. A spokesperson for President Joe Biden said he would attend.

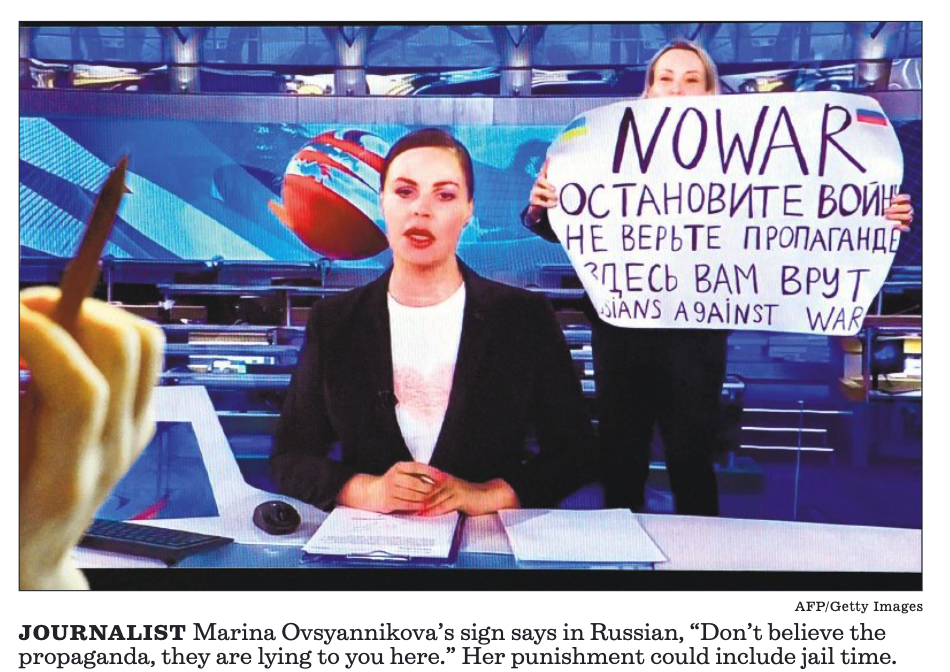

- Protesting journalist who interrupted Russian state TV faces jail term. Marina Ovsyannikova, an employee of Russian state television, was released from custody and fined about $270, but could still face a prison sentence over her anti-war protest on live TV. Ovsyannikova, whose father is Ukrainian and her mother Russian, spent the night in police custody and said she was interrogated for 14 hours.

— Market impacts:

- Oil markets: Russia’s invasion of Ukraine is likely to deal a severe blow to the global economy, something which could weigh on demand for oil, but the rapidly evolving situation made gauging the impact challenging, the Organization of the Petroleum Exporting Countries said Tuesday.

- Double whammy: Russia’s ban on exports could affect about 15% of global trade in solid finished fertilizers, hitting the market for smaller bulk ships.

- Saudi Arabia is in talks with China for yuan-based oil sales, per a Wall Street Journal report (link), which could deal a blow to the global dominance of the US dollar. For decades, the world's top oil exporter has traded crude exclusively in dollars, but a new agreement with China threatens to upend the status quo. About 80% of global oil sales are done in dollars, and the Saudis have used only U.S. dollars since 1974. Yuan-based transactions would bolster China's currency at the expense of the dollar. Crown Prince Mohammed bin Salam reportedly snubbed Biden's request to discuss oil last week.

- Caterpillar is still using Russia as a supply route after the company said it had suspended business with the country, Bloomberg reports (link). An internal document outlining Caterpillar’s logistics and supply-chain activities, seen by Bloomberg, says the company’s rail shipments crossing Russia between Europe and China are operating as normal. Caterpillar began relying more on rail freight through Russia in 2021 when ocean freight became exceedingly tight and costly.

- Norway will export more natural gas in the coming months, aiming to soften the blow of Europe’s energy crunch. Equinor, the state energy company, announced that two of its oil-and-gas fields will between them be allowed to increase gas exports by around 1.4 billion cubic metres, which it says will meet the “gas demand of around 1.4 million European homes” this year.

- A major German power supplier warned against banning Russian energy imports, and European car plants are suffering a shortage of Ukraine-made components.

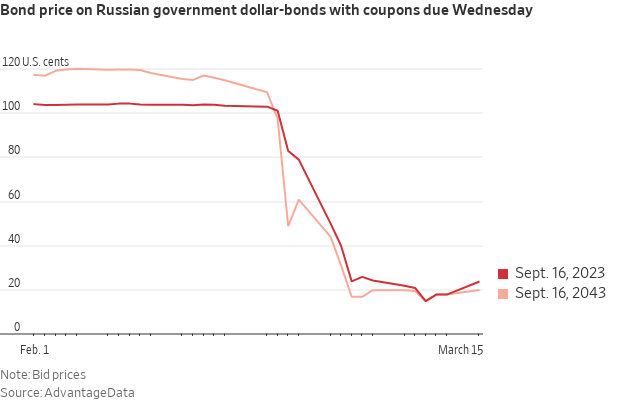

- Russia’s government has a big set of interest payments due to foreign bondholders on Wednesday, setting the stage for the nation’s first default since 1998 and its first default on foreign debt since the Bolshevik Revolution. (There is a 30-day grace period.)

|

PERSONNEL |

— Raskin withdraws nomination to be vice chair of the Federal Reserve. Earlier on Tuesday, Senate Minority Leader Mitch McConnell (R-Ky.) called on the White House to replace Sarah Bloom Raskin with a different nominee to become the Federal Reserve’s top bank regulator. She then withdrew and Biden pulled the nomination. “President Biden’s selection wildly — wildly — missed the mark,” McConnell said in a floor speech. Raskin faced bipartisan opposition and was dealt a heavy blow on Monday after she lost the backing of Centrist Democratic Sen. Joe Manchin of West Virginia. Also, two leading Senate Republican moderates, Susan Collins of Maine and Lisa Murkowski of Alaska, have signaled their opposition to Raskin’s nomination.

Of note: Raskin, in a letter to President Biden asking to withdraw her nomination, wrote: “We are entering an era of financial economic war, inflation and climate transition. These risks cannot be dismissed for political reasons, certainly at this moment when the possibilities of mitigating them still exist.”

— USTR agricultural trade negotiator nominee said to withdraw. Politico is reporting that Elaine Trevino will be withdrawn as the Biden administration nominee to be the chief agricultural negotiator at the Office of the US Trade Representative (USTR) due to unspecified “paperwork issues.” However, they reported Trevino has accepted another administration position working on supply chain issues affecting agriculture. Trevino had been nominated six months ago but had not yet had a confirmation hearing before the Senate Finance Committee.

Another agricultural trade-related post — USDA Undersecretary for Trade and Foreign Agricultural Affairs — also remains vacant despite USDA Secretary Tom Vilsack several months ago stating they were vetting an individual to take the role. Reports indicate that person withdrew from the process due to requirements the person would have to divest a significant level of financial holdings.

Upshot: This continues to raise questions on the trade front relative to the Biden administration and for agricultural trade in particular.

— The Senate confirmed Shalanda Young on Tuesday to be the director of the Office of Management and Budget, the first Black woman to hold the position.

|

CHINA UPDATE |

— China will support capital markets to boost economy. China will keep its capital markets stable, Xinhua news cited Vice Premier Liu He as saying at a meeting of the Financial Stability and Development Committee under the State Council. “All policies that have a significant impact on capital markets should be coordinated with financial management departments in advance to maintain the stability and consistency of policy expectations,” Liu said. Beijing will take measures to boost the economy in the first quarter and monetary policy should embark on initiatives to support the economy, he noted. China also will take forceful and effective measures to prevent and resolve risks in its property sector.

New-home prices in China fell for a sixth consecutive month in February, as authorities’ efforts to ease policy restrictions for developers and boost buyer sentiment have yet to take effect.

— Foxconn Technology Group, Apple’s biggest iPhone assembler, said it restarted some production at its factories in Shenzhen after a Covid-19 outbreak and a city lockdown this week led the company and other manufacturers to suspend operations there.

|

TRADE POLICY |

— USTR Tai sees room for more ag exports to South Korea. “There is still room to grow the market in Korea for U.S. agricultural products — including creating a regulatory environment that facilitates access to agricultural biotechnologies,” U.S. Trade Representative Katherine Tai said. “Innovation in agricultural production will be critical to helping farmers adapt to climate change, and we look forward to working with Korea in its capacity as a global powerhouse of scientific and technological innovation,” Tai said at an event hosted by the U.S. Chamber of Commerce on the 10th Anniversary of the U.S./Korea Free Trade Agreement.

- The value of the goods and services the U.S. has exported to South Korea has grown by more than 17% to almost $70 billion.

- U.S. exported $3.2 billion worth of American-made cars and trucks to South Korea, making the Asian nation the fifth-largest export market for automobiles.

- U.S. agricultural exports to South Korea reached a record $9.4 billion in 2021, making Korea the fifth-largest export destination for U.S. agriculture.

- South Korea became the top destination for U.S. beef and beef products by volume and value in 2021, amounting to $2.38 billion — also a record.

— U.S., U.K. to hold trade and investment talks next week. U.S. Trade Representative Katherine Tai and U.K. Secretary of State for International Trade Anne-Marie Trevelyan are set to meet March 21-22 in Baltimore to start U.S./UK Dialogues on the Future of Atlantic Trade, according to the Office of the U.S. Trade Representative (USTR). USTR said the talks would “explore how the United States and United Kingdom can collaborate to advance mutual international trade priorities” and promote “innovation and inclusive economic growth.” The talks will also include “a diverse group of national and local stakeholders,” but the agency did not indicate who the stakeholders are. An official with the Office of the US Trade Representative (USTR) told Dow Jones that it has not been determined if the two sides will restart free trade agreement negotiations with the U.K., talks that began under the Trump administration but have been on hold under the Biden administration as part of its trade policy to focus on enforcement of existing trade agreements as opposed to negotiating new ones.

|

ENERGY & CLIMATE CHANGE |

— White House Climate Task Force tries to temper rising gas prices. The White House on Tuesday released the readout of Monday’s meeting of the National Climate Task Force. The White House says National Climate Advisor Gina McCarthy convened the tenth meeting of the National Climate Task Force with Cabinet members and senior leadership from across the Biden-Harris administration. The Task Force focused on how agencies can “continue supporting the president’s commitment to addressing Putin’s Price Hike from his unprovoked war against Ukraine, minimizing pain at the pump here at home, continue rapidly deploying clean energy, and keep reducing emissions that cause climate change.”

— White House press secretary says year-round E15 an ‘option’ to bring down gasoline prices. The Biden White House is mulling several options to address gasoline prices which surged to a record level recently, with White House Press Secretary Jen Psaki saying the possibility of allowing year-round sales of E15 fuel is “in the menu of options” being looked at. She said no decisions have been made but ensuring more oil supply on the market is “a big priority and a focus.” Her comments on year-round E15 came in response to a question from reporters on a recent letter by a bipartisan group of senators that urged the White House to allow year-round sales of the higher ethanol blend. A regulation taking that step was vacated by the U.S. Court of Appeals for the DC Circuit, and the U.S. Supreme Court also denied a petition from the biofuel industry to reconsider the lower court ruling.

National Climate Advisor Gina McCarthy convened the tenth meeting of the National Climate Task Force with Cabinet members and senior leadership from across the Biden-Harris administration.

— Growth Energy calls on DOE’s Granholm to ‘correct the record’ on recent University of Wisconsin study on environmental impacts of corn-based ethanol. Energy Secretary Jennifer Granholm is being challenged to “correct the record” relative to a recently released University of Wisconsin-Madison study on corn-based ethanol that indicated carbon emissions of corn ethanol could be 24% higher than from the equivalent amount of gasoline. Growth Energy CEO Emily Skor made the request in a letter to Granholm as the study authors said it was partly funded by the Department of Energy (DOE). Among other studies pointed to by Skor, the letter noted that DOE’s Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model has “been tracking corn ethanol’s lifecycle analysis impacts since 1996 and has drawn starkly contrasting conclusions” to the Wisconsin study. “In its most recent iteration, GREET shows that corn ethanol has roughly 40% lower carbon emissions than traditional petroleum gasoline,” the letter said. Link to letter.

Skor called on Granholm to “make clear” that the University of Wisconsin study is “both inconsistent with and subordinate to the DOE’s GREET model, and that the Department did not specifically fund this study, but instead, provided a grant related to the broader work of dedicated bio-energy crops performed at the University of Wisconsin. Further, we ask the Department to evaluate if this work violated the $115 million award provided by DOE to run from 2017-2022.”

Skor also said failing to address “inconsistencies” from other studies could have a negative impact on efforts to decarbonize the transportation sector.

Bottom line: It is not clear that DOE will act on the Growth Energy request, but it underscores the furor created in the biofuel sector from the study in question.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— EPA seeks additional comments on collecting information from meat and poultry products industry. EPA has published a notice (link) in the Federal Register which reopens the comment period for 30 days on its plan to collect information from the meat and poultry products (MPP) industry. EPA had previously sought comments on this new information collection request in the November 19, 2021, Federal Register. That initial action had a 60-day comment period. EPA is now requesting comments by April 15. EPA is looking to gather data from MPPs to “obtain a robust dataset that characterizes wastewater generation, treatment, and discharge from MPP facilities,” saying the effort is an “essential portion of the rulemaking process, necessary for EPA to determine appropriateness of current regulations.”

— Iowa ag-gag law overturned. Iowa violated the free-speech guarantee of the Constitution by enacting a law that criminalized deceptive access by animal rights activists to factory farms, ruled U.S. District Judge Stephanie Rose. Link for details.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 461,778,416 with 6,052,131 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,587,004 with 966,470 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 557,407,604 doses administered, 216,767,955 have been fully vaccinated, or 66.03% of the U.S. population.

— Second gentleman Doug Emhoff tested positive for Covid-19 on Tuesday, according to a statement from the vice president’s office. Vice President Harris’ deputy press secretary Sabrina Singh said, “Earlier today, the Second Gentleman tested positive for Covid-19. ... Out of an abundance of caution, the Vice President will not participate in tonight’s event. The Vice President tested negative for Covid-19 today and will continue to test.” Emhoff said on Twitter, “I tested positive for Covid. My symptoms are mild and I’m grateful to be both vaccinated and boosted. ... If you have yet to get vaccinated and boosted, please don’t wait.”

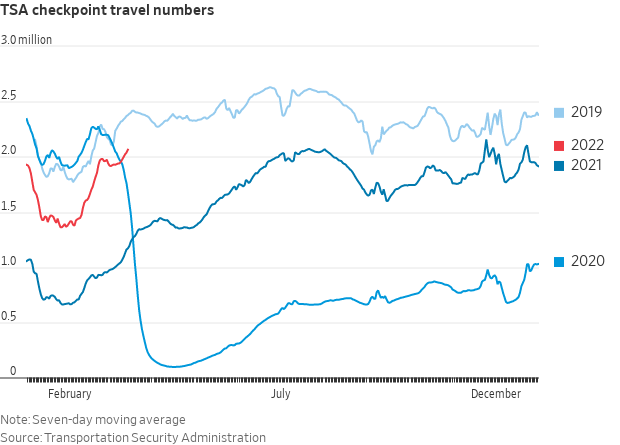

— Air travel rebounds to pre-pandemic levels. U.S. travelers spent an estimated $6.6 billion on domestic flights last month, 6% more than in February 2019. Airlines reported rising daily ticket sales, but fear headwinds from higher fuel prices.

— Pfizer and BioNTech seek U.S. approval for a second booster shot. The drugmakers argue that another dose would help protect those 65 and older against infection from the coronavirus, not just hospitalization.

|

POLITICS & ELECTIONS |

— Roughly half of Americans doubt President Biden will seek re-election in 2024, a new WSJ poll found (link). Among Democrats, 41% said they think he will run again, 32% that he won’t; 26% were unsure. Interviews in recent weeks with dozens of voters, activists and local officials in top battleground states, along with poll respondents, found a degree of ambivalence and uncertainty over whether Biden, 79 years old, should seek another term. The interviews also showed a lack of consensus on who should succeed him as party standard-bearer should he retire.

|

CONGRESS |

— Saving daylight-saving time. The Senate on Tuesday passed legislation that would make daylight-saving time permanent starting in 2023, ending the twice-annual changing of clocks in a move promoted by supporters advocating brighter afternoons and more economic activity. The bill, titled the “Sunshine Protection Act,” was co-sponsored by Sens. Marco Rubio (R-Fla.) and Sheldon Whitehouse (D-R.I.). Rubio cited increased heart attacks and car wrecks during standard time and said permanent daylight-saving time would allow more sunlight at the end of the day for things like sports. As for the House, reports indicate that the office of Majority Leader Steny Hoyer (D-Md.) said they would examine the Senate bill closely and discuss it with members. House Minority Leader Kevin McCarthy (R-Ind.) indicated he would support the Senate bill and indicated many Republicans would. The last time that nationwide DST was put in place was January 6, 1974, in the wake of the energy crisis. While some 79% of Americans approved of the move in December 1973 when the legislation passed, that dropped to 42% just three months later and the move was repealed in October 1974. The situation saw the sun rise around 8:30 a.m., meaning school children were embarking for classes in darkness.

|

OTHER ITEMS OF NOTE |

— Russia: Biden officials have guaranteed sanctions won’t impact Iran nuclear deal. Bloomberg reports (link) that Russia said the U.S. has provided “written guarantees” that sanctions imposed over the invasion of Ukraine won’t affect its nuclear supply agreements with Iran, potentially clearing the way for a resumption of talks to revive the 2015 atomic accord. Talks had been suspended amid deepening tensions between the Kremlin and the White House. Washington reportedly would not sanction Russian participation in nuclear projects that are part of the deal, formally called the Joint Comprehensive Plan of Action (JCPOA), when it is fully implemented, an official said on condition of anonymity. Meanwhile, Russian Foreign Minister Sergei Lavrov said U.S. suggestions that Moscow was blocking efforts to revive the Iran nuclear deal were untrue, following talks with his Iranian counterpart Hossein Amirabdollahian in Moscow.”

— A North Korean test launch failed today, South Korea’s military said, a type of stumble that Pyongyang has largely avoided in recent years.

— Stuck Ship: The Ever Forward, an Evergreen Marine boxship, has run aground in the Chesapeake Bay. It isn’t blocking any vessels from moving in and out of the Port of Baltimore.

— Costly Lesson: School-bus cameras are increasingly being used as a traffic-surveillance tool, generating millions of dollars from tickets as high as $500 for drivers who pass a bus illegally.