Oil and Gold Markets Flashing V-Tops

Continued signs of U.S. inflation as Tesla again raises prices

|

In Today’s Digital Newspaper |

Russia resumed Kyiv strikes as European leaders head to the Ukrainian capital. In occupied parts of southern Ukraine, Russian forces are killing civilians and looting stores and homes, residents said, as Moscow arrested elected local leaders and sought to replace them with pro-Russian collaborators.

The U.S. is adding 11 Russian defense officials and arm-industry figures to its sanctions list, while the European Union agreed on a fourth set of sanctions against Russia.

Reports suggest that Moscow asked China for surface-to-air missiles, drones and armored vehicles as the lingering invasion exhausts its resources. The Kremlin denied the reports, saying it has ample supplies, while a Chinese spokesman also rejected the "malicious" rumors as "disinformation" before U.S. and Chinese officials met Monday. At the meeting, the White House warned Beijing not to bail out strategic ally and trading partner Russia, with a pending default on the cards for the nation.

Ukrainian President Volodymyr Zelensky plans to take his case for more military gear directly to Congress on Wednesday, as many lawmakers are urging the White House to move more aggressively against Russia.

China’s economy got off to a better-than-expected start this year as factories churned out more goods and consumers spent more than anticipated. But this week China locked down the key manufacturing regions of Shenzhen and Changchun due to fresh outbreaks of Covid-19 cases in those cities. Apple shed 2.7% as the lockdown in China disrupted manufacturing by a key supplier. Meanwhile, China wants to avoid being impacted by U.S. sanctions over Russia’s war.

A better-than-expected Producer Price Index report this morning is helping lead U.S. equities higher.

Continued signs of U.S. inflation as the latest increases saw Tesla raise prices for all its American (and Chinese) models by 5%-10%. Its cheapest vehicle, the Model 3 Rear-Wheel-Drive, even went up $2,000 to $46,990.

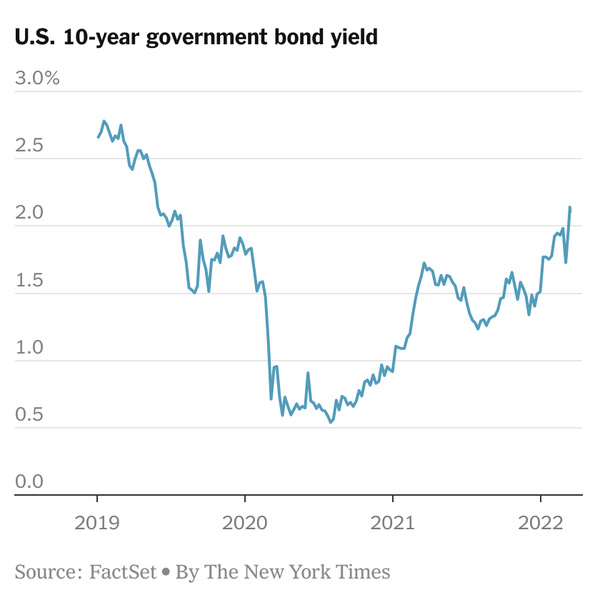

The yield on 10-year Treasury notes rose to 2.139% Monday, their highest level since June 2019, and about four times higher than its pandemic low point in 2020.

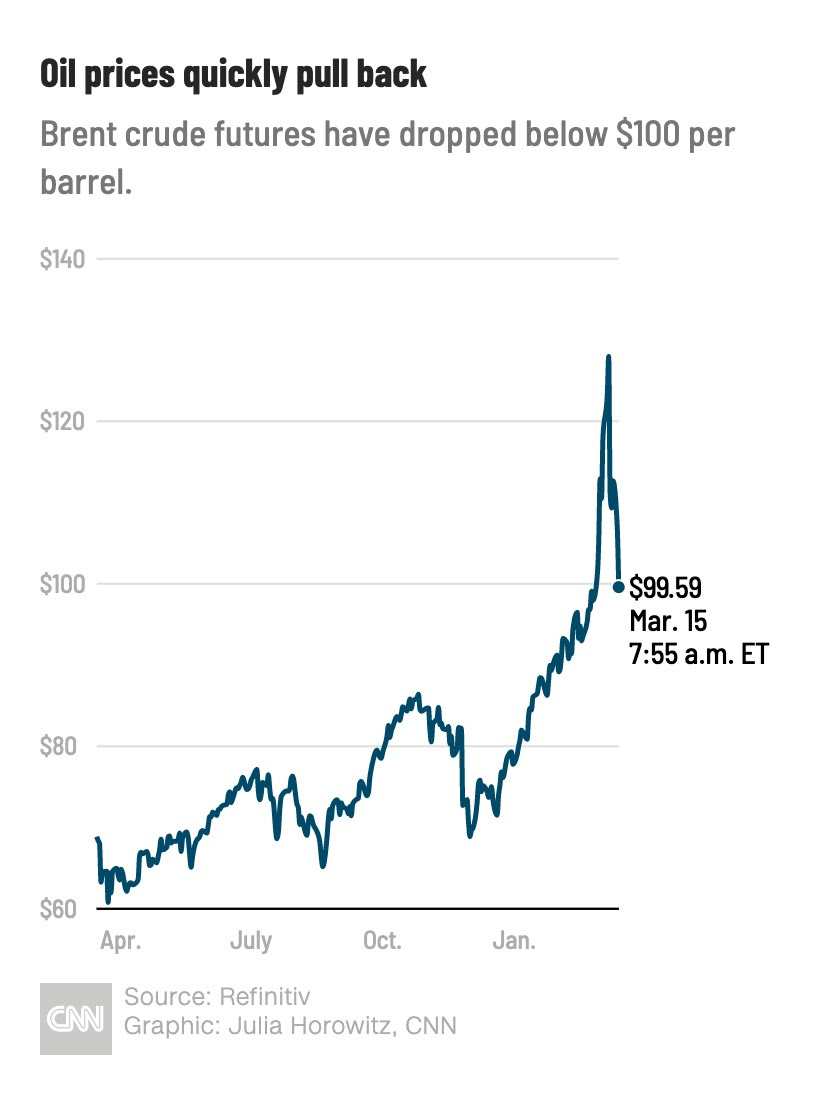

A V-top in oil is being cited by some analysts. Brent crude futures, the global benchmark, have cratered almost 30% from their peak. They're trading below $100 per barrel after shedding another 7% on Tuesday. However, the IEA chief says the risk of further oil price spikes persists.

The London Metal Exchange plans to resume nickel trading on Wednesday and cap price moves

U.S. agricultural imports hit a new record in January. Given the improving U.S. economy, the import forecast is potentially too low while the export forecast could be somewhat optimistic. USDA’s next update of the export outlook is due May 26. Detail below.

President Biden’s pick for the Fed’s top banking regulator is facing stiff odds after centrist Sen. Joe Manchin (D-W.Va.) said he couldn't support Sarah Bloom Raskin’s nomination, citing her views on addressing climate change.

Energy policy: House Democrats urge Biden to push for climate spending this year while senators from key oil and renewable fuel production states urged the president to stop pressuring the Postal Service to shift to electric vehicles.

In the livestock sector, additional bird flu finds confirmed and USDA approved faster line speeds at three pork plants.

Iran's foreign minister visits Moscow to discuss nuclear deal while GOP senators threaten to cancel a revived Iran nuclear deal.

|

MARKET FOCUS |

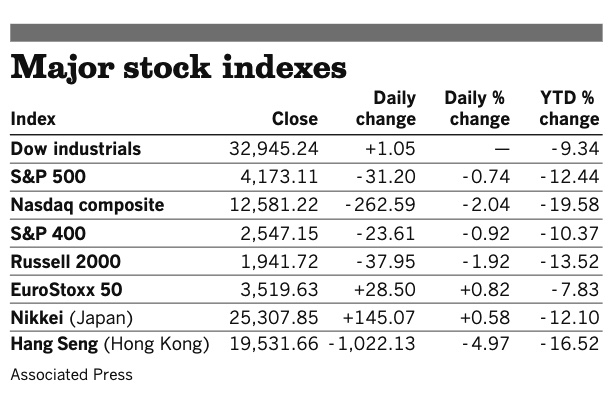

Equities today: Global stocks markets were mostly lower overnight. U.S. stock indexes are pointed toward higher openings. The Hang Seng Tech Index had its most volatile day ever. The Hang Seng China Enterprises Index, which tracks Chinese shares listed in Hong Kong, sank 6.6%. The moves are driven by China locking down more cities to contain the latest coronavirus outbreak, or concerns about the country's ties with Russia. The country’s benchmark bond yield rose the most in five months after the People’s Bank of China surprised markets when it didn’t cut the rate on its one-year medium-term lending facility. Asian equity markets finished mostly lower as the Russia/Ukraine situation remains in focus. Japan’s Nikkei was the exception, rising 38.63 points, 0.15%, at 25,346.48. The Hang Seng Index dropped 1,116.58 points, 5.72%, at 18,415.08. European equities are registering declines in early trading but have lifted off their lows in most markets. The Stoxx 600 was down 0.8% with regional markets down 0.1% to more than 1%.

U.S. equities yesterday: The Dow eked out a gain of 1.05 points, 0.00%, at 32,945.24. The Nasdaq fell 252.59 points, 2.04%, at 12,581.22. The S&P 500 declined 31.20 points, 0.74%, at 4,173.11.

U.S. crude futures on Monday slid 6.75% to $101.95 per barrel, while the international Brent benchmark fell 5.86% to $106.06 per barrel. West Texas Intermediate briefly dipped below $100, trading below that level for the first time since Feb. 24.

Agriculture markets yesterday:

- Corn: May corn fell 14 1/4 cents to $7.48 1/4. December corn fell 2 3/4 cents to $6.52 1/2.

- Soy complex: May soybeans fell 5 1/2 cents to $16.70 1/2, the contract’s lowest settlement since $16.59 1/2 on March 7. May soymeal rose $7.20 to $484.30 per ton, a lifetime-high close for the contract. May soyoil fell 208 points to 73.95 cents per pound.

- Wheat: May SRW wheat rose 10 1/4 cents to $10.96 1/4. May HRW wheat rose 10 3/4 cents to $11.00. May spring wheat futures ended unchanged at $10.70 1/4.

- Cotton: May cotton futures fell 226 points to 118.77 cents per pound.

- Cattle: April live cattle firmed $3.025 to $140.325, the highest closing price since March 1. April feeders jumped $4.425 to $162.40. USDA reported cash steers traded mostly $2 to $4 higher, with feeder heifers $3 to $6 higher

- Hogs: April lean hogs fell 52.5 cents to $102.20. The CME lean hog index quote firmed 85 cents and is projected up 7 cents at $100.83 for Tuesday, a six-month high.

Ag markets this morning: Wheat firmer, corn and soybeans weaker overnight. Pro Farmer notes that w\Wheat futures traded higher but have come well off their overnight highs this morning, while corn and soybeans faced followthrough selling. As of 6:30 a.m. CT, corn is trading 11 to 13 cents lower, soybeans are mostly 22 to 28 cents lower, SRW wheat is mostly 6 to 11 cents higher, HRW wheat is 2 to 8 cents higher and spring wheat is 10 to 18 cents higher. Front-month U.S. crude oil futures are more than $8 lower and the U.S. dollar index is down around 200 points this morning.

On tap today:

• U.S. Producer Price Index for February is expected to increase 0.9% from the prior month. (8:30 a.m. ET) UPDATE: The PPI for final demand increased 0.8% after accelerating 1.2% in January, the Labor Department said. In the 12 months through February, the PPI climbed 10% after a similar gain in January. The data does not capture the surge in prices of oil and other commodities, like wheat, following Russia's invasion of Ukraine on Feb. 24.

• New York Fed's Empire State manufacturing survey is expected to rise to 5.5 in March from 3.1 one month earlier. (8:30 a.m. ET)

• European Central Bank President Christine Lagarde speaks at the 31st WELT Economic Summit in Berlin at 11:15 a.m. ET.

• Federal Reserve begins its two-day policy meeting (FOMC).

January ag trade data; U.S. agricultural trade totals for January 2022

- Exports: $15,876,856,376.00

- Imports: $15,697,726,239.00

- Trade Balance: $179,130,137.00

U.S. agricultural imports hit new record in January. U.S. imports of agricultural products hit $15.7 billion in January, up more than $1 billion from December and setting a fresh record. U.S. agricultural exports were at $15.88 billion, down $660 million from December, resulting in a trade surplus of just $179.1 million. The prior record for imports came in November 2021 at $15.41 billion. That puts total U.S. agricultural exports so far in fiscal year (FY) 2022 at $68.49 billion, ahead of the year-ago pace of $63.09 billion. But U.S. agricultural imports are already at $60.56 billion compared with $50.43 billion at this point in FY 2021. The accumulated trade surplus so far in FY 2022 is at $7.92 billion, well below the $12.66 billion seen at this point in FY 2021. To meet USDA’s forecast for US agricultural exports of $183.5 billion for FY 2022, exports need to run at $14.37 billion monthly through September. In the final eight months of FY 2021, U.S. agricultural exports were under that level five months. To hit USDA’s forecast of $172.5 billion in agricultural imports, they need to be at $13.99 billion monthly through September. In the February-September period in FY 2021, imports were below $14 billion only one month. Given the improving U.S. economy, that suggests the import forecast is potentially too low while the export forecast could be somewhat optimistic. USDA’s next update of the export outlook is due May 26.

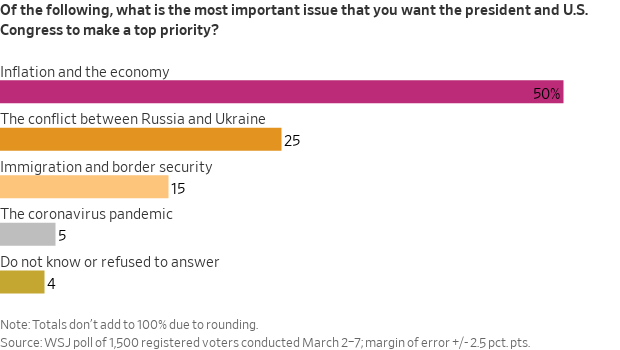

Almost two-thirds of U.S. voters think the economy is headed in the wrong direction. Jobs are plentiful, wages are rising and home values are up. The problem: inflation. Overall, 58% of participants in a Wall Street Journal poll (link) said inflation was causing them major or minor financial strain, up slightly from 56% in a similar survey taken in mid-November.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly weaker ahead of U.S. economic data, with a mostly higher tone in foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note was lower to trade around 2.11% amid a mixed tone in global government bond yields. Gold and silver are seeing sizable losses ahead of U.S. economic updates, with gold falling to $1,930 per troy ounce and silver to $24.90 per troy ounce.

• Crude oil futures are under significant pressure ahead of U.S. trading, with U.S. crude under $95 per barrel and Brent under $99.50 per barrel. Futures were lower in Asian action with U.S. crude around $98.60 per barrel and Brent around $102 per barrel.

• A bearish V-top in crude? Crude oil is down over $35 from its high.

• IEA chief says the risk of further oil price spikes persists. International Energy Agency (IEA) Executive Director Fatih Birol told the Washington Post Monday (March 14) the worst may not be over yet for oil prices. “I think [whether] the worst is over or not will be depending on A, what will be the next steps of Russia continuing with the aggression or not, politically, and also in the energy sector,” Birol said. “Russia is today the top oil exporter of the world and the top natural gas exporter of the world, and as such, the aggression of Russia and the decision taken by the international community to ban or reduce the Russian energy imports do have major implications for the energy balances.” Given the current situation, Birol said it was “too optimistic to say that the worst is over” now. Oil demand could surge in the coming months, Birol said, but he said there may be a “stronger” supply boost “from Canada, from Brazil and hopefully, from some OPEC countries, from, I imagine, Saudi [Arabia] and [the United Arab] Emirates,” to help offset it. Birol also said he believes the situation caused by the Russian invasion of Ukraine could lead countries to rework their energy strategies and accelerate green transition plans, noting the policy emphasis placed on energy efficiency and the deployment of nuclear power after the 1970s energy crisis.

• Also a top for gold?

• Several U.S. states are working on measures to temporarily roll back their gasoline taxes as pump prices soared past $4 a gallon. Lawmakers in Maryland are scheduled to hold a hearing today on a bill that would suspend the state’s approximately 37 cents-per-gallon gas tax for 30 days and has the support of Gov. Larry Hogan. Georgia’s House of Representatives has passed a similar measure, and Florida imposed a one-month suspension that takes effect after the tourist season.

• Nickel trading will resume on the London Metal Exchange on Wednesday, over a week after being suspended amid a historic short squeeze, after the tycoon at the center of the crisis reached a deal with his banks. Xiang Guangda, whose large short position roiled the market last week, has secured a standstill agreement to avoid further margin calls, reducing the risk that the squeeze is repeated when the market reopens. The exchange, in a statement, also outlined new rules to prevent extreme price moves in nickel and other metals.

• The Cass Freight Index for expenditures in February, at 4.453, is up 42.2% from the year before and 10.6% from January.

• High global wheat prices seen through 2023: IFPRI analysts. There are no quick replacements for Ukraine and Russia in global wheat production, said five IFPRI analysts on Monday. "Even under the most optimistic assumptions, global wheat prices will remain high throughout 2022 and the trend is likely to persist through 2023, given limits on expanding production." Link for details.

• Ag demand: South Korea tendered to buy up to 210,000 MT of corn to be sourced from the U.S., South America, South Africa or the Black Sea/eastern Europe. Japan is seeking to buy 104,483 MT of wheat in its weekly tender.

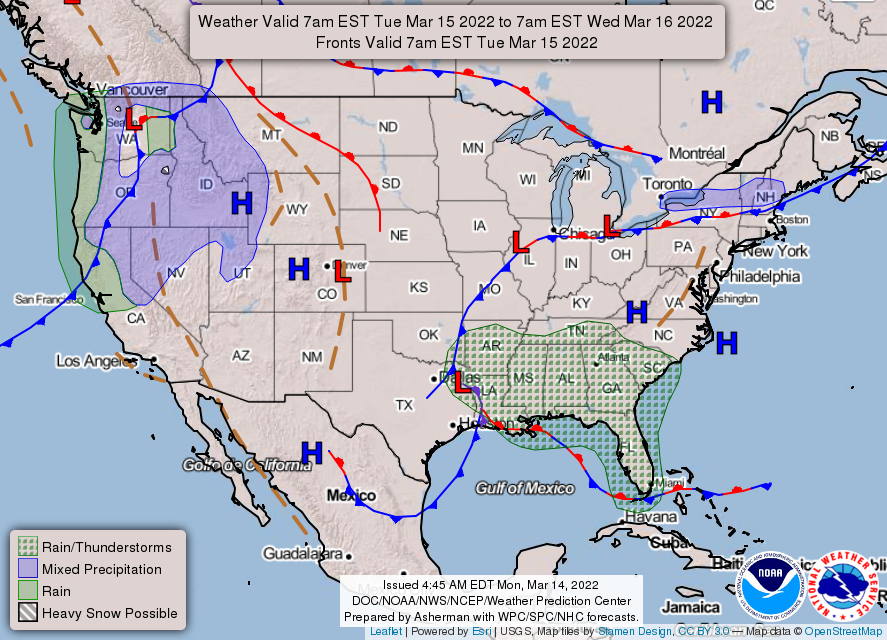

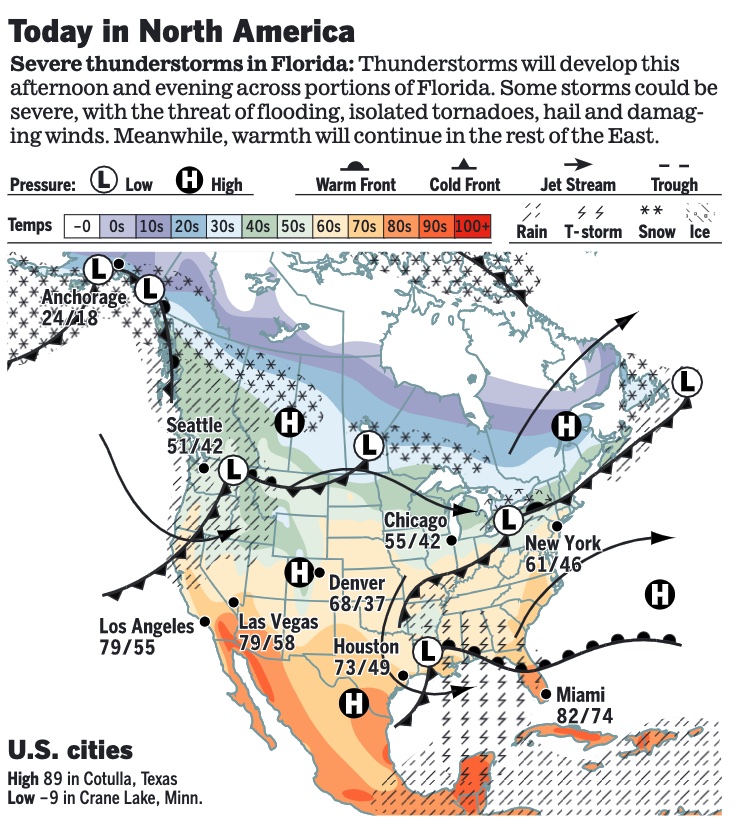

• NWS weather: Severe weather possible over Northeast Texas and the ArkLaTex on Monday and across northern Florida through Tuesday morning... ...Critical fire weather conditions across portions of the Southern High Plains today... ...Additional heavy precipitation possible across the Northwest Monday into Tuesday and across northern Florida Tuesday into Wednesday.

Items in Pro Farmer's First Thing Today include:

• Wheat firmer, corn and soybeans weaker overnight

• NOPA crush expected to drop from January but be above year-ago

• Consultant trims Brazil soybean crop estimate

• China keeps medium-term policy rates unchanged

• USDA approves faster line speeds at three pork plants (details below)

• Beef prices firm, but movement light

• CME lean hog index firms again

|

RUSSIA/UKRAINE |

— Summary: Peace talks between Russian and Ukrainian officials will resume today via videoconference as Russia continues its assault on Ukrainian cities with artillery and missile fire. The discussions began on Monday but yielded no major outcomes. Russian forces widened their bombardment of Kyiv and other cities, and the U.S. warned China over its deepening alignment with an isolated Russia. António Guterres, the secretary general of the U.N., said Ukraine was “being decimated before the eyes of the world.” He warned of a calamitous cascade of world hunger and food inflation, given Ukraine’s role as one of the world’s major grain producers. The impact on civilians, Guterres said, was “reaching terrifying proportions.” Meanwhile, the leaders of three East European EU member states are making an unexpected trip to the Ukrainian capital this morning for talks with President Volodymyr Zelenskyy. A Ukrainian government adviser claimed the war would end “no later than” in May. Oleksiy Arestovich suggested either a peace deal would be struck within the next two weeks or the Ukrainian armed forces would grind down Russia by the end of April. Earlier, the Kremlin said Russia could soon storm and take control of major Ukrainian cities.

- Zelenskyy to speak to Congress. Ukrainian President Volodymyr Zelensky will virtually address the House and Senate Wednesday at 9 a.m. ET. The speech will be fed to TV networks. The speech is only open to members of Congress — no aides. He will speak in an open setting to the Canadian parliament Tuesday.

- The White House is considering having President Joe Biden travel to Europe in the next few weeks to talk about Ukraine with allies, NBC News reported.

- U.S./China talks. The first high-level talks between U.S. and China since Russia’s invasion of Ukraine were described as “substantial,” but no specific outcomes were announced. U.S. national security adviser Jake Sullivan and Chinese Communist Party Politburo member Yang Jiechi met for seven hours on Monday in Rome, including “substantial discussion” of Russia’s war against Ukraine. If China extends military or other aid to Russia in violation of U.S. and international sanctions, it will face unspecified “significant consequences,” White House press secretary Jen Psaki said. U.S. officials said Russia asked China for military equipment and economic aid, which Moscow and Beijing both denied. The U.S. has warned European allies that Russia asked China for armed drones in late February as it was beginning its invasion of Ukraine.

- The Russian central bank said it would stop purchasing gold from banks amid a spike in demand from Russian people.

- Major banks fret Moscow-linked hackers will attack the SWIFT payments system in reprisal for sanctions on Russia.

- A woman holding a placard reading “Stop the war”, and telling Russian people they were being lied to, interrupted the evening news program on Channel One — one of Russia’s most-watched stations. She was later identified as Marina Ovsyannikova, an editor at the channel who has Ukrainian and Russian parents. Ovsyannikova has reportedly been arrested. It was a rare breach of the Kremlin’s control of state news.

— Market impacts:

- Bayer threatens to halt crop supplies to Russia over Ukraine invasion, but essential products delivered this season. Bayer has threatened to suspend crop supply sales to Russia next year unless the country stops its attacks on Ukraine. Bayer said it had already provided essential products to Russia for this year’s growing season to ease pressures on global food supply but would decide on 2023 crop supplies to the country depending on the situation in Ukraine. “We will closely monitor the political situation and decide about supplies for 2023 and beyond at a later stage, depending on Russia stopping its unprovoked attacks on Ukraine and returning to a path of international diplomacy and peace,” the company said in a statement on Monday.

- India is prepared to take advantage of high energy prices by purchasing deeply discounted oil offered from Russia, according to a Reuters report. “Russia is offering oil and other commodities at a heavy discount. We will be happy to take that,” one Indian official, who would not say how much oil was under consideration, told the news agency.

- More European sanctions on Russia. European Union member states have agreed on a fourth package of sanctions against Russia. Sanctions were set to include an import ban on Russian steel and iron, an export ban on luxury goods including cars worth more than 50,000 euros ($55,000), and a ban on investments in oil companies and the energy sector, according to diplomatic sources. Britain also said it would ban the export of luxury goods to Russia and impose a new 35% tariff on 900 million pounds ($1.2 billion) worth of Russian imports, including vodka, metals, fertilizers and other commodities.

- Tobacco group Imperial Brands to pull out of Russia. Imperial Brands has announced that it is pulling out of Russia entirely, becoming the latest large consumer brand to exit the country. The maker of Winston and Davidoff cigarettes said in a statement on Tuesday it had “begun negotiations with a local third party about a transfer of our Russian assets and operations.”

- President Vladimir Putin signed a law allowing Russian airlines to keep foreign aircraft for domestic flights.

- An extended conflict between Russia and Ukraine would hit the U.S. economy broadly, with all 50 states affected by the fallout, according to an analysis by Moody’s Analytics. While the U.S. has limited trade ties with Russia and Ukraine, businesses from beer breweries in Missouri to semiconductor plants in California would see an impact, as prolonged combat and even harsher sanctions constrict supplies and drive up global prices for oil and other critical materials.

|

POLICY FOCUS |

— CFAP 2 payouts edge higher. Total payments under the Coronavirus Food Assistance Program 2 (CFAP 2) were at $19.17 billion as of March 13, up from $19.15 billion the prior week, as original CFAP 2 payments increased to $14.34 billion from $14.32 billion the prior week. There was no major change in top-up payments which are at $4.83 billion. There was little change in CFAP 1 payments as of March 13, with those at $11.83 billion for total payments, $10.64 billion in original CFAP 1 payments while top-up payments were at $1.19 billion.

|

PERSONNEL |

— Manchin says he will not vote to confirm Fed nominee Raskin. CNBC reports on its website that Sen. Joe Manchin (D-W.Va.) said Monday that he opposes one of President Joe Biden’s nominees to the Federal Reserve, leaving her candidacy to join the central bank with the slimmest of hopes. “I have carefully reviewed Sarah Bloom Raskin’s qualifications and previous public statements. Her previous public statements have failed to satisfactorily address my concerns about the critical importance of financing an all-of-the-above energy policy to meet our nation’s critical energy needs,” Manchin said in a statement.” According to CNBC, “Manchin’s formal opposition all but dooms Raskin’s bid to be the Fed’s next vice chair for supervision.” CNBC notes that last week, Manchin “said that his own party should advance Biden’s four other Fed nominees without Raskin.”

Fed Chairman Jay Powell awaits being confirmed for another term as Fed chair, although he remains in the post as chair pro tempore.

— Shalanda Young is expected to be confirmed as OMB director after the Senate invoked cloture on her nomination Monday evening. Young, a former House aide, will be the first Black woman to hold that post. Nine Republicans voted for a procedural motion on her nomination last night.

|

CHINA UPDATE |

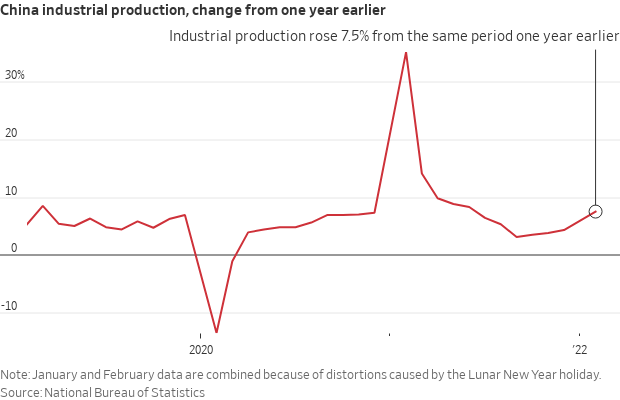

— Chinese industrial output rose 7.5% year-on-year in January and February as compared with a year earlier, higher than the 3.9% increase predicted by analysts in a Reuters poll. Retail sales in China for the first two months of the year also beat expectations, gaining 6.7% in January and February as compared with expectations for a 3% rise by analysts in a Reuters poll. However, China is currently facing its worst Covid-19 outbreak since the height of the pandemic in 2020, with major cities including Shenzhen rushing to limit business activity.

— China wants to avoid being impacted by U.S. sanctions over Russia’s war, Foreign Minister Wang Yi said. Concerns are growing among investors that Chinese companies will face U.S. sanctions after the US has told allies that China signaled its willingness to provide military assistance after Russia requested equipment, including surface-to-air missiles, to support its invasion of Ukraine. Washington had said that Russia had asked China for five types of equipment, including the missiles, drones, intelligence-related equipment, armored vehicles, and vehicles used for logistics and support. U.S. officials believe China is trying to help Russia while its top officials publicly call for a diplomatic solution to the war.

— The surge in Covid-19 cases led Chinese manufacturing hubs Shenzhen and Changchun to lock down in recent days, halting production at many electronics and auto factories in the latest threat to the world’s battered supply chain. Several manufacturers including Foxconn Technology Group, a major assembler of Apple’s iPhones, said they were halting operations in Shenzhen in compliance with the local government’s policy. While China’s case numbers are tiny by global standards, the country has adopted a zero-Covid policy that aims at reducing outbreaks through testing and lockdowns.

More than 40 Taiwan-based makers of semiconductors and other electronic components said they were suspending work in Shenzhen and nearby Dongguan. Logistics operators are warning of potential delays over the lockdowns in Shenzhen, a key export hub with the world’s fourth-largest container port. Vessels are moving and delays may amount to only a few days if the city opens up again by the weekend.

|

ENERGY & CLIMATE CHANGE |

— House Democrats urge Biden to push for climate spending this year. Some House Democrats are urging President Biden to revive efforts to salvage major clean energy investment legislation by resuming talks on his stalled domestic spending and tax package. “The more than $555 billion in climate investments in the House-passed Build Back Better Act can serve as the building block to restart negotiations,” over 80 House members told Biden a letter Monday morning (link). The letter, “led by Reps. Sean Casten (Ill.), Jamaal Bowman (N.Y.) and Nikema Williams (Ga.), includes signatures from the progressive and moderate sides of the House Democratic ranks,” and signals interest in moving clean energy legislation this year amid strong chances Republicans will retake the House and perhaps the Senate in the midterm elections.

— Senators from key oil and renewable fuel production states urged President Biden to stop pressuring the Postal Service to shift to electric vehicles, warning that the approach threatens to make the U.S. more reliant on critical minerals processed in China. The Biden administration’s focus on “a single technology mandate to reduce emissions from the transportation sector” overlooks “the overwhelming evidence of economic, environmental and security benefits of liquid motor fuels” produced in the U.S.,” Republican senators Chuck Grassley (Iowa) and John Cornyn (Texas) said in a letter (link).

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Restaurants are also passing on costs. Shake Shack is raising prices by 3% to 5% in March to offset inflation, on top of its 3% to 5% price increases in October. Wedbush analyst Nick Setyan took it off the firm’s Best Ideas list because of near-term challenges including higher food and fuel costs.

— Tyson Foods raised its prices and thrived during the pandemic. BMO Capital analyst Kenneth Zaslow expects a rapid return to more normalized beef margins, citing expanded U.S. beef processing capacity, more available labor, and tightening cattle supplies.

— Additional bird flu finds confirmed. USDA’s Animal and Plant Health Inspection Service (APHIS) has now confirmed a total of 34 cases of highly pathogenic Avian Influenza (HPAI), including additional cases in commercial poultry operations. That brings the case county in commercial flocks to 21. Cases have been confirmed in Cecil County, Maryland, in a flock of 664,061 commercial layer chickens; 36,000 turkeys in a flock in Charles Mix County, South Dakota; and a flock of 3 million commercial layer chickens in Jefferson County, Wisconsin. There was also another find a backyard mixed species (non-poultry) flock in Lincoln County, Maine. The additional confirmations have also resulted in more countries limiting imports of U.S. poultry.

— USDA approves faster line speeds at three pork plants. USDA approved faster line speeds at Clemens Food Group in Hatfield, Pennsylvania; Quality Pork Processors in Austin, Minnesota; and Wholestone Farms Cooperative in Fremont, Nebraska, as part of a pilot program. Plants approved for the trial program can operate at faster speeds for up to a year and are supposed to collect data on how line speeds affect workers. Nine plants were eligible to apply for the trial program because they were previously able to accelerate processing under the Trump-era rule.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 459,927,299 with 6,046,747 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,562,369 with 965,106 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 557,138,106 doses administered, 216,690,804 have been fully vaccinated, or 66.01% of the U.S. population.

New U.S. Covid-19 cases have declined 48% over the past two weeks to an average of 34,156, hospitalizations are below 30,000, and daily deaths are down 26% to 1,269.

— France lifted most Covid-19 restrictions Monday, abolishing the requirement for face masks in most settings and allowing unvaccinated people back into restaurants, sports arenas and other venues. It comes less than a month before the first round of the presidential election, scheduled for April 10.

|

CONGRESS |

— The Capitol will begin reopening to small groups of tourists, students, and business visitors by March 28, and could be fully open to the public by Labor Day, according to people familiar with the planning. The opening would mark a return to normalcy after the Capitol closed to the public in March 2020 because of concerns about the spread of Covid-19. Other restrictions at the Capitol, such as a mask rule in the House chamber, have recently been dropped. The details for the reopening emerged after a meeting between committees, Sergeants at Arms, and the U. S. Capitol Police.

|

OTHER ITEMS OF NOTE |

— Iran's foreign minister visits Moscow to discuss nuclear deal. Iranian Foreign Minister Hossein Amir-Abdollahian is in Moscow today to meet his Russian counterpart Sergey Lavrov as Tehran seeks to remove a new hurdle in its push to return to the 2015 nuclear deal and remove punishing sanctions. Moscow now demands its own sanctions carve-outs in return for any deal, but U.S. officials have pushed back against that maneuver. One Biden administration official said there was no “scope for going beyond” what has already been agreed in Vienna. The official said that the administration “would know within a week whether or not Russia is prepared to back down,” in comments to the Wall Street Journal.

— GOP senators threaten to cancel revived Iran nuclear deal. A group of Republican senators wrote the Biden administration Monday saying they wouldn’t support a simple revival of the 2015 Iran nuclear deal that would “weaken sanctions and lessen restrictions” on the country’s nuclear program. The letter was signed by 49 of the senate’s 50 GOP members, with only Rand Paul of Kentucky abstaining.” The senators fault the administration for not consulting with Congress on the negotiations and for not committing to submitting the deal to the Senate for review or for ratification as a treaty and raised the prospect of the deal being tossed by the next presidential administration, saying that “a major agreement that does not have bipartisan support in Congress will not survive.”