Dueling Sanctions: U.S. Bans Russian Oil, Putin Halts Exports of Key Products Until Dec. 31

New world disorder taking shape | USDA WASDE today | Wheat market volatility continues

|

In Today’s Digital Newspaper |

Tit-for-tat sanctions continue relative to Russia, with the latest being a U.S. executive order banning fresh energy purchases from Russia and a 45-day winding-down period for existing contracts. “Russian oil will no longer be accepted at U.S. ports,” President Biden said in a speech from the White House. “We will not be part of subsidizing Putin’s war.” Meanwhile, Russian President Vladimir Putin countered by announcing some bans of his own. The announcements came as Ukrainian President Volodymyr Zelenskyy delivered an impassioned speech via video link to the British Parliament, where he received a boisterous standing ovation. There are also signs that Ukraine is willing to move on its ambition for NATO membership, but that seems to have done nothing to reduce Russian attacks. Western allies have been attempting to equip Ukraine’s thinly spread and outmatched military, some of whose soldiers are without boots. Poland said it would immediately give its fleet of Soviet-made MiG-29 jet fighters to the U.S., but the Pentagon said that would raise concerns for NATO. U.S. intelligence agency chiefs said Russia will be hard-pressed to control territory and install a pro-Moscow regime.

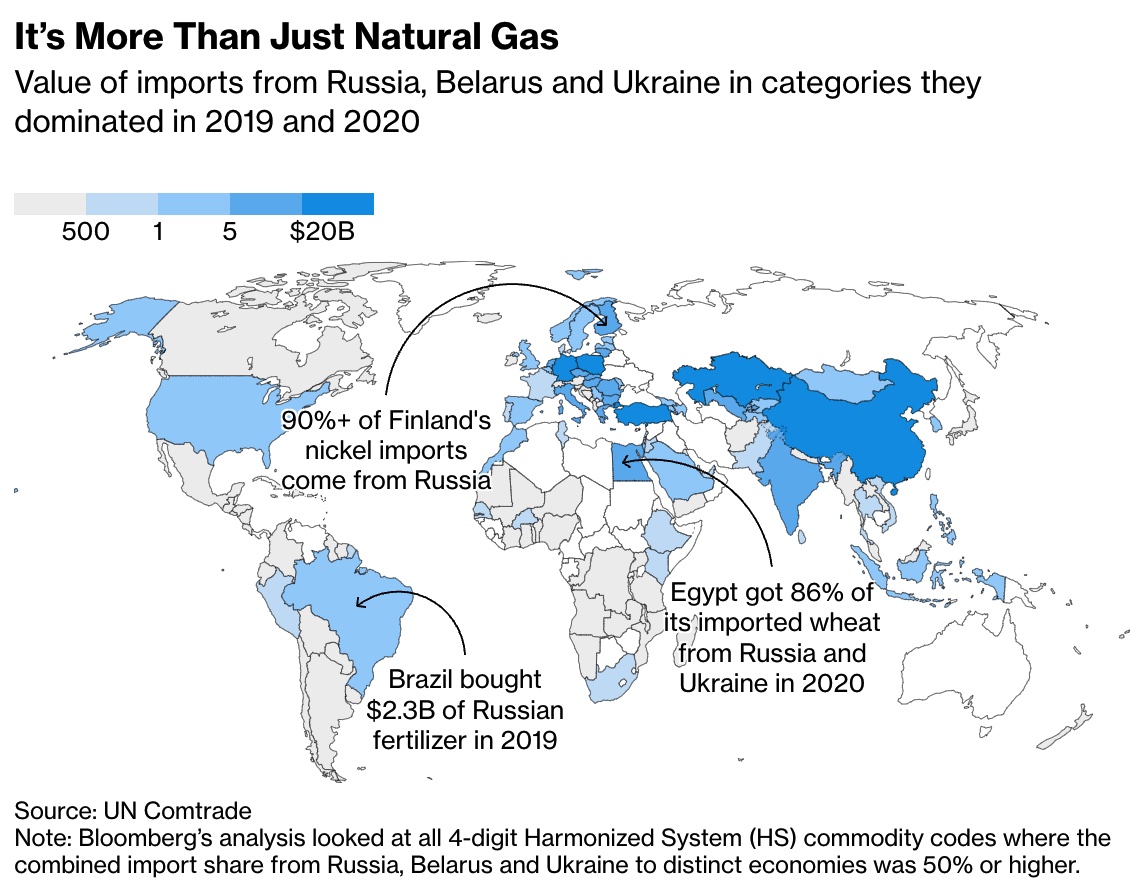

Both Russia and China made statements regarding prioritizing certain agricultural commodities. Beijing has given the word to get coverage on as many major commodities and key inputs as it confronts a volatile trade and market atmosphere.

USDA daily export sales for marketing year 2021-22:

— 100,000 MT corn to Colombia and 20,000 MT soybean oil to unknown destinations.

USDA today releases its monthly WASDE report which traders will monitor to see how the ongoing Russian war with Ukraine will impact trade and carryover forecasts. USDA’s forecasts for South American crops will also be a focus.

As for ag markets, wheat futures slumped by almost 5% the day after a hugely volatile session as traders assess the global supply outlook with war ravaging one of the world’s top grain-growing regions.

The House early this morning reached a bipartisan deal on a $1.5 trillion fiscal year 2022 spending bill needed to avert a government shutdown. The legislation includes $13.6 billion in aid to Ukraine and European allies, and $15.6 billion in funding for Covid-19 vaccines, testing, and treatments in the U.S. and abroad. It also includes an extension of the mandatory livestock price reporting program. We have more details below.

|

MARKET FOCUS |

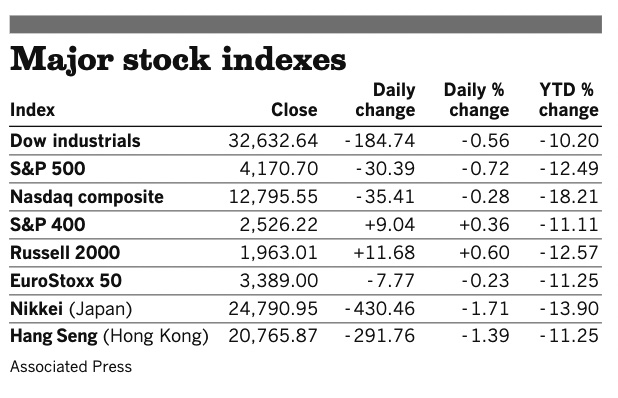

Equities today: Global stock markets mixed overnight, with European shares mostly up and Asian shares mostly down. The U.S. Dow opened 560 points higher while Nasdaq saw gains of 340 points. Asian equity markets mostly ended with losses despite having traded higher during their trading session. The Nikkei ended down 73.42 points, 0.30%, at 24,717.53. The Hang Seng Index was down 138.16 points, 0.67%, at 20,627.71. European equities are posting strong gains in early trading as conditions in most markets were oversold. The Stoxx 600 was up around 3% while regional markets were up 1.5% to nearly 5%.

U.S. equities yesterday: The Dow declined 184.74 points, 0.56%, at 32,632.64. The Nasdaq was down 35.41 points, 0.28%, at 12,795.55. The S&P 500 lost 30.39 points, 0.72%, at 4,170.70.

On tap today:

• U.S. job openings are expected to rise to 11 million in January from 10.9 million one month earlier. (10 a.m. ET)

• USDA WASDE report, 11 a.m. ET.

• South Korea, the world’s 10th largest economy, elects a new president.

• President Biden meets with business leaders and governors at 2 p.m. ET to tout legislative efforts to enhance domestic research and manufacturing to compete with economic rivals. At 6:15 p.m. ET, Biden is scheduled to deliver remarks at Senate Democrats’ spring retreat.

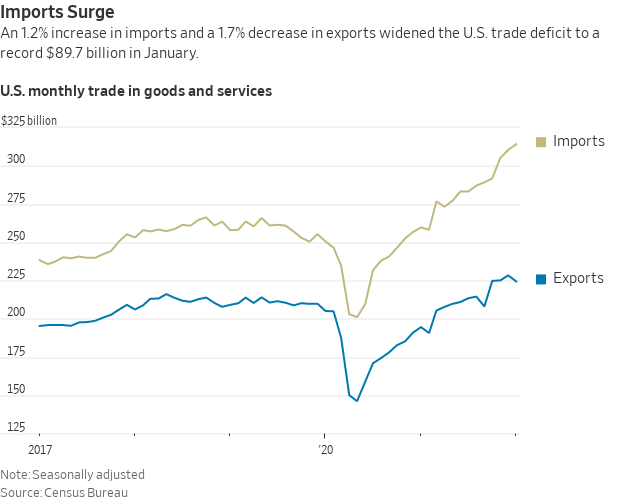

U.S. trade deficit hit a fresh record in January. The foreign-trade gap in goods and services expanded 9.4% from the prior month to $89.7 billion, the Commerce Department said Tuesday. The widening of the deficit in January reflected a pickup in demand for foreign-made imports, led by shipments of vehicles, industrial supplies including crude oil and natural gas, food and capital goods like telecommunications equipment. Exports fell. Trade has been volatile in recent months. The coronavirus pandemic initially closed factories and businesses around the world and disrupted supply chains, but international trade roared back last year, repeatedly pushing the U.S. trade deficit to record levels. Still, companies have struggled with shipping backlogs, product scarcity, order cancellations and delays as a result of the ramp-up in demand. Trade is likely to face further disruption from the conflict in Ukraine and sanctions on the Russian economy.

The value of imports of crude — which has seen sharp price gains since Russia invaded Ukraine — climbed to $13.7 billion, near the highest level since mid-2018.

USDA trade data delayed. USDA has delayed the release of its U.S. Agricultural Trade Data Update that was originally scheduled to be released today. The report is now scheduled to be released Thursday. The data usually comes the day after the broader International Trade in Goods and Services data is released by the Census Bureau. But USDA’s Foreign Agricultural Service posted a notice on its Global Agricultural Trade System (GATS) site Tuesday that they were “experiencing technical issues” with uploading the January 2022 trade data.

Market perspectives:

• Outside markets: The U.S. dollar index is under pressure amid strength in the euro, yen and British pound against the greenback. The yield on the 10-year U.S. Treasury note has risen to trade just above 1.90% with a higher tone in global government bond yields. Gold and silver futures are seeing losses with gold under $2,025 per troy ounce and silver under $26.80 per troy ounce on profit-taking pressure.

• White House today will unveil President Joe Biden’s cryptocurrency executive order, which directs federal agencies to produce a series of reports over the coming months that will lay out the future of U.S. policy toward digital assets — including the possible launch of a federally issued digital dollar.

• Crude oil futures are under pressure ahead of U.S. trading, with U.S. crude falling under $120 per barrel while Brent is under $124.50 per barrel. Futures were higher in Asian action, with US crude trading above $126 per barrel and Brent above $131 per barrel.

• A suspiciously timed cyberattack was launched against the biggest U.S. suppliers of liquefied natural gas.

• Energy prices in Europe have spiraled out of control, with European natural gas trading at ~$62/mmbtu, or translating into $360 oil on an energy equivalent basis.

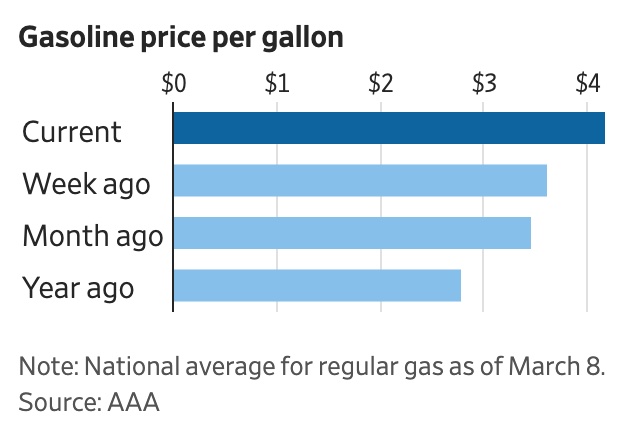

• Prices for diesel fuel across the U.S. jumped to $4.849 a gallon the past week, the highest level on record. The increase of nearly 75 cents a gallon from the week before came as crude prices on global markets touched $140 a barrel on Monday, reaching levels unseen since before the 2008 financial crisis. The Wall Street Journal reports (link) the rising prices will add to the continuing pressure on shipping costs as truckers seek to pass expenses along in a cycle likely to help fuel consumer inflation. The threat to consumer markets may pose the bigger threat to cut off a boom period for freight transportation operators. National average gasoline prices have already surged past the $4-a-gallon mark, and a reduction in U.S. refining capacity triggered by the pandemic raises the potential for tight supplies and still higher prices.

• Big Shot now Little Shot. Reports said a big nickel futures trader in China, called Big Shot, was caught in a major “short squeeze” of over 200,000 metric tons in futures contracts, valued at around $8 billion. The reports said Big Shot, now called Little Shot by traders, is working with banks to unwind his big loss and avoid default. Link for more via WSJ.

• Japan to raise imported wheat price 17.3% from April. Japan’s farm ministry says the government is raising the prices of imported wheat it sells to private companies by an average of 17.3% to 72,530 yen/ton for the April-Sept. period compared with the previous six months. It cited higher prices resulting from poor harvests in the U.S. and Canada last summer as well as Russia’s export controls. The average prices of five major wheat brands imported from the U.S., Canada and Australia are the highest since 2008. Japan reviews the prices every six months; about 90% of wheat consumed in Japan comes from overseas.

• Should the Russian-Ukraine conflict impact 2022 acreage, crop insurance, and commodity title decisions in the Midwest? Link to farmdocDaily item.

• Ag demand: Jordan canceled a tender to buy 120,000 MT of milling wheat. Japan tendered to buy 80,000 MT of feed wheat and 100,000 MT of feed barley.

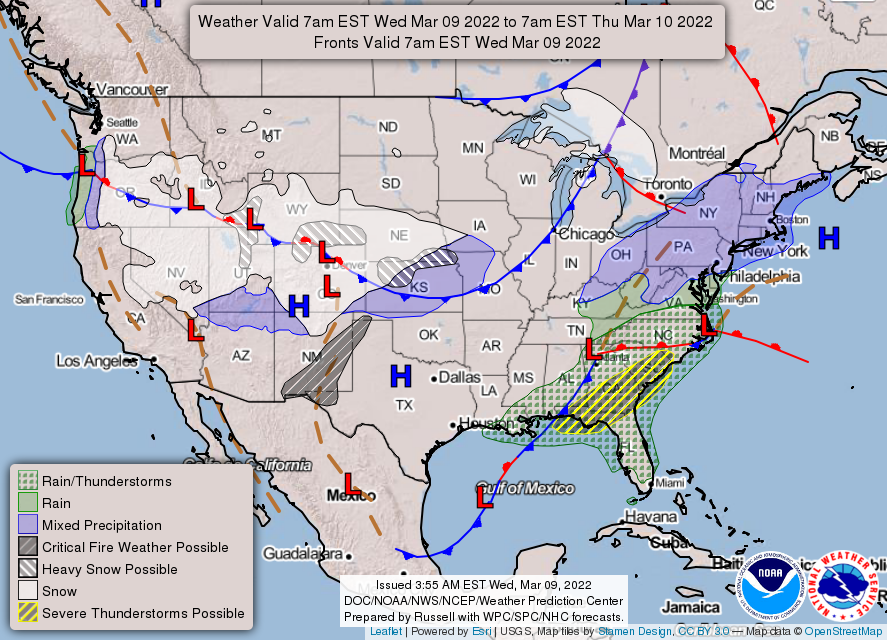

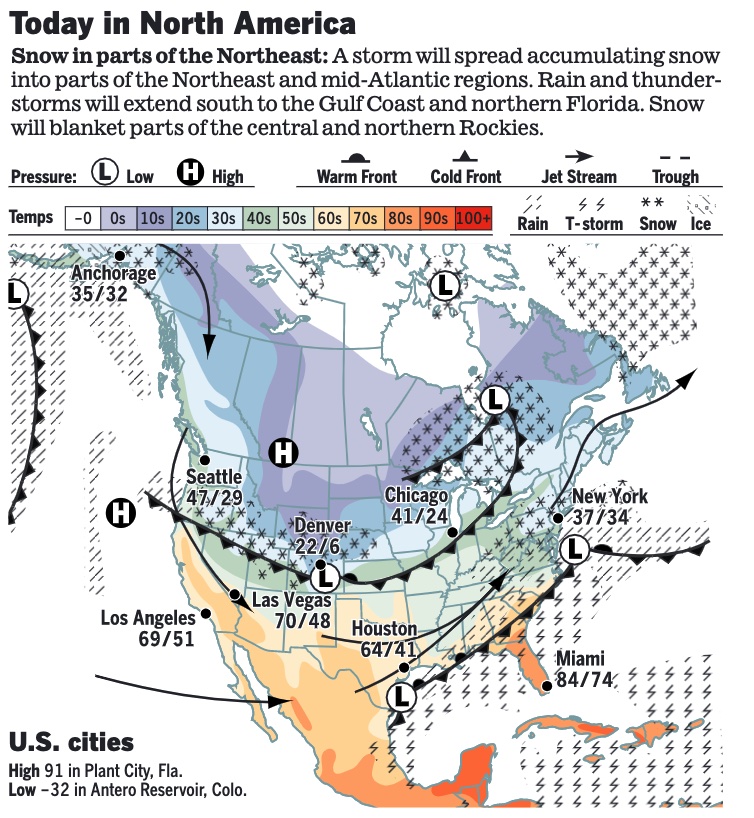

• NWS weather: There is a Slight Risk of Severe Thunderstorms over parts of the Southeast today... ...Heavy snow for parts of the Central/Southern Rockies, and Central Plains today... ...Cold air expands across Plains and Mississippi Valley; there is a Critical Risk of fire weather over parts of the Southern Rockies/Plains.

Items in Pro Farmer's First Thing Today include:

• Wheat faces heavy pressure overnight, soy complex trades higher

• March S&D Report out at noon ET

• China lowers edible oils import forecast (details in China section below)

• France hikes wheat export forecast

• China tells state firms to halt gas, diesel exports in April (more in China section)

• Cash cattle trade lower

• April hogs above cash index

|

RUSSIA/UKRAINE |

— Summary: The dueling sanctions are accelerating. President Biden as expected announced a ban on imports of Russian oil and natural gas into the U.S., an escalation of economic penalties with consequences at home and around the world. But then Russian leader Vladimir Putin responded with some bans of his own, as did Ukraine. The Ukrainian military agreed to a 12-hour ceasefire with Russia today to allow civilians to escape through humanitarian corridors. However, Ukrainian forces are wary of the pact. Ukraine's foreign minister says Russian troops are holding 300,000 civilians "hostage" in the city of Mariupol, where a long-awaited convoy of humanitarian aid to the city appeared to have come under fire.

- Russia responds. Putin said he would ban the export of some products and raw materials outside the Russian Federation until Dec. 31, the list of which will be determined by the government (link). Russian media reports note all commodities and not all countries will be on the export ban. Putin within two days wants the lists of states/countries where the export of certain products and raw materials will be prohibited. It described the goal of the commodity-export ban as “ensuring the security of the Russian Federation and the uninterrupted functioning of industry.”

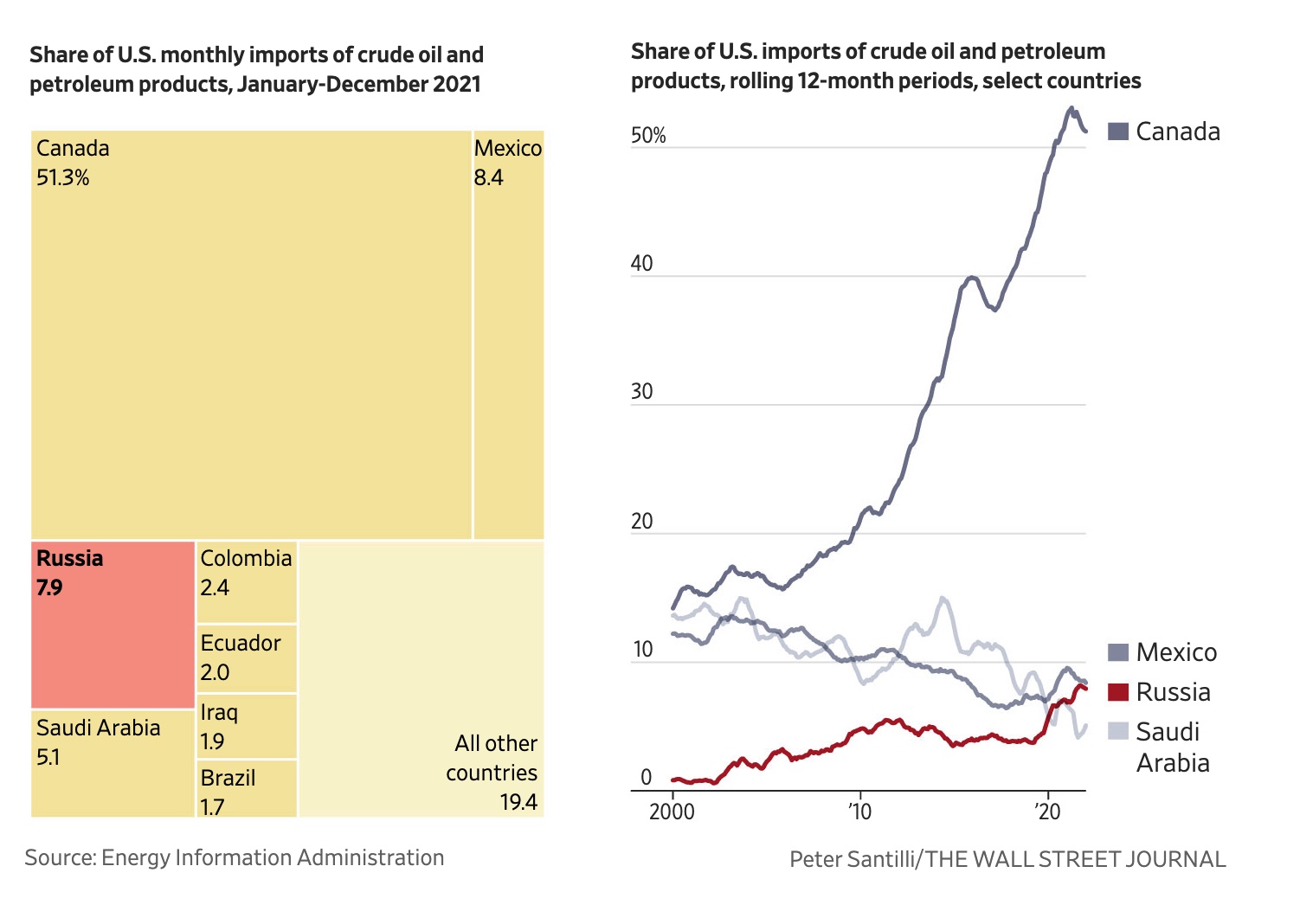

Facts and figures. Russia, the world’s largest exporter of crude and petroleum products, shipped almost 8 million barrels a day to global markets at the end of last year, according to the International Energy Agency. About 60% of Russia’s oil exports go to Europe, including around 2% to the U.K., while 8% go to the U.S. China accounts for about 20%.

Prime Minister: Russia must prioritize domestic grain supplies for bread. Russia must prioritize grain supplies to domestic bakeries over export markets, Prime Minister Mikhail Mishustin said as he unveiled fresh measures to support the domestic economy on Wednesday in the face of international sanctions over Ukraine, Reuters reported (link). "This is important to keep the food market in balance and we are closely monitoring prices for the most essential social goods such as food, including bread," he told a governmental meeting. "Russian grain is in good demand from abroad and its price is increasing. That said, it is necessary to provide the necessary raw materials, first of all, to the domestic baking industry."

- Ukraine bans exports of some commodities. Ukraine’s gov’t banned exports of rye, barley, buckwheat, millet, sugar, salt and meat until the end of this year, according to a cabinet resolution published today. Earlier, Ukraine imposed export licences (but not an outright ban) on wheat, corn and sunflower oil.

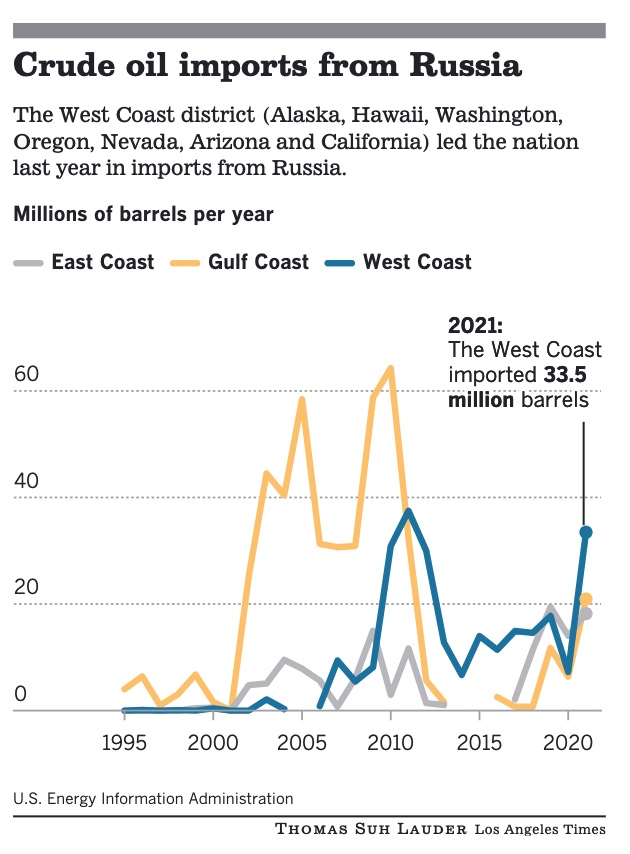

- As expected, President Biden announced a ban Tuesday on all U.S. imports of Russian oil and natural gas, seeking to impose maximum economic pressure on Russia for its violent and unprovoked invasion of Ukraine. “We are enforcing the most significant package of economic sanctions in history,” Biden said at the White House, even as he stressed the administration’s commitment to keeping prices as low as possible for consumers. “This is a step that we're taking to inflict further pain on Putin. but there will be costs as well here in the United States,” Biden said, calling the new actions a “painful blow” against Russia’s economy and its ability to fund its invasion of Ukraine. Biden again warned Americans will likely face heightened gas prices because of the conflict, as he has been for weeks. “Defending freedom is going to cost,” he said. “I said I would level with the American people from the beginning. [And] when I first spoke to this, I said ‘defending freedom is going to cost,’” Biden said. But, he said, “Republicans and Democrats alike have been clear that we must do this.”

Details: The executive order bans U.S. new imports of crude and oil products, coal and liquefied natural gas, with a 45-day winding-down period for existing contracts. It also bars American companies from investing in Russia’s energy industry.

- Biden said it was “simply not true” that his policies were suppressing domestic oil and natural gas production. Oil industry officials and others dispute that assessment. Said Biden:

“We’re approaching a record level of oil and gas production in the United States and we’re on track to set a record oil production next year. In the United States. 90% of onshore oil production takes place on land and isn’t owned by the federal government. And of the remaining 10% that occurs on federal land, the oil and gas industry has millions of acres leased. They have 9,000 permits to drill now. They could be drilling right now, yesterday, last week, last year. They have 9,000 [permits] to drill on shore that are already approved. So let me be clear, let me be clear. They are not using them for production now. That’s their decision. These are the facts. We should be honest about it.”

Perspective: Biden was misleading, say industry lobbyists. The head of the biggest U.S. oil lobby groups said the Biden administration is “misusing facts” when it claims the industry has more than 9,000 federal drilling permits on which it can drill to boost supply and ease soaring energy prices. Mike Sommers, the chief executive officer of the American Petroleum Institute, who was in Houston Monday for CERAWeek by S&P Global, said the industry is using a higher percentage of federal onshore and offshore leases than at any time in the past, and it’s continuing to increase production to meet surging demand. The Biden administration has repeatedly (including Tuesday) pointed to the number of approved but untapped drilling permits on federal land when questioned about how U.S. production can rise, and what the federal government can do to help.

“There’s a fundamental misunderstanding of the administration as to how the process actually works,” Sommers said in an interview with Bloomberg on the sidelines of the conference. “Just because you have a lease doesn’t mean there’s actually oil and gas in that lease, and there has to be a lot of development that occurs between the leasing and then ultimately permitting for that acreage to be productive,” he said. “I think that they’re purposefully misusing the facts here to advantage their position.”

Bottom line: Companies must build up a sufficient inventory of permits before they can contract rigs because of the regulatory difficulties of operating on federal land. It takes 140 days or so for the feds to approve a drilling permit versus two for the state of Texas. A Wall Street Journal editorial adds: “Companies can’t explore and drill, or build pipelines, without capital. Biden financial regulators allied with progressive investors are working to cut it off. The Labor Department has proposed a rule that would require 401(k) managers to consider the climate impact of their investment holdings. The Securities and Exchange Commission is expected to issue a rule requiring companies and their financiers to disclose greenhouse gas emissions. Biden has nominated Sarah Bloom Raskin, of all people, to be the Federal Reserve’s top bank supervisor. Her top priority is using bank regulation to redirect capital from fossil fuels to green energy.”

- The de facto leaders of Saudi Arabia and United Arab Emirates both declined U.S. requests to speak to President Biden in recent weeks, as the administration was working to build international support for Ukraine and contain a surge in oil prices. Link for more via the WSJ.

- Biden said Europe, which depends much more heavily on Russian energy supplies, will not be joining in an import ban, though the administration has said it will be working in “close coordination” with European allies as it moves to slowly phase out Russian energy supplies. (Russia supplies roughly 40% of Europe’s natural gas and a quarter of its crude oil, and ships hard coal, making an abrupt cutoff nearly impossible for the bloc.) Germany recently announced plans to build its first liquefied natural gas terminal, but it will only become operational in 2024 at the earliest.

The United Kingdom announced a plan to phase out Russian oil imports by the end of 2022 — it will ban Russian oil imports, though it will continue to allow natural gas and coal from the country — the country is expected to make a statement later this week on reducing British imports of Russian gas. The U.K. is less dependent on Russia than much of mainland Europe, with Russian supplies making up 8% of overall oil imports into the U.K. The European Commission — the executive arm of the European Union, which is heavily dependent on Russian oil and gas — outlined a proposal to make itself independent of that supply in the coming years.

Russia’s deputy prime minister Alexander Novak on Monday said his country had “every right to take a mirror decision” and cut off natural gas supplied to Europe via the Nord Stream 1 pipeline, a crucial artery for a continent that remains heavily dependent on Russian energy, but had chosen not to so far because “no one will benefit from it.” Novak, who was also Russia’s former energy minister, warned of $300/barrel oil if Europe followed the U.S. in banning Russian imports of crude.

- Venezuelan President Nicolas Maduro spoke positively of talks with the United States about the prospects of his country providing oil to ease the strain on American consumers, the Financial Times reports (link). “We agreed to work on a forward-looking agenda,” Maduro said. “We’ll press ahead with the conversations, the co-ordinations, and a positive agenda for the government of the United States and the government of the Bolivarian Republic of Venezuela.”

- William Burns, the CIA director, told Congress he anticipates an “ugly next few weeks,” with Vladimir Putin trying to “grind down the Ukrainian military with no regard for civilian casualties.”

— Market impacts:

- Gas pains: The average price of a gallon of regular gas soared 59 cents over the past week to $4.25 as of today, a nominal — but not inflation-adjusted — record, AAA announced. That eclipsed the previous high of $4.11 set in summer 2008, during the severe recession caused by the housing crash. In California, the average price of gasoline rose to $5.44, higher because of higher gasoline taxes and environmental standards that require additional steps in the refining process.

Households would spend $850 more this year, on average, compared with last year, if gasoline prices remain above $4 a gallon for most of 2022, according to Diane Swonk, chief economist at the consulting firm Grant Thornton LLP. Last year, such costs rose $940 from 2020, she said.

- The U.S. imports only 3% of its petroleum supply and less than 1% of coal from Russia. About 70% of Russian oil currently can’t find buyers because of sanctions risk. That’s the primary reason crude prices have shot up to $130 per barrel.

- U.S. and other buyers will now chase limited oil supplies. Saudi Arabia, the United Arab Emirates and Kuwait could add 2.5 million barrels, but all are all members of OPEC Plus, an alliance of oil-producing nations that includes Russia. Venezuela and Iran could contribute about 1.5 million barrels a day, but that would require lifting American sanctions. U.S. producers could also ramp up production, but it would take investment and time.

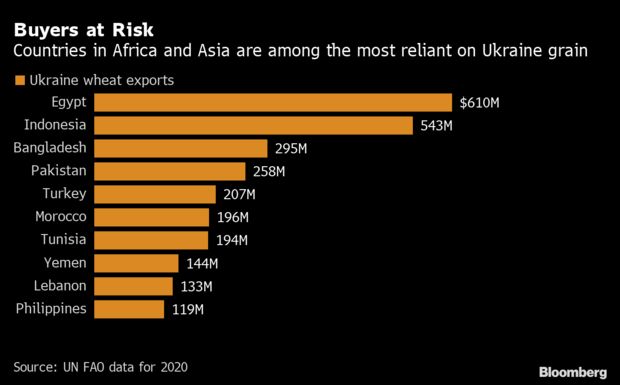

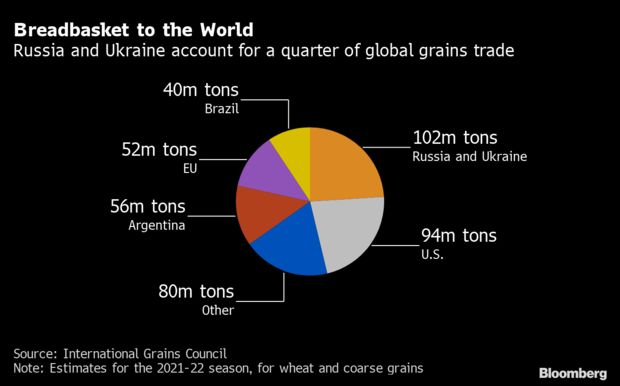

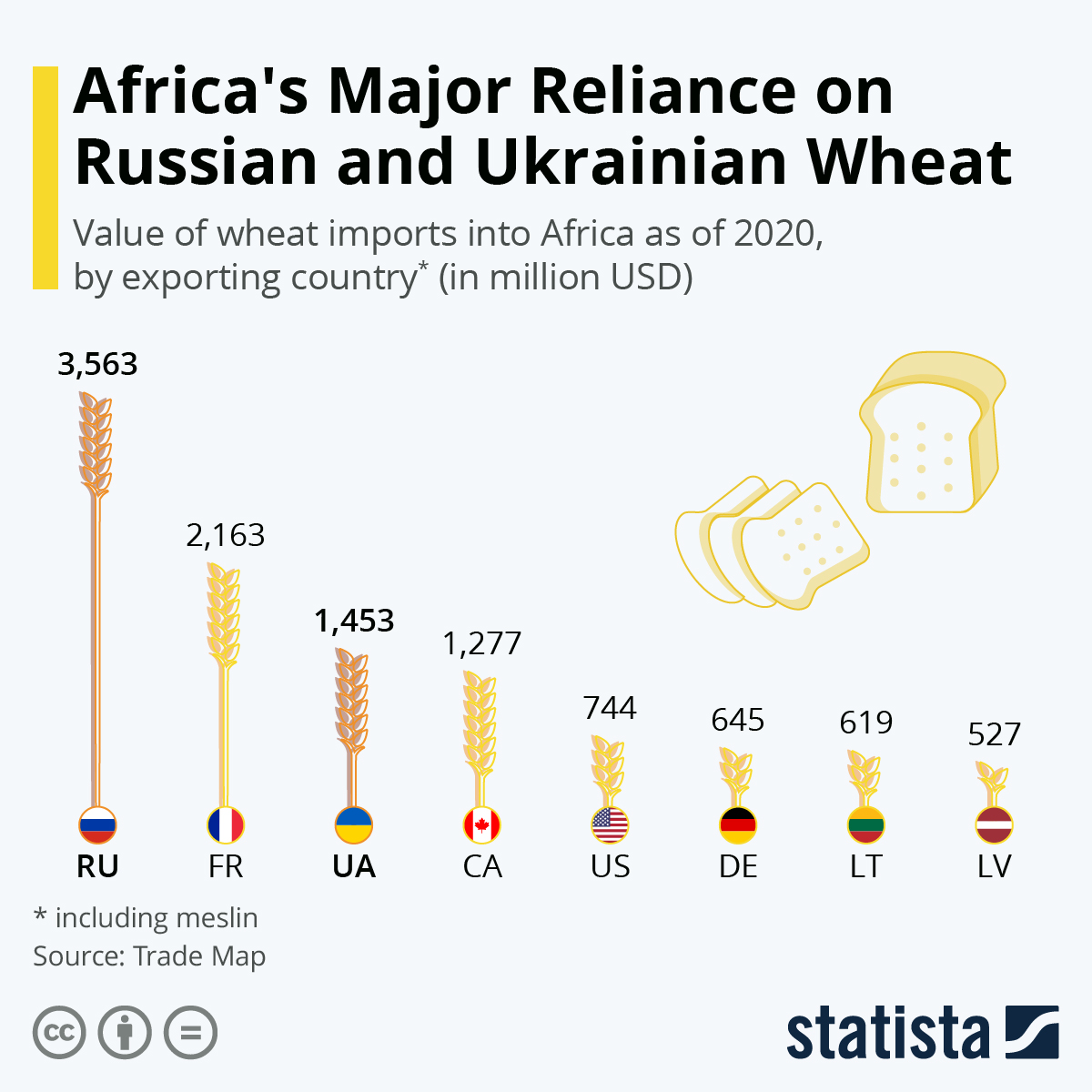

- Russia/Ukraine war is “an amazing food shock,” said Abdolreza Abbassian, an independent market analyst and a former senior economist at the United Nations' Food and Agriculture Organization. “I don’t know of a situation like this in the 30 years I was involved in this sector,” he told Bloomberg.

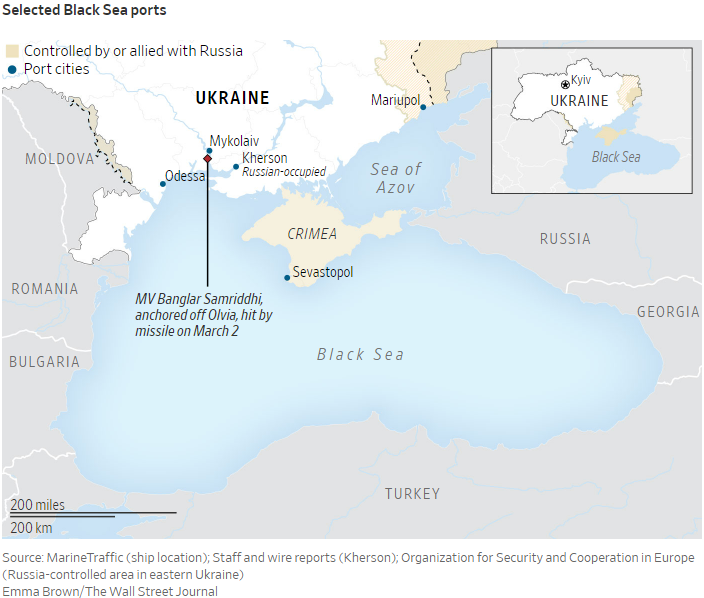

- War in Ukraine has severely hobbled shipping in the Black Sea, with broad consequences for international transport and global supply chains, the Wall Street Journal reports (link). Dozens of cargo ships are stranded at the Ukrainian port of Mykolaiv, shipping trackers said. An estimated 3,500 sailors have been stuck on some 200 ships at Ukrainian ports, according to London-based shipping tracker Windward Ltd. More ships are stranded around the globe than at any point since World War II, maritime historians said. The result is a shutdown of the world’s second-largest grain exporting region. Ukraine accounts for 16% of global corn exports, and together with Russia, 30% of wheat exports. Global wheat prices have jumped more than 55% since the week before the invasion.

- Fitch cuts Russia bond rating, sees ‘imminent’ default. Russia’s sovereign debt rating was cut to the second-lowest level by Fitch Ratings, which said a bond default is “imminent” because of the country’s financial isolation after the Ukraine invasion. Fitch cited a Russian measure that would require some creditors who hold foreign-currency-denominated Russian bonds to be repaid in rubles, which have plunged in value since the war began.

- The effect of the embargoes and sanctions are clearer for the Russian economy, which S&P estimates will shrink by nearly 9% this year.

|

POLICY FOCUS |

— Hog producer payment recap. Hog producers who sold hogs through a spot market sale during the Covid-19 pandemic have until April 15, to submit their applications for USDA’s Spot Market Hog Pandemic Program (SMHPP). SMHPP is part of USDA’s Pandemic Assistance for Producers initiative and originally had a deadline to submit applications by Feb. 25. SMHPP assists hog producers who sold hogs through a spot market sale from April 16, 2020, through Sept. 1, 2020, the period during which these producers faced the greatest reduction in market prices due to the pandemic. USDA is offering SMHPP in response to a reduction in packer production and supply chain issues due to the Covid-19 pandemic, which resulted in fewer negotiated hogs being procured and subsequent lower market prices. USDA’s Farm Service Agency (FSA) began accepting applications for SMHPP on Dec. 15, 2021.

In December, USDA published a notice of funding availability for hog producers who were not able to sell hogs on the spot cash market during the pandemic. USDA Secretary Tom Vilsack previously said when USDA initially set it up, it realized some issues relative to eligibility requirements that created challenges.

— Boozman urges Vilsack to delay CRP signup because of Russian invasion of Ukraine. Sen. John Boozman (R-Ark.), ranking member on the Senate Agriculture Committee, called on USDA Secretary Tom Vilsack to delay signup for the Conservation Reserve Program (CRP) because of the war in Ukraine. In a letter (link) to Vilsack, Boozman said landowners need time to decide whether to keep cultivating the land that could otherwise be locked up in the program. He also urged Vilsack to considering farmers some flexibilities on crop insurance this spring. The closing sales date for insurance on most crops in the Midwest and Plains is next Tuesday.

Comments: “There’s been no change in USDA’s position,” responded USDA spokeswoman Paige Blanchard. Link to some important details relative to the CRP that we released on Tuesday. As for calls to boost U.S. ag/food production, history shows that various administrations over the years have taken different actions on trying to deal with a shortage of some farm products and/or significantly rising prices. For example, former President Richard Nixon got U.S. ag exporters to postpone some export sales of soybeans until new-crop was harvested. The next pressure point could be following USDA’s March 31 Prospective Plantings report, based on a survey of up to 80,000 growers during the first two weeks of March. If there are any surprises in that report, pressure will rise on USDA personnel. Washington has a habit of not liking time or market action to take care of perceived shortages or surging prices.

— Rural broadband, processing grants focus of House Ag farm bill hearing. USDA Undersecretary for Rural Development Xochitl Torres Small faced questions about the department’s plans to expand broadband access for rural communities and bolster local and regional food supply chains during a Tuesday (March 8) House Ag Subcommittee on Commodity Exchanges, Energy and Credit hearing on farm bill rural development programs.

USDA’s ReConnect rural broadband program was the focus of many lawmaker questions during the session. Many sought more details on how the department plans to roll out $2 billion in additional funding for ReConnect grants included under the Bipartisan Infrastructure Framework (BIF) law passed last year — including who the funds will be made available to and what steps are being taken to coordinate with other federal agencies like the Federal Communications Commission (FCC) that are undertaking similar efforts.

House Ag Ranking Member GT Thompson (R-Pa.) was among those who pressed on USDA’s decision to “advantage non-profit applicants over for-profit applicants” through the scoring rubric used to evaluate ReConnect applications. The move “so clearly broke with the long-standing operation and precedence of the program,” he remarked, calling the department’s justification of the move — “an unrelated and much older provision of the Rural Electrification Act” — puzzling. Had lawmakers been consulted, Thompson said, “we would have been happy to clarify that Congress has always wanted to encourage as many options for rural residents as possible and doesn't believe that any type of broadband provider was more deserving of assistance than another,” he said. As USDA looks to roll out the next round of ReConnect, he asked that the department confer with lawmakers “before you embark on major policy changes.”

Torres Small said USDA’s goal is to leverage existing relationships with rural electric co-ops as it seeks to bring broadband to some of the hardest to reach areas. She stressed that the points awarded to applications from non-profits — 15 out of the maximum 150 — aim to “create more options for communities that may not necessarily otherwise have folks who are looking to serve their area,” not exclude for-profit applicants.

Ensuring funds are targeted to un- or under-served areas, was one topic that surfaced several times during the session. “I'm concerned to hear that broadband funding is sometimes been used to overbuild existing broadband networks instead of bringing the benefits of broadband to areas with no service,” said Rep. Anne Custer (D-N.H.), asking Torres Small whether she agreed and, if so, what steps the department was taking to that end. Torres Small said “the largest number of priority points” are available for applications to provide service to unserved areas — those with less than 25 megabits (Mbit) download and 3 Mbit upload speeds. She said USDA is requiring new applicants build networks that provide a minimum of 100Mbit download and upload speeds to ensure they are ready to meet future needs of precision ag and other technologies.

Duplication of effort was another issue, with Rep. Kat Cammack (R-Fla.) asking how USDA was working to see that ReConnect complements and does not duplicate rural broadband buildouts supported by FCC’s Rural Digital Opportunity Fund (DOF) — noting many areas might qualify under both programs. Torres Small said there are “conversations ongoing about how we coordinate” the USDA and FCC efforts, including how applications under one program might impact eligibility under the other.

Rep. Randy Feenstra (R-Iowa) pressed Torres Small on whether USDA was relying on FCC broadband coverage maps — which key off individual census tracks — when it makes decisions about where to deploy ReConnect funding. He expressed concern that local and regional telecom companies could be blocked from funding if a larger telecom zeroes in on the FCC maps and makes buildout commitments first, even if the larger company never follows through. USDA is “supporting better maps through our granular assessment of applications,” Torres Small replied, and she said any provider claiming to provide service must “respond and demonstrate that service.” The information gathered is shared with FCC and the National Telecommunications and Information Administration (NTIA) to help them improve their coverage maps. “We do look beyond the maps and look at the specific people and whether or not they actually have service—and that's why we built this set of priority points,” she added.

USDA’s multi-pronged effort to bolster local and regional food systems was another attention topic. Rep. Angie Craig (D-Minn.) asked how USDA would see that the multiple grant and loan programs aimed at helping local and regional processors expand do not overlap. Torres Small explained that the efforts each serve similar but slightly different purposes. The Food Supply Chain Guaranteed Loan Program “has helped identify potential projects as well as lenders who might be eager to work with us” to start or expand projects in the middle of the supply chain, Torres Small explained. Meanwhile, the Meat and Poultry Processing Expansion Program (MPPEP) is keyed on “identifying middle market projects that are very close to completion” that could use extra support.

Rep. Custer was interested in USDA’s plans for the Value-Added Producer Grant (VAPG) program, which offers competitive grants to farmers and groups of farmers to create or develop value-added producer-owned businesses. Custer said she helped spearhead efforts in 2020 to reduce VAPG matching fund requirements due to Covid-19 and asked about additional steps to ensure small farmers can continue to participate. Torres Small said VAPG “is one of the most popular” Rural Development administered programs for producers, and said she hopes to leverage it in support of broader moves to boost meat processing capacity.

Rep. Chellie Pingree (D-Maine) raised the issue of still unimplemented 2018 Farm Bill provisions aimed at allowing producers to apply for support through VAPG to help them comply with the Food and Drug Administration’s (FDA) new Food Safety Modernization Act (FSMA) rules. Torres Small promised to follow up with Pingree on the issue and attributed ongoing delays to the need to urgently implement “a lot of new programs in the midst of Covid” which has “created a capacity challenge.”

|

PERSONNEL |

— President Biden formally nominated Joseph Goffman to lead the EPA’s air office, a role he has informally held since the start of the administration. Goffman formerly worked in the Obama administration and is expected to face opposition from Republicans.

— Senate tomorrow will vote on confirming Maria Pagan to be deputy U.S. trade chief.

|

CHINA UPDATE |

— Securing supplies of energy, food, chemical fertilizers and other raw materials was a focus of a key Chinese report. Chinese Premier Li Keqiang released China's Government Work Report (link) on March 5, at the meeting of the National People's Congress, part of China's annual Two Sessions legislative event. It included quantitative targets and general policy focuses and described Beijing's chief economic concerns. Economic targets for 2022 include a 5.5% gross domestic product growth target and the allocation of $101 billion in central government funds for investment, especially to construction projects like energy pipelines and civil infrastructure. Economic goals for the year include securing supplies of energy, food, chemical fertilizers and other raw materials (especially industrial inputs) and protecting the productivity, access to loans and employment levels of small- and medium-sized enterprises. The report listed China's chief economic concerns for 2022 as declining global demand for Chinese exports, unstable global commodities markets, insufficient progress toward state innovation goals, persistent domestic systemic risks (e.g., real estate) and excess bureaucracy in implementing the state economic agenda.

Upshot: Analysts note the report's emphasis on stable supplies for key commodities (such as grain, key minerals, oil and gas) suggests China will again heavily purchase on international markets to replenish stockpiles and prevent a repeat of the fuel and food shortages of 2021, driving international prices up further. Stratfor says ‘this may also see China impose additional restrictions or bans on imports of key agricultural and industrial inputs, like fertilizers, causing acute goods shortages in Asia similar to those seen in October 2021.” The annual government report, delivered by Premier Li Keqiang on Saturday, skipped all mention of trade relations with the U.S. and Europe, in a clear departure from past practice.

— China tells state firms to halt gas, diesel exports in April. Beijing has told China’s state refiners to pause exports of gasoline and diesel in April as the war between Russia and Ukraine sparks supply concerns, several sources with knowledge of the matter told Reuters. “This is to prevent a shortage as independent refiners are under big pressure to lower throughput in the face of soaring crude oil prices,” said one source. Meanwhile, China will keep coal output at record levels of more than 12 MMT a day and speed up approvals for new mining projects to ensure sufficient supplies as prices surge in the wake of the Russia/Ukraine conflict, according to China’s National Development and Reform Commission.

— Chinese companies that defy U.S. sanctions on Russia could be cut off from crucial American components, Commerce Secretary Gina Raimondo warned. Link for more via the New York Times.

— China lowers edible oils import forecast. China lowered its 2021-22 edible oil import forecast as drought in South America, palm oil export restrictions in Indonesia and the conflict in Ukraine limited supplies and sent prices soaring. China’s ag ministry now expects the country to import 8.5 MMT of edible oils, down from February’s forecast of 9.3 MMT. China did not adjust its 2021-22 corn or soybean import forecasts this month, leaving them at 20 MMT and 102 MMT, respectively.

— U.N. human rights chief to visit China. The United Nations’ top human rights official said Tuesday that China would allow her to visit the country and examine conditions there, including in the Xinjiang region, a major twist after years of negotiations and stonewalling by Beijing.

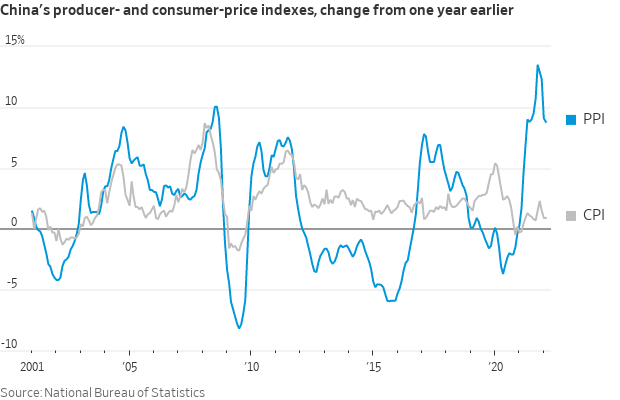

— China inflationary pressures remain subdued… for now. Rising energy prices in the run-up to Russia’s invasion of Ukraine added to Chinese inflation in February, an early sign of the pressures building in the global economy as the war sends commodity prices soaring. Producer-price inflation slowed in February, to 8.8% from a year earlier, versus a 9.1% rate in January and a peak of 13.5% in October. Consumer prices rose at the same 0.9% annual pace as a month earlier. At the same time, prices charged by companies at the factory gate rose on a month-to-month basis for the first time since October, while the monthly pace of consumer-price inflation also picked up, data from China’s National Bureau of Statistics showed Wednesday. Producer prices rose 0.5% in February compared with January, while consumer prices rose 0.6%. Behind the uptick were rising prices for energy and metals, a reflection of investor unease ahead of Russia’s invasion of Ukraine last month.

|

TRADE POLICY |

— Indonesia to further restrict palm oil exports. Indonesia is expanding its limits on exports of palm oil with the country’s Trade Minister Muhammad Lutfi saying the new restrictions were aimed at quelling rising cooking oil prices. In restrictions that will run for at least six months, Lutfi said Indonesia will require firms to sell 30% of planned exports of crude palm oil and olein domestically, an increase from the 20% level currently in place under the Domestic Market Obligation (DMO). "We increase this DMO to ensure that all parts of the domestic cooking oil industry can function properly," Lutfi said, noting the effort will be reviewed after six months to determine “whether it needs further expansion or adjustment.” This action further restricts supplies in a market that has already become tight and comes as exports of sunflowerseed oil out of Russia and Ukraine are uncertain at best — the two countries account for over 70% of global sunflowerseed oil trade.

|

ENERGY & CLIMATE CHANGE |

— The U.S. Energy Information Administration (EIA) released their Short-Term Energy Outlook report Tuesday, and outlined its scenarios for energy prices ahead, noting the current events have unfolded against a backdrop of already low inventories. The EIA said they are watching the following as the most consequential factors in the situation (clearly prepared before the announced US ban on imports of Russian energy): Nations could choose to ban imports of Russian energy; additional sanctions against Russia could be announced; corporations could take additional independent actions that would affect Russia’s oil output; and producers of crude oil outside Russia could respond to higher prices by increasing production.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 449,858,142 with 6,015,871 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,369,459 with 961,935 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 555,595,418 doses administered, 216,273,632 have been fully vaccinated, or 65.88% of the U.S. population.

— Travelers are running into fewer Covid-19 rules. Ireland, Iceland and Norway are among the countries that have eliminated testing and vaccination requirements for travelers. Others, such as France and England, have eliminated pre-departure testing for fully vaccinated people entering the country. Rules vary greatly and change often, so travel advisers suggest looking closely at entry requirements for specific destinations — as well as rules for indoor venues, which can vary by city or region. Link to details via the WSJ.

— Hawaii became the last state to announce an end to universal mask requirements, though they’ll still be required indoors at public schools.

|

POLITICS & ELECTIONS |

— South Koreans are heading to the polls today to elect a new president. The election is down to a tight two-way race between Lee Jae-myung, the standard-bearer of the ruling Democratic Party, and Yoon Suk-yeol, from the conservative main opposition People Power Party. Exit polls showed a slim lead for the conservative Yoon Suk-yeol. The victor will succeed President Moon Jae-in, who is constitutionally barred from seeking re-election.

|

CONGRESS |

— Democrats and Republicans reach deal on $1.5 trillion spending bill that would fund the U.S. gov’t through the rest of the 2022 fiscal year and provide $13.6 billion to respond to Russia’s invasion of Ukraine (link) and $15.6 billion for Covid-19 relief (link). Lawmakers released the text (link) of the 2,741-page measure early Wednesday, with the House planning to pass it later today. The House also is set to vote on another stopgap spending bill, continuing government funding at current levels through March 15 to give the Senate time to deal with the full-year legislation.

Details:

- The legislation would provide $730 billion for non-defense discretionary spending, a 6.7% increase and a win for Democrats while Republicans were able to negotiate a 5.6% increase for defense spending over fiscal 2021, bringing it to $782 billion.

- In a last-minute compromise, funding for pandemic-related measures was cut from the from the $22.5 billion the administration wanted, to $15.6 billion.

- The $13.6 billion in emergency Ukraine-related spending would provide $6.5 billion for the Pentagon, including $3 billion to bolster U.S. troops in Europe and $3.5 billion to replace weapons given to Ukraine. The State department would receive $4 billion including for refugee assistance, economic assistance to the region and foreign military financing. The U.S. Agency for International Development (USAID) would get $2.8 billion mostly for immediate humanitarian disaster assistance. Other funding is provided to enforce sanctions and increase media broadcasts into Ukraine.

- President Biden’s signature infrastructure law would be fully funded after months of delay under the spending bill. New programs would be allowed to get off the ground and increased funding levels for this fiscal year authorized by the recent infrastructure law would be able to be deployed under the Transportation-Housing and Urban Development spending portion of the package.

- Immigrants stuck in chronic green card backlogs lost out on a policy solution in the funding deal. The Department of Homeland Security spending bill omits previously drafted provisions that would have salvaged unused immigrant visas from recent fiscal years beset by processing delays. House and Senate appropriators in bills proposed last year had included measures to recapture family- and employment-based immigrant visa numbers from fiscal 2020 and 2021.

- Cybersecurity legislation that would impose new hack and ransomware reporting requirements on businesses was included in the spending bill. The Senate passed the cyber reporting requirements on March 1 under a bill from Sen. Gary Peters (D-Mich). The Cybersecurity and Infrastructure Security Agency would get $2.6 billion under the bill, a $568.7 million increase from fiscal 2021.

- Lawmakers were able to direct funding to specific projects in their districts the first time since a ban on such so-called earmarks went into effect 11 years ago — the measure includes 2,727 earmarks from House members totaling $4.2 billion, according to the House Appropriations Committee. Senate aggregate earmark totals weren’t immediately made available.

Topline Totals: Link to details.

- Agriculture-FDA: $25.125 billion, a $1.426 billion increase above FY 2021

- Commerce-Justice-Science: $75.8 billion, a $4.7 billion increase

- Defense: $728.5 billion, a $32.5 billion increase

- Energy and Water: $54.97 billion, a $3.2 billion increase

- Financial Services: $25.5 billion, a $1.1 billion increase

- Homeland Security: $57.5 billion, a $5.6 billion increase

- Labor-HHS-Education: $213.6 billion, a $15.3 billion increase

- Legislative Branch: $5.9 billion, a $625 million increase

- Military Construction-VA: $284.6 billion, a $32.7 billion increase

- State and Foreign Operations: $56.1 billion, a $595 million increase

- Interior-Environment: $38 billion, a $1.9 billion increase

- Transportation-HUD: $81 billion, $6.4 billion increase

Agriculture details. Link to summary.

- Farm programs: The legislation provides $1.87 billion for farm programs, which is $44 million above the FY 2021 enacted level. This includes $61 million to resolve ownership and succession of farmland issues, also known as heirs’ property issues. This funding will continue support for various farm, conservation, and emergency loan programs, and help American farmers and ranchers. It will also meet estimates of demand for farm loan programs.

- Extends the mandatory livestock price reporting program.

- Authorizes a cattle contract library at USDA to address concerns about market power in the beef sector.

- WIC: The measure would provide $834 million for increased purchasing of fruits and vegetables by participants in the Women, Infants and Children (WIC) nutrition assistance program.

— Senate passed The Postal Service Reform Act, a sweeping bipartisan bill that will overhaul the U.S. Postal Service's finances and allow the agency to modernize. The vote was 79 to 19 on the bill, which has already passed the House. The legislation now heads to Biden, who is expected to sign it into law. By making changes to health care coverage within the agency, the bill is expected to save the postal service $50 billion over the next decade. The bill also requires the USPS to create an online dashboard with local and national delivery time data. Unlike other government agencies, the USPS generally does not receive taxpayer funding, which is why its financial situation has been so dire. Critics say it doesn’t actually create ways to improve mail service.

|

OTHER ITEMS OF NOTE |

— Venezuela released at least two imprisoned Americans, a potential turning point in the Biden administration’s relationship with Russia’s staunchest ally in the Western Hemisphere. Since the Obama administration, Washington has been sanctioning Venezuela and blacklisting senior Venezuelan officials because of human rights abuses and the trampling of democracy there. President Trump broke diplomatic ties with Caracas. But Venezuela sits on one of the world’s largest reserves of oil, exploitation of which the sanctions have helped to curb. Biden’s announcement Tuesday did not mention Venezuela or other alternative sources of crude.

— Iran’s Revolutionary Guard says it launched second satellite. Iran’s paramilitary Revolutionary Guard said Tuesday it launched a second reconnaissance satellite into space as world powers await Tehran’s decision in negotiations over its tattered nuclear deal.

— Northeast dairy: Farmer cooperative Organic Valley offered to buy milk from 80 of the 130 small organic farms in the U.S. Northeast that are losing contracts with Danone and Maple Hill Creamery. Link for details.

— USDA updated its farm loan regulations to reflect changes made by the 2018 farm bill to increase loan and loan guarantee limits, allow larger loan guarantees for beginning and socially disadvantaged farmers, and provide additional benefits to farmers; most of the changes were self-enacting and already in force. Link to details.