Commodity Prices Roar Higher with War in Ukraine Continuing to Fuel Fears of Supply Crunches

Food security and food inflation are now battle cries in several countries, including U.S. and EU

|

In Today’s Digital Newspaper |

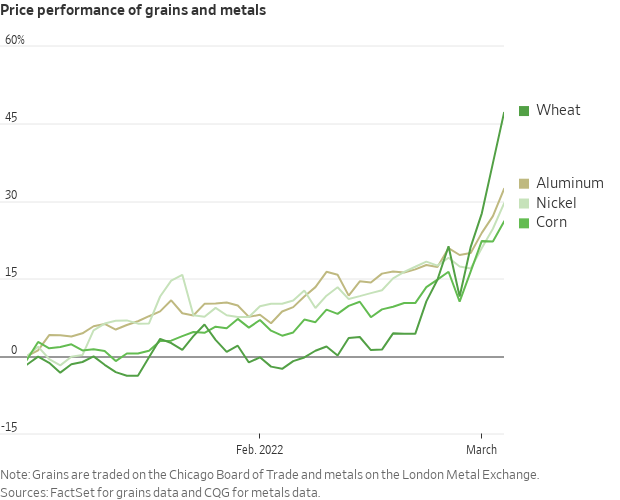

The fog of war is clear for at least one item: surging commodity prices, with some (Citigroup) even predicting $14 wheat is possible. Equity traders got more than a bit nervous as Russia took over Ukraine’s largest nuclear power plant. Even a more robust Jobs report did not have much market impact. Meanwhile, there are growing odds that Congress will clear a halt to imports of Russian energy, despite current White House opposition — even House Speaker Nancy Pelosi (D-Calif.) supports the push.

On the inflation front, in the last two days, regular unleaded gasoline rose 18 cents.

On the policy front, USDA is trying to damp suggestions it could/should alter the CRP to get more grain for the U.S. market. Meanwhile, Reuters reported the Biden administration may be mulling a possible change to the RFS due to food vs fuel concerns, even though the same wire service quoted an administration official as saying it was not under serious consideration. Go figure. (That’s like saying I am pondering going on a diet, but my food intake says otherwise.) And in Europe, the European Commission shifted gears in the wake of the Russian invasion of Ukraine and now said it will re-evaluate the EU’s sustainability ambitions of the Farm to Fork (F2F) strategy.

On the let’s get ‘em area, the WSJ alerted the Dept. of Justice is conducting antitrust probe of poultry companies on sharing employment practices, and some farm groups are asking the FTC for the right to repair Deere equipment.

|

MARKET FOCUS |

Equities today: Global stock markets were lower overnight. The U.S. Dow is now trading around 400 points lower. Asian markets dropped on an escalation in the Russian invasion of Ukraine. The Nikkei fell 591.80 points, 2.23%, at 25,985.47. The Hang Seng Index was down 562.05 points, 2.50%, at 21,905.29. European equities opened sharply lower after reports Russia had taken control of the largest nuclear power plant in Europe located in Ukraine. The Stoxx 600 was down more than 2% with losses of 2% to 3% in regional markets.

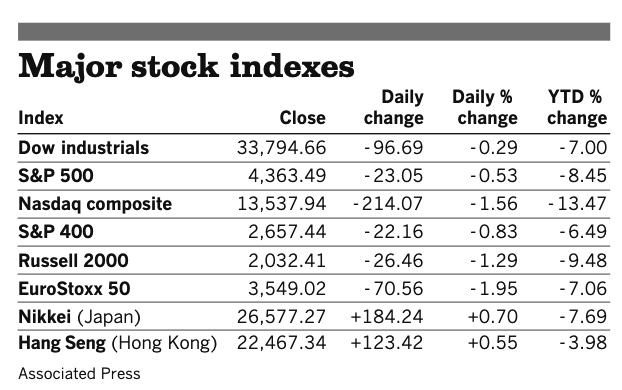

U.S. equities yesterday: The Dow closed down 96.69 points, 0.29%, at 33,794.66. The Nasdaq declined 214.07 points, 1.56%, at 13,537.94. The S&P 500 fell 23.05 points, 0.53%, at 4,363.49.

On tap today:

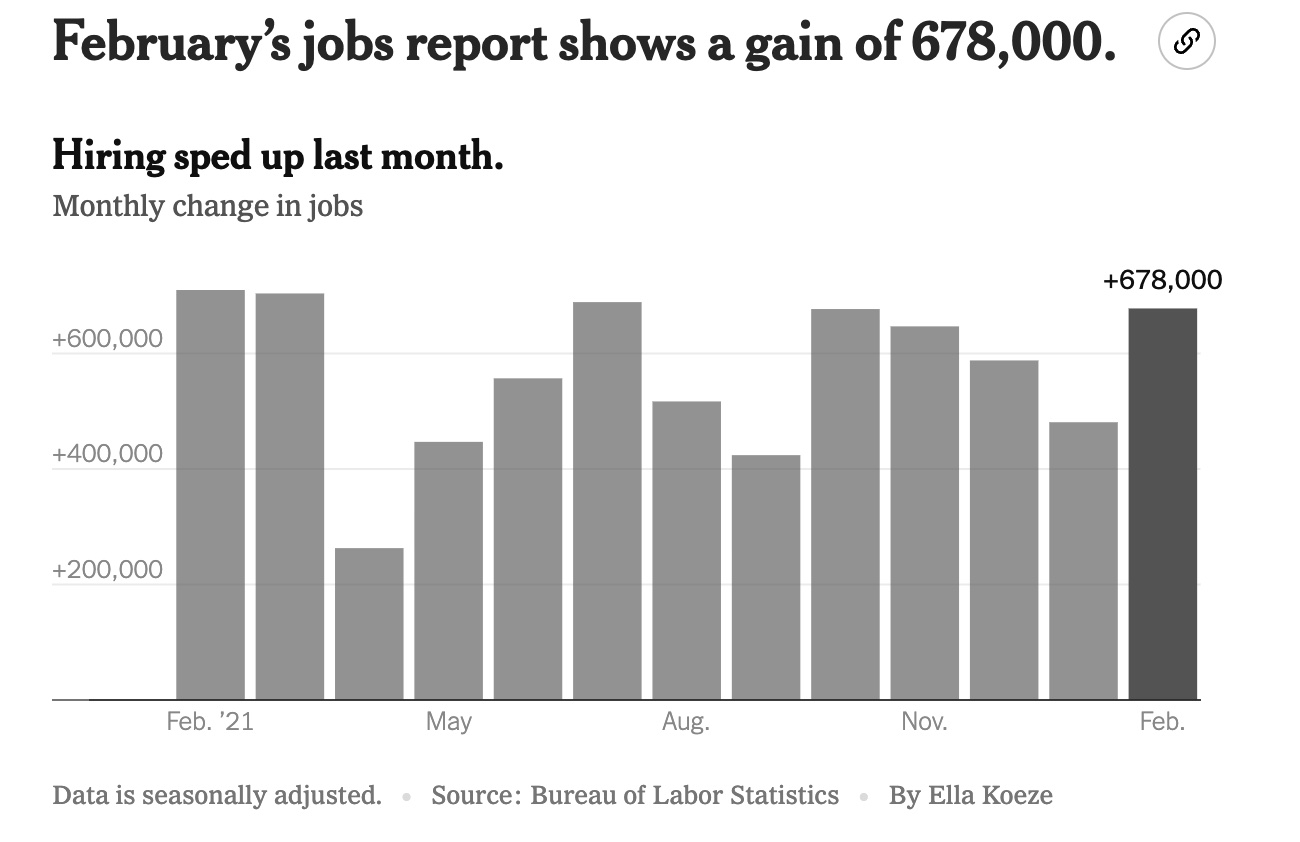

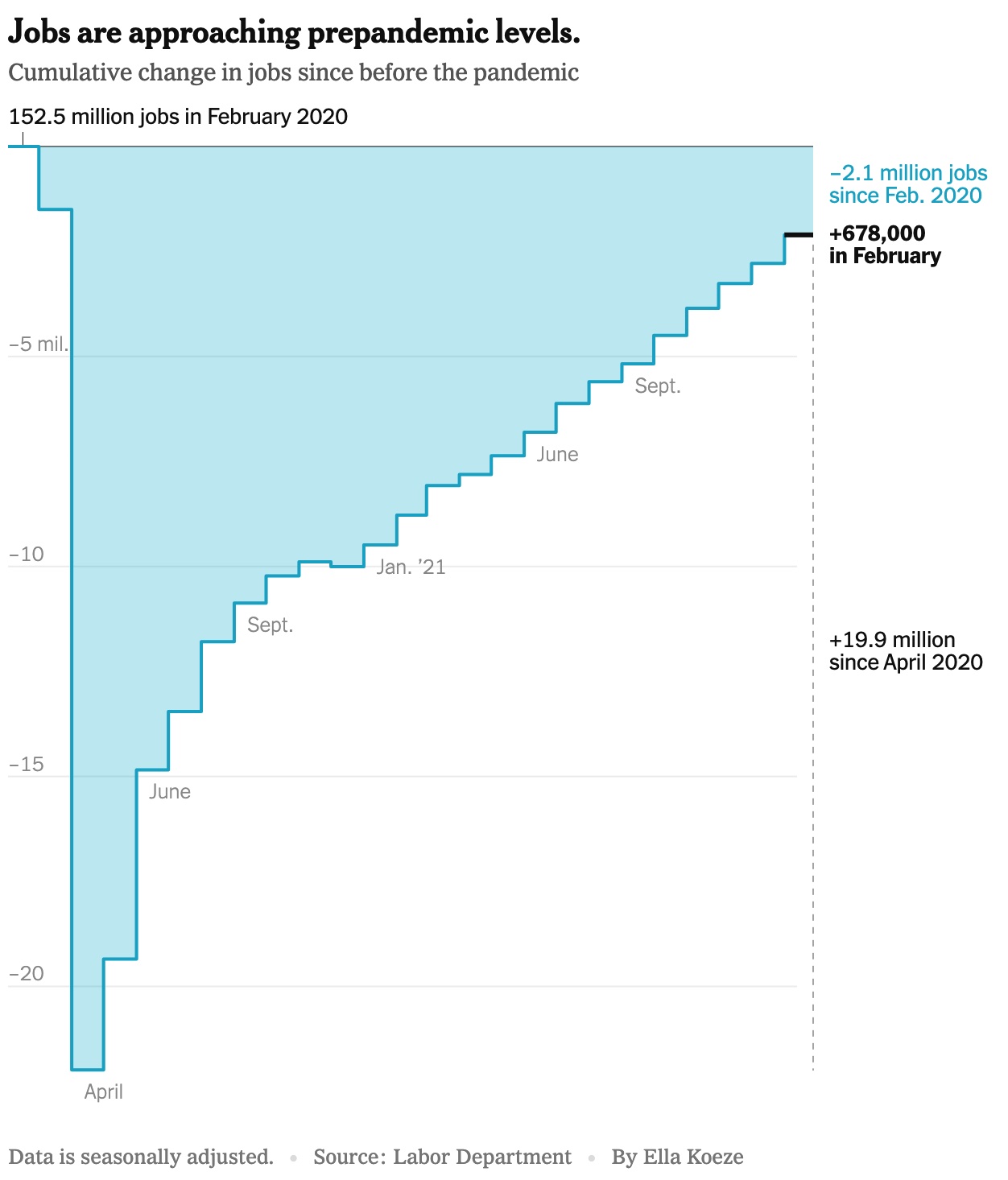

• U.S. nonfarm payrolls, due at 8:30 a.m. ET, are expected to have increased by 440,000 in February and the unemployment rate is forecast to have fallen to 3.9% from 4.0% one month earlier. UPDATE: Job growth soared in February as employers added 678,000 jobs and the unemployment rate fell to 3.8% from 4%. It was the best month for job growth since July. The nation has 2.1 million jobs to go before hitting the February 2020 level and recouping all positions lost in the pandemic. Markets, however, reacted little to the news as investors remain focused on the Russia-Ukraine war. The Jobs report shows the U.S. economy was humming in the weeks before Russia's invasion of Ukraine. February's job gains are an improvement from the month before, when revised figures show employers added 481,000 jobs. Job gains for December were also revised upward. (December moved up to 588,000, an increase of 78,000 from the previous estimate, while January’s rose to 481,000. Together, the revisions added 92,000 more than previously recorded and brought the three-month average to 582,000.) Job gains in February were widespread, with bars and restaurants adding 124,000 jobs, construction companies adding 60,000, and factories adding 36,000. In a sign that inflation could be cooling, wages barely rose for the month, up just 1 cent an hour or 0.03%, compared to estimates for a 0.5% gain. The year-over-year increase was 5.13%, well below the 5.8% Dow Jones estimate. Many employers have been raising prices to offset their higher labor costs, a process that has fueled inflation. Source of charts: New York Times.

• U.N. food Price Index is published at 12:00 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Why inflation can really hurt. Inflation becomes a problem when prices continue to rise while wages stagnate. The New York Times notes that’s what happened in the 1970s and is threatening to happen again. Inflation has been stoked by supply-chain problems during the pandemic, and “now Russia’s invasion of Ukraine may prolong supply-chain issues and push up energy costs. This persistent inflation could start to hit economic growth, an important factor underlying pay packages and investment gains.”

But Nobel-winning economist Joseph Stiglitz said, “We are not facing an inflation crisis.” At a panel discussion hosted by the Center for Economic and Policy Research, a liberal-leaning think tank, he argued that the economy is “not likely to have the type of wage-price inflation that we had in the 1970s.”

President Biden said this week that fighting inflation was his “top priority,” and the Fed chair Jay Powell said he was prepared to raise interest rates for the first time in years later this month.

Are price controls ahead? Some economists think the government should be more creative, trying things like paying people not to drive to lower the price of gas. Biden also expressed support for some price controls in his State of the Union speech this week. “It is a political problem,” Stiglitz said. “We should try to protect people from the downside of inflation.”

Market perspectives:

• Outside markets: The U.S. dollar index is higher ahead of U.S. market action as the greenback is stronger against many foreign currencies. The yield on the 10-year U.S. Treasury note has weakened to trade under 1.80% with a lower tone in global government bond yields. Gold and silver have risen ahead of U.S. trading on the Russia/Ukraine developments, with gold above $1,945 per troy ounce and silver above $25.30 per troy ounce.

• Crude oil futures have shown strength ahead of U.S. trading, with U.S. crude around $109 and Brent around $111 per barrel. Crude futures had risen even higher in Asian action, with U.S. crude around $109.75 per barrel and Brent around $112 per barrel.

• Nutrien, the world’s biggest crop-nutrient producer, is asking the Canadian government to intervene and halt a potential strike at one of the nation’s largest railways, because the disruption could potentially lead to smaller harvests. About 3,000 workers at Canadian Pacific Railway Ltd. voted in favor of going on strike March 16 if a collective bargaining agreement isn’t reached, according to their union. That would impact Nutrien’s ability to move potash, nitrogen and other crop chemicals to retail locations across Canada just ahead of spring planting, the company said. “The global food supply is already stretched and cannot afford further negative impacts at this time,” the company said Wednesday. “We would hope that the Canadian government will consider intervening to avert another transportation crisis.”

• USDA daily export sales:

— 106,000 metric tons of soybeans to China during 2021-2022 marketing year;

— 108,860 metric tons of soybeans to Mexico, 2021-2022 marketing year

— 125,000 metric tons of soybeans to unknown destinations, 2021-2022 marketing year

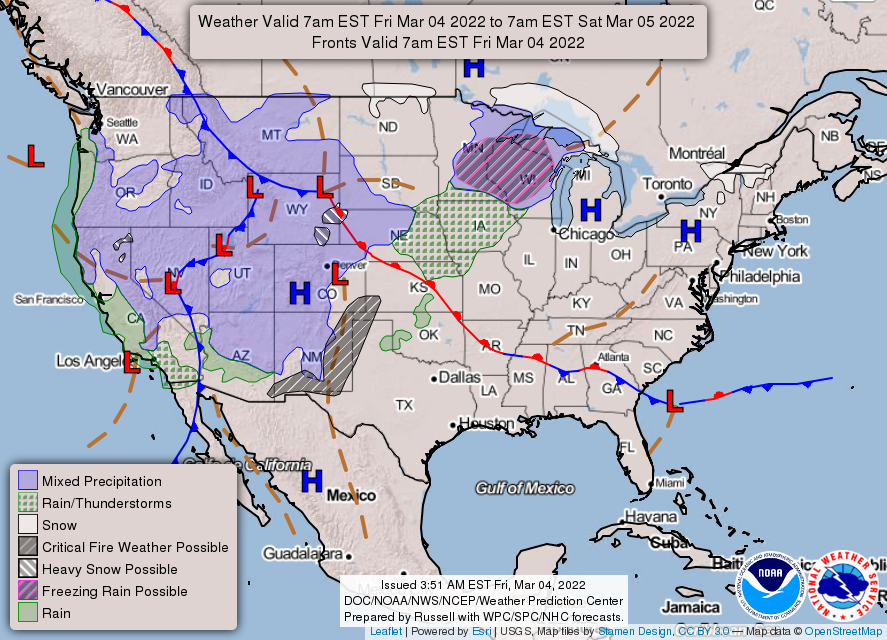

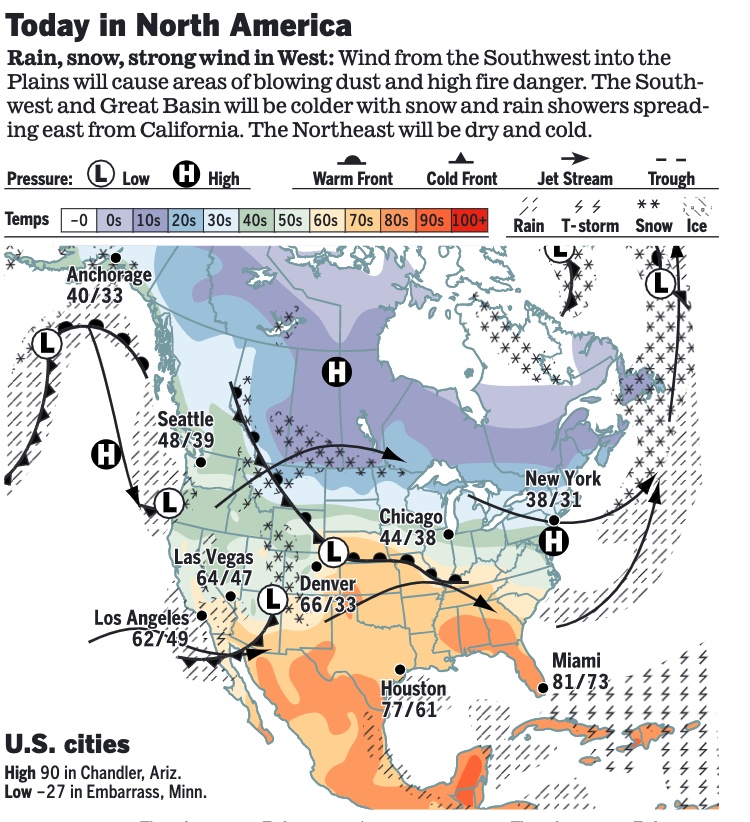

• NWS weather: Dynamic system to produce wintry weather and thunderstorms over the Northern Plains and Midwest this weekend... ...Potential for record breaking warmth across parts of the East on Sunday-Monday, with fire weather conditions worsening in the Southwest and Southern/Central Plains this weekend... ...Cooler temperatures, lower elevation rain, and mountain snow move into California, the Southwest, and Great Basin today.

Items in Pro Farmer's First Thing Today include:

• Wheat limit up again

• Black Sea supply chain mostly shut off

• Cattle selloff extends

• Hogs pause

|

RUSSIA/UKRAINE |

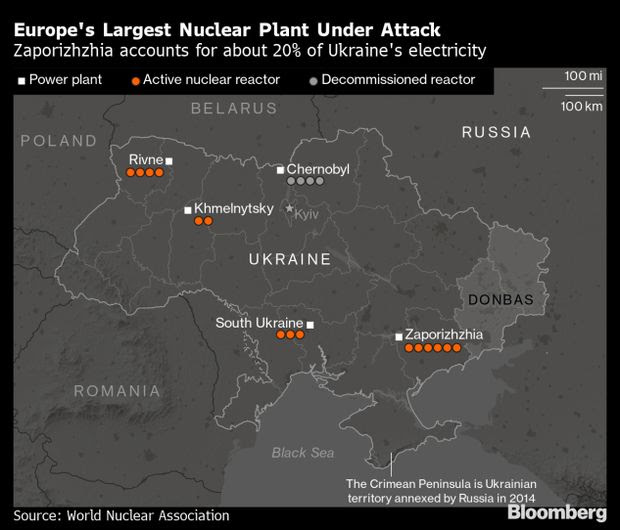

— Summary: Russian troops seized Europe’s largest nuclear power plant, after fighting sparked a fire that raised worldwide alarms about radiation leaks. American and French officials worry that Vladimir Putin will double down on his invasion despite worldwide opposition. Officials say the Zaporizhzhia nuclear power plant (close to the town of Enerhodar in south-east Ukraine) is operating normally after it was captured by Russian forces in fighting overnight. But Ukraine’s foreign ministry said any damage to a storage facility for spent nuclear fuel could release nuclear radiation and called on global leaders to take decisive action. However, International monitors said there was no sign that radiation had leaked. The plant, which is the largest of its type in Europe, provides about 20% of Ukraine’s electricity. On the ground, Russian troops are encircling Ukraine’s capital Kyiv, while assaults on the southern city of Mariupol continue. Officials from Russia and Ukraine agreed to establish “humanitarian corridors” that would allow civilians to evacuate. The U.S. will allow some Ukrainians to stay temporarily. The EU and Canada announced similar measures.

“Europe must wake up,” Ukrainian President Volodymyr Zelenskyy said in a video message early today, adding that he also spoke with U.K. Prime Minister Boris Johnson, German Chancellor Olaf Scholz and other leaders. “If there is an explosion, it is the end of Europe,” Zelenskyy added. “Only urgent Europe actions can stop Russian troops.”

Zelenskyy also spoke with President Biden, telling him that "if it blows up, it will be 10 times larger than Chernobyl," before the fire was extinguished and Russia took control of the facility

Bottom line: Vladimir Putin is signaling that he will respond to setbacks with more destruction. He also seems willing to allow Russia to pay a high price, in both economic terms and soldiers’ lives. On Thursday Emmanuel Macron, the French president, spoke with Putin by phone and came away convinced that “the worst is yet to come.” At home Russian lawmakers passed legislation making publishing “fake news” — that is, anything that contradicts the Kremlin’s claims — about the armed forces punishable by 15 years in prison.

- Sens. Manchin, Murkowski introduce bill to block energy imports from Russia, though the White House is resisting. Senate Energy and Natural Resources Committee Chair Joe Manchin (D-W.Va.) and fellow panel member Lisa Murkowski (R-Alaska) introduced the Ban Russian Energy Imports Act Thursday (March 3), which would block imports of Russian crude oil, petroleum, petroleum products, liquefied natural gas (LNG) and coal. The bill has 16 cosponsors, and Reps. Brian Fitzpatrick (R-Pa.) and Josh Gottheimer (D-N.J.) will introduce a companion bill in the House. Of note, House Speaker Nancy Pelosi (D-Calif.) said she was “all for” banning Russian oil. The bill would declare a national emergency related to threats from Russia’s invasion of Ukraine and direct the president to ban the imports using existing authority. Either Congress or the president could later terminate the emergency, lifting the import ban. The bill would exempt any product already in transit at time of enactment from the block. Given the sentiment in Congress, the measure could draw considerable bipartisan support. Notably, the Russian oil company Lukoil called for a stop to the fighting.

Upshot: Odds are growing there will be a stop to U.S. imports of Russian energy. The strong show of support for the legislation runs counter to signals the White House is sending, at least for the moment. “We don’t have a strategic interest in reducing the global supply of energy, and that would raise prices at the gas pump for the American people,” said White House press secretary Jen Psaki at a press briefing yesterday. If the measure passes Congress, it would require President Joe Biden’s signature. “I think we are giving a path forward for the administration,” said Murkowski in a scrum with reporters after a briefing. Meanwhile, Japan’s government and local companies are sticking with their Russian energy deals. - NATO rejects no-fly zone over Ukraine. NATO won't establish a no-fly zone over Ukrainian airspace amid a full-scale invasion from Russian armed forces, the alliance announced today. Secretary-General Jens Stoltenberg said during a press briefing that "allies agree that we should not have NATO planes operating over Ukrainian airspace or NATO troops on Ukrainian territory."

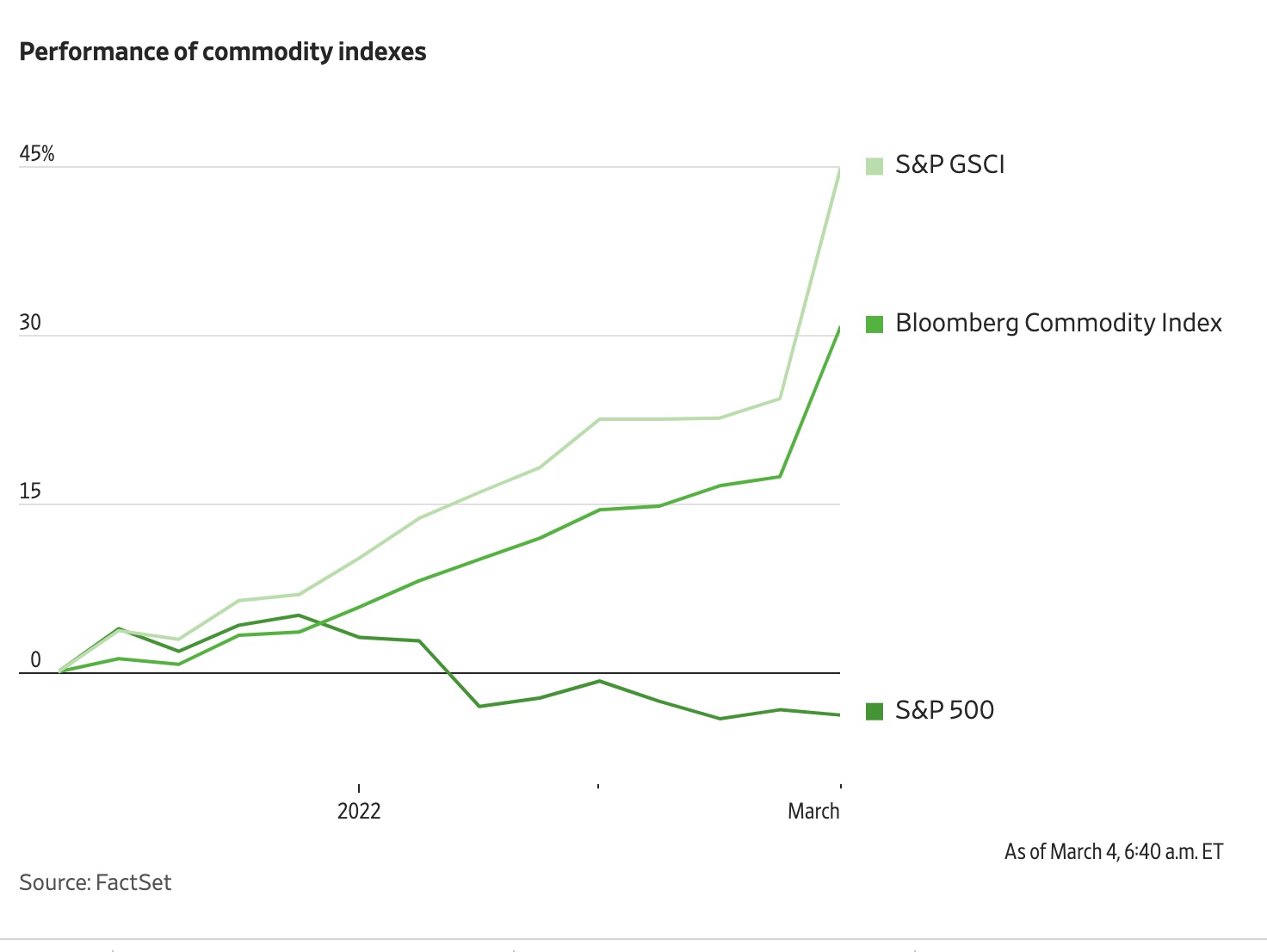

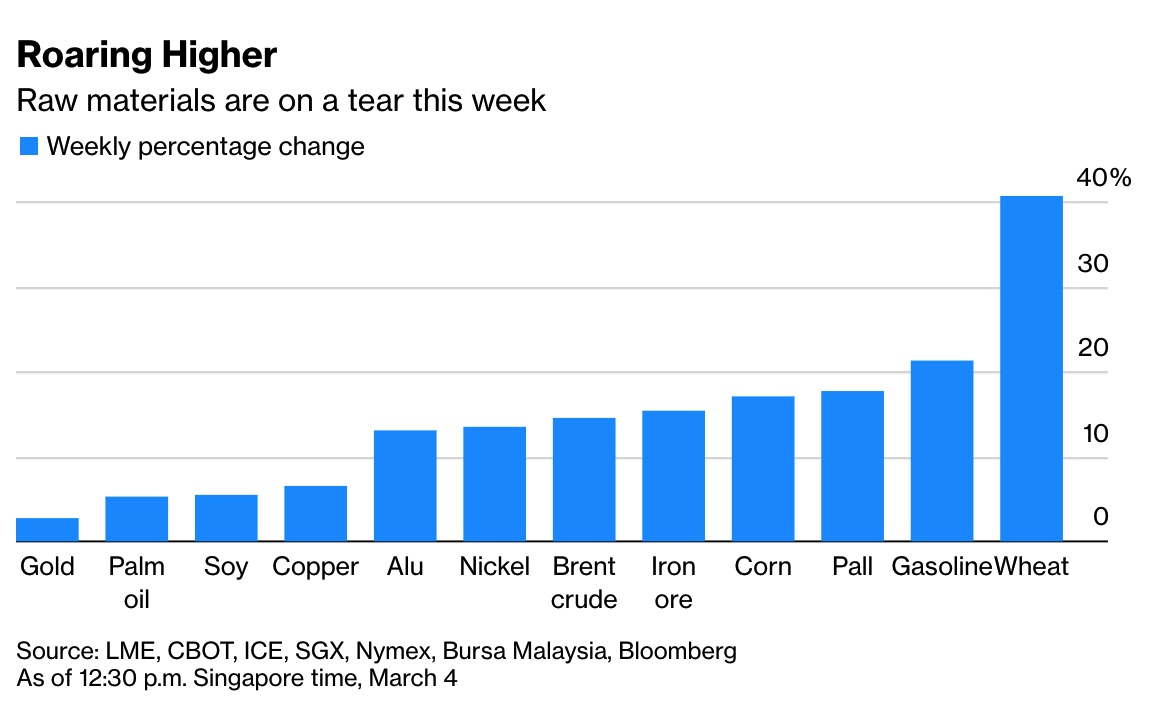

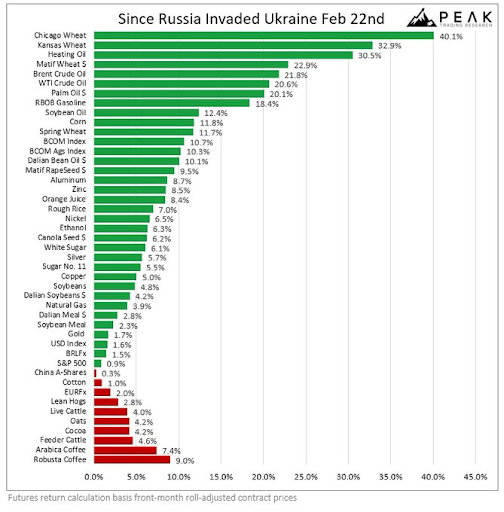

— Market impacts: Futures and global stock indexes fell as concerns mounted about Russia’s intensifying military campaign in Ukraine while ag-related markets kept up their surging action. Commodities again extended their rally, with wheat rising by the exchange limit to hit $12 a bushel. Oil is headed for its biggest weekly surge in almost two years. Hedge funds are betting on an extended rally in crude which at least one says could send prices to $200 a barrel (Westbeck Capital Management; see next item). In Europe, natural gas prices remain extremely volatile as authorities prepare for severe economic consequences should Russia cut off supplies. Later today the United Nations publishes its latest World Food Price Index.

- $200 a barrel oil? In a letter to investors, Westbeck said a lasting impairment to Russian oil exports coupled with demand destruction will probably drive prices into the $150 to $175 range and could overshoot above $200 — nearly double its current price. It said that spike might in turn fuel rampant inflation, potentially forcing the Federal Reserve to slam the brakes on rate rises. “Oil and equity markets are not priced for such a scenario even though, in our view, the odds are high,” the firm said in its letter. “We believe investors should think about insurance policies against that outcome.”

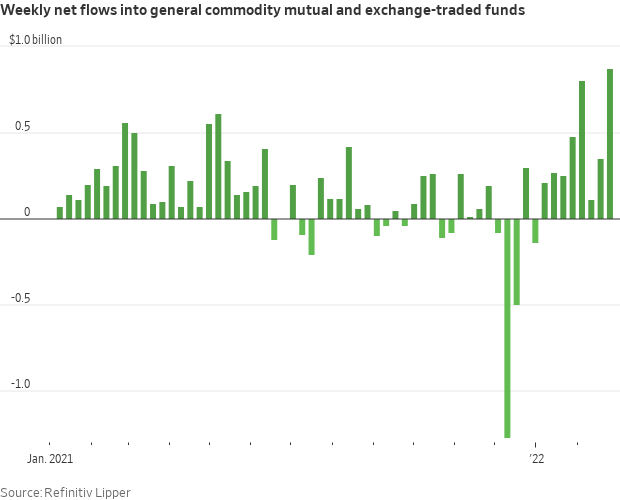

- Commodity funds draw interest. Investors are raising bets that the invasion of Ukraine and sanctions on Russia will further fuel an already-hot commodities rally. Wheat has surge to its highest level since 2008. Corn prices have jumped around 25% so far this year, earlier this week touching their highest levels since March 2013 before paring gains. Aluminum and nickel have jumped to their highest levels in over a decade. Commodity mutual funds and exchange-traded funds report net inflows for the eighth consecutive week through Wednesday, according to data from Refinitiv Lipper. That marks the longest streak since a 23-week run that ended in June 2021. Inflows for the week ended March 2, at $867 million, were at a record high, according to data going back to 2011. “People are looking for a way to get out of inflation's impact, and commodities really look like a good hedge,” Hakan Kaya, commodity portfolio manager at Neuberger Berman, whose firm has increased exposure across commodities from energy to livestock and agriculture in 2022. Link to more via the WSJ.

- Key unknown: How much grain will/can Ukraine produce this year? Some are already predicting zero, while others say it’s too early to assess, as there are six to eight weeks before usual planting. But this is not usual planting in Ukraine.

- Shipping: Many Black Sea ports are shut, while some container lines have halted Russian visits. The impact will cascade through supply chains. The crisis will last as long as shipping is disrupted, say observers.

- Russia’s connections to global trade routes are disappearing as shipping companies halt services and a tit-for-tat battle over sanctions pares back operations, the Wall Street Journal reports (link). Several of the world’s largest freight forwarders suspended service in and out of Russia this week, and some extended their new bars to Moscow ally Belarus as Russia pressed its attacks on Ukraine. Digital cargo marketplace Freightos says the disruptions in ocean and air freight services, along with rising oil prices, threaten to pump up shipping costs still further around the world. The showdown over sanctions is buffeting the aviation industry, the WSJ reports (link), slashing airfreight capacity and raising costs as airlines take longer routes to avoid Russian airspace. Rerouting around Russia is costly, adding about 700 nautical miles and two hours’ time for a flight from Frankfurt to Beijing, limiting room for freight. Freightos notes the European bar against Russian airlines removes Russian freighter operator AirBridgeCargo from the European market.

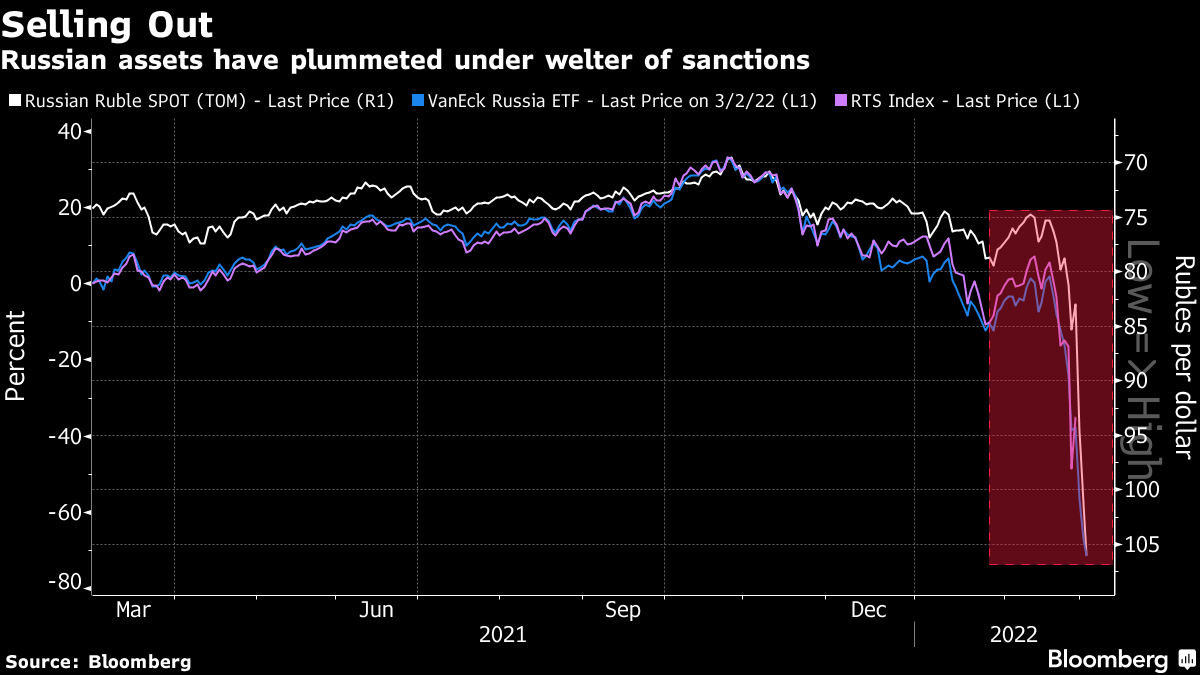

- Russian corporate bond prices have plummeted as much as 70% since the country invaded Ukraine, triggering U.S. and European sanctions that cut the country off from much of the international financial system. Unlike most countries with debt at distressed prices, Russia enjoys current-account surpluses, and its largest companies are cash-rich.

- The Moscow stock exchange remained closed for a fifth consecutive day, to prevent a mass sell-off of shares. Over in the U.S., FINRA halted OTC trading in several Russian stocks, while the London Stock Exchange suspended trading in more than 50 Russian securities to "maintain orderly markets." Another wave of sanctions has also hit Russian oligarchs and Vladimir Putin's inner circle, ratcheting up financial pressure in response to Moscow's "destabilizing foreign policy."

- Venezuela is pushing for a lift in U.S. sanctions. With energy prices soaring because of war in Ukraine, Wall Street firms and other U.S. investors are seeing an opening to press the Biden administration to lift sanctions against a potentially major Western Hemisphere producer of crude.

|

POLICY FOCUS |

— European Commission now rethinking Farm-to-Fork policy in wake of Ukraine situation. The European Commission has shifted gears in the wake of the Russian invasion of Ukraine and now said it will re-evaluate the EU’s sustainability ambitions of the Farm to Fork (F2F) strategy. The rethink is to make sure that that European Union (EU) food security is maintained.

Following a meeting of agriculture ministers this week, French Agriculture Julien Denormandie said several member states raised questions about ensuring food supplies and food sovereignty in Europe. EU Agriculture Commissioner Janusz Wojciechowski confirmed the development, noting the Commission will analyze their sustainability policies in the coming weeks to take the new circumstances into account. “If food security is endangered, then we need to have another look at the [F2F] objectives and possibly correct them,” Wojciechowski said. However, he said the EU did not want to “throw away” the F2F strategy.

Upshot: This could be a significant development elative to the EU F2F plan and it is not clear if it will prompt a rethink in other countries that are pursuing sustainability/climate-related programs and efforts.

— USDA: No discussions about emergency crops in Conservation Reserve Program (CRP). USDA is not considering suggestions that it open the land-idling CRP for cropping this year to stabilize grain supplies following Russia’s invasion of Ukraine, said USDA press secretary Kate Waters on Thursday. “There are no immediate discussions to that effect.”

Economist and former USDA chief economist Joe Glauber now of the IFPRI think tank said he doesn’t think that allowing emergency planting of CRP acreage would have a major impact on global wheat supplies, at least this year. Glauber said (link) “much of the land in the CRP is marginal, less productive land so yields would likely not be nearly as large as the historical yields that we saw in 2018-20.” On Wednesday, tweeting economist Scott Irwin of the University of Illinois suggested an emergency opening of the CRP for one year. Russia and Ukraine, two of the world’s largest wheat exporters, may be out of the international market for months.

|

CHINA UPDATE |

— If China tries to help Russia evade sanctions in the wake of Moscow’s invasion of Ukraine, it will face countermeasures, a senior U.S. State Department official said on Thursday, without providing details. State Department counsellor Derek Chollet said the allied nations that have joined in sanctioning Russia represent a combined 50% of the global economy; China accounts for around 15%. “China, if it were to seek to evade the sanctions, or somehow dividing the sanctions, they would be vulnerable,” he said. “Any country that tries to evade these sanctions will also face the consequences of its actions. I don’t want to speculate with that would be.”

Meanwhile, Chinese state media is embracing Russian disinformation about the conflict, but Beijing officials are reportedly worried about the consequences of backing Moscow.

Bottom line: Beijing is having to adjust its foreign policy in a way that could damage relations with the West and undo years of effort to paint itself as a responsible world leader.

— China's National People's Congress (NPC) will convene its annual parliamentary gathering on Saturday, setting economic and political priorities for 2022. Nearly 3,000 lawmakers will descend on Beijing, where the nation's rubber-stamp parliament will lay out targets for spending, employment, inflation and other growth goals. In recent years, President Xi has also used the NPC to further legitimize governance decisions, like the lifting of presidential term limits in 2018 and Hong Kong's sweeping national security law in 2020. Some ask: Could this year's conference make a reference to Taiwan?

The Communist Party leadership is expected to lay out its lowest economic growth goal in more than three decades, adopting a GDP target of between 5% and 5.5%, according to analysts at BNP Paribas. That would be the first time since 1991 that the figure fell below 6%, so watch for a possible release of additional tax cuts and stimulus measures.

|

ENERGY & CLIMATE CHANGE |

— White House studying whether RFS waiver would tame food inflation? The Biden administration is looking at whether waiving biofuels blending requirements under the Renewable Fuel Standard (RFS) could help fend off food inflation, according to Reuters, citing two sources familiar with the situation. An administration official told Reuters “There is no serious consideration of this” right now, but given surging food inflation, it was just a matter of time until the food vs. fuel debate rekindled.

It is not clear any such waiver would impact food prices as it would most likely provide a psychological impact for prices. But waiving biofuel requirements, if it were to happen, would only be a one-year situation. The Biden administration has yet to finalize the RFS levels for 2021 and 2022, proposing to move the corn ethanol requirement back to 15 billion bushels as specified by law. Any waiver would also likely bring sharp pushback from farm-state lawmakers.

Perspective: This isn’t the first time Reuters was out first with a food vs fuel angle. Early last August, Reuters reported that a trade group representing some of America’s biggest baked goods companies is urging the Biden administration to ratchet back its biofuel ambitions, arguing that using fuel made from crops could raise the cost of donuts, bread and other foods. At the time it appeared they were also taking on biodiesel because of a lack of oilseed supplies. The Environmental Protection Agency on Dec. 7 issued its long-awaited proposed Renewable Fuel Standard renewable volume obligations (RVOs) for refiners for 2022, 2021 and 2020.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Department of Justice is conducting antitrust probe of poultry companies on sharing employment practices. The Department of Justice has launched an antitrust problem of major poultry companies for sharing employment information and keeping worker wages low, according to the Wall Street Journal (link). Both Pilgrim’s Pride and Perdue confirmed they have been notified by DOJ of the investigation, with Pilgrim’s saying in recent securities filings that they would cooperate with the probe. The investigation is said to be in the early stages and WSJ said it was not clear whether it would lead to action by DOJ. This marks another stage of investigations by DOJ of the U.S. poultry and meat industry and signals the focus on the industry is rising. The Biden administration has made clear that antitrust activities will be increasing.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 442,101,244 with 5,981,240 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,196,394 with 956,262 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 554,168,735 doses administered, 215,892,470 have been fully vaccinated, or 65.77% of the U.S. population.

— Biden administration asks Congress for $22.5 billion in Covid aid. The money would help fund the White House’s new coronavirus response strategy. But Republicans point to the billions in unused funding from the American Rescue Plan.

— The NFL is dropping its Covid rules, the first major U.S. sports league to do so.

|

POLITICS & ELECTIONS |

— Republicans will have a clear path to a lopsided 6–2 edge in Wisconsin’s congressional delegation under a redistricting plan the State Supreme Court approved yesterday. The court, in a 4–3 decision, opted for a configuration offered by Gov. Tony Evers (D), who had rejected the version drafted by the Republican-controlled legislature.

— Despite GOP Entreaties, Ducey won’t enter Arizona Senate contest. The Associated Press reports (link) Arizona Gov. Doug Ducey (R) “has notified” Senate Minority Leader McConnell (R-Ky.) that “he will not enter his state’s high-profile Senate contest, a disappointing development for establishment Republicans who saw Ducey as their best hope to defeat Democratic Sen. Mark Kelly this fall.” Ducey’s decision was long expected. For months, he had told both reporters pressing him and Republicans courting him that he had little appetite for the race.

— Redistricting: Where the six remaining states stand. According to David Wasserman, House editor of the Cook Political Report with Amy Walter: “Now that 38 of the 44 states with more than one House seat have adopted new lines, our 2022 House ratings are coming into view. At the moment, there are 19 Democratic-held seats in Toss Up or worse, compared to 11 GOP-held seats in Toss Up or worse. A possible state court-ordered map in Ohio could soon put a few more GOP seats at risk. Meanwhile, Florida, New Hampshire and Wisconsin could add to Democrats' tally of vulnerable seats.”

— President Joe Biden will attend the House Democratic retreat in Philadelphia next Friday, the last day of the three-day meeting, according to reports. Vice President Kamala Harris is also invited.

|

CONGRESS |

— The upcoming funding bill to keep the government open is unlikely to include tax provisions. Industries advocating for particular tax provisions, especially a renewal of the more generous expensing rule for research and development that was phased out at the end of last year, have held out hope that their priorities could catch a ride with the must-pass legislation. In a brief interview Wednesday with Bloomberg, Senate Finance Committee Chairman Ron Wyden (D-Ore.) remained noncommittal about including a tax section in the upcoming government funding bill.

— Ocean carriers need more regulation that would make it harder for them to turn away U.S. goods at ports, senators from both parties said yesterday. Lawmakers and the Biden administration have taken special interest in solutions to backups at ports that have fed into shortages and high prices. As a potential remedy, a bipartisan bill would give the Federal Maritime Commission more authority to regulate international shipping companies and stop carriers from turning down U.S. exports.

|

OTHER ITEMS OF NOTE |

— Cotton AWP eases but remains elevated. The Adjusted World Price (AWP) for cotton eased to 112.71 cents per pound, effective today (March 4), down from 113.71 cents per pound the prior week. This still marked the ninth week in a row the cotton AWP remained at or above $1 per pound. Meanwhile, USDA said Special Import Quota #20 would be established March 10 for 46,572 bales of Upland Cotton, applying to supplies bought not later than June 7 and entered into the U.S. not later than Sept. 5.

— Some farm groups ask FTC for right to repair Deere equipment. Deere and Co., unlawfully forces farmers to pay a Deere dealer when their tractors or other equipment break down, some farm groups alleged in a “right to repair” complaint (link) filed with the Federal Trade Commission (FTC) on Thursday. The FTC said last year that it would ramp up its law enforcement against repair restrictions that prevent small businesses, workers, and consumers from fixing their own products. Link for details.

— Iran talks: “An agreement to restore the 2015 Iran nuclear deal could be just days away, with negotiators from Europe and Iran making clear that they've reached the final hurdles.” Link to more from Axios.