Biden’s State of the Union Address Pushes Unity Against Russia, Battle Against Inflation

Fed chairman comments | Farm groups focus on input costs, need for higher reference prices

|

In Today’s Digital Newspaper |

More companies have frozen ties to Russia, including Apple, Visa and Mastercard, Boeing and Ford and P.R. firms, while Facebook restricted Russian state media on its global platforms. But some cryptocurrency exchanges are resisting bans on Russian transactions. Russia is finding fewer buyers for its oil, even at deep discounts. Jamie Dimon of JPMorgan Chase warned that the sanctions on Russian banks would have unintended consequences and said market volatility would persist.

Today’s dispatch focuses on President Biden’s first State of the Union address and shows why most people do not view it on television.

We have updates on the new farm bill hearing in the House Ag Committee and release of another trade report by the U.S. Trade Representative.

On the economic front, Fed Chairman Jerome Powell says higher rates and tapering are coming, despite the major uncertainty of the Russia/Ukraine war.

On the ag market front, a look at wheat futures shows volatility is here to stay for a while.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed to firmer overnight, and the U.S. Dow opened 200 points higher and is currently over 300 points higher. The Russian invasion of Ukraine continues, and oil prices climbed. The Nikkei fell 451.69 points, 1.68%, at 26,393.03. The Hang Seng Index declined 417.79 points, 1.84%, at 22,343.92. European equities are off to a relatively muted start with most markets trading slightly higher in early action. The Stoxx 600 was up 0.1% while other markets were up 0.1% to more than 1%, but most are showing advances of less than 1%.

U.S. equities yesterday: The Dow ended down 597.65 points, 1.76%, at 33,294.95. The Nasdaq dropped 218.94 points, 1.59%, at 13,532.46. The S&P 500 was down 67.68 points, 1.55%, at 4,306.26.

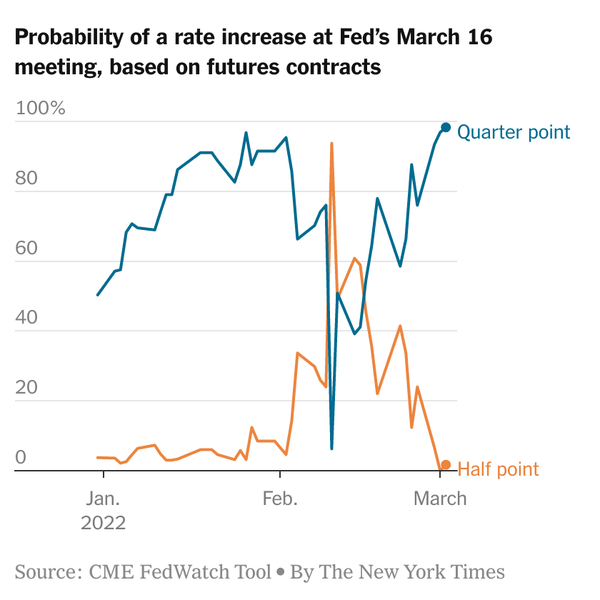

Fed Chair Powell notes 'highly uncertain' Ukraine impact but says rate hikes are still coming. Fed Chairman Jerome Powell said today he still sees interest rate hikes ahead though he noted the “implications for the U.S. economy are highly uncertain” from the Ukraine war. Powell called the labor market “extremely tight” and said inflation has risen well above the Fed’s 2% target. His remarks are part of mandatory appearances this week before House and Senate committees in Congress.

The central bank chief acknowledged the “tremendous hardship” the Russian invasion of Ukraine is causing. “The implications for the U.S. economy are highly uncertain, and we will be monitoring the situation closely,” Powell said. “The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain,” he added. “Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.”

“We will use our policy tools as appropriate to prevent higher inflation from becoming entrenched while promoting a sustainable expansion and a strong labor market,” he said. “We have phased out our net asset purchases. With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month.”

The Fed has been buying Treasurys and mortgage-backed securities at the fastest pace ever, driving the total holdings on the central bank balance sheet to nearly $9 trillion. Powell said the reduction will be conducted “in a predictable manner,” largely through allowing some proceeds from the bonds to roll off each month rather than reinvesting them.

On the economy, the chairman said he still expects inflation to decelerate through the year as supply chain issues are resolved. He called the labor market “extremely tight” and noted strong wage gains, particularly for lower earners and minorities. “We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation,” he said. “We know that the best thing we can do to support a strong labor market is to promote a long expansion, and that is only possible in an environment of price stability.”

“The Fed is facing a nightmare scenario,” Diane Swonk, the chief economist at Grant Thornton, told the New York Times. While it needs to raise rates to stop inflation, it also doesn’t want to disrupt the markets, she said: “The Fed is going to have to be more cautious in how they move.”

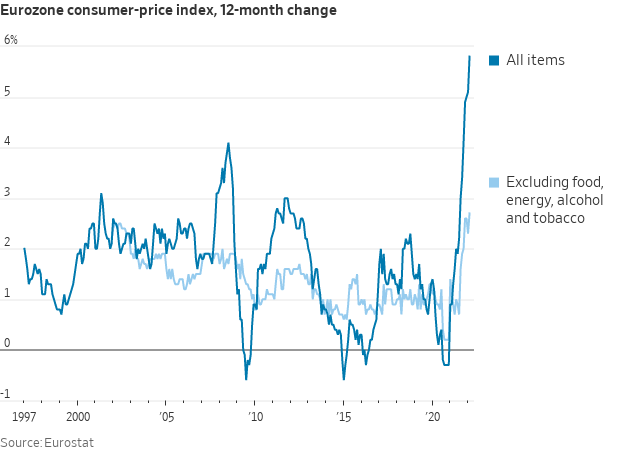

Eurozone inflation reaches another high in February. Eurozone inflation soared to another record high last month as consumer prices surged 5.8% from year-ago, up from a 5.1% rise in January. A 32% jump in energy costs drove inflation but unprocessed food prices also rose a sharp 6.1%. Inflation excluding food and energy prices accelerated to 2.9% in February from a 2.4% rise the previous month.

Market perspectives:

• Outside markets: The U.S. dollar index has strengthened again in early trade action. The yield on the 10-year U.S. Treasury note has firmed to trade just above 1.76% amid a mixed tone in global government bond yields. Gold and silver futures are under pressure ahead of U.S. trading, with gold under $1,930 per troy ounce and silver under $25.15 per troy ounce.

• Crude oil futures: Another big rise in crude oil ahead of U.S. trading with U.S. crude around $110 per barrel and Brent around $112 per barrel. U.S. crude had risen to around $108 per barrel and Brent around $110 per barrel in Asian trading.

• 60 million barrels of crude from strategic reserves. The International Energy Agency's member nations, which includes the U.S., will release a combined 60 million barrels of crude oil from their reserves in a bid to stem rising oil prices, with the U.S. contributing 30 million barrels to the overall release.

• USDA daily export sales:

— 264,000 metric tons of soybeans for delivery to unknown destinations. Of the total, 198,000 metric tons is for delivery during the 2021-2022 marketing year and 66,000 metric tons is for delivery during the 2022-2023 marketing year;

— 266,000 metric tons of soybeans for delivery to China. Of the total, 198,000 metric tons is for delivery during the 2021-2022 marketing year and 68,000 metric tons is for delivery during the 2022-2023 marketing year.

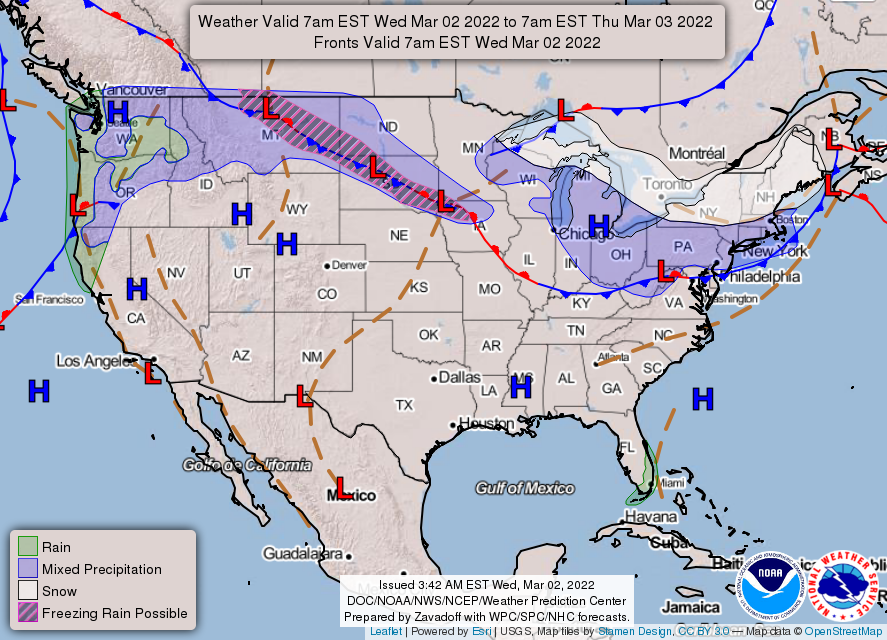

• NWS weather: Rain/snow across the Pacific Northwest slowly wanes as increasingly unsettled weather works its way into California by Friday morning... ...Above normal temperatures from parts of the West expanding to the eastern U.S. will be contrasted with arctic air and periods of light snow across the northern tier.

|

RUSSIA/UKRAINE |

— Russia/Ukraine update: The two countries will hold a second round of talks later today, TASS said, citing an aide to Ukraine’s presidential office. Russian forces resumed airstrikes on central Kharkiv, Ukraine’s second-largest city, and continued pounding other cities on the seventh day of the war. Russia’s shift to a strategy of pummeling civilian areas is an attempt to break Ukrainian resistance and reignite their own slowing military advance, says the Wall Street Journal. Ukrainians are hiding in basements and shelters, struggling to find food and looking for ways to escape the increasingly violent onslaught. In an emotional video address to the European Parliament, Ukrainian President Volodymyr Zelenskyy said his compatriots were dying in a struggle for the country’s survival. Several Russian oligarchs are distancing themselves from Russian President Vladimir Putin, as Western countries threaten to squeeze their assets.

- The Ukraine city of Kharkiv has not yet been taken by Russia despite an intensive shelling effort that took place over the past 24 hours. Russia had warned citizens to flee the city, but so far reports indicate Ukrainian forces still have control over the city.

- Russian Foreign Minister Sergei Lavrov said that if a third World War were to take place, it would involve nuclear weapons and be destructive, the RIA news agency reported, per Reuters. Lavrov has said that Russia, which launched what it calls a special military operation against Ukraine last week, would face a “real danger” if Kyiv acquired nuclear weapons.”

- Senior Biden administration officials are preparing to dramatically expand the number of Russian oligarchs subject to U.S. sanctions, aiming to punish the financial elite close to President Vladimir Putin over his invasion of Ukraine, according to the Washington Post, citing three people briefed on internal administration deliberations.

- Head of People’s Bank of China, Guo Shuqing, said China will not participate in Western banking sanctions against Russia. “We will not participate in such sanctions, and we will continue to maintain normal economic, trade and financial exchanges with relevant parties,” he told a briefing. He stated that universal financial sanctions usually do not have a good effect and lack a legal basis. Russian sanctions do not currently have an “obvious” impact on the Chinese economy and financial system, Guo said, but noted it “needs to be observed.”

Western countries have removed seven Russian banks from the SWIFT payment system, but have left open the route relative to energy payments.

- Russia’s Sberbank said it would withdraw from the European market, with subsidiaries in Austria, Croatia, Slovenia, the Czech Republic, Hungary and the Baltics, with the Wall Street Journal reporting that four of the bank’s operations in the region have run into trouble and have had to be sold or liquidated as citizens rushed to pull funds out of the banks. The European Central Bank warned earlier this week that Sberbank’s European units in Austria, Croatia and Serbia had already been deemed to have failed or were failing.

Background. Since Russia’s aggression towards Ukraine in 2014, Moscow has sought to protect its financial system from possibly being cut off from international markets by the U.S. Its central bank amassed $630 billion in foreign exchange reserves and shifted them away from the dollar and towards the euro, China’s renminbi and gold. Moscow seemed to believe a disunited Europe, dependent on Russian gas, would not join with the U.S. But around half of Russia’s total reserves are now frozen.

- The Russian stock market remained closed for a third day.

- Hyundai closed its St. Petersburg, Russia, manufacturing facility but plans to resume operations next week. But the firm said the closure was not due to the Russian invasion of Ukraine but a shortage of components.

- Apple has suspended sales of its products in Russia, as the world’s most valuable company joins other multinationals boycotting the country following its invasion of Ukraine.

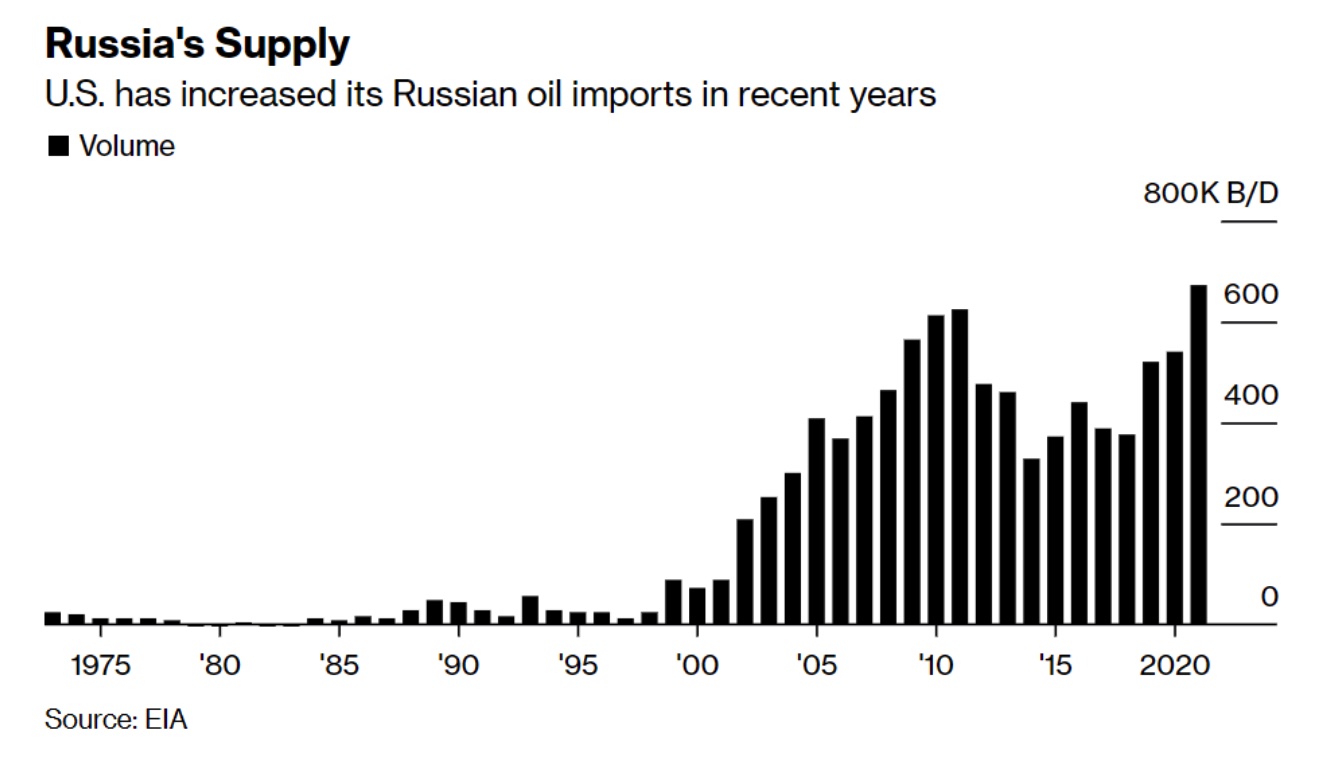

- Oil and gas payments remain largely excluded from sanctions. Russia continues to export about 5 million barrels a day of oil. While Europe depends on Russian supplies to avoid shortages, sanctions on payments would be pointless, is the European view of many. If Moscow’s shipments were only partially restricted and not completely stopped, moreover, higher global energy prices would offset some of the cost to Russia. Canada has banned Russian oil imports and Canadian politicians want the Keystone XL pipeline revived. Some say the U.S. now has another incentive to sign a nuclear deal with Iran.

Why does the U.S. buy Russian oil? In part because of a century-old law known as the Jones Act, says the Wall Street Journal (link).

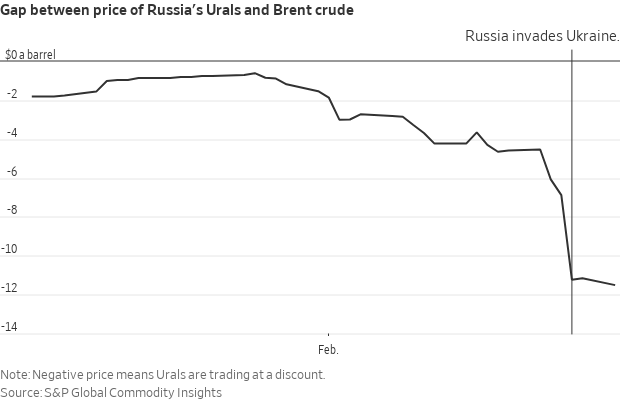

- The gap between Russian oil and Brent is widening. In a sign that demand for Russian oil has evaporated, prices for the country’s flagship Urals crude sold at massive discounts—as much as $18 a barrel below the price of global benchmark Brent—and even then had trouble finding buyers.

- Exxon Mobil Corp. said it will exit operations in Russia, including its large oil and gas production project on Sakhalin Island, joining other oil majors such as BP PLC and Royal Dutch Shell PLC in severing business ties with Russia because of its invasion of Ukraine. Exxon also said it will suspend new investments in Russia "given the current situation," but it did not provide details on when it plans to end its current operations there or any possible asset write-downs. The retreats from Russia are putting pressure others such as TotalEnergies to follow suit. Baker Hughes, Halliburton and Schlumberger are also in Russia.

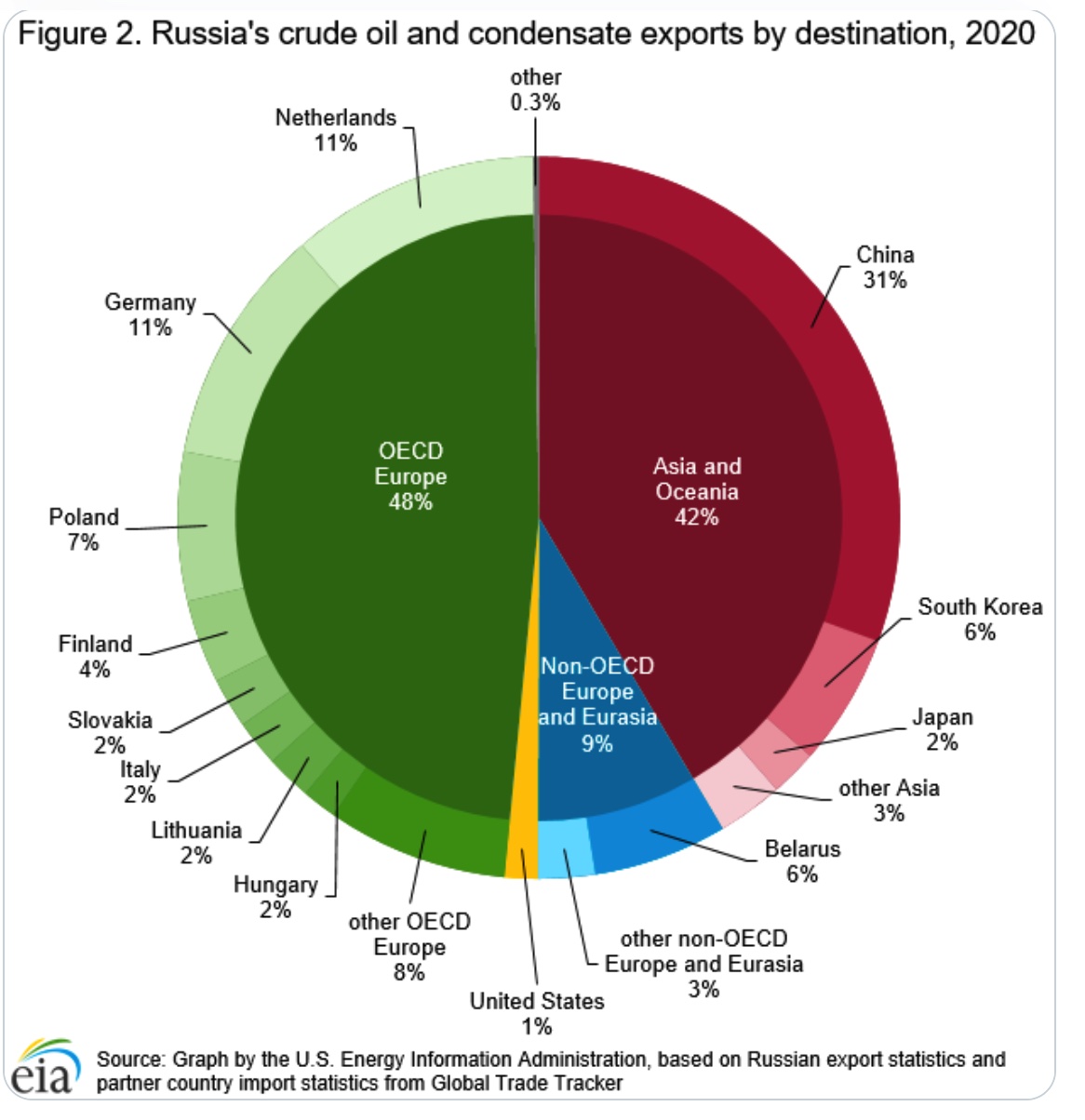

- Russian energy supplies are particularly important in Europe, which receives around 70% of the country’s gas exports and half of its oil exports, according to official U.S. data. The rest of Russia’s gas exports go to Belarus (8%), China (5%), Kazakhstan (5%), Japan (4%) and other parts of Eurasia, Asia and Oceania. Its remaining oil exports go to China (31%), South Korea (6%), Belarus (6%), Japan (2%), the U.S. (1%) and other parts of Eurasia, Asia and Oceania.

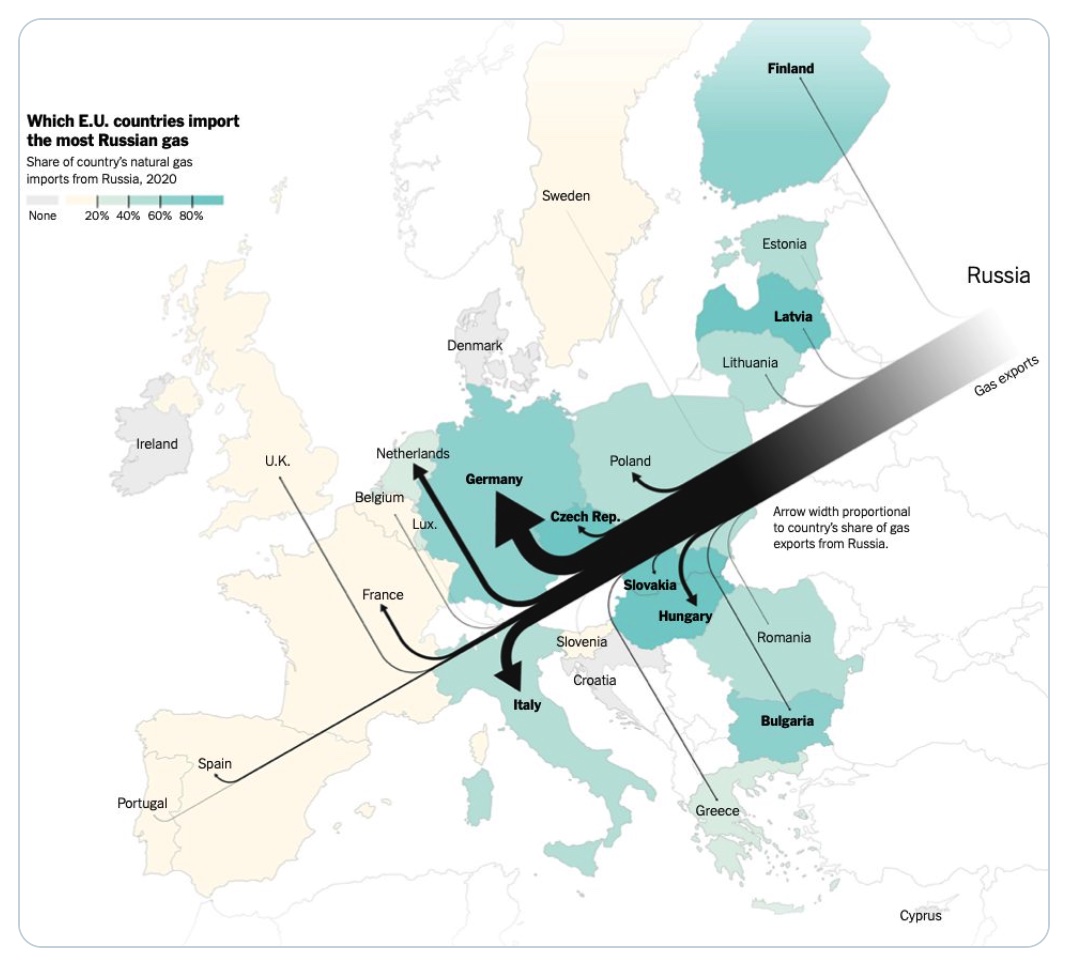

More than a third of Europe’s gas supplies come from Russia, according to the New York Times. It has produced a map showing how Russian gas exports are received across Europe.

- Russian crisis could cause Germany to rethink its exit from coal-powered energy. Germany would consider a slower exit from coal-powered energy should Russia stop gas deliveries to Europe in response to sanctions over its invasion of Ukraine, Economy Minister Robert Habeck said. “Short term it may be that, as a precaution and in order to be prepared for the worst, we have to keep coal-powered plants on standby and maybe even let them operate,” said Habeck. Germany had planned to shut its nuclear power plants by the end of this year and phase out coal-fired plants by 2030, but the Russian situation has forced it to consider both keeping nuclear and extending the lifespan of coal plants.

- Vilsack: USDA analyzes Ukraine situation, but still no trade undersecretary. USDA Secretary Tom Vilsack said Tuesday that USDA officials are analyzing the impact of Russia’s invasion of Ukraine on global agriculture and food supplies, but he is frustrated by the slowness in nominating an Agriculture undersecretary for trade and foreign agricultural affairs and other officials. During a speech delivered online to the National Farmers Union convention in Denver, Vilsack said that the situation in Ukraine is “not just a battle between two countries,” but a battle between governing in a democratic way despite the challenges or a more authoritarian approach. Ukrainians “relished” the opportunity for democracy and “didn’t want to be told how to do it by a dictator in another country,” Vilsack said. He noted that the democratic world has rallied to create enormous stress on the Russian economy that has to finance “this illegal war,” with even usually neutral Switzerland joining in.

On the impact on agriculture, Vilsack repeated earlier statements that it is still too early to tell but added that if food production does not take place in Ukraine “then the world community has another set of issues to cope with.” If food needs to be provided to developing countries, he said, the United States has programs to provide that food, Vilsack noted, adding his team “is taking a look at what might happen,” Vilsack said.

There have been two candidates for the position of Agriculture undersecretary for trade and foreign agricultural affairs, but the White House told one that he would have to sell his farm to take the job and told the other that he would have to liquidate most of his holdings, Vilsack said. Vilsack said he understands the ethics awareness raised after the Trump administration, but that “we have to find a medium spot where we support the message of ethics but make sure we can find people to serve.”

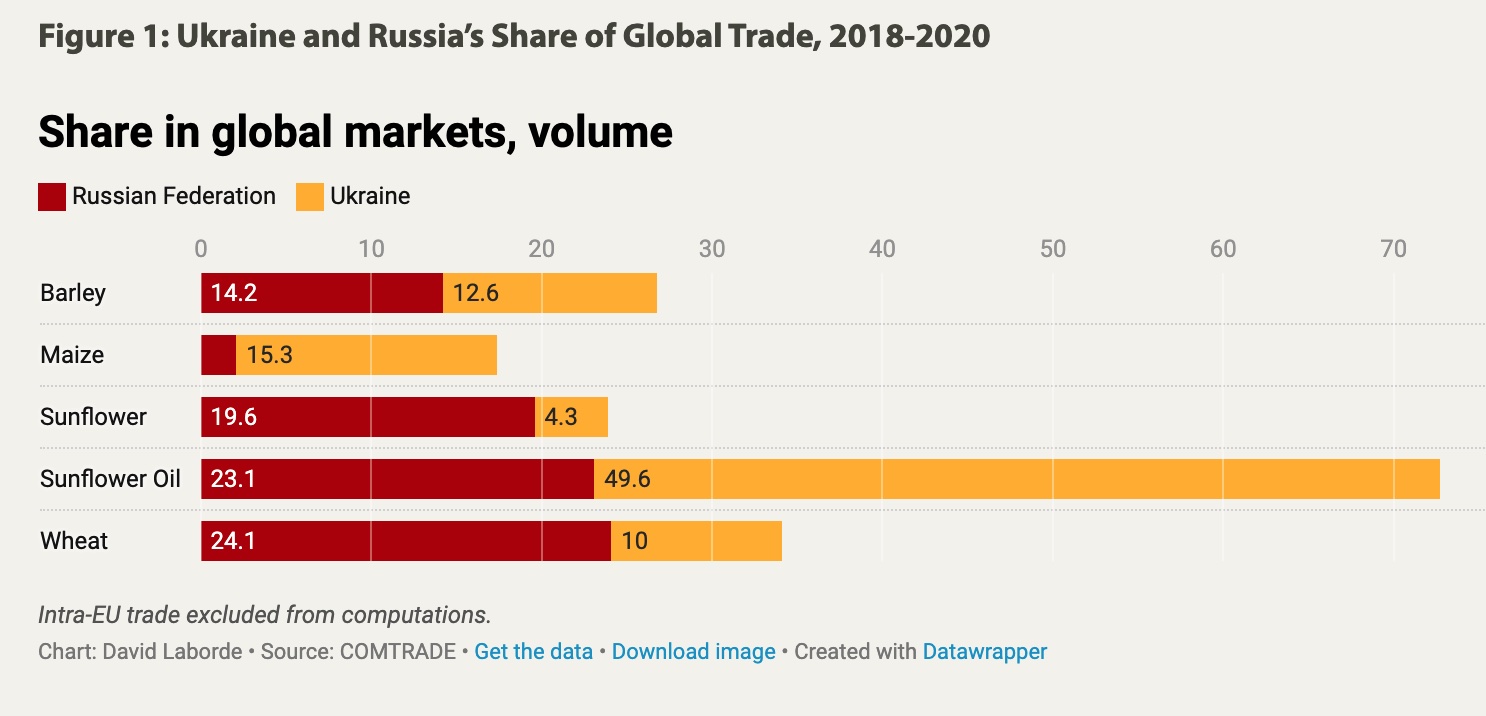

— IFPRI: Ukraine exports disruption hurts developing countries first. Three senior research fellows at the International Food Policy Research Institute (IFPRI) said any disruption in the export of grains from Ukraine will first hurt the developing countries to which they export but will become an issue for the U.S. and other countries if those developing countries don’t have enough food. Link for details.

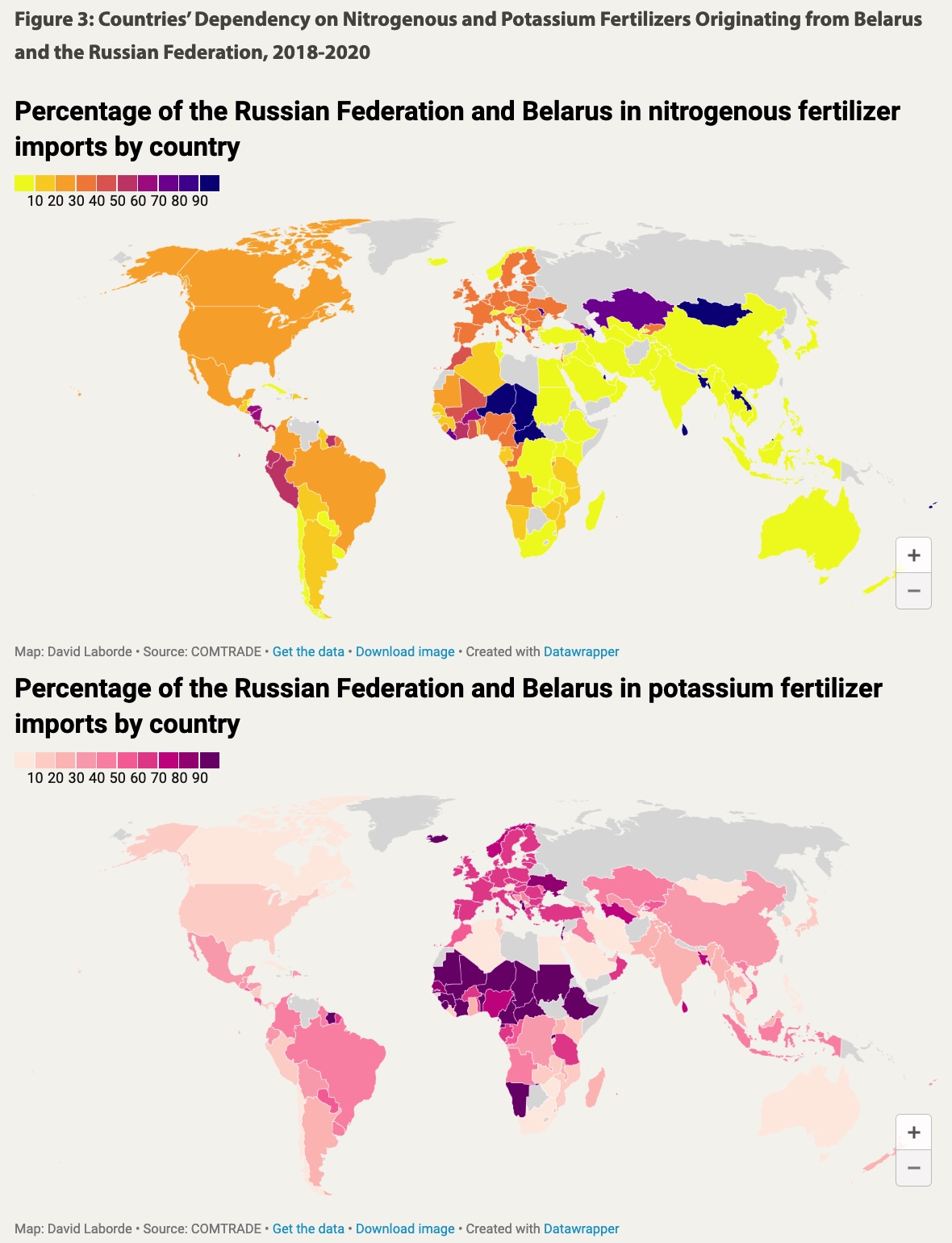

Fertilizer impact. The fellows — Joe Glauber and David LaBorde — said fertilizer will become more of an issue if there are sanctions placed on Belarus, which with Russia produces 25% of the world's fertilizer.

|

BIDEN’S STATE OF THE UNION ADDRESS |

— Highlights: The world shifts but Biden mostly didn’t.

- President Biden repackaged his prior controversial proposals into a speech that many say lacked a coherent theme and ended up mostly being a 62-minute traditional laundry wish list. He barely mentioned China, and he stayed away from noting the withdrawal (some say surrender) in Afghanistan. During his address Tuesday evening, Biden referred to Ukrainians as the "Iranian people" in a gaffe that quickly drew mockery on social media.

- Biden began by commenting on Ukraine and the topic got the most applause. He lashed out at Russian President Vladimir Putin, saying he “badly miscalculated” by ordering the invasion of Ukraine. He pledged that Russia will suffer even more economically the longer the conflict goes on. Noting risks both economically and militarily, Biden said: “I want you to know that we are going to be okay. When the history of this era is written. Putin’s war on Ukraine will have left Russia weaker and the rest of the world stronger,” he said. Biden prompted a standing ovation for the Ukrainian ambassador to the United States, Oksana Markarova, who was seated with first lady Jill Biden.

“Putin’s latest attack on Ukraine was premeditated and totally unprovoked. He rejected repeated, repeated efforts at diplomacy. He thought the West and NATO wouldn’t respond. He thought he could divide us at home, in this chamber and this nation. He thought he could divide us in Europe, as well,” Biden said. “But Putin was wrong.”

Biden warned Russian oligarchs that the U.S would “seize your yachts, your luxury apartments, your private jets” — to bipartisan applause.

“I’m taking robust action to make sure the pain of our sanctions is targeted at Russia’s economy — and I will use every tool at our disposal to protect American businesses and consumers,” Biden said as he announced the planned release of another 30 million barrels of oil from the U.S. strategic petroleum reserve. Gasoline prices are averaging $3.61 a gallon, according to AAA. But most of that increase occurred over the past year, rather than Russia/Ukraine impacts.

- Tackling rising inflation. Biden said investment was needed in U.S. manufacturing capacity in a bid to lower prices, speed up supply chains and boost American jobs. “I think I have a better idea to fight inflation: lower costs, not your wages,” Biden said. “Instead of relying on foreign supply chains, let’s make it in America.” He added: “Too many families are struggling to keep up with the bills. Inflation is robbing them of the gains they might otherwise feel. I get it. That’s why my top priority is getting prices under control.”

Biden extolled a resurgence of manufacturing, saying that the Rust Belt deserved a new name. Intel’s CEO Pat Gelsinger attended the speech and got a shout-out as the president cited the company’s $20 billion plan to build semiconductor factories in Ohio. Biden also praised Ford and G.M. for devoting a combined $18 billion toward making electric vehicles in the U.S. (He did not mention Tesla. After the speech, Elon Musk tweeted that Tesla had created 50,000 U.S. jobs and invested more in electric-vehicle tech than G.M. and Ford combined; the exchange underscored Biden’s focus on automakers with unionized workforces.) While the American manufacturing sector has added 400,000 workers in the past year, jobs in the sector, which accounts for around 8% of the work force, are still down from pre-pandemic levels.

- Biden did not mention Build Back Better specifically but listed its provisions that failed to garner enough Democratic support. It showed the president his confronted by a Congress he cannot convince or control. His list included: the Paycheck Fairness Act, lowering prescription drug prices, paid leave, expanding background checks on gun sales, the Freedom to Vote Act and John Lewis Voting Rights Act and immigration reform. Of note, centrist Sen. Joe Manchin (D-W.Va.), who helped defeat the Build Back Better Act, did not stand to applaud when Biden called for passing the child tax credit or other progressive proposals. (Note: Manchin opted to sit with Republican members rather than his Democratic colleagues. He sat between GOP Mississippi Sen. Roger Wicker and Utah Republican Sen. Mitt Romney, directly behind Iowa Sen. Joni Ernst.)

So what’s BBB called now? Biden in outlining his agenda said instead, “I call it building a better America.” So, what does that look like? The prior BBB, except it’s been slimmed down.

- The president made clear his support for progressive ideas, calling for increasing the minimum wage to $15 per hour and setting aside more money to fight climate change. Biden still wants universal pre-K, higher taxes on corporations and the rich, and more affordable housing and better health care. He scolded CEOs to “lower your costs, not your wages.” And Biden again said his plan to fight inflation is to spend.

- Biden supported some Republican items, likely with an eye on Nov. 8 elections and current dismal polls for the Democrats, when he said the answer to crime and problems with the criminal justice system isn’t to “defund the police… The answer is to fund the police with the resources and training they need to protect our communities,” Biden said to widespread Republican applause. He also called for increased community services and bans of high-powered assault weapons.

Biden also said the U.S. needs “to secure the border and fix the immigration system.”

- Biden as expected noted his bipartisan successes, such as the $1 trillion infrastructure bill.

- While not mentioning China specifically in his prepared remarks, the bill meant to combat the rise of China got a new name: the Bipartisan Innovation Act. Biden urged Congress to pass the high-tech research and manufacturing package has been stymied in differences between the House and Senate. In his actual remarks, Biden mentioned China. Regarding the passed bipartisan infrastructure measure, Biden said: “It is going to transform America and put us on a path to win the economic competition of the 21st Century that we face with the rest of the world — particularly with China. As I’ve told Xi Jinping, it is never a good bet to bet against the American people… But to compete for the best jobs of the future, we also need to level the playing field with China and other competitors. That’s why it is so important to pass the Bipartisan Innovation Act sitting in Congress that will make record investments in emerging technologies and American manufacturing."

- Biden again goes after meatpackers, ocean carriers. Biden again singled out meatpackers and ocean carriers for blame when it comes to inflation. His attack on the four big packers was not in the text of the speech provided by the White House. “I’m a capitalist, but capitalism without competition isn’t capitalism,” Biden said. “It’s exploitation — and it drives up prices. When corporations don’t have to compete, their profits go up, your prices go up, and small businesses and family farmers and ranchers go under. We see it happening with ocean carriers moving goods in and out of America. During the pandemic, these foreign-owned companies raised prices by as much as 1,000% and made record profits. Tonight, I’m announcing a crackdown on these companies overcharging American businesses and consumers.”

- Biden spoke to the upcoming Senate consideration of his nomination of Ketanji Brown Jackson to be the next associate justice of the U.S. Supreme Court.

- On Covid, Biden warned it could flare up again if a new variant emerges, and he said the country must be ready. The president got bipartisan support for his remarks about the next phase of Covid-19, saying the tools are now available for Americans to return to more normal lives. “It’s time for America to get back to work and fill our great downtowns again with people. People working from home can feel safe to begin to return to their offices,” the president said. “We’re doing that here in the federal government. The vast majority of federal workers will once again work in person. Our schools are open. Let’s keep it that way. Our kids need to be in school.”

“With 75% of adult Americans fully vaccinated and hospitalizations down by 77%, most Americans can remove their masks, and stay in the classroom and move forward safely,” Biden said, adding that he would still be requesting further supplemental spending to address the pandemic.

- On drug prices, Biden appeared to embrace the contentious idea of price controls, for example with a call to “cap the cost” of insulin at $35 a month.

What most have missed: During his address, Biden said he would transfer unused money from the American Rescue Plan to help shore up ObamaCare. Hmmm - The member of Biden’s Cabinet kept from the capital to be able to take over if there had been an attack on the building that eliminated the president and others in the presidential succession line was Commerce Secretary Gina Raimondo who was kept in a secure location during the address.

- Bottom line: What was not mentioned by Biden is perhaps more important in many areas than what he said. He did not pivot on energy policy as many Republicans and some others wanted him to relative to boosting U.S. energy production. He did not mention trade policy, which signals this is not a priority of this administration. He just doubled down on the Democratic agenda that has given him and Democrats very low poll numbers.

|

POLICY FOCUS |

— CFAP 1, 2 payouts mostly static as spot checks on payments continue. Payments under the Coronavirus Food Assistance Program 1 (CFAP 1) and CFAP 2 both were largely unchanged in data from USDA as of Feb. 28. CFAP 2 payments are at $1908 billion with original CFAP 2 payouts at $14.25 billion and top-up payments at $4.83 billion. Similarly, total CFAP 1 payments were at $11.77 billion, with $10.58 billion in original CFAP 1 payments and $1.19 billion in top-up payments ($1.18 billion prior).

Meanwhile, the Farm Service Agency has been conducting spot checks on CFAP 1 and CFAP 2 payments, an effort to “provide program oversight and ensure payments are issued to eligible program applicants and certifications provided by the applicants are supported by appropriate documentation.” County FSA offices are to complete the reviews by May 27.

— Vilsack says coming focus on seed patents. In his speech to the National Farmers Union, Vilsack revealed that in the next seven to 10 days, USDA will look at seed patents to create “a balanced and fair marketplace.” Vilsack also urged Farmers Union members to tell the senators and House members who represent them to pass the budget so USDA can hire the personnel it needs, particularly in the Office of the General Counsel. He also said that the standard for climate-smart commodities should be equal to the standards created for USDA-certified organic products.

— Farm groups as expected push for revised farm bill reference prices, while soybean lobbyist again pushes for base update. Link to testimonies.

Several farm groups pushed to update prices for farm programs such as ARC, PLC and marketing assistance loans during Tuesday’s House Agriculture Committee hearing. They explained higher market prices and higher input prices mean the current reference prices do not provide an adequate safety net for farmers. For marketing loans, the low loan rate means they are no longer relevant for some commodities. But the groups did not specify what the levels should be. However, while the American Soybean Assn. isn’t recommending how much the PLC price should be raised, Doyle said a Purdue University study found the break-even point for soybean production was more than $11 a bushel. Verity Ulibarri, a New Mexico farmer representing the National Sorghum Producers, suggested tying the reference prices to an index for fuel and fertilizer prices as a way of accounting for fluctuations in input costs. “We believe reference prices and marketing loan rates must be adjusted upward to remain relevant,” she said.

Sugar growers aren't covered by ARC or PLC. The sugar loan rate sets the floor under domestic prices, and it's too low, said Rob Johansson, director of economics and policy analysis for the American Sugar Alliance. He didn't say how much it should be increased. "The loan rate for raw sugar cane and refined beet sugar has not kept up with inflation or the rising cost of production. It no longer provides a realistic safety net for our producers," said Johansson, a former USDA chief economist.

Brad Doyle, American Soybean Association president, advocated to allow farmers to update soybean base acres. In 2021, American farmers planted 87.2 million acres of soybeans, but there were only 52.5 million soybean base acres. He explained more soybean acres are planted due to no-till, farmers switching from tobacco and dairy farmers switching to crop farming. Soybean growers have been behind the acreage base curve even since it did not initially favor and join the move to the marketing loan program. Meanwhile, several groups pushed for increased funding for FSA to implement farm bill programs.

The farm bill hearing again revealed the focus on inputs. Rising input costs — specifically fertilizers — were an area of focus (also, see next item). Rep. Austin Scott (R-Ga.) called on the panel to include provisions in the coming farm bill that would anticompetitive behavior in areas like the fertilizer market where farmers have faced rising costs. There are few farm policy tools at this stage to deal with increased input costs, but as previously noted, some of the commodity groups said that to increase the reference prices under the Price Loss Coverage (PLC) program could help address those costs. The reference prices are used to determine benefits paid out to farmers when prices have fallen. Rice, soybean and cotton growers said the $125,000-a-person annual limit on crop subsidies was too low. “The high prices of these last two years will not last forever and it is important that Congress maintain a strong safety net in place given the cyclical nature of the farm economy,” said Nicole Berg, vice president of the National Association of Wheat Growers, to the House Agriculture Committee.

U.S. companies should give farmers a break by withdrawing their petitions for anti-dumping duties on imported fertilizer, said a corn farmer group. “Rising input costs are a major concern,” said Chris Edgington, president of the National Corn Growers Association. “Specifically, fertilizer prices have soared to record levels and several companies have unfortunately made a bad situation worse for growers by applying for tariffs to be applied to phosphate and nitrogen fertilizers.” NCGA and state affiliates have made “a direct request of those companies to voluntarily withdraw their tariff petitions,” said Edgington.

“We can have record-high commodity prices but with inflation, it’s the margin that matters,” said the committee’s ranking Republican, Glenn “GT” Thompson (R-Pa.).

Comments: These early hearings by either the House or Senate Agriculture Committees is to gather input and information from farmers and commodity groups. And some of the early policy suggestions made in that process are not always part of the final package. Regional hearings will take place later this year.

— Rice growers urge USDA to provide aid to sector for low prices, rising input costs. USDA needs to use its “available authorities” to provide U.S. rice farmers with financial help as they face “both low commodity prices and disproportionately higher input costs, creating a severe financial squeeze that threatens the continued viability of US rice farms and the rural communities they support.” The letter from USA Rice to USDA Secretary of Agriculture Tom Vilsack pointed to the “unique infrastructure” involved in rice production, warning that if that infrastructure is lost, “it would be extremely difficult to re-establish.” The letter also noted that rice farmers have received far less under US farm programs and emergency aid provided for agriculture than other sectors. “Whether through the funding for market disruptions or by utilizing residual funds available under ad hoc programs, relief is necessary to ensure rice farmers survive the combination of stagnant prices and high input costs,” the letter stated. Link to letter.

|

CHINA UPDATE |

— China buying U.S. soybeans, corn. Export sources told Reuters China booked at least five cargoes of U.S. old-crop soybeans for delivery in April-May. “While prices of U.S. and Brazil beans were almost the same, logistics for U.S. cargoes were faster,” one trader said. On Monday, China was rumored to have purchased at least 10 cargoes of U.S. corn to replace shipments from Ukraine due to the closure of its ports until at least the Russian invasion ends.

— U.S. efforts ahead could include a new investigation into Beijing’s support for sectors it considers strategic, according to people familiar with policy discussions cited by the Wall Street Journal (link). While the people didn’t cite potential targeted sectors, China has identified semiconductors, artificial intelligence, 5G wireless and electric vehicles as areas where it seeks global leadership.

|

TRADE POLICY |

— USTR trade agenda report sheds some additional light on administration trade plans. The Office of the US Trade Representative (USTR) has released the 2022 Trade Policy Agenda report (link), outlining their focus on trade issues ahead. The report delved heavily into enforcement of existing trade deals and the administration’s Indo-Pacific Strategy. The focus in the report reflects the fact that U.S. Trade Representative Katherine Tai was heavily involved in the writing of enforcement components in the U.S.-Mexico-Canada Agreement (USMCA). The importance of the administration’s Indo-Pacific Strategy (link) and efforts to reduce trade barriers across the globe and bring new reform pressure on China are clearly the initial trade policy initiatives ahead. Tai has previously discussed how work on trade and investment framework agreements (TIFAs) can serve as a foundation for collaboration and cooperation with trade partners. “I think we've got over 40 of them. Some of them are with individual economies and countries, some of them are with groupings,” she said. “A lot of the gains that we've made over the course of the last year in the Indo Pacific have come out of our agenda to intensify our TIFA engagement.”

Upshot: As we have previously noted, the Biden administration is in no hurry to push a major new trade agreement via Congress. Before that can even be a possibility, the White House needs to ask Congress to reauthorize Trade Promotion Authority (TPA) by which Congress can vote on any new trade agreement proposals in an up or down vote without any amendments. Tai and USDA Secretary Tom Vilsack are pushing a Biden administration goal to reduce U.S. reliance on exports to China, the biggest buyer of U.S. ag products. As for China, the issues are mounting, but the focus by some on the tariffs imposed by the Trump administration continue to swirl in Washington. Tai has been forceful in her stance within the administration that talks with China are needed, not higher tariffs as some would like to see.

|

ENERGY & CLIMATE CHANGE |

— U.N. Secretary General António Guterres argued that the world’s reliance on fossil fuels left it vulnerable to “geopolitical shocks” as he unveiled a new IPCC report (link) showing we are nowhere near on track to meet net zero emissions goals.

— U.S. natural gas production capacity will increase ahead, but that will take time. However, analysts note that the EU’s recent decision to include LNG in its taxonomy of green investments will give confidence to developers in the U.S.

Chevron said this week it is buying America’s largest renewable fuels producer, Renewable Energy Group (REG), for $3.1 billion, deploying a major chunk of the $10 billion war chest (through 2028) the oil major has set aside for its new low-carbon business. The company, based in Ames, Iowa, is the U.S.’ largest producer of ethanol and biofuels. Analysts say that for Chevron, a big driver behind the deal was securing not just the company’s facilities but its pipeline of biofuel feedstocks — things like used cooking oil, animal fats and other inputs for renewable fuels. The Financial Times noted, “As Chevron and other oil companies have ramped up their biofuel ambitions over the past year, they have suddenly found themselves competing in unfamiliar agricultural markets with giants like Cargill that have much deeper roots with farmers and other suppliers. This deal aimed to close that gap.” The race is on to get U.S. biofuel feedstocks as the sourcing business race is underway.

Trafigura, Vitol, Glencore and others are all still buying and shipping Russian commodities.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— FSIS ends mask mandate at meat plants. USDA’s Food Safety and Inspection Service (FSIS) on Tuesday rescinded its policy that meat plants that did not require employees to wear masks would lose meat inspection services.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 438,819,267 with 5,966,350 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,092,025 with 952,509 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 553,378,046 doses administered, 215,677,777 have been fully vaccinated, or 65.70% of the U.S. population.

|

CONGRESS |

— Budget plans still being finalized. House Majority Leader Steny Hoyer (D-Md.) said Tuesday the chamber is poised to vote on a budget package for fiscal year (FY) 2022 on March 8. However, Senate Minority Leader Mitch McConnell (R-Ky.) suggested Tuesday the package was not yet ready to be finalized. He said there was a "snag" in the spending bill over whether the Defense Department’s budget should be bigger due to Russian invasion of Ukraine. The current stopgap funding measure expires March 11.

|

OTHER ITEMS OF NOTE |

— Poor or no internet for 3 in 10 of largest U.S. farmers. A sizable portion of America's largest farmers "are unable to take advantage of many applications and services" on the internet because they don't have a connection or it is of poor quality, said a Purdue University survey released on Tuesday. The gap in access exists at the same time the sector is embracing precision agriculture technology such as GPS guidance of tractors and combines. Link for details.

— The first two series of Major League Baseball’s regular season, scheduled to start March 31, were canceled after owners and locked-out players failed to agree on a new contract by a management-imposed deadline. Owners had agreed to keep negotiating until 5 p.m. ET Tuesday, believing headway made during a marathon session Monday justified further discussions—but progress stalled on the economic issues at the core of the dispute. The sides will now retrench and figure out next steps.

— The cargo ship Felicity Ace, which burned intensely for days after catching fire last month, sank with its load of some 4,000 luxury cars as it was being towed to safety. The fire was one of the first on board a major vehicle carrier loaded with a substantial cargo of electric vehicles. It has insurers and regulators debating how to safely transport such vehicles, a question that will gain urgency as EVs become more widespread.