USDA Releases First Look at 2022-23 Supply & Demand for U.S. Ag

General Mills warns it has been facing ‘acute supply shortages’

|

In Today’s Digital Newspaper |

While USDA is holding the first of its two-day Ag Outlook Forum, the focus is elsewhere, in this case, Russia invasion of Ukraine (link to special report).

|

MARKET FOCUS |

Equities today: Global stock markets are tumbling as are U.S. futures following the Russian invasion of Asian equities finished with sharp losses. The Nikkei fell 478.79 points, 1.81%, at 25,970.82. the Hang Seng Index lost 758.72 points, 3.21%, at 22,901.56, and South Korea’s KOSPI dropped 70.73 points, 2.60%, at 2,648.80. European equities opened sharply lower and remain deeply lower on the Russian invasion of Ukraine. The Stoxx 600 was down more than 4% with losses of 3% to more than 5% in regional markets.

U.S. equities yesterday: The Dow declined 464.85 points, 1.38%, at 33,131.76, the Dow’s worst close so far in 2022. The Nasdaq dropped 344.03 points, 2.57%, at 13,037.49, and is nearing bear-market territory as it sits more than 18% from its November closing record. The S&P 500 fell 79.26 points, 1.84%, at 4,225.50, and now sits nearly 12% from its Jan. 3 record close. The Dow and Nasdaq closed below their Jan. 24 intra-day lows.

On tap today:

• USDA Ag Outlook forum… see details below

• Bank of England Gov. Andrew Bailey gives opening remarks at a BOE conference on the monetary toolkit at 8:15 a.m. ET.

• U.S. jobless claims are expected to fall to 235,000 in the week ended Feb. 19 from 248,000 one week earlier. (8:30 a.m. ET)

• U.S. gross domestic product for the fourth quarter is expected to advance at an annual pace of 7% from the prior quarter, revised from a previous estimate of 6.9% growth. (8:30 a.m. ET)

• U.S. new-home sales are expected to fall to an annual pace of 803,000 in January from 811,000 one month earlier. (10 a.m. ET)

• Kansas City Fed's manufacturing survey is expected to tick up to 25 in February from 24 one month earlier. (11 a.m. ET)

• Federal Reserve speakers: Richmond's Thomas Barkin to the Maryland Chamber of Commerce at 9 a.m. ET, San Francisco’s Mary Daly at a Bank of England panel on unwinding quantitative easing at 11 a.m. ET, Atlanta's Raphael Bostic at a banking outlook conference at 11:10 a.m. ET, Cleveland's Loretta Mester on the economic outlook and monetary policy at 12 p.m. ET, and governor Christopher Waller on the economic outlook at 8:25 p.m. ET

• President Biden’s schedule: At 9 a.m. ET, Biden is to participate in a G7 Leaders’ meeting to discuss Russia and Ukraine. U.S. Secretary of State Antony Blinken and Treasury Secretary Janet Yellen are also scheduled to attend. The president later in the day will address the American public and outline a new set of punishments on Russia in response to the attack, according to a statement.

Will supply chain delays continue? That is what many are asking. Morgan Stanley analysts have looked at the topic and have three takeaways:

#1 Demand surges triggered disruptions. While supply chains do remain fragile, serious constraints may be more fleeting than many investors are forecasting. “The most important trigger of supply chain disruptions, in our view, has been a surge in demand for physical goods as a result of record stimulus programs and a sharp shift in spending from services to consumer durables," says Michael Zezas, Head of Public Policy Research and Municipal Strategy for Morgan Stanley. As demand normalizes, he says, so too should the production and movement of physical goods. Broadly speaking, Zezas and team think production issues for most industries should ease over the course of 2022 and revert to normal by the end of the year. Demand trends suggest that services will capture a larger share of consumer wallets, signaling that some supply chain strains will dissipate, the firm’s analysts predict.

#2 Transportation costs remain high. Normalizing consumer demand should take pressure off supply chains, but transportation bottlenecks are an ongoing issue. Morgan Stanley analysts think quarantine and travel restrictions for key transcontinental routes may stay in place throughout the year and don't expect capacity increases until late 2023. Meanwhile, the trucking industry is facing persistent labor shortages, all of which add up to higher logistics burdens throughout 2022. Further, a significant decline in airfreight capacity — about 65% into the U.S. — is contributing to higher costs. “We expect to see some supply chain relief in the first half of 2022 but expect this relief to be only limited and temporary," says Ravi Shanker, Transportation & Airlines Analyst. Longer-term, near-shoring, changes in inventory management, and increased automation and insourcing are potential levers for improvement.

#3 Dislocated cycle impacts earnings. The combination of easing demand and persistently higher transportation costs is laying the groundwork for a highly dislocated cycle in which earnings fall short of expectations for three super-sectors — Industrials, Semiconductors and Tech Hardware. “We think the market may be disappointed by how quickly strong demand and long backlogs evolve into normalized demand and pockets of inventory overhang," says Daniel Blake, Asia and Emerging Market Equity Strategist. Blake and his colleagues are more cautious on companies exposed to PCs and Consumer Hardware and more bullish on those exposed to Autos, Industrials, and data center infrastructure.

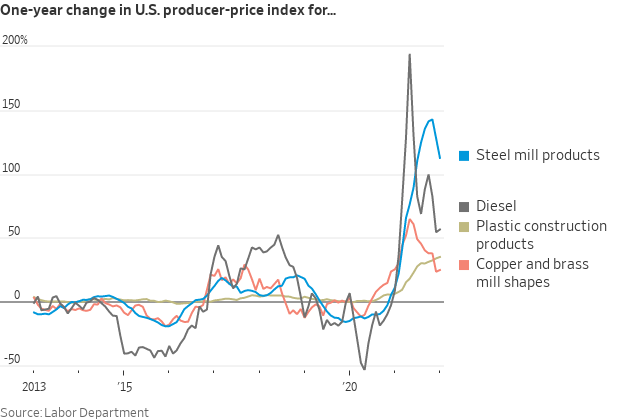

Rising prices and snarled supply chains are poised to blunt the impact of the $1 trillion infrastructure law Congress passed with bipartisan support last year, the WSJ reports (link). How many roads, bridges, railways, fiber optic lines and other types of infrastructure the U.S. can build or fix under the law will largely hinge on the extent of increases in everything from the cost of diesel fuel to workers’ wages. Elevated costs for materials and labor are already pushing contractors to charge more for construction projects, government data show, increases that economists and industry officials say could reduce the number of infrastructure projects the new federal money can finance. State and local officials facing higher prices may give priority to easier, less ambitious projects, and some worry that a rush of government spending could exacerbate inflation in the industry.

Market perspectives:

• Outside markets: The U.S. dollar index is more than 1% higher ahead of U.S. trading with sharp declines in the euro, yen and British pound versus the greenback. The yield on the 10-year U.S. Treasury market has fallen to trade around 1.85%. Gold and silver are seeing sizable advances in the wake of Russia’s action, with gold atop $1,970 per troy ounce and silver above $25.49 per troy ounce.

• Crude oil futures have surged with U.S. crude nearing $100 per barrel and Brent over $101.50 per barrel. Futures had registered gains of more than $1 in Asian action, with U.S. crude around $93.55 per barrel and Brent around $95.40 per barrel.

• USDA Ag Outlook Forum update (see details below): This year the 2022 Commodity Outlook reports will be released at the start of USDA’s Annual Agricultural Outlook Forum today, Feb. 24, at 7:00 a.m. ET on this page https://www.usda.gov/oce/ag-outlook-forum/2022-commodity-outlooks

USDA Chief Economist Seth Meyer will discuss the 2022 U.S. Agricultural Economic and Trade Outlook at 8:10-8:45 a.m. today.

Sessions covering commodity outlooks are scheduled during the Forum on Friday, Feb. 25 as follows (in ET):

10:00 a.m. – 11:30 a.m. - Sugar Outlook and policy discussion (then a sugar lunch)

10:00 -11:30 a.m. – Grain and Oilseeds Outlook

1:00 - 2:30 pm - Cotton Outlook

1:00 - 2:30 pm - Livestock and Poultry Outlook

3:00 - 4:30 pm - Dairy Outlook

Highlights of USDA commodity guesstimates released this morning:

- Corn: Planted acres of 92.0 million and harvested acres of 84.2 million with a national average yield of 181.0 bushels per acre bring a crop of 15,240 million bushels. Feed & residual use is pegged at 5,650 million bushels, food, seed and industrial use is at 6,840 million bushels—including 5,400 million for ethanol—putting total domestic use at 12,490 million bushels. With exports forecast to fall to to 2,350 million bushels, carryover is pegged at 1,965 million bushels with a season-average price of $5 per bushel.

- Soybeans: Planted acres of 88.0 million and harvested area at 87.2 million with a national-average yield of 51.5 bushels per acre nets a crop of 4,490 million bushels. Crush is forecast at 2,250 million bushels, with 125 million bushels of seed and residual use and exports of 2,150 million bushels put carryover at 305 million bushels with a season-average price of $12.75 per bushel.

- Rice: Planted area of 2.60 million and harvested at 2.55 million acres with an average yield of 7,709 pounds per acre nets a crop of 196.7 million cwt. Total domestic and residual use is pegged at 144.0 million cwt. with 86.0 million cwt. in exports for ending stocks of 33.2 million cwt. and a season-average price of $16.10 per cwt.

- Wheat: Planted acres of 48.0 million with harvested at 39.5 million and a national average yield of 49.1 bushels per acre brings a crop of 1,940 million bushels. Feed & residual use is seen at 100 million bushels, with food and seed use of 1,027 million for total domestic use of 1,127 million bushels. Exports of 850 million would put ending stocks at 731 million bushels with a season-average price of $6.80 per bushel.

- Cotton: Planted acres of 12.7 million with harvested at 10.2 million (19.7% abandonment) and a yield of 856 pounds per acre puts production at 18.2 million bales. With exports of 15.5 million bales and domestic use of 2.7 million bales, carryover would be at 3.6 million bales with a season-average price of 80.0 cents per pound.

- Cattle/Beef: Beef production for 2022 is forecast at 27.38 billion pounds (down 2% vs 2021) with higher weights only partly making up for lower slaughter numbers, with total beef exports of 3.27 billion pounds and imports at 3.37 billion pounds. The 5-area steer price is seen at $137.5 per cwt. in 2021.

- Hogs/Pork: Commercial production is seen at 27.38 billion pounds (down 1% from 2021) with lower hog numbers lightly offset by higher carcass weights. Pork exports are seen declining to 6.81 billion pounds with imports at a record 1.31 billion pounds. The national base 51% -52% lean, live equivalent prices is seen at $65 per cwt.

- Broilers: Record-large production of 45.49 billion pounds with broiler meat exports seen at a record 7.38 billion pounds after two years of flat exports. National composite wholesale broiler price forecast at $1.13 per pound, up $1.02 per pound in 2021.

- Dairy: Milk production is forecast at 227.2 billion pounds, with a reduction in the US cow herd a factor for the growth of just 0.4%. Output per cow is seen up 1.3%. Exports on a fat-basis are seen at 11.0 billion pounds and on skim-solids basis they are forecast at 51.2 billion pounds. The all-milk price forecast is $23.55 per cwt., up $4.86 per cwt. from 2021.

• General Mills — the maker of Wheaties cereal — warned it has been facing “acute supply shortages on its refrigerated dough, pizza and hot snacks," though it did not specify whether wheat was a primary reason. Kellogg CFO Amit Banati told investors earlier this month that wheat inflation is putting pressure on the cereal maker. In January, the price of flour and prepared flour mixes was up 10.3% year-over-year, while the price of bakery products like donuts, crackers and pies was up 9.9%.

Meanwhile, Ukrainian wheat exports have held steady in recent weeks even as fears mount that “ongoing tensions with Russia is likely to put pressure” on exports, according to S&P Global Platts (link).

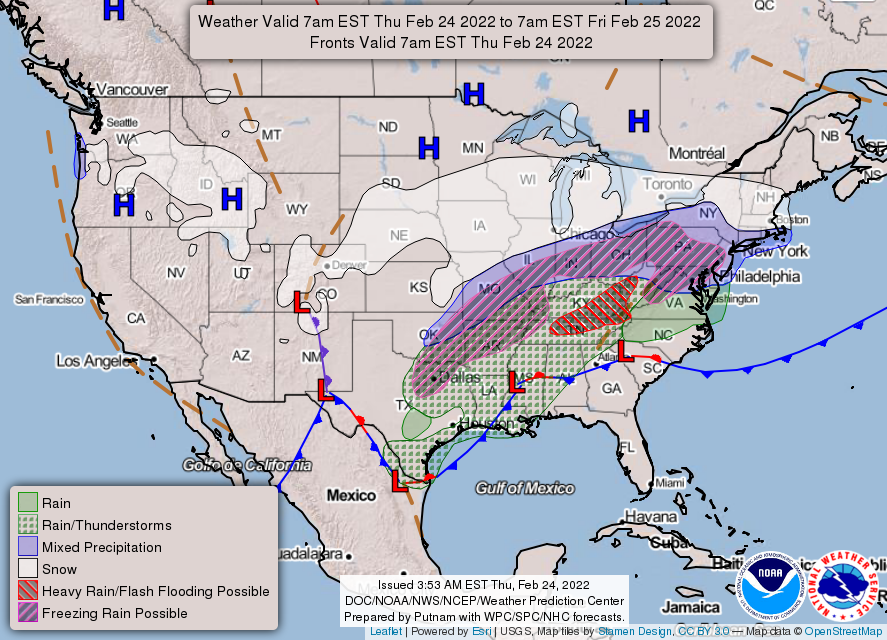

• NWS weather: Significant winter storm impacting the Southern Plains to the Ohio Valley on Thursday into late Thursday night then the Northeast/Mid-Atlantic Thursday afternoon into Friday... ...a Slight Risk of Excessive rainfall from the Tennessee and Ohio Valley on through Friday morning... ...Temperatures will be 15 to 35 degrees below average over the Northern/Central Rockies, Plains, and the Mississippi Valley; In contrast, temperatures will be 10 to 15 degrees above average over the Southeast.

|

ENERGY & CLIMATE CHANGE |

— The EU is slated to unveil a strategy to break free from Russian gas. The Washington Post reports (link) that the new strategy––slated to be unveiled next week–– will call for a 40% reduction in fossil fuel use by the year 2030. It also calls on European energy companies to fill their storage tanks with natural gas over the summer, to reduce Europe’s dependence on Russian gas supplies next winter.

But in the meantime, Europeans are feeling the squeeze. “In the short and medium term, there are no good options,” Nathalie Tocci, the head of the Italian Institute of International Affairs and an adviser to EU policymakers in Brussels, told the WaPo. “The problem is not now, but next fall. And by next fall we will not have found the silver bullet.”

Perspective: Russia is the third-largest crude oil producer, and the world’s largest natural gas producer. (Some 40% of the EU’s natural gas supply currently comes from Russia, while Moscow’s economy depends on oil and gas exports for roughly 36% of its country’s budget.) And roughly one in 12 barrels of oil that the U.S. imports comes from Russia.

— The U.S. may release more oil reserves. The Biden administration is discussing potential price point triggers and how to coordinate a move with other nations. Analysts have said gasoline prices could top $4 a gallon amid the Russia-Ukraine conflict; they were at $3.54 on Wednesday, according to AAA.

Suspend federal gas tax? The most endangered Democratic senators — Sens. Raphael Warnock (Ga.), Maggie Hassan (N.H.), Catherine Cortez Masto (Nev.) and Mark Kelly (Ariz.) — all signed onto a proposal to suspend the federal gas tax for the rest of the year, which could save consumers 18 cents per gallon.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 429,963,733 with 5,919,279 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,731,240 with 941,909 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 551,372,287 doses administered, 215,129,430 have been fully vaccinated, or 65.54% of the U.S. population.

— Boston, Philadelphia and Washington, D.C. have recently ended requirements to show proof of vaccination in indoor spaces — and New York may be next. Mayor Eric Adams wants to move toward a phase out in the next few weeks. Adams said he'll continue to "follow the science" in deciding when the rule will be eliminated, though he "can't wait to get it done."

|

OTHER ITEMS OF NOTE |

— Authorities are preparing for potential trucker protests in the Washington, D.C., area. Demonstrations inspired by Canada’s "Freedom Convoy," which opposed Covid-19 vaccine mandates and social restrictions, could be timed to the State of the Union address on March 1. The Defense Department approved deploying around 700 National Guard troops for traffic control and other support, following plans by other law-enforcement entities in recent days.

About two dozen trucks and several other vehicles hit the road from the Mojave Desert town of Adelanto as part of a self-proclaimed “People’s Convoy.” Organizers said in a statement that they planned to undertake a “100% safe, lawful and peaceful” journey that would “terminate in the vicinity of the DC area but will NOT be going into DC proper.”