Weak Initial U.S. Sanctions Confront Strong Russian Moves; Germany Halts Pipeline

Oil, natural gas, wheat, corn & other markets rally on Putin moves | Defining invasion

|

In Today’s Digital Newspaper |

Russian leader Vladimir Putin is testing U.S., Europe and NATO resolve regarding prior sanction threats. The Biden administration’s initial sanctions move is seen as timid at best, focusing only on the breakaway areas in Ukraine. But the western response to Russia’s latest escalation over Ukraine became clearer as Germany halted the certification process for the Nord Stream 2 pipeline following Putin’s decision to send troops to two self-proclaimed separatist republics. German Chancellor Olaf Scholz, who held a call with Putin late yesterday, said that the Russian leader’s recognition of the breakaway republics in eastern Ukraine had materially changed the situation so that “no certification of the pipeline can happen right now.” Without it, he told reporters in Berlin, the gas pipeline from Russia to Germany “cannot go into operation.” Meanwhile, the Biden administration is openly trying to define what constitutes a Russian invasion.

|

MARKET FOCUS |

Equities today: Russia's benchmark stock index, the MOEX, plunged 10.5% for its largest daily percentage decline since the invasion of Crimea in 2014. Jitters are also showing up in the U.S., with futures contracts tied to the Dow and S&P 500 slipping 1.3% and 1.5% overnight, while the Nasdaq fell back 2.2%. Asian equities finished with losses on a rise in Russia/Ukraine tensions. The Nikkei fell 461.26 points, 1.71%, at 26,449.61. The Hang Seng Index was down 650.07 points, 2.69%, at 23,520.00. European equities are mixed to slightly weaker in early action. The Stoxx 600 was down 0.1% with regional markets up 0.2% to down 0.2%.

On tap today:

• S&P/Case-Shiller 20-city home-price index for December is forecast to rise 18.1% from one year earlier. (9 a.m. ET)

• IHS Markit's U.S. manufacturing index is expected to rise to 56.0 in the opening weeks of February from 55.5 in January, and the services index is forecast to rise to 52.2 from 51.2. (9:45 a.m. ET)

• Conference Board's consumer confidence index is expected to fall to 109.5 in February from 113.8 one month earlier. (10 a.m. ET)

• Richmond Fed's manufacturing survey is forecast to rise to 10 in February from 8 one month earlier. (10 a.m. ET)

• USDA Export Inspections report, 11 a.m. ET.

• Atlanta Fed President Raphael Bostic participates in a moderated conversation at a banking outlook conference at 11:10 a.m. ET, and speaks on the role of the Fed in the community at 3:30 p.m. ET.

• Biden will host a virtual event on mineral supply chains, clean energy manufacturing and creating jobs. 3:30 p.m. ET.

Fed's Bowman suggests larger March rate hike. Federal Reserve Governor Michelle Bowman suggested Monday the central bank could raise interest rates at a faster pace than in previous cycles, as inflation remains “much too high.” In a speech to a convention of bankers, Bowman said she supported raising rates when the Fed’s monetary policy panel — the Federal Open Market Committee (FOMC) — meets March 15-16. She added she will be “watching the data closely to judge the appropriate size of an increase,” opening the door to a larger-than-typical rate hike. While the Fed usually hikes or cuts interest rates in 0.25 percent increments, a few expect the bank to raise rates by 0.5 percentage points in March.

Electric vehicles are gaining momentum. Sales of pure and hybrid plug-ins doubled in the U.S. last year to 656,866, according to data from electric-vehicle sales database EV-volumes, making up 4.4% of the passenger-vehicle market.

There are now over 3 million industrial robots working in factories across the planet, according to the International Federation of Robotics, a worldwide industry association. Millions more move goods around warehouses, clean homes, mow lawns and help surgeons conduct operations. Instead of destroying jobs, robots can create them by making businesses more efficient, allowing firms to expand. For the past decade manufacturing employment in the U.S. has grown even as the number of factory robots increased.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker amid a mixed tone in foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note has firmed to trade just above 1.94% while there is a mixed tone to global government bond yields. Gold is lower and silver higher ahead of U.S. trading, with gold trading under $1,898 per troy ounce and silver above $24 per troy ounce.

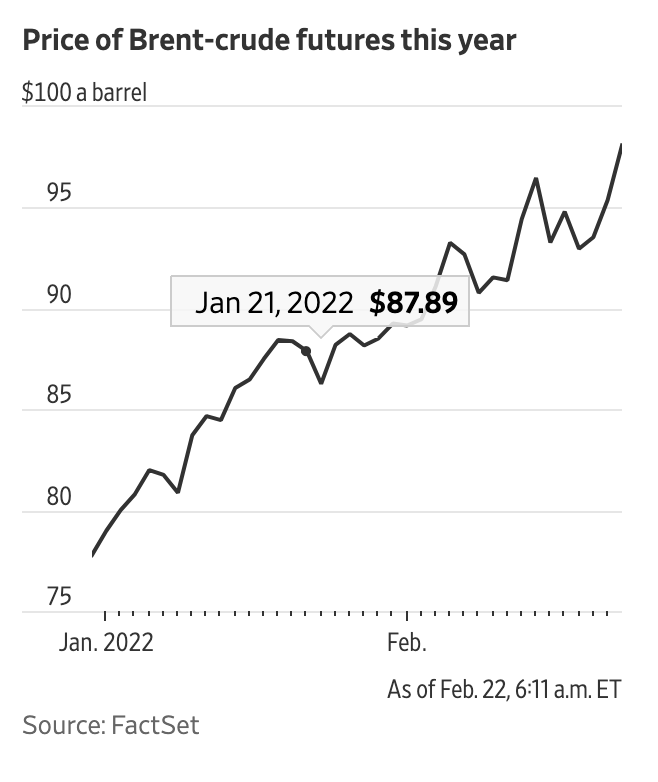

• Crude oil futures are seeing sharp gains linked to the Russia/Ukraine situation, with U.S. crude trading around $95.45 per barrel and Brent around $98 per barrel. Futures moved higher in Asian action, with U.S. crude around $92.60 per barrel and Brent around $96.75 per barrel.

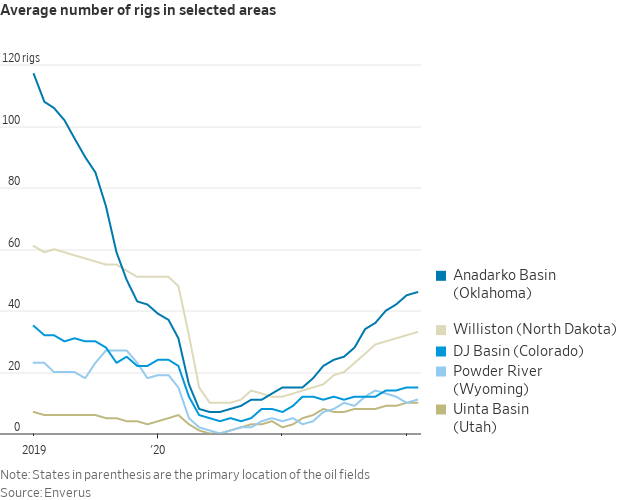

• Spurred by the highest oil prices in years, shale companies are moving drilling rigs back into oil fields that were all but abandoned a few years ago, the WSJ reports (link). Private oil producers are leading an industry return to places like the Anadarko Basin of Oklahoma and the DJ Basin in Colorado, where drilling had almost completely stopped in mid-2020 when those areas became unprofitable because of lower oil prices. Oil production in these marginal regions isn’t expected to move the needle in the global market, which is facing tight supplies, but it could help some oil producers who have lost money in past years.

• Escalating tensions between Russia and Ukraine have boosted gold prices to their highest levels since June. Gold has gained in 12 of the past 15 sessions, including seven straight through Monday, lifted by demand from investors nervous that an outbreak of war could spark losses in other investments.

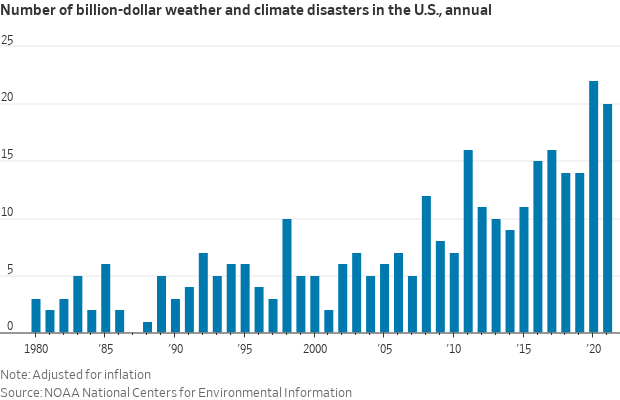

• Why more businesses, homeowners are buying their own power systems. As the U.S. electric grid becomes less dependable, a growing number of businesses and homeowners are buying their own power systems to protect themselves from being left in the dark. Twenty years ago, only 0.57% of U.S. homes worth $150,000 or more had installed backup generators, according to backup-power provider Generac Holdings. Now the number is 5.75%, a 10-fold increase.

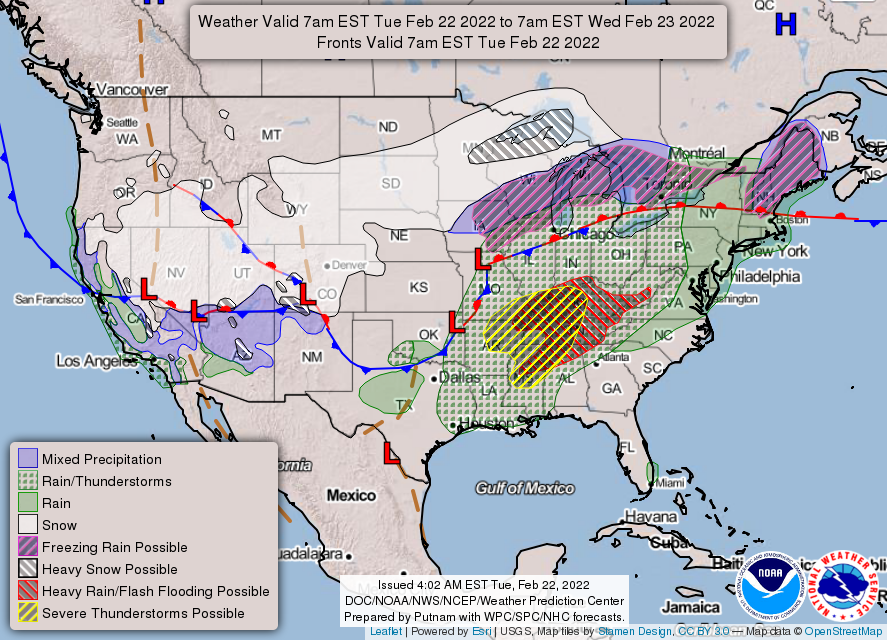

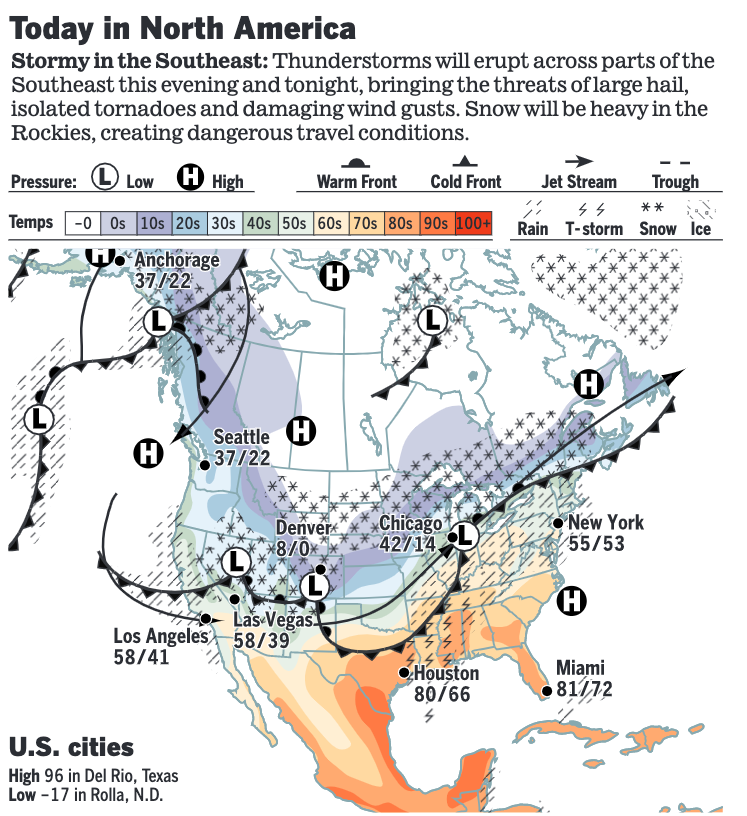

• NWS weather: Significant winter storm impacting areas of the Great Lakes into the Northeast on Tuesday into Wednesday morning... ...Risk of Excessive rainfall and severe thunderstorms increasing from the Lower Mississippi to Tennessee/Ohio Valleys from Tuesday into Wednesday... ...A second significant winter storm impacting areas of the Southern Plains into the Ohio Valley on Wednesday into Thursday.

|

RUSSIA/UKRAINE |

— Updates:

- Link to a special report on the topic issued Monday.

- Putin on Monday announced he’s recognizing two self-proclaimed separatist republics in eastern Ukraine, in an escalation in Russia’s standoff with the West. The Russian president signed aid and cooperation pacts with separatist leaders at a Kremlin ceremony after a televised address in which he stated: “I consider it necessary to take the long overdue decision to recognize the independence and sovereignty of the Donetsk People’s Republic and the Luhansk People’s Republic.”

- Peacekeeping or “piecekeeping”? Russian President Vladimir Putin orders “peacekeeping forces” into separatist areas of Ukraine.

- U.S. comments. Russian troops entering disputed territories within Ukraine will not amount to an invasion in the eyes of the White House, according to a senior administration official.

- The United Nations Security Council met Monday night behind closed doors. The U.S. is moving its personnel temporarily out of Ukraine and into Poland.

- Congress reacts. Congress’ bipartisan delegation to the Munich Security Conference said lawmakers would work together on any emergency supplemental legislation to support NATO and Ukraine. The group including Senators Lindsey Graham, a South Carolina Republican, and Dick Durbin, an Illinois Democrat, said Putin must be held accountable should Russia invade Ukraine. Based on initial White House comments, a key will be what constitutes an invasion. Meanwhile, the top Republican on the House Foreign Affairs Committee, Rep. Michael McCaul of Texas, and the ranking Republican on the House Armed Services Committee, Rep. Mike D. Rogers of Alabama, urged Biden to immediately take stronger action: “[N]ow is not the time for symbolic pinpricks that will serve only to embolden Putin and endanger our friends in Ukraine. Now is the time for President Biden to impose sanctions that strike at the heart of the Russian economy,” they said in a statement Monday evening condemning Putin’s latest actions. It was unclear how many American businesspeople are investing in the region. The sanctions announced by the Biden administration are more limited than measures the U.S. and Europe have been threatening if Putin invaded Ukraine.

- Pelosi met with British PM Johnson. House Speaker Nancy Pelosi (D-Calif.), leading a separate congressional delegation, met with U.K. Prime Minister Boris Johnson on Monday. She said they discussed deterrence strategies including the “threat” of preventing Russian companies from accessing U.S. dollars and the British pound.

- EU ambassadors will meet today to discuss a plan for sanctions in response to Putin’s decree, according to multiple diplomats familiar with the talks. Member states are expected to make a swift decision on a package in the following days, officials said. EU chiefs Ursula von der Leyen and Charles Michel said earlier in a joint statement that Putin’s move was “a blatant violation of international law as well as of the Minsk agreements,” referring to the agreement where Russia had recognized the two regions as part of Ukraine.

- Ukraine’s president, Volodymyr Zelensky, gave a television address vowing not to cede territory to the Russians, making it plain he expected “clear support” from the West.

- This is Putin’s war. Thomas L. Friedman, Opinion Columnist at the New York Times, writes: “Putin is the most powerful, unchecked Russian leader since Stalin, and the timing of this war is a product of his ambitions, strategies and grievances. But Friedman also lays some of the blame for recent events on past actions by the United States and NATO (link).

- “We’ll continue to pursue diplomacy until the tanks roll. We are under no illusions about what is likely to come next,” said a senior Biden administration official. The official portrayed Putin’s comments in stark terms: “This was a speech to the Russian people to justify a war. This is Potemkin politics. President Putin is accelerating the very conflict he’s creating.”

- Markets: Oil, natural gas and agricultural prices rose as escalating tensions threatened to disrupt flows of natural resources from Eastern Europe to world markets. Futures for Brent crude, the benchmark in international energy markets, added 3.4% to reach $98.65 a barrel and earlier climbed to $99.50 a barrel, their highest level since 2014. In Europe, which buys much of its natural gas from Russia, the price of the heating and power-generation fuel rose 6% to €76.90 ($87.14) a megawatt-hour. (Europe met 38% of its gas needs with imports from Russia in 2020, according to the most recent official data. Prices in northwest Europe are almost five times as high as they were a year ago, in part because state energy supplier Gazprom has throttled exports in recent months. Putin today told a gas conference that the country will continue to provide uninterrupted supplies of gas, according to a state news agency.) U.S. natural-gas prices also rose today, though the move was less pronounced than in Europe. Futures gained 3.2% to $4.57 per million British thermal units. Prices for aluminum, nickel and wheat, all produced in large quantities in Russia or Ukraine, rose too. Together, Russia and Ukraine account for a quarter of global trade in wheat, and concerns about Black Sea shipment disruptions could send soaring food costs even higher.

- Key unknown: Will Putin order a full-on invasion in Ukraine — a scenario that could ignite fighting reminiscent of World War II — or stop at the borders of the separatist enclaves, which make up roughly a third of the eastern Ukrainian region known as the Donbas.

- Bottom line: Putin’s new strategy would mean the end of the Minsk agreements — signed after Russia-backed separatist forces surrounded several thousand Ukrainian soldiers — that have maintained a threadbare cease-fire in the Donbas since 2015 after Moscow seized Crimea. But it could also provide cover for Moscow to begin its blitz into Ukraine. Putin awaits more reaction from the U.S., Europe and NATO as he ponders his next move. Bottom line: Putin's new strategy would mean the end of the Minsk agreements - signed after Russia-backed separatist forces surrounded several thousand Ukrainian soldiers - that have maintained a threadbare cease-fire in the Donbas since 2015 after Moscow seized Crimea. But it could also provide cover for Moscow to begin its blitz into Ukraine. There’s a Russian adage that you can’t have a Russian Empire without Ukraine, a mineral-rich vast land of fertile fields.

Link to NYT maps of the two breakaway regions at the center of the conflict.

— Biden administration sanctions key off whether there has been a Russian invasion. After he took flak last month for speculating about a potential “minor incursion” by Russia into Ukrainian territory, President Biden spelled out exactly what would trigger the brutal sanctions he’d promised if Putin attacked Ukraine. “Any assembled Russian units move across the Ukrainian border, that is an invasion,” Biden told reporters. Such a move, he added, would bring a “severe and coordinated economic response.” The White House is expected to announce new sanctions on Russia today, but they are not to be as severe as Biden and a host of other administration officials threatened prior to Putin’s latest moves. The administration is coordinating with allies on the announcement, the official said.

A senior administration official said, “Russian troops moving into Donbas would not itself be a new step," since Russian forces have been active in the separatist region since 2014. The administration planned to monitor what Russia did overnight and ”respond to any actions that Russia takes in a way that we believe is appropriate to the action," the official said. A different administration official defined a Russian invasion that would prompt a clear U.S. response as crossing into Ukrainian territory that Russia has 'not occupied since 2014.”

Sen. Lindsey Graham (R-S.C.) said the move “should immediately be met with forceful sanctions to destroy the ruble and crush the Russian oil and gas sector.”

Senate Foreign Relations Chair Bob Menendez (D-N.J.) said: “To be clear, if any additional Russian troops or proxy forces cross into Donbas, the Biden administration and our European allies must not hesitate in imposing crushing sanctions.”

Sen. Chris Coons (D-Del.), a top Biden ally in the upper chamber, said in a statement Monday night that “the time for taking action to impose significant costs on President Putin and the Kremlin starts now.”

Former acting CIA Director John McLaughlin: “Putin has choreographed this with the hope that we and the Europeans will debate whether this is an ‘invasion’ or not. And hoping that throws us enough off balance that he will pay a minimal price for this first slice of salami.”

— German Chancellor Olaf Scholz announced he’s halting the Nord Stream 2 pipeline over the Russia/Ukraine crisis, per Deutsche Welle (link). Construction of the pipeline project has been completed, but the project still needed regulatory certification from German authorities before the gas could be delivered.

— Russia on sanctions: “Russia is used to sanctions,” Foreign Minister Sergey Lavrov boasted this morning. Link to details via Reuters.

|

POLICY FOCUS |

— Black farmers fear foreclosure as debt relief remains frozen. Lawsuits from white farmers have blocked $4 billion of pandemic aid that was allocated to Black farmers in the American Rescue Plan. The New York Times takes a look at the topic (link).

|

CHINA UPDATE |

— China announced plans to slash taxes and increase payments to local governments as part of efforts to boost slowing economic growth. The country’s finance minister said tax and fees cuts in 2022 would exceed the $174 billion reduction last year. The central government will also send more funds to local governments, with the most earmarked for underdeveloped regions.

|

ENERGY & CLIMATE CHANGE |

— Biden administration will suspend or delay new federal oil and gas leasing following a court ruling against the process by which it calculates the social cost of climate change, the administration announced over the weekend. On Feb. 11, Judge James Cain of the Western District of Louisiana, a Trump appointee, blocked the administration’s method of calculating the social costs associated with greenhouse gases, the primary driver of climate change. The Biden administration had returned to Obama-era calculation methods, with plans to develop its own in the future.

In his ruling, Cain blocked federal agencies from considering findings from the White House Interagency Working Group, which had been tasked with devising new metrics based on the Obama-era calculations. It also bars the administration from considering the global impacts of greenhouse gas emissions, one of the major distinctions that made the Obama estimates far higher than the Trump administration’s. In a legal filing Saturday evening, the Justice Department asked the court to stay the injunction, citing the likelihood that its appeal of the decision will succeed.

“The Interior Department has assessed program components that incorporate the interim guidance on social cost of carbon analysis from the Interagency Working Group, and delays are expected in permitting and leasing for the oil and gas programs,” Interior spokesperson Melissa Schwartz said in a statement Saturday night.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 426,219,106 with 5,896,937 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,529,492 with 935,992 deaths.

— WSJ: FDA mulling approving second covid booster shot. The U.S. Food and Drug Administration is considering authorizing a fourth dose of a Covid-19 vaccine later in the year, according to a report by the Wall Street Journal (link). The FDA has started reviewing data to authorize a second booster dose of the Pfizer and Moderna vaccines, the WSJ reported on Saturday, citing people familiar with the situation. The FDA did not immediately respond to a request for comment.

— The U.K. government will lift all remaining Covid-19 restrictions in England this week, including a legal requirement that those infected with the virus self-isolate, as Prime Minister Boris Johnson looks to fully reopen the British economy and society two years after the pandemic first hit. Johnson said Monday that with the virus on the wane, government-mandated rules are no longer necessary to stop the spread of Covid-19.

|

OTHER ITEMS OF NOTE |

— Canadian premier sues Trudeau and government over 'unjustified' Emergencies Act. Canada's premier of the province of Alberta, Jason Kenney, filed suit against Prime Minister Justin Trudeau and the nation's federal government, citing the nature of the Emergencies Act as "unjustified in the circumstances," according to a Saturday announcement.

— The Iran deal. Negotiators enter another crunch week in Vienna, with an agreement to revive the 2015 Iran nuclear deal reportedly days away. Any deal will hinge on whether the United States proves “its will” to lift major sanctions, Iranian President Ebrahim Raisi said on Monday. Key issues still outstanding in negotiations include the U.S. designation of the Iranian Revolutionary Guard Corps as a terrorist group, as well as assurances that the United States won’t later renege on the deal.