Happy Friday? Invasion Risk | Surging Inflation | Higher Rates | Oh Canada | No Porsche?

Russia-Ukraine tension drives gas prices | Rep. Hagedorn dies

|

In Today’s Digital Newspaper |

Market Focus:

• USDA daily export sale:

— 198,000 MT of soybeans for to unknown destinations. Of the total, 66,000 metric tons

is for delivery during 2021-2022 marketing year and 132,000 metric tons for 2022-2023 MY.

• U.S. gov’t offices, markets closed Monday

• Several Federal Reserve speakers on tap today

• White House economist: Inflation should moderate in coming months

• If the White House is wrong, again, on inflation… faster rate hikes ahead

• Klain: Biden’s SOU will emphasize efforts to combat inflation, expand manufacturing

• More delays, rising costs to move shipping containers sinking hopes problems will ease

• Supply chains aren't just snarled in the U.S.

• Housing market anxiety

• Police in Canada’s capital began arrests of people protesting against Covid-19 mandates

• Deere reports quarterly earnings well above consensus estimate

• Russia-Ukraine tension drives gas prices

• Iran nuclear deal inches toward revival but faces critics in U.S.

• Energy security for Europe

• Ag demand update

• Old-crop soybeans testing waters above $16 again

• Russian wheat export tax declines again

• French wheat crop ratings remain high

• Still some cattle to clean up

• Hogs could face pre-holiday corrective trade

Russia/Ukraine:

• Russian Foreign Minister to meet U.S. Secretary of State Antony Blinken for talks in Europe

• U.S. Senate clears non-binding resolution of ‘unwavering’ U.S. support for Ukraine

• U.S. on Thursday ramped up warnings of a possible Russian attack on Ukraine

• Moscow again denies any intention to invade Ukraine

• Artillery exchanges in Eastern Ukraine may presage invasion, U.S. warns

• China comments

• Even if Putin holds off on invading Ukraine, he has made himself center of global attention

• How well could Russia’s economy withstand sanctions?

• Bottom line on Russia/Ukraine

Policy Focus:

• Senate finally clears three-week stopgap gov’t funding bill, 65-27

• Perspective on tardy appropriators

• Transportation groups blast bill to suspend federal gas tax.

China Update:

• U.S. gov’t namechecks some Chinese companies

• China pouring resources into South America, chipping away at U.S.' dominance

• China to strengthen commodity market monitoring amid industrial growth push

Energy & Climate Change:

• Carbon pricing in the EU

• Energy Transfer eyes new Permian Basin natural gas pipeline

Livestock, Food & Beverage Industry Update:

• Grocery prices rising for months and will keep climbing: supermarket executives

• Pilgrim's Pride slumps after Brazilian meatpacker JBS drops plan

• CSPI gets major cash infusion

• Update on HPAI-linked poultry trade restrictions

Coronavirus Update:

• Newly reported Covid-19 deaths are starting to decline in U.S.

Politics & Elections:

• House GOP leader endorses Liz Cheney’s opponent

• Boozman is popular in Arkansas… and so is a primary opponent

• Democrats biggest opponent in Nov. 8 elections: pushback against their far-left agenda

• Think Hillary Clinton will run in 2024?

Congress:

• Rep. Jim Hagedorn (R-Minn.) dies at 59

Other Items of Note:

• Immigration and U.S. benefits

• Possible Iran deal

• USDA releases recap of 2021 U.S. hemp production

• Cotton AWP eases but remains well over $1 per pound

• If you were waiting on a new Porsche, your order might be up in smoke

|

MARKET FOCUS |

U.S. gov’t offices, markets closed Monday. U.S. financial and commodity markets will be closed Monday (Feb. 21) in observance of Presidents Day and the Securities Industry and Financial Markets Association (SIFMA) has recommended no trading in the bond market. US government offices will also be closed for the holiday, meaning weekly updates such as Grain Inspections and Weekly Export Sales will be delayed a day from their normal release days. The Commodity Futures Trading Commission (CFTC) will still release the weekly Commitments of Traders report as scheduled on Friday (Feb. 25).

Equities today: Global stock markets were mixed overnight. The U.S. Dow opened around 70 points lower but then turned slightly higher. Heightened tensions between Russia and Ukraine left investors confused and dumping risky assets and rotating into the perceived safety of bonds Thursday and Friday. The 10-year Treasury yield, which moves inversely to price, continued to move lower to around 1.94%. Asian equities ended mostly lower following US losses amid a view that Russia/Ukraine tensions had risen. The Nikkei was down 110.80 points, 0.41%, at 27,122.07. The Hang Seng Index declined 465.06 points, 1.88%, at 24,327.71. Equities in the region are mostly with some markets having shifted between losses and gains in early trading. The Stoxx 600 was up 0.3% while regional markets were down 0.1% to up 0.6%.

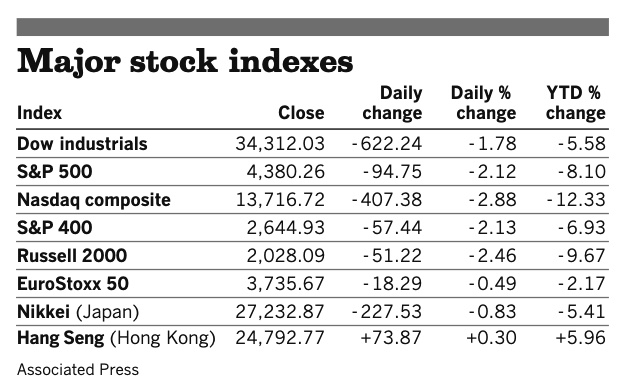

U.S. equities yesterday: The Dow fell 622.24 points, 1.78%, at 34,212.03. The Nasdaq fell 407.38 points, 2.88%. at 13,716.72. The S&P 500 declined 94.75 points, 2.12%, at 4,380.26.

On tap today:

• U.S. existing-home sales are expected to fall to an annual pace of 6.1 million in January from 6.18 million one month earlier. (10 a.m. ET)

• Conference Board's leading economic index for January is expected to be unchanged from the prior month. (10 a.m. ET)

• Federal Reserve speakers: Chicago's Charles Evans and governor Christopher Waller on the Fed's new monetary policy strategy at 10:15 a.m. ET, New York's John Williams on the economic outlook at 11 a.m. ET, and governor Lael Brainard on central bank digital currencies at 1:30 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• President Joe Biden will speak with Europeans leaders today about the Russia/Ukraine crisis.

White House economist: Inflation should moderate in coming months. President Biden’s top economic adviser tried to ease lawmakers’ concerns about elevated inflation, saying that several factors in the coming months should help slow a steep rise in consumer prices over the last year. “We expect inflation to moderate over the coming year, because we believe that the factors that have been causing high inflation will begin to ease as Covid cases gradually decrease,” Cecilia Rouse, chair of the White House Council of Economic Advisers, said during a Senate Banking Committee hearing.

Inflating number: Inflation in January advanced at its fastest pace in nearly 40 years, as the consumer price index—a measure of what consumers pay for goods and services — rose 7.5% from a year earlier.

If the White House is wrong, again, on inflation… faster rate hikes ahead. Loretta Mester said she's ready to hike next month and tighten policy at a faster pace if needed to curb inflation. The Cleveland Fed president said, "If by mid-year, I assess that inflation is not going to moderate as expected, then I would support removing accommodation at a faster pace over the second half."

St. Louis Fed President James Bullard cautioned that without interest rates hikes, inflation could become an even more serious problem. Bullard has called for a full percentage point in rate increases by July.

More Fedspeak: Be on the lookout for more signals today from the central bank. Federal Reserve Board Governor Christopher Waller (more hawkish) will take part in a discussion on monetary policy issues at the University of Chicago Booth School of Business, while New York Fed President John Williams (somewhat dovish) will give a speech on the economic outlook at an event organized by New Jersey City University.

Klain tells Democratic senators Biden’s State of The Union will emphasize efforts to combat inflation, expand manufacturing. The Wall Street Journal reports (link) that Chief of Staff Klain told Democratic senators Thursday that in his State of the Union address on March 1, President Biden will emphasize combatting inflation and expanding manufacturing to address snarled supply chains. Democratic senators did not say whether Biden will try to mobilize support for the Build Back Better legislation. After meeting with Klain, they said Biden will likely focus on legislation that can win support from both sides of the aisle. In an online report, CNN says (link) Klain “promised there would be some ‘good surprises’ in [Biden’s] remarks.”

All members can attend the address, but must follow Covid-19 health guidelines, including masking, or risk being tossed from the event and fined, according to Bloomberg.

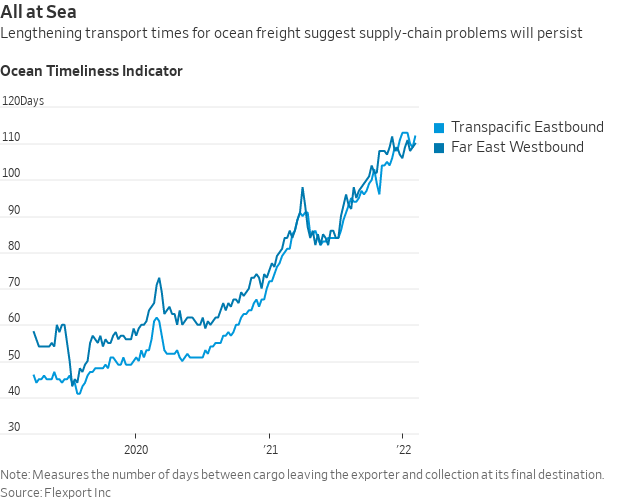

More delays and rising costs to move shipping containers are sinking hopes that the world’s supply-chain problems will ease anytime soon. Shipping experts, economists and company executives say any end-of-year optimism that kinks in global supply chains would work themselves out in the first half of 2022 has faded, the WSJ reports (link). Ports in the U.S. and Europe are clogged and prices for moving goods around the world are rising. In Asia, congestion worsened in the run-up to the Lunar New Year as companies snapped up capacity to get goods sailing before factories shut for the holiday early this month. The squeeze on global supply chains means Western consumers can expect little respite from rising prices, keeping the pressure on central banks to tighten policy to suppress inflation.

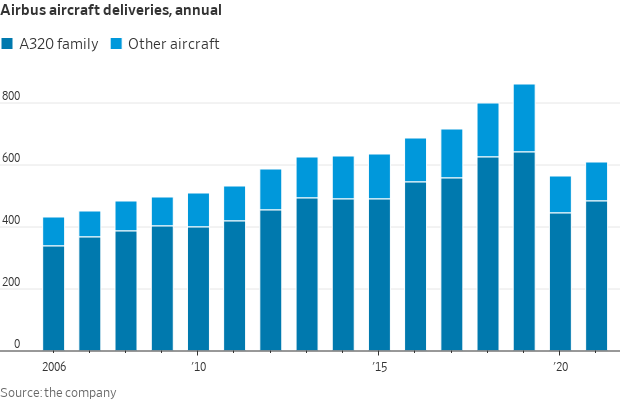

Supply chains aren't just snarled in the U.S. Airbus tempered expectations for sharply boosting production of its bestselling jet. The European plane maker has been bullish on the aviation sector’s eventual recovery, after pandemic travel restrictions hobbled many airlines. It told suppliers last year to be ready for a quick production ramp-up. But on Thursday, Airbus said that retooling its supply chain after the pandemic slowdown, labor shortfalls and a surge in raw-material and energy prices was proving challenging.

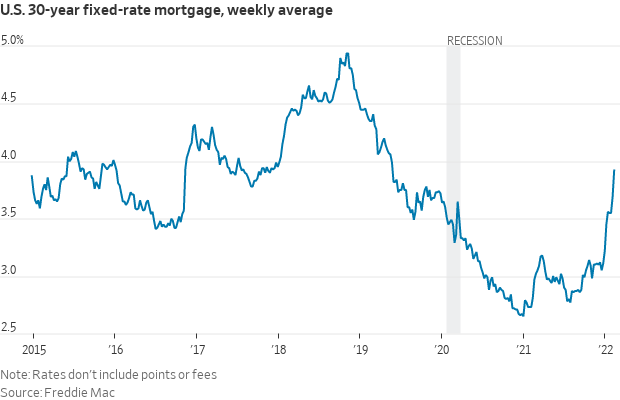

Housing market anxiety. High inflation, strong consumer spending and a Fed that's expected to raise rates multiple times this year is shaking up things in the housing market. The 30-year fixed-rate mortgage averaged 3.92% in the week ending Feb. 17, up from 3.69% the week before and higher than 2.81% a year ago, according to the Freddie Mac Primary Mortgage Survey. While rates are still near historic lows, the rising figures are putting some industry watchers on edge amid low inventories and elevated property prices. Mortgage applications to purchase a home also saw a decline of 5.4% on the week, while refinancing applications fell to its lowest level since July 2019 (with rising rates negating many of those benefits). Homebuyers are now faced with a choice of paying more for borrowing costs, or finding a less-expensive home, which also isn't easy, given that the median sales price of an existing home soared 17% over the past year.

Police in Canada’s capital began arrests of people protesting against Covid-19 mandates. The arrests began Thursday evening after police warned they would take action to remove a weekslong encampment from the streets of Ottawa. Police also installed fencing and concrete barriers in some areas of the city, set up checkpoints downtown and continued to warn protesters that further action was imminent. After the arrests began, hundreds of protesters remained in the encampment area.

Deere reported quarterly earnings of $2.92 per share, well above the $2.26 consensus estimate, with revenue also topping analyst forecasts. The heavy equipment maker also raised its annual profit forecast amid solid demand and higher prices. Deere and other equipment manufacturers are benefiting as higher crop prices boost farmers’ incomes, giving them the ability to replace aging tractor fleets. That and price increases are helping Deere stay ahead of rising production costs. The results come even after the company’s first strike since the 1980s resulted in weeks-long delays for parts orders during the busiest season of the year. Deere said it incurred a cost of $90 million in the first quarter tied to a signing bonus for union employees. The company forecasts net sales in its production and precision ag business to rise 25% to 30% in 2022, while its small ag and turf will rise about 15%. Sales in the construction and forestry business will climb 10% to 15%.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly higher despite a broadly firm tone in global currencies versus the greenback. The yield on the 10-year U.S. Treasury note is slightly higher around 1.96% while there is a mostly weaker tone in global government bond yields. Gold futures are lower and silver futures are seeing advances ahead of U.S. action. Gold is around $1,896 per troy ounce and silver around $23.88 per troy ounce.

• Crude oil futures are seeing pressure ahead of U.S. trading, with U.S. crude around $89.75 per barrel and Brent around $91.10 per barrel. Futures saw mild pressure in Asian

• Iran nuclear deal inches toward revival but faces critics in U.S. as Republicans warned that any new agreement would “likely be torn up” by the next administration. See related item below.

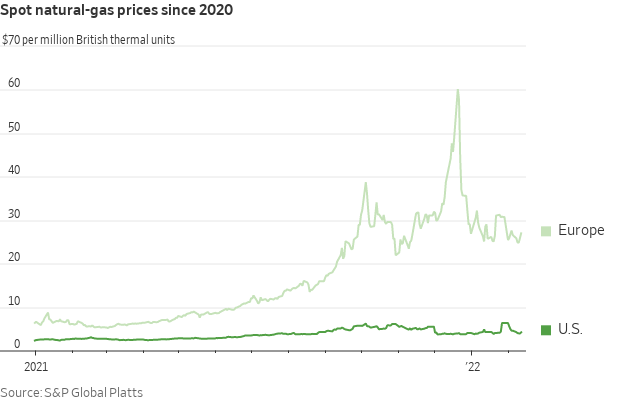

• Russia-Ukraine tension drives gas prices. U.S. natural-gas producers and global commodity traders are emerging as some of the biggest beneficiaries of surging energy prices in Europe. Falling supplies from Russia to Europe, as well as the threat of a Russian invasion of Ukraine, have elevated prices of the coveted fuel used to heat homes and generate electricity. The rally has hurt European utilities, put dozens of British energy suppliers out of business and raised costs for consumers, the WSJ reports (link). But the price surge has been a boon for American suppliers of liquefied natural gas, the traders shipping the gas to Europe at historically high prices, and money managers profiting from volatility in global gas markets.

• Energy security for Europe. The European Commission is looking at ways to build up strategic inventories of natural gas to better prepare for the next winter after limited supplies of the fuel pushed energy prices to records. The action plan due to be presented next month will include a legal requirement for member states to have a minimum level of storage by Sept. 30 of every year.

• USDA daily export sale: 198,000 MT of soybeans for to unknown destinations. Of the total, 66,000 metric tons is for delivery during the 2021-2022 marketing year and 132,000 metric tons for 2022-2023 MY.

• Ag demand: Taiwan purchased 54,920 MT of U.S milling wheat.

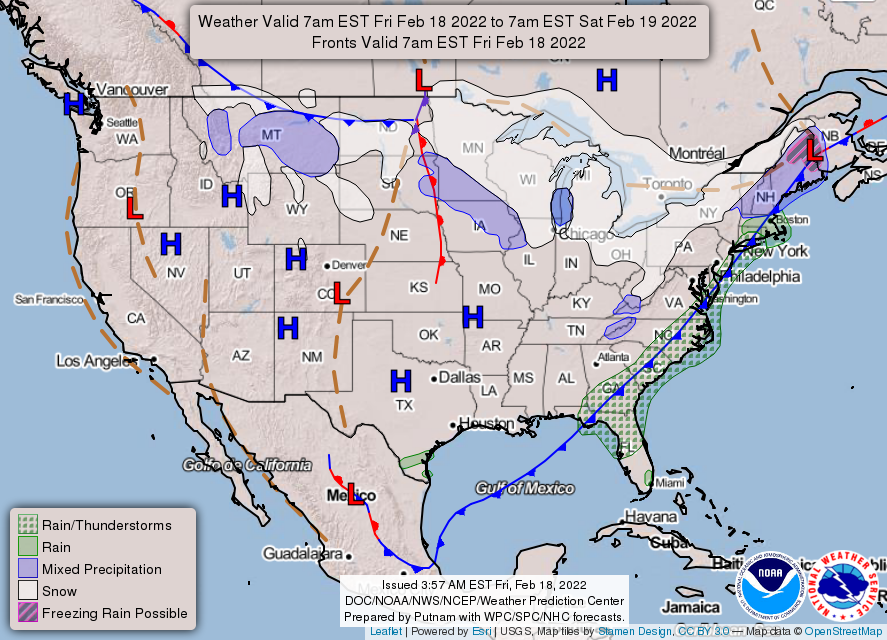

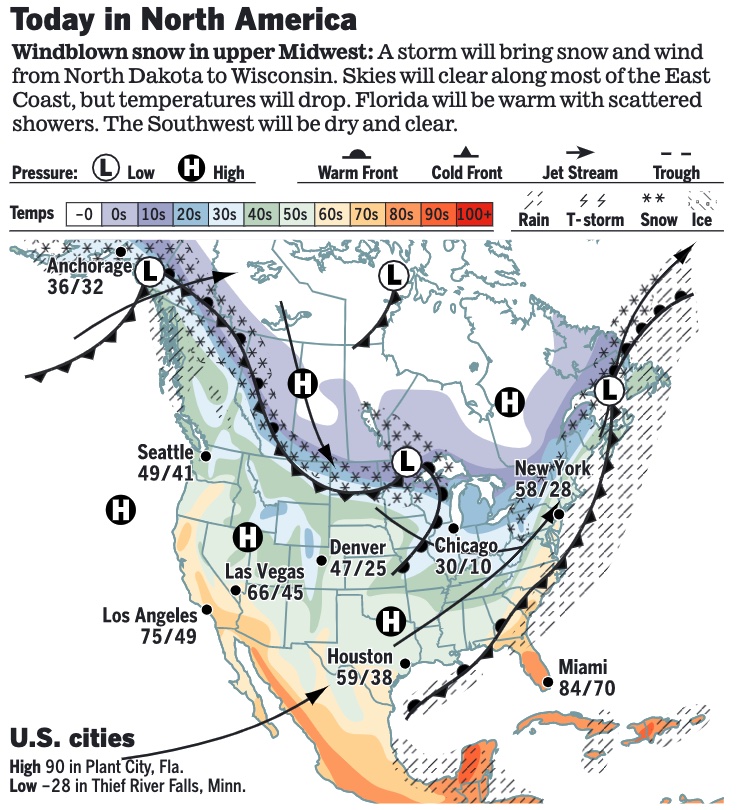

• NWS weather: A strong winter storm will be exiting the Northeast this morning... ...Strong winds and snow squalls expected today and tonight for the Upper Midwest and Great Lakes... ...Storm system to bring rain to the Pacific Northwest Sunday with higher elevation snowfall from the Cascades to the Northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Old-crop soybeans testing waters above $16 again

• China to strengthen commodity market monitoring amid industrial growth push... see details in China section.

• Russian wheat export tax declines again

• French wheat crop ratings remain high

• Still some cattle to clean up

• Hogs could face pre-holiday corrective trade

|

RUSSIA/UKRAINE |

— Russian Foreign Minister Sergei Lavrov agreed to meet U.S. Secretary of State Antony Blinken for talks in Europe next week. That eased some anxiety in markets, bolstering risk sentiment and sending U.S. and European equity futures higher. The Russian military exercises are due to end on Sunday, with troop movements after that date seen as a key test of the Kremlin’s intentions.

Blinken, President Biden’s top diplomat, top diplomat made his case Thursday to the U.N. Security Council. It didn’t help that the worst U.S. intelligence prediction in recent memory, that of Saddam’s Hussein’s alleged weapons of mass destruction, hung over the room. Blinken even tried to preempt the comparison to his predecessor Colin Powell. “I am mindful that some have called into question our information, recalling previous instances where intelligence ultimately did not bear out. But let me be clear: I am here today not to start a war, but to prevent one,” Blinken said.

Elsewhere, the U.S. Senate passed a non-binding resolution of "unwavering" U.S. support for Ukraine, as well as condemning the 2014 annexation by Russia of the Crimean Peninsula.

— U.S. on Thursday ramped up warnings of a possible Russian attack on Ukraine, with President Joe Biden saying the probability of an invasion is “very high.” Russian officials said no invasion of Ukraine was underway and none was planned. But the Kremlin said in an official response to the Biden administration’s proposed security assurances that the offers were unsatisfactory, and Russia might have to resort to unspecified “military-technical measures.”

The repeated messages: Moscow has repeatedly denied any intention to invade Ukraine, claiming this week it was withdrawing forces from the borders. But the U.S. remains skeptical and has accused Russia of increasing troops instead of pulling back. “If Russia doesn’t invade Ukraine, then we will be relieved that Russia changed course,’’ Secretary of State Antony J. Blinken said at the United Nations.

— Artillery exchanges in Eastern Ukraine may presage invasion, U.S. warns. As shelling intensified in the east, officials warned that Moscow might use false claims of “genocide” against Russians in the region as a pretext for an attack. Meanwhile, Russian-backed separatists claimed that they had come under fire from the Ukrainians — the sort of incident Western officials have warned that Russia might try to use to justify military action.

— China comments. In its public statements, Beijing has sided with Moscow in dismissing fears of an invasion as an American "disinformation campaign… Over the past few days, the U.S. has hyped up the threat of war and created tension, which has severely impacted economic and social stability and people's lives in Ukraine and added obstacles to the dialogue and negotiation of relevant parties," Chinese Foreign Ministry spokesperson Wang Wenbin said at a briefing Wednesday. "Such persistent inciting and spreading of false information by some people in the U.S. and the West have only added more turbulence and uncertainty to the world full of challenges, and intensified mistrust and division."

Chinese leader Xi Jinping would need to decide how far China is willing to go to back Russia should conflict break out — which could come at the expense of its relationships in Europe and further jeopardize China/U.S. ties. On Wednesday, Xi made his first public comment on Ukraine since meeting Putin on Feb. 4. In a phone call with French President Emmanuel Macron, Xi called for a diplomatic resolution to the crisis, according to a readout by the Chinese Foreign Ministry.

— Even if Vladimir Putin holds off on invading Ukraine, he has made himself the center of global attention, "proving that Russia matters once more," the Economist writes in its latest cover story (link). He has destabilized Ukraine "and impressed on everyone that its future is his business. ... And at home he has ... distracted from economic hardship and the repression of opposition figures." But the Economist contends that "in a longer-lasting and more strategic sense he has lost ground" by galvanizing his opponents.

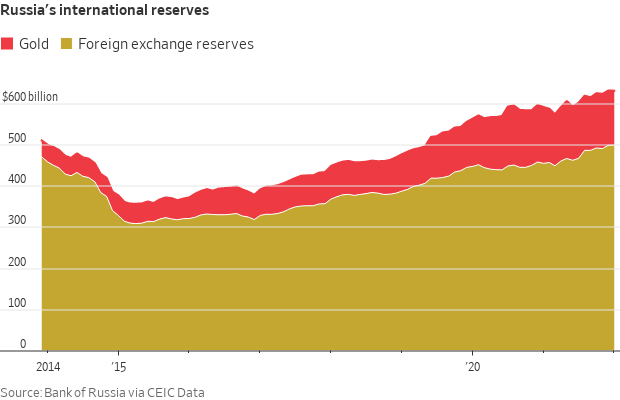

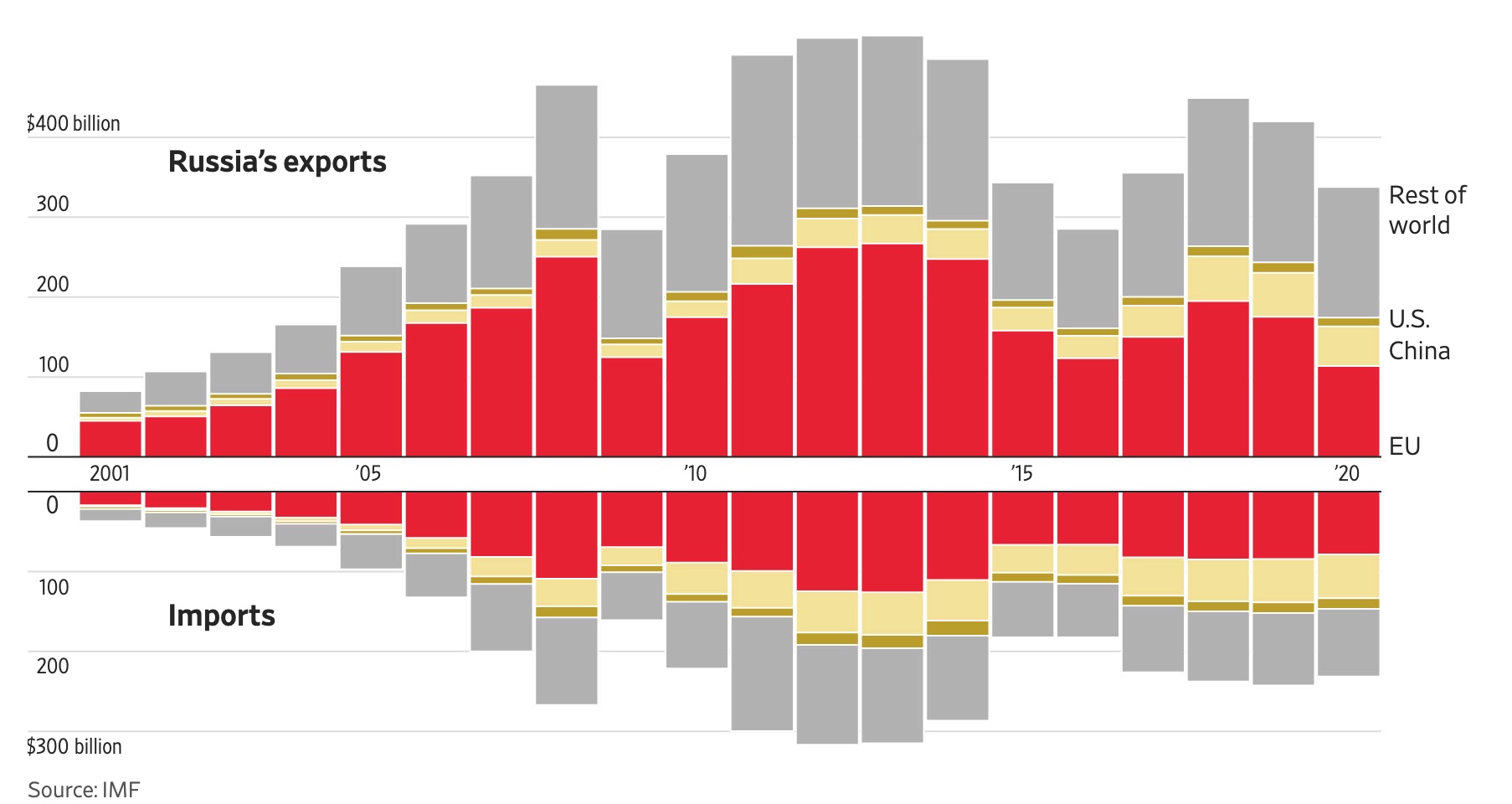

— How well could Russia’s economy withstand sanctions? Russia has taken steps to buffer itself against the economic blow that sanctions could impose, according to the Wall Street Journal’s assessment (link). The country has trimmed its budget, beefed up foreign exchange reserves and sought to diversify its trade portfolio to become less dependent on the European Union for export revenues.

— Bottom line on Russia/Ukraine: Putin wants a buffer because Ukraine’s border is only 450 miles away from Moscow. Russia watchers note this is like how the U.S. felt with potential then-Soviet missiles destined for Cuba during the Kennedy administration. U.S. observers stress that Putin really doesn’t understand the West, having served as a KGB official only in Eastern Europe. If an invasion does not occur, sources say it will be the result of diplomacy finding some way for Putin to get a portion of what he wants and to claim victory. If not, an invasion is coming. All eyes will be on the line of contact in its eastern Donbass region, a place where Kremlin spokesman Dmitry Peskov has warned could “ignite at any moment.” The OSCE monitoring mission there saw a jump in cease-fire violations on Thursday, 591 in total, compared to 153 the day before. The number includes 316 explosions, compared to 88 on Wednesday.

|

POLICY FOCUS |

— Senate on Thursday evening finally passed a three-week stopgap government funding bill, 65-27. The continuing resolution runs until March 11, and it’s designed to give House and Senate appropriators time to finish an omnibus covering fiscal year 2022.

Three amendment votes occurred:

- Sen. Mike Lee’s (R-Utah) amendment to strip money for all federal Covid vaccine mandates failed, 46-47. It was considered on a 51-vote threshold.

- Sen. Mike Braun’s (R-Ind.) balanced budget amendment vote failed, 47-45. It was considered on a 60-vote threshold.

- Sen. Ted Cruz’s (R-Texas) amendment to stop federal funding for schools that mandate Covid vaccines failed, 44-49. That was also considered on a 51-vote threshold.

Sen. Marco Rubio’s (R-Fla.) CRACK bill, which prohibits the federal government from sending out drug-related paraphernalia pipes, was blocked by Sen. Pat Leahy (D-Vt.).

Comments: Here is how one congressional analyst sums up the spending bill timeline: “House Ds unilaterally set their own spending caps and froze out the Rs in their process entirely. On the Senate side they never did get spending caps agreed to but did manage to muddle through three of 13 bills. Finally, Senate Ds just unveiled partisan bills. Both chambers’ Ds included controversial riders they said they wouldn’t include in previous Congresses. And they dropped longtime legacy riders of 40 and 50 years. Ds also abandoned parity spending between defense and non-defense. In short, all the deals the Ds cut when Rs were in charge were dropped by Ds when they took charge. That did not give Rs much chance to meaningfully participate. That’s why it is Feb 2022 and bills aren’t done that were due last September. That said, I am not sure why some opposed the CR. Seems amendments they offered could be interjected in an omnibus later on. But perhaps they were worried about giving up an opportunity. There were some amendments offered that have considerable public support.”

— Transportation groups blast bill to suspend federal gas tax. A proposal from six Senate Democrats to suspend the federal gas tax through the end of the year has been met with nearly universal criticism from transportation groups, who argue it would undermine the new infrastructure law, Roll Call reports (link).” The measure would cut the excise tax on gasoline produced, imported or sold from 18.4 cents per gallon to zero until Jan. 1, 2023. Transportation groups “blasted the plan. Ed Mortimer, vice president of transportation and infrastructure at the U.S. Chamber of Commerce, called the proposal” a “temporary stunt that...has no promise of actually helping lower prices for consumers or improving the economy.” Bill Sullivan, executive vice president for advocacy for the American Trucking Associations, said the measure “seems driven by short-term political interest and poorly targeted to relieve the drivers of fuel and other inflation.” And National Stone, Sand & Gravel Association President and CEO Michael Johnson called it a “gimmick.”

Meanwhile, Senate Minority Leader Mitch McConnell (R-Ky.) took to the Senate floor to blame Democrats for "historic" inflation and expressed his opposition to the gas-tax holiday. “And just to make the political games transparent, they want this to expire right after the midterm, as soon as the next Congress is sworn in,” McConnell stated.

|

CHINA UPDATE |

— U.S. gov’t namechecks some Chinese companies. In an announcement on Thursday, the Office of the United States Trade Representative (USTR) said it had designated for the first time AliExpress, an online marketplace run by Alibaba, and WeChat, Tencent’s ubiquitous mobile app, as “markets that reportedly facilitate substantial trademark counterfeiting.” The annual list includes 77 entities that are alleged to be engaged in “counterfeiting or copyright piracy,” spanning over a dozen countries.

In a statement today, Tencent said “we strongly disagree with the decision made by the United States Trade Representative and are committed to working collaboratively to resolve this matter.” The protection of intellectual property “is central to our business,” the company continued, adding that it takes measures to clamp down on violations across its platforms “including education, enforcement and close collaboration with rights holders, government agencies and law enforcement.”

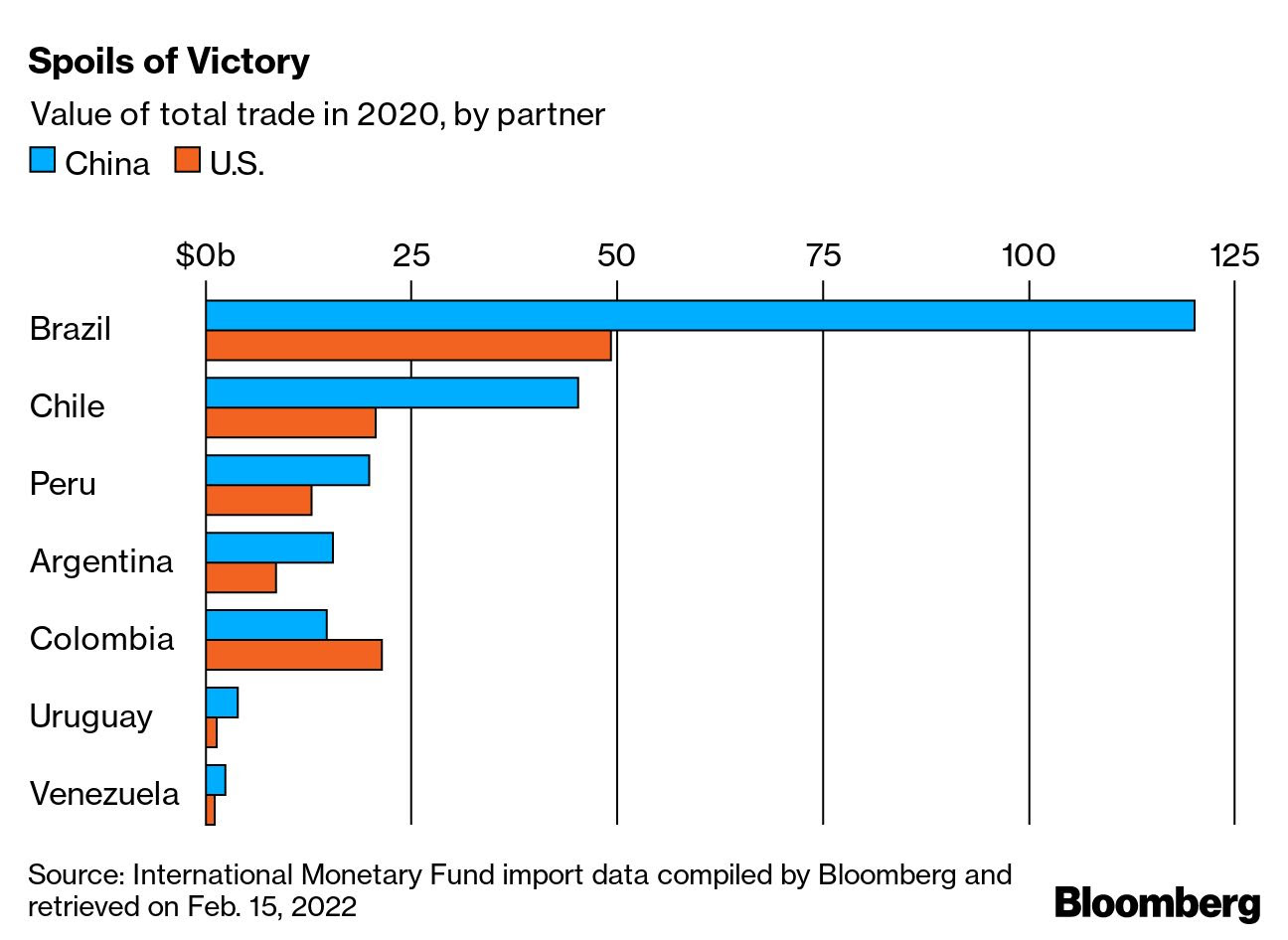

— China is pouring resources into South America, chipping away at the U.S.' historic dominance and making itself the continent's top trading partner. Link for details via Bloomberg.

— China to strengthen commodity market monitoring amid industrial growth push. The National Development and Reform Commission (NDRC) and other regulators announced 18 measures in a notice involving fiscal, financial, environmental and other policies to prop up China’s industrial sector. NDRC said the authorities would ensure supply and stabilize prices of primary products and key raw materials, including iron ore and fertilizer. They also pledged to reinforce futures and spot market supervision of commodities and strengthen price monitoring. The state planner said it will encourage companies to invest in certain domestic iron ore and copper projects and boost use of scrap metal. Distributed solar power projects in central and eastern regions will also be encouraged. State-owned banks will be encouraged to lend more to manufacturers and back major projects to cut carbon emissions. The country will also speed up construction of new infrastructure projects and increase financial support for traditional trading firms, cross-border e-commerce companies and others.

|

ENERGY & CLIMATE CHANGE |

— Carbon pricing in the EU. The EU plans to seek more granular reporting on different types of emissions derivatives to boost the transparency of its carbon market, according to a draft plan we got a peek at. Separately, France proposed that member states discuss next week the existing provisions to prevent excessive carbon price growth, as well as potential changes, in talks on overhauling the Emissions Trading System.

— Energy Transfer eyes new Permian Basin natural gas pipeline. Energy Transfer LP is the latest company to throw its hat into the ring to build a new natural gas pipeline from the Permian Basin shale field in West Texas and eastern New Mexico to liquefied natural gas (LNG) export hubs along the Gulf Coast. "Given the proposed route and our ability to utilize existing assets, we believe we could complete construction of [the Permian Basin] project in two years or less once we have reached FID (final investment decision)," Energy Transfer Co-CEO Thomas Long said in an earnings call Wednesday (Feb. 16). The proposal appears to be more economical than those put forward by other companies like Kinder Morgan as Energy Transfer's conduit could add roughly 1.5-2.0 billion cubic feet per day of capacity using around 260 miles of new pipeline.

Meanwhile, Energy Transfer Co-CEO Marshall McCrea said the company is also moving forward with a bid to build a new LNG export facility in Lake Charles, Louisiana. "We hope to be able to announce some agreements that we are close to getting signed over the next few years," he said during the call.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Grocery prices have been rising for months and will keep climbing, supermarket executives said. New price increases are coming every week and stores are studying how much of these jumps to absorb and how much to pass along to consumers. Overall, however, supplies are ample, supermarket operators and food makers say. Shoppers will find what they are looking for but may have to opt for different brands. Link for details via the WSJ.

— Pilgrim's Pride slumped 14.8% in premarket trading after Brazilian meatpacker JBS dropped plans to buy the portion of the poultry producer that it doesn't already own. JBS holds an 80% stake in Pilgrim's Pride, but the two sides could not agree on terms of a deal for the remaining 20%.

— CSPI gets major cash infusion. The Center for Science in the Public Interest (CSPI) is on the receiving end of $15 million from philanthropist MacKenzie Scott, the former wife of Amazon founder Jeff Bezos. The donation is the largest for the 50-year-old nonprofit group, which has spearheaded a variety of campaigns focused on improving public health and nutrition in the U.S.

— Update on HPAI-linked poultry trade restrictions. Canada has shifted its restrictions on U.S. poultry products from Kentucky from the entire counties of Webster and Fulton to limits that apply to only a 10-kilometer radius from the location where the HPAI cases were found and Taiwan has now halted imports from Virginia. USDA has also now added the second location in Dubois County, Indiana as being confirmed with HPAI in a commercial turkey flock, but the Animal and Plant Health Inspection Service still does not list Webster County, Kentucky as being confirmed with HPAI.

— Poultry/products from Fulton County on or after Feb. 12 unless otherwise noted: Chile (includes Hickman County), Costa Rica, Curacao, Ecuador, Hong Kong, India, Jamaica (includes Hickman County), French Polynesia (Tahiti – Jan. 23), Guatemala, Jordan, Nicaragua, North Macedonia, Qatar, Solomon Islands, Turks & Caicos Islands, United Arab Emirates, Vietnam (Feb. 8).

— Poultry/products from a 10-kilometer radius from location in Fulton County as Feb. 12 unless otherwise noted: Canada, Egypt, Hong Kong, Mauritius (Jan. 22, 25), Morocco (Jan. 22), New Caledonia, Vietnam, Western Samoa (Samoa – 50 kilometers).

— Poultry/products from Webster County on or after Feb. 15 unless otherwise noted: Barbados, Chile (includes Hopkins and McLean Counties), Costa Rica, Curacao, Ecuador, French Polynesia (Tahiti – Jan. 25), Guatemala, Hong Kong, India, Jamaica (includes Hopkins and McLean Counties), Jordan, Nicaragua, North Macedonia, Solomon Islands, Turks & Caicos Islands, Qatar, United Arab Emirates, Vietnam (Feb. 8).

— Poultry/products from a 10-kilometer radius from location in Webster County as of Feb.15 unless otherwise noted: Canada, Egypt, Mauritius (Jan. 22), Morocco (Jan. 22), New Caledonia, Singapore, Vietnam, Western Samoa (Samoa – 50 kilometers).

— Poultry/products from the state of Kentucky on or after Feb. 12 unless otherwise noted: Benin (Jan. 22), China, Cuba, Dominica, Dominican Republic, French Polynesia (Tahiti), Japan (Jan. 21), Jamaica, Korea, Mexico (Jan. 17), Namibia (Jan. 22), Myanmar, South Africa (Jan. 22), Singapore, St. Lucia, Tunisia, Uruguay.

— Poultry/products from the state of Virginia on or after Jan. 17 unless otherwise noted: Mexico, Taiwan (Feb. 13).

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 420,069,473 with 5,864,866 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,269,887 with 931,742 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 548,934,364 doses administered, 214,474,721 have been fully vaccinated, or 65.34% of the U.S. population.

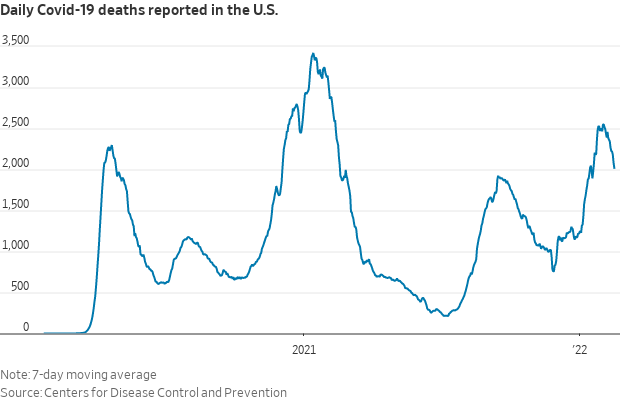

— Newly reported Covid-19 deaths are starting to decline in the U.S., offering the latest sign that the surge fueled by the highly transmissible Omicron variant is fading. Cases and hospitalizations have already fallen sharply from record-breaking peaks, including in places such as New York, New Jersey and Illinois where Omicron spread widely late last year. Deaths, which tend to follow cases by several weeks, appear to be following the same pattern by declining in the places hit hard early on.

|

POLITICS & ELECTIONS |

— House GOP leader endorses Liz Cheney’s opponent. House Minority Leader Kevin McCarthy (R-Calif.) endorsed a Republican challenger to incumbent Rep. Liz Cheney of Wyoming, a former member of his leadership team, after breaking with her over her criticism of former President Donald Trump. In a statement, McCarthy (R-Calif.) said he was proud to endorse Cheney’s opponent Harriet Hageman. The House seat in conservative Wyoming is expected to stay Republican, regardless of which Republican wins the primary. Former President Donald Trump has also backed Hageman. In a statement, Hageman criticized Cheney for “actively damaging the Republican Party.”

— Boozman is popular in Arkansas… and so is a primary opponent. Based on a recent visit to Arkansas, voters in the state told me they like and think current Sen. John Boozman (R-Ark.) will get the GOP nomination and win re-election. But they also quickly note they like his May primary opponent, Jake Bequette, an Army veteran and former standout Razorback defensive lineman who played in the NFL. They noted they like Bequette’s ads. “If John wasn’t running, I could easily vote for Bequette,” said several state voters. Another Arkansan said, “John isn’t like another former senator we liked who got defeated, Blanche Lincoln (D-Ark.), because she made some controversial votes that upset us. John has not done so.”

Couching himself as a “conservative outsider” running against “career politicians,” Bequette outlined some of his strong positions. “Arkansas deserves a difference-maker in the U.S. Senate who will stand up for Arkansas families and push the conservative change we need,” said Bequette.

Bequette is not the only Republican challenging Boozman in the 2022 election. Other candidates who have said they will challenge Boozman for the GOP nomination include Michael Deel, Heath Loftis and Jan Morgan. Democrats who have announced for the Senate seat include Natalie James, Jack Foster, and Dan Whitfield. Boozman, who has held the U.S. Senate seat since 2010, has been endorsed by former President Donald Trump and U.S. Sen. Tom Cotton (R-Ark.).

Comments: “Boozman remains the favorite, but he has a pretty low-key personality,” said David Wasserman, House editor of the Cook Political Report with Amy Walter, in reported remarks at the Crop Insurance Industry Annual Convention. He noted the personality of the Senate Agriculture Committee’s ranking member has served him well in Washington but might not be as popular with the electorate. That comment is not backed up with conversations I had with Arkansans.

— Democrats biggest opponent in Nov. 8 elections: pushback against their far-left agenda. The push to defund the police, rename schools and tear down statues has created a significant obstacle to Democrats keeping control of the House, the Senate and the party's overall image.

Former Sen. Heidi Heitkamp (D-N.D.) says her fellow Democrats are hurting themselves by not speaking out more forcefully against liberal positions that alienate rural America. Heitkamp who spends a lot of time energizing rural voters — told AP: "Now, the brand is so toxic that people who are Democrats, the ones left, aren't fighting for the party."

— Think Hillary Clinton will run in 2024? Here’s a New York Post graphic on the matter:

|

CONGRESS |

— Rep. Jim Hagedorn (R-Minn.) dies at 59. He had been receiving treatment for kidney cancer. Hagedorn was elected to the House in 2018. In a statement on social media, his wife, former state GOP chairwoman Jennifer Carnahan, announced the news, saying, “It is with a broken heart, shattered spirit and overwhelming sadness I share my husband Congressman Jim Hagedorn passed away peacefully last night.”

Said one Minnesota contact: “He was soft spoken and kind. He served on the Agriculture Committee and he was a strong champion of Minnesota farmers. He will be missed.”

|

OTHER ITEMS OF NOTE |

— Immigration and U.S. benefits. The Biden administration plans to roll out a new rule that aims to eliminate hurdles for immigrants using public benefits and for those seeking legal status. The Trump administration had previously modified the decades-old “public charge” rule in a way that made it more difficult for individuals to obtain legal status. Under the new proposed rule, the Department of Homeland Security would consider benefits, like cash assistance for income maintenance and some other services, a gov’t expense, according to a notice sent to Congress. Separately, more than 100 congressional Democrats have urged President Joe Biden to review the "disparate treatment of Black migrants" throughout the immigration system and end the public health order that allows authorities to turn away migrants at the U.S. southern border.

— The possible Iran deal. In the draft seen by Reuters, which is still subject to negotiation, Iran will agree to stop uranium enrichment above the 5% level and release certain Western prisoners held in Iran, while $7 billion in Iranian funds held in South Korean banks would become unfrozen. Those initial steps would pave the way for further sanctions, particularly on Iran’s oil sector, to be lifted. The overall deal is expected to fall short of a U.S. guarantee to never leave the deal, with a provision agreed that Iran would instead be allowed enrich uranium up to 60% purity in the event of a U.S. pullout.

— USDA releases recap of 2021 U.S. hemp production. U.S. industrial hemp was valued at $824 million in 2021, with hemp planted in the open on 54,200 acres with a value of $712 million. Harvested area for all purposes was put at 33,500 acres. Of the total, floral hemp grown had a production of 19.7 million pounds in 2021, with harvested area at 16,000 acres and a yield of 1,235 pounds per acre with a value of $623 million. This is hemp used for the extraction of essential oils from plant resin, such as cannabidiol (CBD), cannabigerol (CBG), cannabinol (CBN), or other phytocannabinoids. Floral hemp includes smokable hemp. Hemp growers used 15.6 million square to grow hemp under protection for production. Of industrial floral hemp grown in the open, USDA said that 4,002 million pounds were harvested but not sold. Hemp harvested but not sold is defined as the difference between total production and utilized production. This is hemp that was harvested from the field but not sold due to reasons that include poor quality, market conditions, marketing restrictions, or other reasons. However, hemp destroyed due to high levels of tetrahydrocannabinol (THC) is not considered harvested. Under the 2018 Farm Bill, to be considered hemp, the crop must have less than 0.3% Delta-9 THC.

Hemp advocates continue to push for a higher level of Delta-9 THC — 1%— so that more of the crop can be utilized.

In 2021, Idaho was the only state in the country that did not have a regulated hemp growing program either under the 2018 Farm Bill or under the rules for the pilot program launched in the 2014 Farm Bill.

Link to USDA report.

— Cotton AWP eases but remains well over $1 per pound. The Adjusted World Price (AWP) for cotton declined to 114.62 cents per pound, effective today (Feb. 18), down from 117.60 cents per pound the prior week, but still the seventh straight week at $1 per pound or more. Meanwhile, USDA announced that Special Import Quota #18 would be established Feb. 24 to allow the import of 46,837 bales of Upland Cotton, applying to supplies purchased not later than May 24 and entered into the U.S. not later than Aug. 22.

— If you were waiting on a new Porsche, your order might be up in smoke. About 1,000 Porsches are estimated to be among some 4,000 vehicles left adrift on a burning cargo ship. The massive Felicity Ace was carrying thousands of Volkswagen cars when it caught fire near the Azores islands in the Atlantic Ocean. The 22 crewmembers were evacuated. But the cargo may be lost. (Note: I used to have a Porsche… most people mispronounce it. Link to be educated.)