U.S. and NATO: No Indication Russia Is De-escalating Anything

Vilsack wants DOJ to investigate input prices | Some signs of relief re: supply chain backlogs

|

In Today’s Digital Newspaper |

Market Focus:

• USDA daily export sale: 120,000 MT soybeans to unknown destinations 2021-2022 MY

• FOMC minutes: Fed eyes rate hike soon and faster tightening pace if needed

• Carrier executives warn production at truck & trailer manufacturers remains constrained

• IMF backs ECB’s stance on inflation, monetary policy

• Supply chain backlogs continue, but some signs of relief

• Disagreement between White House and Yellen slowing U.S. crypto strategy

• IEA: OPEC+ must fix its million-barrel supply gap

• U.S. spot cotton prices have reached highest level since 2011

• Focus items for ag commodities

• Ag demand update

• Followthrough strength in soybeans, soymeal

• Wholesale beef prices continue to drop

• Cash hog index continues to firm

Policy Focus:

• Vilsack wants DOJ to investigate input prices

Personnel:

• Senate panel delays EPA nominee votes

• Zinke faulted over ethics in Montana land deal

• Sen. Cotton blocks six attorney nominees and two marshal nominees from advancing

China Update:

• Hefty new-crop soybean sales mark activity for China in most recent week

• Hong Kong announced plans to test entire city for Covid-19 amid surging infections

• Biden administration not seeking to engage with China in its Indo-Pacific efforts

Trade Policy:

• Another supply crunch after U.S. suspended all avocado imports from Mexico

Energy & Climate Change:

• Vilsack discusses climate initiatives and early adopters

• GOP confronts Democrats on natural gas export plea

• RFS hearing sees well-known positions put forth with attention on RIN prices

Livestock, Food & Beverage Industry Update:

• Reuters: DOJ urged to oppose Sanderson chicken deal if antitrust violation found

• Supply-chain woes siphoning sales away from big food companies

• Carl Icahn prepared to begin board fight at McDonald’s to improve its treatment of pigs

• Update on HPAI-linked poultry trade restrictions

Coronavirus Update:

• Yellen wants World Bank fund to fight future pandemics

• Romney against more Covid-19 relief

• Texas sued to block mask mandate for all U.S. travel on airplanes, trains and buses

• California officials set to unveil today a plan for coexisting with Covid

• Biden administration health officials preparing for shift in federal Covid-19 guidance

Politics & Elections:

• Can election “experts” see what others are seeing in liberal cities?

Congress:

• Senators want to send stopgap gov’t funding bill to Biden’s desk today

Other Items of Note:

• U.S. and NATO said they’ve seen no indication Russia is de-escalating anything

• Satellites show continued Russian buildup

• Police in Canada threatened to arrest protesters in Ottawa if they did not leave capital

|

MARKET FOCUS |

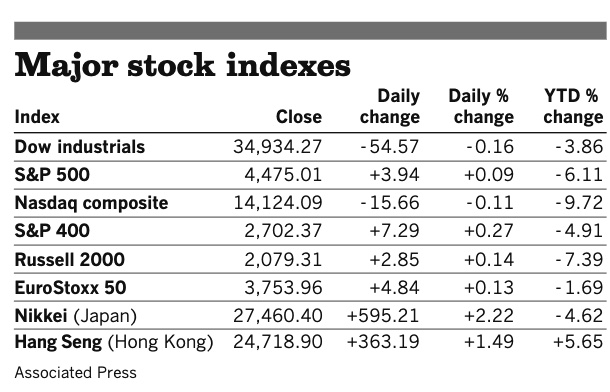

Equities today: Global stock markets were mixed to weaker overnight. The U.S. stock indexes are pointed toward weaker openings. Stock futures are down this morning as the Ukraine crisis continues, with Western officials accusing Russia of lying about withdrawing troops from the Ukrainian border. There has been talk of potential economic punishments for Moscow, including sanctions. Asian equities finished mixed as markets continued to monitor the Russia/Ukraine situation. The Nikkei was down 227.53 points, 0.83%, at 27,232.87. The Hang Seng Index rose 73.87 points, 0.30%, at 24,792.77. European equities are mixed with indices moving between losses and gains early in the session. The Stoxx 600 was slightly weaker while other markets were mixed — up 0.3% to down 0.5%. Walmart topped quarterly estimates on earnings and revenue today as the company said it's on track to hit its long-term growth targets.

U.S. equities yesterday: The Dow ended lower despite a late climb into positive territory. The Blue Chip index was down 54.57 points, 0.16%, at 34,934.27. The Nasdaq lost 15.66 points, 0.11%, at 14,124.09. The S&P 500 managed a gain of 3.94 points, 0.09%, at 4,475.01.

On tap today:

• U.S. jobless claims are expected to fall to 218,000 in the week ended Feb. 12 from 223,000 one week earlier. (8:30 a.m. ET) UPDATE: Initial jobless claims, a proxy for layoffs, increased to a seasonally adjusted 248,000 last week from 225,000 a week earlier, the Labor Department said. The four-week moving average, which smooths volatility, fell slightly to 243,250. New filings for unemployment benefits have largely stayed below 250,000 a week since mid-November. Continuing claims, a proxy for the total number of people receiving unemployment benefits through regular state programs, declined to 1.59 million for the week ended Feb. 5 from 1.62 million a week earlier. Continuing claims are reported with a one-week lag.

• U.S. housing starts are expected to fall to an annual pace of 1.69 million in January from 1.702 million one month earlier. (8:30 a.m. ET)

• Philadelphia Fed's manufacturing index is expected to fall to 19 in February from 23.2 one month earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• Federal Reserve speakers: St. Louis's James Bullard at an SGH Macro Advisors and Columbia University fireside chat at 11 a.m. ET, and Cleveland's Loretta Mester to the Volatility and Risk Institute and Center for Global Economy and Business at 5 p.m. ET.

• Goldman Sachs plans today to issue its first long-term business forecast since the pandemic upended its 2020 prediction.

• Biden to talk infrastructure. President Biden will travel to Cleveland and Lorain, Ohio, today, the White House said. During the trip, the president will “deliver remarks on how the Bipartisan Infrastructure Law delivers for the American people by rebuilding roads and bridges, upgrading water systems, cleaning up the environment, and creating good-paying, union jobs,” it said in a statement.

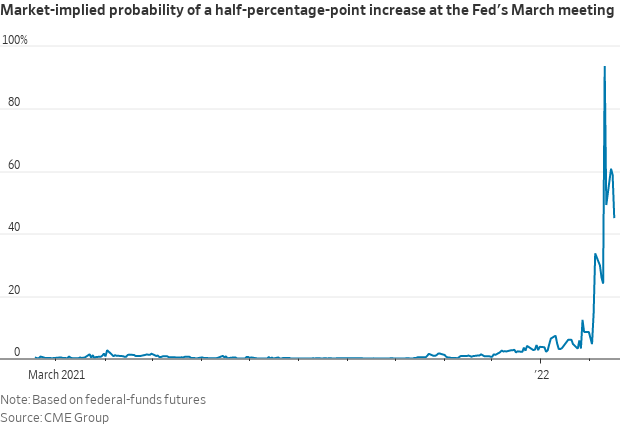

Fed eyes rate hike soon and faster tightening pace if needed. Federal Reserve officials concluded in January that they would start raising interest rates soon and were on alert for persistent inflation that would justify a faster pace of tightening. Minutes of the Jan. 25-26 Federal Open Market Committee (FOMC) meeting, released yesterday, said most policy makers “noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate.”

Upshot: Yesterday’s minutes of the FOMC meeting provided few new details for investors who are now pricing at least six rate hikes this year. Analysts are becoming increasingly concerned that the central bank may not be able to slow inflation without inflicting damage to the economy. Fed officials will have another round of inflation and employment data before making their decision next month.

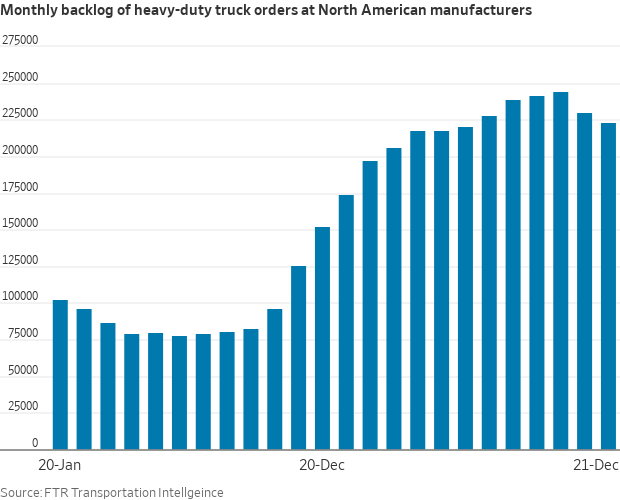

Carrier executives warn that production at truck and trailer manufacturers remains constrained. New orders for trucks and trailers have weakened in recent months as manufacturers limit sales while they try to cut into backlogs driven by parts shortages. FTR Transportation Intelligence expects North American makers of Class 8 trucks to fall 85,000 units short of demand, suggesting some of that capital spending may have to be rolled into next year.

IMF backs ECB’s stance on inflation, monetary policy. The European Central Bank has been right to maintain its easy money policy as inflation is set to fall after “transient boosts” from supply snags that may extend into next year, the International Monetary Fund (IMF) said. "We expect inflation to fall slightly below the European Central Bank’s target once the pandemic fades," read a blog post signed by managing director Kristalina Georgieva and two other officials. “The ECB has appropriately decided to maintain an accommodative monetary stance until its medium-term inflation target is met while preserving its flexibility to adjust course if high underlying inflation proves more durable than expected.” ECB President Christine Lagarde was previously the head of IMF.

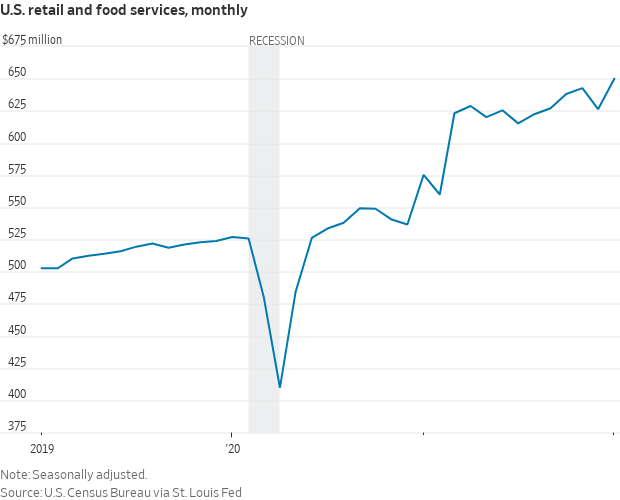

Supply chain backlogs continue, but there are some signs of relief. An indicator tracking supply chain stress compiled by UBS has improved significantly after peaking in October, the bank said this week. It found that a quarter of bottleneck pressure has been reversed. Its economists point to several data points. More air freight capacity is opening up as passengers return to the skies, reducing costs. Spending in the U.S. is starting to shift from goods to services. And outside of China, countries in Asia are moving away from "zero-Covid" policies, which implemented harsh restrictions that affected trade to limit infections. "We attribute the sharp improvement in global delivery time indices in large part to the shift away from 'zero-Covid' in Asia," UBS said. "The jump in production as restrictions were removed led to greater availability of goods and an immediate reduction in backlogs." Meanwhile, congestion at the ports of Los Angeles and Long Beach is declining, too. The number of ships waiting to be offloaded is down by half since early January, according to UBS. But the bank's economists admit there is "a lot of work to be done." Getting hold of shipping containers remains extremely difficult and shipping costs are still elevated, according to data from Freightos.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly higher ahead of U.S. economic reports, with the euro and British pound slightly higher against the greenback. The yield on the 10-year U.S. Treasury note has moved up to trade just above 2% with a mostly weaker tone in global government bond yields. Gold and silver futures are seeing solid advances ahead of U.S. market action, with gold around $1,887 per troy ounce and silver around $23.66 per troy ounce. Gold prices surged to an eight-month high overnight on safe-haven demand amid the geopolitical crisis.

• Crude oil prices are under pressure ahead of U.S. trading, with U.S. crude around $92 per barrel and Brent around $93.25 per barrel. Futures had been under even more pressure in Asian trading, with U.S. crude around $91.70 per barrel and Brent around $92.90 per barrel.

• Disagreement between White House officials and Treasury Secretary Janet Yellen is slowing the arrival of a U.S. crypto strategy, according to reports. Yellen is said to be concerned about the implication of any executive order for a digital dollar. Industry executives warn that the U.S. scattergun approach to regulation and lack of clarity is giving the advantage to other nations. They even say that other gov’t-backed coins could threaten the dollar’s global dominance.

• IEA: OPEC+ must fix its million-barrel supply gap. The International Energy Agency (IEA) urged OPEC and its allies to address a widening shortfall in their oil production as a volatile market sends crude prices rocketing toward $100 a barrel. While fuel consumption is bouncing back from the pandemic, the 23-nation alliance led by Saudi Arabia and Russia is struggling to restore output it halted. Members need to fix the issue as the supply gap versus their target spirals toward 1 million barrels a day, IEA Executive Director Fatih Birol told a conference in Riyadh via video-link.

• U.S. spot cotton prices have reached their highest level since 2011. It’s been exactly 11 years since cotton prices topped $2.

• Focus items for ag commodities: The Russia/Ukraine situation is in the background of all the market activity. South America crops are of significant concern, with some private people lowering crop sizes. Analyst and trader Richard Crow says “the talk is Argentina's [soybean] crop is down to 40 million tons and Brazil's below 125. The discussion flows around the market movement. What is known is that Brazil's cash values rallied yesterday.”

• USDA daily export sale: 120,000 MT soybeans to unknown destinations 2021-2022 MY

• Ag demand: Japan purchased 54,692 MT of U.S. milling wheat in its weekly tender. Algeria bought at least 120,000 MT of optional origin milling wheat. The Philippines purchased 45,000 MT of Australian feed wheat. Egypt tendered for an unspecified amount of wheat from multiple origins, with results of the snap tendered expected later this morning.

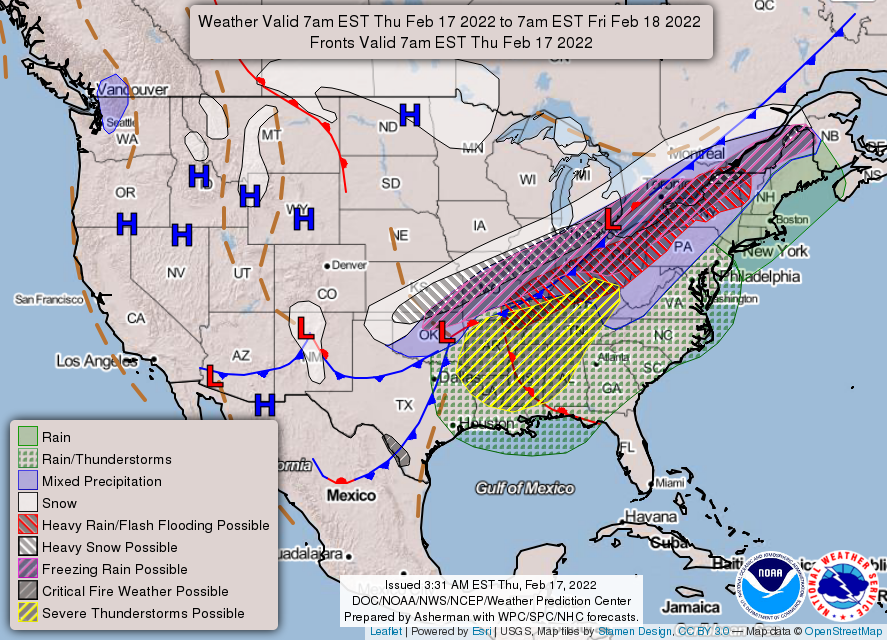

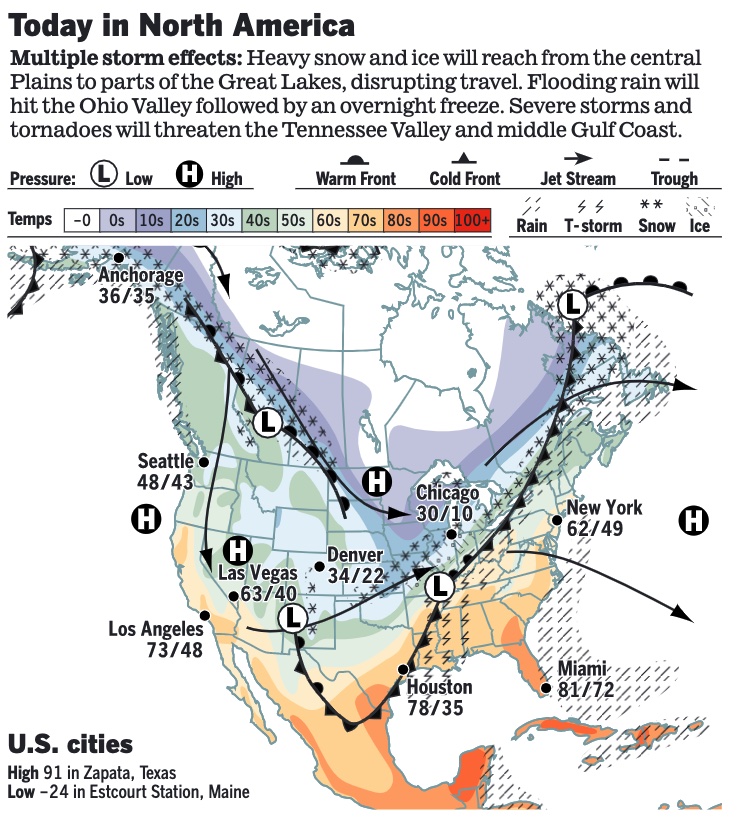

• NWS weather: Quick burst of heavy snow to extend from northern Oklahoma to southern Michigan today, with wintry weather also possible across far northern and western New York as well as northern Maine into Friday morning... ...Threat of severe thunderstorms exists from the Lower Mississippi Valley to the Tennessee Valley through this evening, while flash flooding is possible throughout much of the Ohio Valley and Interior Northeast... ...A bitter cold airmass is found across the Upper Midwest and Northern Plains ahead of an approaching clipper system that may produce blizzard conditions on Friday.

Items in Pro Farmer's First Thing Today include:

• Followthrough strength in soybeans, soymeal

• Wholesale beef prices continue to drop

• Cash hog index continues to firm

|

POLICY FOCUS |

— Vilsack wants DOJ to investigate input prices. USDA Secretary Tom Vilsack wants the Dept. of Justice (DOJ) to ensure seed companies and other input suppliers are not using their market power and current conditions to raise prices unfairly. “It's important for us to ask questions about whether all of these increases, every penny of these increases, is justified based on disruptions, based on supply, based on the normal economics,” Vilsack said during an appearance at the National Association of State Departments of Agriculture’s (NASDA) 2022 Winter Policy Conference. He told the nation’s state agriculture commissioners on Wednesday that if input companies cannot justify current pricing, “then shame on anybody who's trying to take advantage of this circumstance.”

Vilsack acknowledged the volume of challenges weighing on the ag sector, mentioning supply chains, animal disease threats and rising input costs, but stressed his confidence in the “capacity of American agriculture” to overcome them.

Farmers continue to grapple with higher costs for fertilizer and other inputs, and Arkansas Ag Secretary Wes Ward asked what USDA was doing to address the issue — and how state ag officials might be able to help. Vilsack said higher input costs are tightly linked to broader pandemic-driven supply chain woes, with heavy demand running up against scarce supplies. “A lot of these factors are things that the department of Agriculture, whether at the state level or at the federal level, is not in a position to provide much assistance,” he said. However, he said USDA’s other moves aimed at creating and expanding market opportunities for farmers and ranchers through climate-smart ag and new export markets can support higher commodity prices and help producers “withstand some of these shocking [input] prices that they're currently facing.”

Vilsack reiterated his view that research into new precision ag technologies can also play a role by helping farmers utilize fertilizer and other inputs more efficiently.

Comments: Vilsack’s comments come as the DOJ and the FBI today are scheduled to announce a new initiative to look at finding companies that are exploiting supply chain disruptions in the U.S. to make increased profits, violating U.S. antitrust laws. The effort seeks to address concerns that companies may “seek to exploit supply chain disruptions for their own illicit gain,” the DOJ said in a statement. Violations they are looking for include agreements between individuals and businesses to fix prices or wages or to rig bids. The U.S. has also formed a working group on supply chain collusion with countries like the U.K., Australia, New Zealand and Canada to share intelligence and root out global efforts on that front. “Temporary supply chain disruptions should not be allowed to conceal illegal conduct,” said Assistant Attorney General Jonathan Kanter, in charge of the DOJ antitrust division. “The Antitrust Division will not allow companies to collude in order to overcharge consumers under the guise of supply chain disruptions.”

|

PERSONNEL |

— Senate panel delays EPA nominee votes. The Senate Environment and Public Works Committee postponed a scheduled vote Wednesday on two EPA nominees to “accommodate scheduling conflicts” with members, according to a Democratic aide. The planned votes on David Uhlmann to head up the EPA’s enforcement office and Carlton Waterhouse to lead its office of land and emergency management will be held soon, the aide said. Sen. Cynthia Lummis (R-Wyo.) has placed a hold on all EPA nominees over concerns related to the EPA’s revised air quality control plan at a coal plant in her state. Meanwhile, Sen. Bill Cassidy (R-La.) yesterday said he was placing a hold on all EPA nominees due to “unnecessary delays” of Louisiana’s bid for the right to permit and site carbon sequestration wells. “We have met the requirements and we have the workers, capacity, and resources to begin this process,” Cassidy said in a statement. “All that’s needed is the green light from the Biden administration. The EPA has emphasized their desire to lower emissions and ensure a healthy environment, yet hinders Louisiana’s ability to do just that.”

— Zinke faulted over ethics in Montana land deal. Former Interior Secretary Ryan Zinke failed to meet ethical obligations by continuing to be involved in Montana land negotiations and directing gov’t employees to assist him while serving in his cabinet post, government investigators said Wednesday. Zinke, who served under former President Donald Trump and is now running to reclaim his seat in the House, “failed to abide by his ethics obligations” because of his continued involvement in the land deal, the Interior Department’s Office of Inspector General said in its report. He also violated his “duty of candor” when questioned about the matter, the report said. The Zinke campaign called the report “a political hit job.”

— Sen. Tom Cotton (R-Ark.) blocked six U.S. attorney nominees and two U.S. marshal nominees from advancing. He’s threatening to hold up the nominees until the Justice Department agrees to pay the legal bills of four federal officers being sued for their handling of Black Lives Matter protests in Portland in 2020.

|

CHINA UPDATE |

— Hefty new-crop soybean sales mark activity for China in most recent week. U.S. weekly Export Sales figures for the week ended Feb. 10 showed China booked a sizable quantity of new-crop U.S. soybeans. Sales for 2022-23 of 876,000 tonnes of soybeans and cancelations of 53,000 tonnes of sorghum were reported for China.

For 2021-22, weekly activity included net reductions of 30 tonnes of wheat, the last of sales that were unshipped. Sales activity for other commodities for 2021-22 included net sales of 5,544 tonnes of corn, 208,374 tonnes of sorghum, 224,516 tonnes of soybeans and 47,780 running bales of upland cotton.

Net sales of 606 tonnes of U.S. beef and 272 tonnes of U.S. pork were reported for 2021.

— Officials in Hong Kong announced plans to test the entire city for Covid-19 amid surging infections. Around a million residents are expected to be tested daily with the help of medical workers brought in from mainland China. There were more than 4,000 cases reported on Wednesday, but the city is persisting with its zero-covid policy.

— Biden administration not seeking to engage with China in its Indo-Pacific efforts. The Biden administration will not work with China as it reaches out to countries in the Indo-Pacific region with its Indo-Pacific Economic Framework, according to a U.S. State Department official. "I think it's safe to say that we are engaged in initial conversations with partners across the region, who share our vision for the kind of region that we want to live in again, a free and open region in which countries are free from coercion and are able to pursue their economic and security interests freely in an in an unhindered fashion," U.S. Assistant Secretary of State for East Asian and Pacific Affairs Daniel Kritenbrink said in a call with reporters. “And you are correct that there is currently no intention to engage the People's Republic of China on the Indo-Pacific Economic Framework."

As for the joint statement released by China and Russia for a “no limits” linkup earlier this month, Kritenbrink said the administration would not “dismiss” that effort. "We stand for a world and a vision grounded in problem solving and innovation, not coercion and aggression," he said. "That is our affirmative vision for the region. I think it stands in stark contrast to the vision of others, including that put forward by Presidents Putin and Xi."

|

TRADE POLICY |

— Consumers and restaurants are facing another supply crunch after the U.S. suspended all avocado imports from Mexico. The action followed a credible death threat issued to a U.S. safety inspector, who denied permission for a shipment from the Mexican state of Michoacán. A warning was previously issued in 2019, stating that export privileges would immediately be revoked following an earlier threat to another safety inspector. Avocados are the single largest American fruit import. Over 90% of the nation's avocados came from Mexico, which exports over 80% of its crop to the U.S. The market is even worth more than $2.5 billion each year, making it a major industry (and a target for crime groups).

The monthly average price of an avocado has already climbed about 40% since January 2021, and consumers can now expect to pay about $1.36 per avocado, according to Zhengfei Guan, a food and resource economics professor at the University of Florida. If the suspension lasts more than two weeks, it can also weigh on the profit margins of companies that are highly dependent on the fruit as their stock runs out. Truist analyst Jake Bartlett estimates that avocados account for 5%-10% of Chipotle's cost of goods sold and about 2% of El Pollo Loco's.

Now what? Staff from USDA’s Animal and Plant Health Inspection Service have been dispatched to Michoacán to "collaborate with local officials to get inspections back on track as soon as possible." However, it will "remain in place for as long as necessary to ensure the appropriate actions are taken, to secure the safety of APHIS personnel working in Mexico."

|

ENERGY & CLIMATE CHANGE |

— Vilsack discusses climate initiatives and early adopters. USDA’s climate initiatives drew attention during USDA Secretary Tom Vilsack’s “fireside chat” where he answered questions from NASDA members — top state ag officials from across the U.S. Indiana Ag Department Director Bruce Kettler asked Vilsack how USDA will make good on its commitment to ensure early adopters of climate-smart ag practices are compensated. Vilsack noted USDA’s $1 billion Partnerships for Climate-Smart Commodities initiative — aimed at pilot programs to promote the use of climate-smart ag practices — seeks to include all producers, even those who have already invested in new practices. “I think early adopters can fit themselves nicely into those pilots,” Vilsack remarked, adding the experience they bring to the table will be valuable as USDA seeks to define a standard for climate-smart commodities. Right now, “those early adopters are not getting credit because nobody's keeping score,” he remarked. “This program allows us to keep score and allows us to tell the world what agriculture is doing.”

— GOP confronts Democrats on Natural Gas export plea. Limiting U.S. natural gas exports to help American consumers with rising energy prices won’t work and only will increase the country’s dependence on foreign oil and gas, a group of House Republicans wrote in a letter (link) to Energy Secretary Jennifer Granholm. Republicans, led by Natural Resources ranking member Bruce Westerman (R-Ark.), blasted a Feb. 2 letter from nine Senate Democrats and one Independent asking Granholm to consider halting permits for U.S. liquefied natural gas facilities until the department conducts a review of such exports and their impact on domestic energy prices.

The scrutiny of the Biden administration’s energy policies continued Wednesday on the Senate floor. “Energy prices are up overall about 30 cents on the dollar since Joe Biden took over,” said Sen. John Barrasso (R-Wyo.), the top Republican on the Energy and Natural Resources Committee. “This isn’t a coincidence. This is a direct result of the anti-American energy policies of this president and the Democrats in this body and administration.”

Perspective: If stations passed along the whole savings of suspending the federal gas tax of 18.4 cents, it would amount to about a 5% reduction on gas prices, or about $2 discount a tank for a passenger car, $3 for a minivan or crossover, $5 for a larger SUV and $6 for a pickup truck. But opponents argue it would cause a $26 billion shortfall to the highway trust fund.

— RFS hearing sees well-known positions put forth with attention on RIN prices. The Senate Environment and Public Works Committee hearing on the Renewable Fuel Standard (RFS) not surprisingly revealed that the positions of biofuel backers and biofuel opponents have not materially changed.

One area of focus in the session related to EPA’s proposal to deny all 65 pending small refinery exemptions (SREs). LeAnn Johnson Koch with Perkins Coie, LLP and a history of representing the refining industry, told lawmakers that prices for Renewable Identification Numbers (RIN) had been climbing due to uncertainty over what EPA will set as the final levels for the RFS for 2020, 2021 and 2022. Obligated parties under the RFS can purchase RINs to demonstrate compliance if they do not blend enough ethanol into fuels. But the proposal to deny all pending SREs means that if the agency take that step, Koch said, would mean “parties holding the RINs that small refineries need for compliance will be in a position to demand exorbitant prices because small refiners will be captive buyers on the eve of the compliance deadlines.” She argued that higher RIN prices would reduce production at refineries or prompt some to close, sending gasoline prices higher. Emily Skor, CEO of Growth Energy, countered Congress needed to approve year-round E15 sales. “The easiest way to bring down RIN prices is to blend more ethanol,” she stated. The issue of bringing down costs to consumers remains a key point for Senate Democrats, with some emerging from their weekly caucus indicating RIN prices were briefly discussed at this week’s session.

No conclusions on RFS policy were expected ahead of the hearing and panel chair Tom Carper (D-Del.) said he would work with the panel’s top Republican, Shelley Moore Capito (W.Va.), and determine the next steps. He characterized the hearing as a “beginning, I think, of a process that leads us to be a better place.”

Comments: Sen. Carper noted that the committee has not held an oversight hearing on the RFS since 2018, even though the Environmental Protection Agency, which manages the RFS, is under its jurisdiction.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Reuters: DOJ urged to oppose Sanderson chicken deal if antitrust violation found. Sen. Elizabeth Warren (D-Mass.), backed by some dozen other U.S. lawmakers, told the Justice Department that a plan to merge chicken producer Sanderson Farms with smaller rival Wayne Farms "raises significant antitrust concerns." Commodities trader Cargill Inc and Continental Grain Co announced in August that they would buy Sanderson Farms SAFM.O, the third largest chicken producer, and combine it with Continental's Wayne in a deal worth some $4.53 billion. Link for details.

— Supply-chain woes are siphoning sales away from big food companies. Sales at major food makers are still rising, the Wall Street Journal reports (link), but executives say they are still coping with production strains that leave room for competitors to gain ground. Kraft Heinz says it couldn’t make enough Lunchables or Philadelphia cream cheese to meet demand in recent months and faced a shortage of packaging materials in the fourth quarter. Kellogg lost ground in U.S. grocery stores after a strike among factory workers and a fire slammed its production capabilities last year. Their troubles show that U.S. logistics networks remain strained even as broader bottlenecks show signs of easing, and that supply chains have become central to battles over market share. NielsenIQ says U.S. consumer packaged-goods companies lost some $82 billion in sales last year because items were out of stock, according to trade publication Supply Chain Dive.

— Carl Icahn said he’s prepared to begin a board fight at McDonald’s to force the company to improve its treatment of pigs. Link for details via Bloomberg.

— Update on HPAI-linked poultry trade restrictions. Confirmation of highly pathogenic avian influenza (HPAI) in a commercial broiler flock of 240,000 chickens owned by Tyson Foods in Fulton County, Kentucky has prompted additional countries to block imports of poultry, and now some countries have begun adding restrictions for a confirmed case in Webster County, even though USDA’s Animal and Plant Health Inspection Service has so far not yet added that location to its confirmed HPAI case list.

- Poultry/products from Fulton County on or after Feb. 12 unless otherwise noted: Canada, Chile (includes Hickman County), Costa Rica, Curacao, Ecuador, India, Jamaica (Feb. 12, includes Hickman County), Jordan, Nicaragua, North Macedonia, Qatar, United Arab Emirates, Vietnam (Feb. 8).

- Poultry/products from a 10-kilometer radius from location in Fulton County as Feb. 12 unless otherwise noted: Egypt, Hong Kong, Mauritius (Jan. 22), Morocco (Jan. 22), Vietnam.

- Poultry/products from Webster County on or after Feb. 15 unless otherwise noted: Barbados, Chile (includes Hopkins and McLean Counties), Canada, Costa Rica, Curacao, Ecuador, Hong Kong, India, Jamaica (includes Hopkins and McLean Counties), Jordan, Nicaragua, North Macedonia, Qatar, United Arab Emirates, Vietnam (Feb. 8).

- Poultry/products from a 10-kilometer radius from location in Webster County as of Feb. 15 unless otherwise noted: Egypt, Mauritius (Jan. 22), Morocco (Jan. 22), Vietnam.

- Poultry/products from the state of Kentucky on or after Feb. 12 unless otherwise noted: Benin (Jan. 22), China, Cuba, Dominica, Dominican Republic, French Polynesia (Tahiti), Japan (Jan. 21), Korea, Mexico (Jan. 17), Namibia (Jan. 22), Myanmar, South Africa (Jan. 22), St. Lucia, Tunisia, Uruguay.

- Poultry/products from the state of Virginia on or after Jan. 17 unless otherwise noted: Mexico.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 418,085,439 with 5,852,033 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,173,320 with 029,519 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 548,391,614 doses administered, 214,218,580 have been fully vaccinated, or 65.26% of the U.S. population.

— Yellen wants World Bank fund to fight future pandemics. Treasury Secretary Janet Yellen urged her counterparts from leading industrialized countries to support the establishment of a new World Bank fund intended to prevent and prepare for future global health crises. A new “financial intermediary fund” under the auspices of the World Bank would help address gaps in preparedness, particularly among low-income countries, Yellen said, according to prepared remarks she’s scheduled to deliver virtually today to a meeting of finance ministers and central bank governors from Group of 20 countries.

— Romney against more Covid-19 relief. While some industries, including in the travel and restaurant industries, are lobbying Congress to add more aid to offset losses from Covid-19, Sen. Mitt Romney (R-Utah) isn’t sold on the idea. “Let’s not spend more money, we got inflation going up, we got huge deficit. Let’s not add more money. Let’s instead look at the money that’s already been sent out through the American Rescue Plan and repurpose some of that for the needs of our citizens and small businesses,” he said.

— Texas sued to block the Biden administration’s mask mandate for all U.S. travel on airplanes, trains and buses, saying the Centers for Disease Control and Prevention had exceeded its authority with a rule intended to limit the spread of Covid-19. The mandate, which has been in effect for almost a year, was implemented without following proper rulemaking steps, such as allowing a public comment period, Texas claimed in a federal complaint filed yesterday in Fort Worth.

— California officials are set to unveil today a plan for coexisting with Covid, entering the endemic stage when a virus still exists in the community but becomes manageable as immunity builds. In fact, one influential model estimates that 73% of Americans are, for now, immune to omicron, the dominant variant, and that could rise to 80% by mid-March.

— Biden administration health officials said they are preparing for a shift in federal Covid-19 guidance. “We’re moving toward a time when Covid isn’t a crisis, but is something we can protect against and treat,” White House Covid-19 response coordinator Jeff Zients said at a press briefing.

|

POLITICS & ELECTIONS |

— Can election “experts” see what others are seeing in liberal cities? The liberal New York Times today notes that “an earthquake” is evident in liberal places, “frustrated by what they consider a leftward lurch from parts of the Democratic Party and its allies. This frustration spans several issues, including education, crime and Covid-19.” It details the following:

- Recall elections of the San Francisco Board of Education ousted three board members were approved by an overwhelming margin. The school board recall was a landslide, with Alison Collins (79%), Gabriela Lopez (75%) and Faauuga Moliga (72%) getting soundly defeated.

- In Minneapolis, voters rejected a ballot measure to replace the city’s Police Department with an agency that would have focused less on law enforcement.

- In Seattle, voters elected Ann Davison — a lawyer who had recently quit the Democratic Party because she thought it had moved “so far left” — as the city’s top prosecutor. Davison beat a candidate who wanted to abolish the police.

- In New York, voters elected as their mayor Eric Adams, a Democrat who revels in defying liberal orthodoxy. As a candidate, Adams promised to crack down on crime. Since taking office, he has signaled his frustration with Covid restrictions.

- In the Democratic-leaning suburbs of both New Jersey and Virginia, Republican candidates for governor did surprisingly well. Several postelection analyses — including one by aides to Phil Murphy, New Jersey’s Democratic governor, who narrowly survived — concluded that anger over Covid policies played a central role.

|

CONGRESS |

— Senators want to send a stopgap gov’t funding bill to the president’s desk today, as they negotiate amendment votes on vaccine mandates and a balanced budget amendment. Lawmakers need to get the continuing resolution to the president’s desk before the Friday night deadline as they look to extend funding through March 11. Appropriators are working on a 12-bill omnibus funding package in the meantime.

|

OTHER ITEMS OF NOTE |

— Satellites show continued Russian buildup. A new military pontoon bridge has been established over the Pripyat River in Belarus, less than four miles from the Ukraine border, Maxar Technologies found. Satellite images this week continue to show heightened military activity in Belarus, Crimea and western Russia, Maxar said. The Biden administration last evening said that it now believes Russia's claims of withdrawing troops from near Ukraine are "false.” Moscow has in fact increased its presence on the border "by as many as 7,000 troops" in recent days, a senior administration official said.

On Wednesday the Kremlin said it was calling back some of its forces after the completion of military exercises and posted a video purporting to show this. But Western countries, and NATO, found no proof of the claims. New estimates indicate Russia now has more than 150,000 troops encircling Ukraine. Back in 2008, Russia also announced it was withdrawing troops from its border with Georgia... eight days before invading the country.

Ukraine has denied claims by Russian state-controlled media that it launched shells in eastern Ukraine, and accused Moscow-backed rebels of attacking a village in the region. The two countries currently have a cease-fire agreement in place.

Separately, Vice President Kamala Harris is scheduled to meet with Ukrainian President Volodymyr Zelensky this weekend to discuss new ways the U.S.and allies can possibly deter Russia from an invasion.

March 2014: Russia annexes Ukraine’s Crimean Peninsula.

April 2014: An armed conflict with Russia-backed separatists in Ukraine’s Donbas region begins, continuing to this day.

November 2021: Ukraine confirms nearly 100,000 Russian soldiers near its border.

December 2021: Russia issues a list of demands to ease tensions, including refusing Ukraine membership to NATO, which the U.S. and NATO allies later reject.

February 2022: Russia says it’s pulling back troops from Ukraine’s border, but the U.S. and NATO remain unconvinced.

— Police in Canada threatened to arrest protesters in Ottawa if they did not leave the capital. For nearly three weeks truck drivers have blockaded the city’s downtown areas as part of demonstrations over covid restrictions. Marco Mendicino, the federal public safety minister, suggested that Diagolon, a far-right group, is helping organize the protests with the intention to “overthrow the existing government.”