First New Farm Bill Hearing Today, Next One Set for Feb. 8

Commerce makes preliminary determination urea nitrate from Russia, Trinidad and Tobago\

|

In Today’s Digital Newspaper |

Market Focus:

• Fed officials talk about number and timing of coming rate hikes

• Eurozone inflation hits record high of 5.1%

• Latest hoarding trend: warehouse space

• U.S. national debt topped $30 trillion as pandemic spending fueled gov’t borrowing

• UPS reported $3.1 billion in fourth-quarter profit

• OMB nominee signals early March for Biden budget

• Energy prices in Europe are brutal

• OPEC+ meets today

• Ag demand update

• Soybeans continue to surge

• Ukraine grain exports remain strong, country may cut VAT

• Cash cattle initially trade higher

• Cash hog index continues to rise

Policy Focus:

• Manchin says BBB is dead, withholds judgement on revised and differently named package

• Next House Ag subcommittee farm bill session set for Feb. 8

China Update:

• China expanding its ties to the Middle East

• USTR official sounds familiar refrain relative to China and Phase 1 trade deal commitments

Trade Policy:

• Commerce makes preliminary determination urea nitrate from Russia, Trinidad and Tobago

Energy & Climate Change:

• EC to adopt legislation to label some gas & nuclear projects as sustainable

Livestock, Food & Beverage Industry Update:

• Legislation proposed re: rampaging feral pigs of the San Francisco Bay Area

Coronavirus Update:

• Denmark and Norway lift Covid restrictions

Congress:

• Democratic Sen. Ben Ray Luján hospitalized for stroke

Other Items of Note:

• Putin suggests openness to diplomacy while blaming U.S. for crisis

• Fire at a North Carolina fertilizer plant prompts evacuations

• Groundhog Day: How accurate is Punxsutawney Phil?

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. stock indexes are pointed toward firmer openings. Asian equities gained with several markets closed for the Lunar New Year holiday, including China, South Korea and other Southeast Asian markets. The Nikkei rose 455.12 points, 1.68%, at 27,533.60. The Australia S&P/ASX index was up 81.7 points, 1.17%, at 7,087.7. European equities are registering gains in early trade action, with the Stoxx 600 up 0.7% and regional markets up 0.4% to 1%.

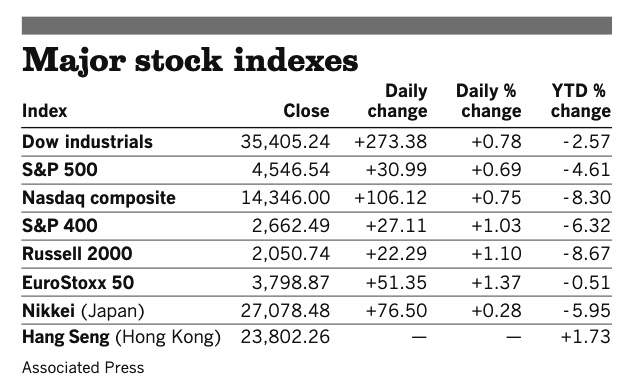

U.S. equities yesterday: U.S. equities opened February with solid gains after a difficult January for all three major indices. The Dow finished up 273.38 points, 0.78%, at 35,405.24. The Nasdaq was up 106.12 points, 0.75%, at 14,346.00. The S&P 500 gained 30.99 points, 0.69%, at 4,546.54.

On tap today:

• ADP employment report is expected to show that the U.S. private sector added 200,000 jobs in January. (8:15 a.m. ET)

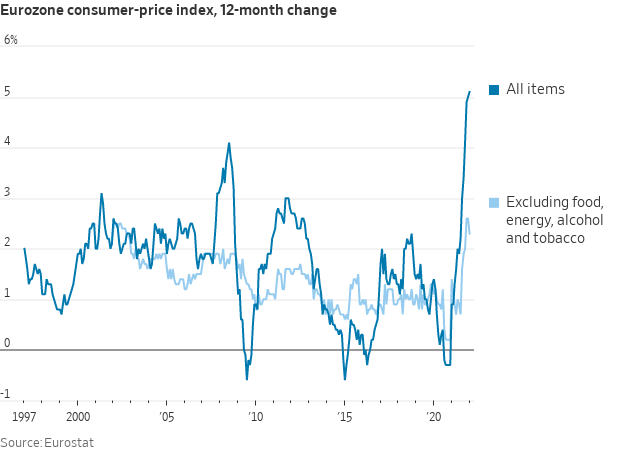

Eurozone inflation hits record high of 5.1%. Consumer prices in the eurozone rose by a record 5.1% in January from a year earlier, keeping inflation higher than expected and increasing the pressure on the European Central Bank to respond with tighter monetary policy. (The ECB will announce its latest policy decisions Thursday, although little is expected to change ahead of its March meeting, when policy makers will discuss the implications of new forecasts for inflation and growth.)

Inflation slowed in Germany and France but was pushed up by rising energy costs across the bloc. Meanwhile, Eurozone jobless rate hit a record low of 7% as worker shortages spread and youth unemployment reached an all-time low of 14.9% as the bloc continues recovery.

None of six Federal Reserve officials speaking this week have backed the idea of a half-point rate increase in March, and James Bullard, president of the St. Louis Fed, said five hikes is “not too bad a bet.” Ideally, the Fed prefers to go gradually, said Kansas City Fed chief Esther George.

Latest hoarding trend: warehouse space. The New York Times notes that in many parts of the U.S., there is little to no commercial warehouse space available to stockpile goods as a hedge against supply chain problems. Some firms are signing deals for new space long before construction even begins.

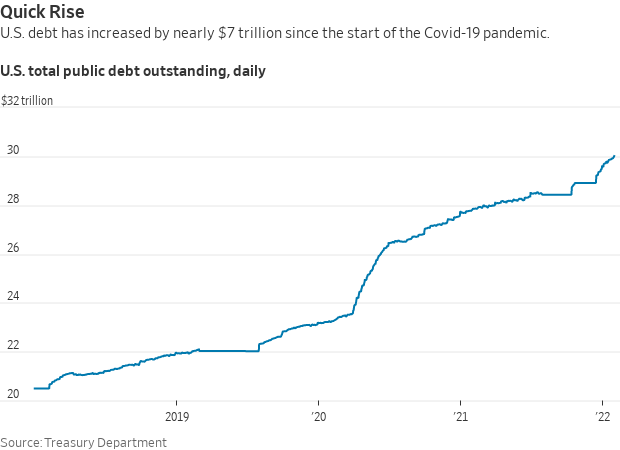

U.S. national debt topped $30 trillion as pandemic spending fueled gov’t borrowing. Total public debt outstanding was $30.01 trillion as of Jan. 31, according to Treasury Department data released Tuesday. That was a nearly $7 trillion increase from late January 2020, just before the pandemic hit the U.S. economy. The total debt comprises debt held by the public and intragovernmental debt.

Perspective: The record amount of red ink and gloomy fiscal milestone are adding to worries about the long-term economic health of the country, which is grappling with red-hot inflation and a higher interest rate environment, which can make servicing the debt even more challenging. Other factors like an aging population, elevated healthcare costs, and a tax system that doesn't bring in enough revenue to cover spending are also worrying as the federal gov’t kicks the can down the road.

UPS reported $3.1 billion in fourth-quarter profit, surpassing analyst expectations, and recorded operating margins bigger than it has achieved in years. Its shares soared 14% yesterday after the report, to a record high. The shipping giant raised its dividend by nearly 50%, its biggest increase since going public, and said it would hit revenue and margin targets a year earlier than expected.

OMB nominee signals early March for Biden budget. The Biden administration’s fiscal year (FY) 2023 budget plan will likely be released in early March, acting Office of Management Budget (OMB) Director Shalanda Young told the Senate Budget Committee at a hearing on her nomination to take the helm of the budget agency on a permanent basis. President Joe Biden is to deliver his State of the Union message March 1, and Young indicated the budget submission would come shortly after that. “It is typical that the State of the Union would lead into a budget,” Young said. “So that is certainly our expectation, that you would see that normal course of interaction between the State of the Union and the budget.”

Young also appeared before the Senate Homeland Security Committee in a nomination hearing to take the top OMB post. Republicans expressed unease last year when Young was nominated to hold the number two spot at OMB, and those concerns also surfaced in the Tuesday hearings. Most of their concern has been over the Hyde amendment which prohibits federal funding of abortions except in limited cases. Some Democrats have sought to weaken or remove the provision, but Republicans have resisted those efforts. Young is expected to eventually be confirmed to lead OMB.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker ahead of U.S. private sector jobs data, with a mixed tone in global currencies versus the greenback. The yield on the 10-year U.S. Treasury note is little changed at just above 1.78%, with a mixed-to-lower tone in global government bond yields. Gold and silver futures are showing modest gains ahead of U.S. trading, with gold around $1,804 per troy ounce and silver around $22.80 per troy ounce.

• Crude oil futures are narrowly mixed ahead of U.S. gov’t inventory data due later this morning. U.S. crude is trading around $88.20 per barrel and Brent around $89 per barrel. Futures were slightly higher in Asian action, with U.S. crude trading around $88.30 per barrel and Brent around $89.30 per barrel.

• Energy prices in Europe are brutal: Gas on the benchmark Dutch TTF hub for March is hovering around $30 per metric million British thermal units. By contrast, gas in the U.S. is trading around $4.67 per MMBtu. Meanwhile, the region’s major oil distribution hub has been forced to halt operations due to a suspected cyberattack.

• Energy prices remain firmly in focus, and expectations are high ahead of today’s OPEC+ meeting. While some analysts say that the spike in crude prices might force the cartel to increase production quotas beyond the penciled-in 400,000 barrels per day, there remains a huge problem with ramping up output for some members.

• Ag demand: Tunisia purchased unspecified quantities from its tender for 100,000 MT of soft wheat and 75,000 MT each of durum and feed barley.

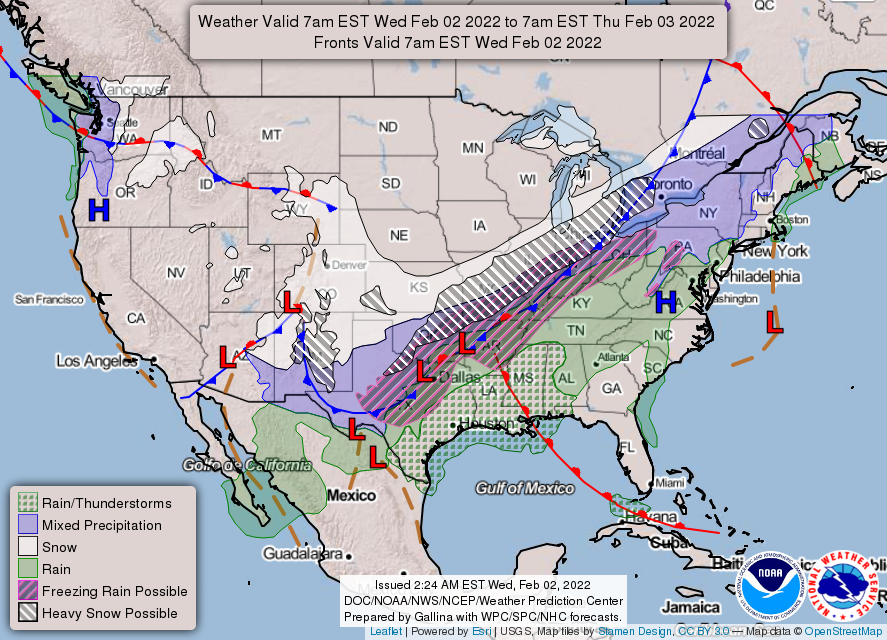

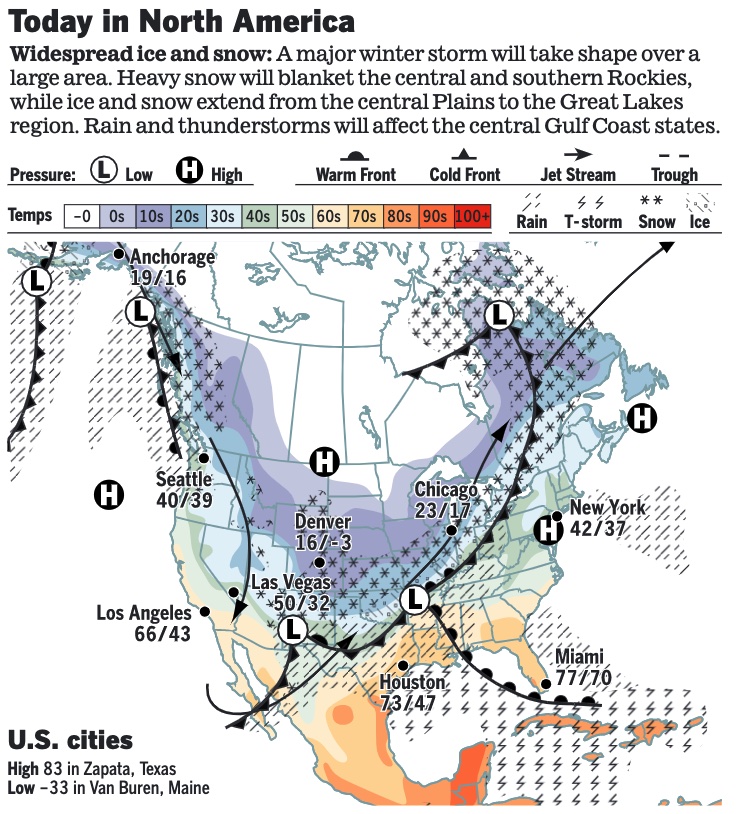

• NWS weather: An ongoing significant winter storm will impact much of the central and northeastern U.S. through Thursday morning... ...A Slight Risk of Excessive Rainfall leading to Flash Flooding is in effect for portions of the Southeast and Lower Mississippi Valley on Thursday... ...Arctic air surges south through central U.S.; East Coast warms up.

Items in Pro Farmer's First Thing Today include:

• Soybeans continue to surge

• Ukraine grain exports remain strong, country may cut VAT

• Cash cattle initially trade higher

• Cash hog index continues to rise

|

POLICY FOCUS |

— Manchin says BBB is dead but withholds judgement on a revised and differently named package. Key swing vote Sen. Joe Manchin (D-W.Va.) offered a grim update on the status of President Joe Biden's Build Back Better act, calling it "dead." But he was noncommittal regarding the possibility of a scaled-back BBB that will very likely be labeled differently. Democrats remain hopeful to eventually pass some kind of scaled-back version of the legislation. Manchin has raised concerns over inflation and said that passing a government spending bill "has to be done first."

— Next House Agriculture subcommittee farm bill session set for Feb. 8. The House Agriculture General Farm Commodities and Risk Management Subcommittee has set Feb. 8 for a hearing “to review farm policy” with USDA Undersecretary for Farm Production and Conservation Robert Bonnie. This will be the second hearing geared toward the next farm bill as the House Agriculture Conservation and Forestry Subcommittee holds a hearing today titled a “2022 review of farm bill conservation programs.” The hearing will see Farm Service Agency (FSA) Administrator Zach Ducheneaux and Natural Resources Conservation Service Administrator Terry Crosby testify.

The hearings are the first in a series of sessions that will be held as the panel starts working on the successor to the 2018 Farm Bill. However, contacts continue to expect that there could well be an extension of the 2018 law as Republicans expect they will take control of the House following Nov. 8 elections which would put them in charge of the agenda for the next farm bill and the new Congress in 2023.

|

CHINA UPDATE |

— China is expanding its ties to the Middle East, where some states are looking to Beijing to invest in their infrastructure and cooperate on technology and security as the U.S. pulls back from the region. Link for details.

— USTR official sounds familiar refrain relative to China and Phase 1 trade deal commitments. Deputy U.S. Trade Representative (USTR) Sarah Bianchi Tuesday addressed the Washington International Trade Association (WITA) and echoed comments made Monday by USTR Katherine Tai relative to China regarding their failing short of meeting commitments under the Phase 1 trade deal. "You know, it is really clear that the Chinese haven't met their commitment in Phase 1,” Bianchi said. “That's something we're trying to address.”

She also said the discussions USTR is holding with China on the Phase 1 agreement are “difficult” and that the U.S. was “unflinchingly honest” in those talks, two terms Tai used Monday to describe the negotiations. Bianchi added that it was “important” the two sides are having the discussions.

Bianchi also did not discuss or mention any potential Phase 2 negotiations with China on additional issues that were not covered under the Phase 1 deal. A spokesperson for the Chinese embassy in Washington told Reuters in an email that China has tried to implement the Phase 1 agreement “despite the impact of Covid-19, global recession and supply chain disruptions.” The spokesperson indicated the two sides are in “normal communication.”

U.S. trade data on goods and services due to be released Feb. 8 will provide December U.S. figures and provide a picture of the full-year trade figures between the two countries. The Phase 1 agreement that outlined Chinese purchase commitments said that verification would be based on official Chinese and official U.S. trade data. Consultations are called for under the deal if there are “conflicting assessments” of whether the purchase commitments have been made.

|

TRADE POLICY |

— Commerce makes preliminary determination urea nitrate from Russia, Trinidad and Tobago being sold into the U.S. at less than fair value. The Department of Commerce (DOC) has issued a preliminary determination that urea ammonium nitrate solutions (UAN) fertilizer from Russia and from Trinidad and Tobago being imported into the U.S. at less than fair value, with DOC’s International Trade Administration (ITA) announcing countervailing duty (CVD) rates based on their finding.

The dumping rates for Trinidad and Tobago (link) are 63.08% for Methanol Holdings and for all other firms.

Rates for specified Russian entities (link) range from 9.15% to 127.19%, with a rate of 15.48% for all other firms.

Facts and figures. Commerce said that imports from Russia totaled 1,186,295 short tons in 2020 with a value at $137.8 million, with imports of 996,136 short tons from Trinidad and Tobago with a value of $99.7 million.

Commerce will impose cash deposit requirements on imports of UAN from Russia and Trinidad, based on the preliminary rates of dumping. Additional CVD cash deposit requirements are already in place based on Commerce’s previous preliminary finding that Russian UAN imports are unfairly subsidized at rates ranging from 9.66% to 9.84%, and that Trinidadian UAN imports are unfairly subsidized at a rate of 1.83%.

DOC also announced their final determination will be delayed and will now be released June 17 with a final determination by the US International Trade Commission (ITC) due Aug. 1.

CF Industries commented on the development. “Commerce’s affirmative preliminary antidumping and countervailing duty determinations not only address unfair trade practices that have harmed the U.S. UAN industry and its workers, but also help ensure that this vital product remains readily available to U.S. farmers from reliable domestic suppliers,” said Tony Will, president and chief executive officer, CF Industries Holdings, Inc.

|

ENERGY & CLIMATE CHANGE |

— The European Commission today will adopt legislation to label some gas and nuclear projects as sustainable under its rulebook for green economic activities, known as the taxonomy. The EU’s executive sees those energy sources as crucial stepping stones for the transition to renewable energy. Meanwhile, some member states continue to close down nuclear plants. Germany has shut almost all its capacity already, and the rest will be switched off at the end of 2022. Meanwhile, countries including China and Russia are moving forward building new reactors. Beijing is expected to surpass the U.S. in number of plants by as soon as the middle of this decade.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— The rampaging feral pigs of the San Francisco Bay Area are tearing up lawns, threatening the drinking water and disturbing vineyards’ harvests. A legislative proposal would make it easier to deal with the situation.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 381,724,054 with 5,688,009 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 75,350,359 with 890,770 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 539,921,122 doses administered, 211,954,555 have been fully vaccinated, or 64.57% of the U.S. population.

— Denmark and Norway lift Covid restrictions. Despite a recent spike in coronavirus cases because of the Omicron variant, Denmark and Norway lifted most of their remaining Covid restrictions yesterday. The two countries are among the first European nations to abandon pandemic restrictions in favor of treating the virus as endemic. “Even if many more people are becoming infected, there are fewer who are hospitalized,” said Jonas Gahr Stoere, the Norwegian prime minister. “We’re well protected by vaccines.”

|

CONGRESS |

— Democratic Sen. Ben Ray Luján hospitalized for stroke. Sen. Ben Ray Luján (D-N.M.) suffered a stroke and had surgery to ease swelling in his brain, his top aide said. “He is currently being cared for at UNM Hospital, resting comfortably, and expected to make a full recovery,” Carlos Sanchez, his chief of staff, said in a statement. Luján, 49 years old, first started experiencing symptoms of dizziness and fatigue last Thursday, he said. With Lujan in a hospital in New Mexico, Democrats don’t have a functioning majority to push through bills or nominations if all 50 Republicans are present.

|

OTHER ITEMS OF NOTE |

— Putin suggests openness to diplomacy while blaming U.S. for crisis. For weeks, Russian President Vladimir Putin had said little publicly about the crisis sparked by Russia's buildup of tens of thousands of troops near Ukraine's border, which has raised fears of a possible invasion. Putin appeared to ratchet down tensions in the standoff over Ukraine, while claiming the U.S. was seeking to goad Moscow into an invasion. Putin said he hoped that “dialogue will be continued” over Russia’s security demands, refraining from repeating his earlier threat to take unspecified “military-technical” measures if the West did not comply. “Their most important task is to contain Russia’s development,” Putin said of the United States, repeating one of his frequent talking points. “Ukraine is just an instrument of achieving this goal. It can be done in different ways, such as pulling us into some armed conflict and then forcing their allies in Europe to enact those harsh sanctions against us.” Asked about the United States’ written responses to Moscow’s security demands, which were delivered last week, Putin said that it was clear “that the principal Russian concerns turned out to be ignored.” The Kremlin, he said, is still assessing the responses as it weighs its next move. Bottom line: Putin did not offer any solutions during his comments, but he did say he was open to more talks.

Meanwhile, the Biden administration reportedly informed the Kremlin it is willing to discuss giving Russia a way to verify there aren’t offensive Tomahawk cruise missiles stationed at sensitive NATO missile-defense bases in Romania and Poland. The U.S. proposal is aimed at allaying Moscow’s concerns the launchers could be used to target Russia.

— Fire at a North Carolina fertilizer plant prompts evacuations. Thousands of residents were ordered to leave a neighborhood in Winston-Salem, N.C., over worries of a possible explosion, as the fire continued burning for the second day.

— It’s Groundhog Day, and according to tradition, we'll get six more weeks of winter if Phil sees his shadow. Groundhogs may be popular, but they are often misunderstood, according to scientific research. They do not, however, make good meteorologists. It seems that Punxsutawney Phil is a charlatan. The Pennsylvania-based groundhog who makes annual predictions about the arrival of spring is not nearly as reliable a prognosticator as those close to him claim. Phil has been forecasting when spring will arrive annually on Groundhog Day since 1887. But when comparing his predictions to historical weather data, he’s only right about a third of the time. Link for details.