White House Cautioning about Friday’s Employment Report

Updates for world food prices & U.S. farm income | Russia/Ukraine, China/Taiwan

Washington Focus

Congress returns with Democrat-controlled chambers wanting to get some big things done before the March 1 State of the Union Address by President Joe Biden.

Build Back Slower? The House Progressive Caucus are calling on party lawmakers to pass the Build Back Better act by March 1 “so the president can use the power of the State of the Union platform to share with the nation the relief that people will soon receive,” said Caucus Chairwoman Pramila Jayapal, a Washington Democrat, in a statement. Some are calling it Build Back Slower. That may be an understatement.

Centrist Democrats central to any BBB passage. Whatever changes are made must get approved by centrist Sen. Joe Manchin (D-W.Va.), and regarding any tax issues, centrist Sen. Kyrsten Sinema (D-Ariz.). Manchin has indicated support for some but not all the initially proposed climate change/carbon mitigation proposals. But he does not like green energy provisions meant to end the use of fossil fuels.

Progressive Democrats still want child tax credit language included, but Manchin has signaled the credit should be directed only toward the neediest families and include a work requirement.

Bottom line: BBB has gone from Socialist Vermont Sen. Bernie Sanders’ $6.5 trillion price tag to $3.5 trillion, to $1.75 trillion and now much lower if the measure stands any chance of getting the 50 Democratic votes in the Senate relative to the budget reconciliation approach that avoids the 60-vote filibuster. If there is a slimmed-down BBB, some observers say there would likely be some tax provisions added to defray some of the costs, but NOT earlier proposals regarding a transfer tax, and other provisions that would have been very negative for the ag sector. Manchin is demanding the legislation be entirely offset so it does not add to the deficit. Another thorny issue: A group of Democrats from high-tax states is warning they won’t support the legislation if it modifies the tax code but leaves out a provision ending the $10,000 cap on state and local tax deductions, or SALT. But others say SALT language will not be part of any final bill as liberal Democrats became increasingly critical of the effort to raise it, arguing it would mostly benefit well-off homeowners.

The first new farm bill hearing comes Feb. 2 via the House Ag Committee, and the topic shows the key issue Democrats want to address: conservation programs. Other hearings will follow during the year, likely including field hearings. But veteran farm bill watchers predict no major action on the writing of a new omnibus farm bill. Reason: Republicans know they have a good chance to capture at least one (House) if not both chambers (Senate) after Nov. 8 elections. That is why this group sees a short-term extension of the current farm bill.

On the geopolitical front, Russian leader Vladimir Putin said the U.S. has not met Russian demands over Ukraine. In comments made on a phone call with his French counterpart Emmanuel Macron and reported by the Kremlin press service, Putin said Washington’s written responses, delivered last week, had ignored Moscow’s demands to roll back the expansion of the NATO security alliance, which Putin sees as a significant threat. “Attention was drawn to the fact that U.S. and NATO answers did not take into account such fundamental Russian concerns as the prevention of NATO enlargement,” the Kremlin said in a statement, summarizing Putin’s comments to Macron. In Paris, however, a senior French official said Putin told Macron “he was not looking for confrontation,” according to the Financial Times.

Meanwhile, Volodymyr Zelensky, Ukrainian president, urged the U.S. and other western backers to tone down public warnings of an imminent full-blown Russian invasion on fears that it would destabilize his country’s economy. “We do understand what the risks are,” Zelensky said at a press conference where he added that “we do not see a bigger escalation” than last spring when Russia’s military build-up started. “We don’t need this panic,” he said. Zelensky urged western backers to help Kyiv plug financial gaps of up to $5 billion as the risk of war stymied access markets. “We can’t handle this alone. We have to take money out [of our reserves] and stabilize our currency. It’s a very expensive price to pay,” Zelensky said.

Defense Secretary Lloyd Austin delivered “the military’s starkest public warning to date” Friday that Russia now has the capability to invade all of Ukraine, taking significant portions of territory and cities, according to the Wall Street Journal (link). Though the Pentagon said they don’t believe Putin has yet decided whether to invade, they went into detail about what an invasion could entail, including a “significant amount of casualties,” said Joint Chiefs of Staff Chair Gen. Mark Milley.

Another geopolitical hotspot: China warned of a risk of military conflict with the U.S. over Taiwan. The Chinese ambassador to Washington warned that the U.S. and China could end up at war over Taiwan. “If the Taiwanese authorities, emboldened by the United States, keep going down the road for independence, it most likely will involve China and the United States, the two big countries, in a military conflict,” Qin Gang told NPR in his first one-on-one interview since arriving in the U.S. last July.

Background: Since Washington switched diplomatic allegiance from Taipei to Beijing in 1979, the U.S. has maintained a “one China” policy under which it recognizes Beijing as the sole seat of government in China. Qin said the Biden administration was hollowing out the “one China” policy and “playing the Taiwan card to contain China.”

The Chinese military recently flew 39 fighter jets and other warplanes into Taiwan’s air defense identification zone (ADIZ), as part of an escalating campaign to both pressure the government in Taipei and train for possible future military action.

Economic Reports for the Week

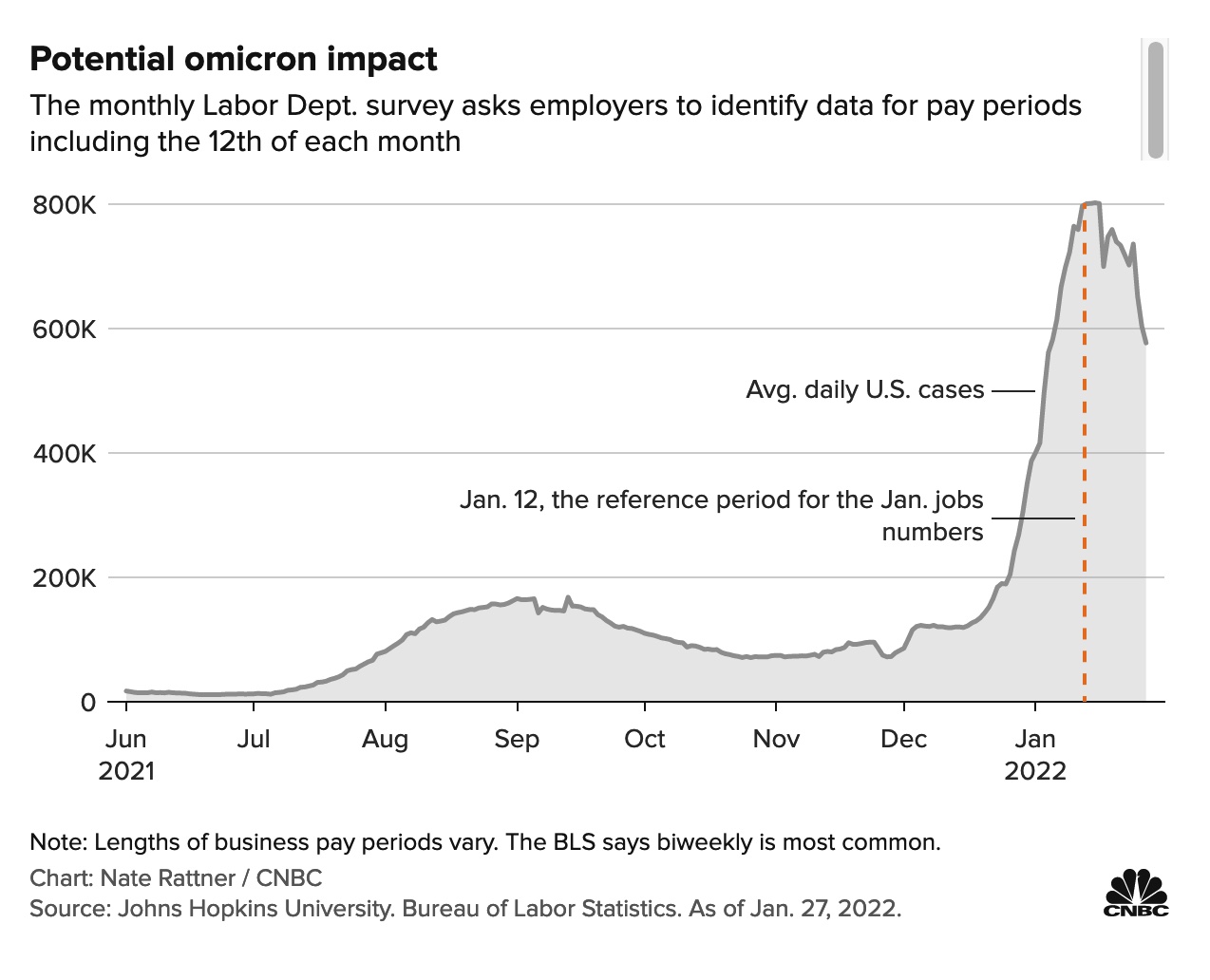

Investors will watch to see if the next batch of economic data has weakened due to the Omicron variant and whether coming reports will impact the timing and number of Fed interest rate hikes ahead. The White House is already warning that Friday’s update on jobs could be impacted by January's Omicron spike. Brian Deese, President Joe Biden’s top economic advisor, said the way the Labor Department collects data may have a pronounced effect on the Employment report.

Monday, Jan. 31

- Chicago PMI: The Institute for Supply Management releases its Chicago Purchasing Manager Index for January. The consensus estimate is for a 60.2 reading, about three points less than the December figure.

- San Francisco Fed President Mary Daly

- Kansas City Fed President Esther George

- Senior loan officer survey

Tuesday, Feb. 1

- Monthly vehicle sales

- Manufacturing PMI

- ISM manufacturing: The ISM releases its Manufacturing Purchasing Managers’ Index for January. Economists forecast a 58 reading, about level with December’s.

- Construction spending

- JOLTS: The Bureau of Labor Statistics releases the Job Openings and Labor Turnover Survey (JOLTS). Expectations are that there were 10.1 million job openings on December’s last business day, a half-million less than in November. Openings now outnumber the unemployed.

Wednesday, Feb. 2

- MBA Mortgage Applications

- ADP employment: ADP releases its National Employment Report for January. Private-sector employment is seen increasing by 215,000 jobs, after 807,000 were added in December.

- Q4 Housing vacancies

Thursday, Feb. 3

- Initial Jobless Claims

- Productivity and costs

- Services PMI

- ISM services: ISM releases its Services Purchasing Managers’ Index for January. Consensus estimate is for a 58.9 reading, about three points less than in December.

- Factory orders

- Senate Banking, Housing and Urban Affairs on nomination of Sarah Bloom Raskin to be Fed Vice Chair for Supervision

- Fed Balance Sheet

- Money Supply

- European Central Bank (ECB) announces its monetary-policy decision. The ECB is widely expected to keep its key short-term interest rates unchanged at negative 0.5%. Christine Lagarde, president of the ECB, has said it’s unlikely to raise rates this year.

Friday, Feb. 4

- Employment: Labor Department releases the jobs report for January. The economy is expected to add 150,000 positions after a gain of 199,000 in December. The unemployment rate is seen remaining unchanged at 3.9%.

Key USDA & international Ag & Energy Reports and Events

OPEC+ meets virtually on Wednesday to decide production policy. Several oil majors will report fourth-quarter earnings.

On the ag front, the United Nations’ monthly FAO food price index will be published Thursday and Friday brings an update on the U.S. farm income situation. The International Cotton Advisory Committee’s market outlook report comes Tuesday.

Monday, Jan. 31

Ag reports and events:

- Export Inspections

- Agricultural Prices

- Cattle Inventory

- Capacity of Refrigerated Warehouses

- Sheep and Goats

- Malaysia’s palm oil exports in January

- Holiday: China, South Korea, Vietnam

Energy reports and events:

- EIA releases 914 production report

- EIA releases Petroleum Supply Monthly

Tuesday, Feb. 1

Ag reports and events:

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Flour Milling

- Grain Crushings and Co-Products Production

- International Cotton Advisory Committee releases market outlook report

- U.S. Purdue Agriculture Sentiment

- USDA soybean crush, DDGS output, corn for ethanol

- International Cotton Advisory Committee releases market outlook report

- EU weekly grain, oilseed import and export data

- ProZerno holds Mountain Grain Assembly in Sochi, Russia, Feb. 1-4

- Holiday: China, Hong Kong, Malaysia, Indonesia, South Korea, Singapore, Vietnam

Energy reports and events:

- API weekly U.S. oil inventory report

- OPEC+ Joint Technical Committee meets

- Spain’s CORES releases fuel consumption data for December

- Earnings: Lundin Energy AB, Exxon Mobil

Wednesday, Feb. 2

Ag reports and events:

- Broiler Hatchery

- Holiday: China, Hong Kong, Malaysia, South Korea, Singapore, Vietnam

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- OPEC+ meeting, virtually

Thursday, Feb. 3

Ag reports and events:

- Weekly Export Sales

- FAO World Food Price Index and grains supply/demand outlook

- Port of Rouen data on French grain exports

- Holiday: China, Hong Kong, Vietnam

Energy reports and events:

- EIA natural gas storage change

- Russian weekly refinery outage data from ministry

- Insights Global weekly oil product inventories in Europe’s ARA region

- Earnings: OMV AG, Shell, ConocoPhillips

Friday, Feb. 4

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Highlights From February 2022 Farm Income Forecast

- Dairy Products

- Holiday: China, Vietnam

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts