SOTU Address Tonight: Can Biden Change an Unhappy Nation? Biden Vs Trump Key Tone

Senate to clear first FY 2024 spending package | China trade | Earmarks | ‘Voluntary’ COOL

Modified report today as I am near Peoria, Illinois, for a

speaking event at the Strom Family Farms.

Note to Pro Farmer members: Please fill out the Pro Farmer acreage survey... You should have received our annual spring acreage survey via e-mail. Please fill out the survey with your current planting intentions for this year. We’ll cover results and our acreage forecasts ahead of USDA’s March 28 Prospective Plantings Report. Click here to fill out the survey if you haven’t already responded. Please complete the survey only once.

— Financial markets today: Key outside markets today see the U.S. dollar index lower, on follow-through selling from Wednesday’s losses. Nymex crude oil prices are down and trading around $78.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching 4.102%. The yen climbed to a one-month high on speculation the BOJ will raise rates in March. Federal Reserve Chair Jerome Powell will testify on Capitol Hill, this time in the Senate, where he’s likely to reiterate the central bank is re-thinking new bank capital requirements, but holding steady on interest rates. Powell on Wednesday told a House panel that the central bank is not rushing to cut interest rates until policymakers are convinced they’ve won their inflation battle. The Fed chief said it will likely be appropriate to begin lower borrowing costs “at some point this year,” but made clear officials are not ready yet. In Asia, Japan -1.2%. Hong Kong -1.3%. China -0.4%. India +0.1%. In Europe, at midday, London -0.1%. Paris +0.2%. Frankfurt flat.

— Equities on Wednesday: The Dow was up 75.86 points, 0.20%, at 38,661.05. The Nasdaq gained 91.95 points, 0.58%, at 16,031.54. The S&P 500 rose 26.11 points, 0.51%, at 5,104.76. All three indexes are still in the red for the week. The S&P has about 0.6% to claw back by the end of the week to end in positive territory, the Nasdaq is 1.5% off on the week, and the Dow has about 1% to make up.

— Federal Reserve Bank of Minneapolis President Neel Kashkari anticipates that the Fed will reduce interest rates twice, or possibly only once, in 2024. In December, Kashkari had forecasted two rate cuts for the year. However, speaking at a Wall Street Journal event, he suggested that his updated forecast for the mid-March meeting might indicate the same number of rate cuts or potentially one fewer.

— Federal Reserve Chair Jerome Powell's recent comments suggest a significant shift in regulatory plans, signaling a potential victory for Wall Street banks. Powell indicated that there would be "broad and material changes" to the government's proposal, with the possibility of a complete overhaul. This unexpected announcement has thrown into doubt a key regulatory effort of the Biden administration. The industry's pushback against tougher regulations has found support among Republicans, further complicating the regulatory landscape.

— The Securities and Exchange Commission (SEC) approved a climate risk reporting rule aimed at compelling public companies to disclose more information about their climate-related risks, costs of severe weather events, and greenhouse gas emissions. The rule, voted along party lines, represents a significant overhaul of U.S. corporate reporting and is considered a legacy-defining effort for SEC Chair Gary Gensler.

Of note: Ag groups are mostly praising SEC’s move to shield the ag sector. “AFBF thanks SEC Chair Gary Gensler and his staff for their diligence in researching the unintended consequences of an overreaching Scope 3 requirement,” said AFBF President Zippy Duvall. “Farmers are committed to protecting the natural resources they’ve been entrusted with, and they continue to advance climate-smart agriculture, but they cannot afford to hire compliance officers just to handle SEC reporting requirements. This is especially true for small farms that would have likely been squeezed out of the supply chain… Farm Bureau recognizes the value of data collection and has actively contributed to responsible approaches to such efforts, including as a founding member of the Ecosystem Services Market Consortium and a leader in Field to Market. Both organizations work to empower farmers when it comes to on-farm data collection. The proposed Scope 3 requirement, however, would have imposed additional burdens on farmers, who provide almost every raw product that goes into the food supply chain. The onerous reporting requirements could have disqualified small, family-owned farms from doing business with public companies, putting those farms at risk of going out of business. Now that the SEC has thoughtfully evaluated the issue, AFBF urges California to follow the SEC’s lead by withdrawing its Scope 3 reporting requirement for any company doing business in the state. Farm Bureau, along with the U.S. Chamber of Commerce and others, recently challenged that state law and its national ramifications.”

The final rule is a scaled-back version of the original proposal due to intense lobbying and threats of litigation.

Details: The final rule requires public companies to disclose climate-related risks, management strategies, and the impact of severe weather events. However, it drops the requirement for Scope 3 disclosures, which would have covered emissions from suppliers and customers. This reduction in requirements aims to address concerns about compliance costs and data reliability.

— G.T. Thompson supports CFTC reauthorization. House Ag Committee Chair "GT" Thompson (R-Pa.) expressed support for reauthorizing the Commodity Futures Trading Commission (CFTC) during a hearing Wednesday with CFTC Chair Rostin Behnam. The CFTC, which regulates the U.S. derivatives markets, has not been reauthorized since 2008. Thompson highlighted the importance of reauthorizing the CFTC, emphasizing that it is essential to provide the commission with the necessary tools and authorities to effectively carry out its responsibilities. He reiterated his commitment, along with the committee's top Democrat, Rep. David Scott (Ga.), to reauthorizing the commission.

On the Senate side, Ag Committee Chairwoman Debbie Stabenow (D-Mich.) is working on her own CFTC reauthorization bill, and a separate crypto bill. She has been discussing both topics with CFTC officials.

— Ag markets today: As of 7:30 a.m. ET, corn futures were trading 6 to 8 cents higher, soybeans were mostly 7 to 11 cents higher, SRW wheat was around 6 cents higher, HRW wheat was 9 to 11 cents higher and HRS wheat was 10 to 11 cents higher.

— Ag markets on Wednesday:

- Corn: May corn rose 2 1/2 cents to $4.28 3/4 and closed near the session high.

- Soy complex: May soybeans fell 3/4 cent to $11.48 1/4 and near mid-range. May soybean meal rose 50 cents to $330.40 and near the session high. May bean oil closed up 28 points at 45.32 cents and near mid-range.

- Wheat: May SRW wheat plunged 20 cents to $5.31, ending near the session close after a move to a fresh contract low. May HRW fell 13 cents to $5.56 1/4, forging a low-range close, while May spring wheat fell 10 1/4 cents to $6.45 1/4.

- Cotton: May cotton rose 104 points at 95.28 cents but closed nearer the session low.

- Cattle: Cattle futures set back Wednesday, but the uptrend remains intact. Nearby April live cattle slid 75 cents to $187.25. Nearby March feeder futures dropped $1.275 to $251.025, while most-active April fell $1.30 cents to $255.875.

- Hogs: April lean hog futures closed 17.5 cents lower at $85.00, though the various contracts settled well off session lows.

— China exports, imports beat estimates. China's exports experienced a notable surge of 7.1% year-on-year to $528.01 billion in the combined months of January and February 2024. This growth, surpassing market expectations of a 1.9% rise, suggests a positive trajectory in global trade recovery.

Key sectors contributing to this growth include household appliances (20.8%), integrated circuits (24.3%), cars (12.6%), ships (173.1%), plastic products (22.9%), and LCD flat panel display modules (13.2%).

However, there were declines in exports of rare earth (-44.7%) and steel (-10.0%).

Notable changes in trading partners include export growth to the U.S., Russia, the UK, Canada, Latin America, New Zealand, India, and the ASEAN Countries, while exports declined to Japan, South Korea, Australia, and the EU.

Of note: The decision to combine trade data for January and February aims to mitigate the impact of the Lunar New Year holiday, which varies annually.

Outlook, according to ING Economics: “We expect a relatively difficult trade environment moving forward, as global growth is largely expected to moderate this year, which will act as a headwind on Chinese exports. Besides a generally unfavorable global environment, there is also an additional risk that we will see China-specific trade barriers later in the year.”

China comments: “This year, the situation for foreign trade is still extremely severe,” said Chinese Commerce Minister Wang Wentao, warning that exports might decline in March compared to the strong growth in March 2023.

— China's Foreign Minister Wang Yi strongly criticized the U.S. for imposing what he calls "bewildering" trade curbs on China, warning that these actions will ultimately harm America itself. Wang's remarks come as President Biden's administration seeks to restrict China's access to advanced technology, citing national security concerns.

Despite some improvements in tensions between the US and China since a summit between Presidents Xi Jinping and Biden, Wang claims that the U.S. has not fulfilled all promises made during that meeting. He also highlights ongoing issues such as disagreements over Russia's war in Ukraine and China's territorial claims over Taiwan.

Wang asserts that blocking China from accessing artificial intelligence could have significant consequences and pledges to submit a proposal for international cooperation in this area to the United Nations.

— A Houthi missile strikes a ship, resulting in the first deaths of crew members. A Houthi missile struck a commercial ship in the Gulf of Aden, resulting in the first confirmed deaths of crew members since attacks began. Three were killed and at least four were wounded. U.S. forces conducted strikes against two drones in a Houthi controlled area of Yemen.

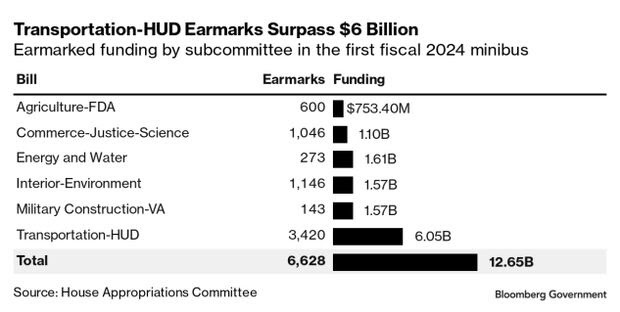

— Government funding bill with 6,628 earmarks totaling $12.7 billion passes House. The government-funding package, consisting of six bills, passed the House with a vote of 339-85. This $485 billion package funds the departments of Agriculture, Justice, Transportation, Housing and Urban Development, Veterans Affairs, Energy and Commerce.

Details: House Speaker Mike Johnson (R-La.) secured a majority of his GOP majority – 132 votes, but it was the Democrats who really helped clear the bill— Just two Democrats voted against the bill and 207 voted yes. This package includes a total of 6,628 earmarks amounting to $12.7 billion. The earmarks cover various projects such as dam construction, bridge rehabilitation, and providing safety equipment for local police departments.

Some 42 House members who voted against the bill, including 40 Republicans and 2 Democrats, are set to benefit from earmarked funds totaling $946.5 million, according to a Bloomberg assessment. Some of the notable earmarked funds include $144.3 million for Rep. Randy Weber (R-Texas) and $50 million for Rep. Matt Gaetz (R-Fla.).

Gone but not forgotten. The late Sen. Dianne Feinstein and former House members also have earmarks allocated to them.

House GOP lawmakers are expected to receive the highest amount of earmarked funds, totaling $3.4 billion, compared to other parties.

Key figures in earmarked funds include Sen. Susan Collins (R) with $426.6 million and Sen. Lisa Murkowski (R-Alaska) with $368 million.

Rep. Chuck Fleischmann (R-Tenn.) has the most earmarked funds in the House, totaling $270.4 million.

The Transportation-HUD bill contains the largest portion of earmarks, with nearly half of them totaling $6.1 billion.

Next up: The Senate will consider the package today and is expected to pass it. The rest of the gov’t funding bills must be passed by midnight March 22.

— SOTU address: President Biden's campaign is shifting its focus to criticizing Donald Trump's economic plans for a potential second term, rather than solely focusing on his actions while in office. During Biden's upcoming State of the Union (SOTU) address this evening, his team plans to contrast his agenda with Trump's proposals to repeal healthcare policies, roll back climate laws, and cut taxes for the wealthy. Polls suggest that Trump's policies are perceived to have benefited individuals more than Biden's.

The State of the Union provides an opportunity for Biden to reframe the election debate as a choice between him and Trump, rather than a referendum on his presidency. Biden will also resurface Trump's previous comments about clean-energy policy changes.

Biden is set to unveil a series of tax proposals targeting large corporations during his SOTU address, contrasting sharply with former President Trump's tax agenda. Biden's plan includes raising the corporate minimum tax rate from 15% to 21%, alongside stiffer limits on companies' ability to deduct the wages of their highest-paid employees. These measures, among others, aim to raise revenue and address what Biden sees as unfair tax advantages for corporations and high-income individuals. Republicans argue that the 2017 law was an economic success and advocate for extending its provisions. The outcome of this debate will shape the tax landscape for years to come, with significant financial implications for corporations and high-income individuals.

One notable proposal is the denial of tax deductions for employee compensation exceeding $1 million, expanding on existing restrictions for top executives. This measure, if approved by Congress, could generate substantial revenue over the next decade.

Additionally, Biden plans to increase the fuel tax on corporate and private jet travel and modify depreciation rules for commercial jets.

As for the ag/food sector, Biden is planning to target big food companies and “shrinkflation”, as he presses what he views as wider “corporate greed” driving food prices higher. White House officials say one of Biden’s main focuses in his speech will be lowering prices for Americans, and pressing companies to pass on savings to consumers.

Biden wants to boost the number of drugs that are subject to Medicare price negotiations. He’s proposing that 50 drugs annually be put through the price talks, up from a current target of 20 medications, according to a fact sheet released Wednesday by the White House. It’s one of multiple healthcare policy proposals Biden is expected to outline during his address this evening. The Medicare price negotiations, introduced as part of the Inflation Reduction Act, have already invited lawsuits from the pharmaceutical industry, which stands to lose some profits as a result of lower prices.

The success of his proposals hinges on political dynamics in Congress, where Democrats face an uphill battle given Republican opposition and the current Senate election map favoring the GOP.

Biden’s address will meet a hostile reception from Republicans in the SOTU audience. “America is in decline, nothing he says is going to change that,” House Speaker Mike Johnson (R-La.) and a close Trump ally, said on Wednesday.

Bottom line: Biden's upcoming address will be closely scrutinized by both television audiences and his opponents in Congress. The president faces heightened pressure to address the surge of immigrants at the U.S./Mexico border, aiming to neutralize a key attack line for Trump and Republicans. He is expected to blame Republicans for failure of a legislative response. Biden’s address will kick off the presidential campaign; he will try make the contest a referendum on Trump rather than himself.

— USMEF comments on proposed “voluntary” COOL rule. USMEF’s comments on FSIS’s “voluntary” COOL can be read at this link. USMEF says: “We are very concerned that this will cause disruptions for trade. Product of USA is mandatory for export, so even though the proposed rule allowed for that label for export, it would force a segregation for export vs. domestic; and/or a segregation of production derived from imported livestock. All adds costs and complexity at a time that cannot be afforded, especially for the beef industry.”

— Bayer CEO Bill Anderson has dismissed speculation about a fresh capital increase, asserting in a Financial Times interview (link/paywall) that the company has no plans for one. This comes as investors express skepticism about his strategy to revitalize the German pharmaceutical and pesticides giant, particularly following his decision to postpone the company's breakup.

Anderson emphasized the need to address Bayer's financial and operational challenges before considering such measures, despite anticipating further profitability declines in 2024. The company's shares plummeted to their lowest level in 19 years following the announcement.

Anderson, who assumed the CEO role last summer, is facing the aftermath of Bayer's troubled 2016 acquisition of Monsanto, which left the company burdened with debt and entangled in legal battles.

Despite the share price slump, Anderson remains confident in his strategy and has received positive feedback from key shareholders, including activist investor Jeff Ubben. Anderson also highlighted concerns about the potential dilution of existing shareholders' equity in the event of a capital increase and emphasized that the management board lacks authorization to proceed without approval from the annual general meeting. Additionally, he noted conflicting opinions from bondholders and equity investors regarding the proposed breakup of the company.

— Sen. Marshall secures expanded wildfire aid for Kansas ranchers. Sen. Roger Marshall (R-Kan.) successfully advocated for changes to the Emergency Livestock Assistance Program (ELAP), securing additional support for farmers impacted by winter wildfires. The modifications extend coverage to include losses of winter stored forage, addressing a previous gap in assistance for ranchers in Kansas. This development follows efforts by Senator Marshall and his team, including urging the USDA for robust assistance in February 2022 and collaborating with fellow senators on legislation in 2023. USDA's decision to update the ELAP program comes after negotiations with Marshall, providing retroactive aid to ranchers affected by wildfires in December 2021, particularly in the 4-county area of Ellis, Rooks, Osborne, and Russell.

— Rep. Crawford challenges Graves for Transportation Committee leadership. Rep. Rick Crawford (R-Ark.) announced his intention to run for the position of the top Republican on the House Transportation and Infrastructure Committee in the upcoming Congress. This move puts him in direct competition with the current chairman, Rep. Sam Graves from Missouri, who is seeking an exemption from conference term limits to retain his position. Graves, who is currently serving his third term as chairman, is pursuing a waiver to extend his tenure beyond the term limits imposed by House Republicans. Crawford, the second most senior member of the committee after Graves, currently chairs the highways and transit subcommittee. He outlined his priorities for the chairmanship, including conducting oversight of the administration's rulemaking, reducing regulatory burdens, and protecting infrastructure from cyber threats. Crawford highlighted the importance of the upcoming reauthorization of the surface transportation bill in 2026 and outlined his strategy for addressing key issues such as Highway Trust Fund solvency.

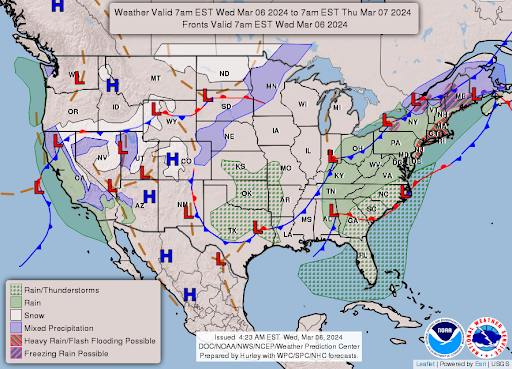

— NWS weather: Storm system to bring the threat of flash flooding and severe weather to the Southern Plains Thursday, spreading eastward into the Lower Mississippi Valley and Southeast Friday... ...Areas of moderate to heavy snow expected for the Central Rockies/High Plains Thursday... ...Another Critical Risk of Fire Weather Thursday for the Southern High Plains... ...High temperatures remain above average and Spring-like for the eastern U.S. with below average temperatures in the West.

|

KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |